- Canadian Bookkeeping Compliance Resource

- GST HST In Canada

- Sales Tax Rates

An Examination of CANADIAN SALES TAX RATES: Exploring Reporting Options

How To File A Sales Tax Return In Canada

By L.Kenway BComm CPB Retired

Revised March 29, 2024 | Edited April 22, 2024 | Originally Published on Bookkeeping-Essentials.com in 2009

WHAT'S IN THIS ARTICLE

Introduction | How to Calculate | Current Rates | How To File A Return | Mandatory Registration Threshold | Simplified Rates | Quick Method Rates | Historical Rates from 1991 |Historical Notes | 2010 HST Transition |

NEXT IN SERIES >> CRA Invoicing Requirements: Avoid Disallowed Input Tax Credits

I've already talked about what GST HST is, why it was introduced into Canada, and how it is different from PST. I've also discussed how governments raise tax revenues.

Now we'll look at the actual sales tax rates across Canada. I've included two tables - a current rate table and an historical rate table going back to 1991 when GST was first introduced. I'll wrap up with the input tax rates for the Quick Method and Simplified Method of accounting for GST & HST.

How To Calculate The Provincial Part of HST

HST rate % - Federal Part % = Provincial Part %

For example in Ontario since July 1, 2010:

HST rate 13% - Federal Part 5% = Provincial Part 8%

Sales Tax Rates in Canadian Provinces and Territories

April 1, 2013 to March 12, 2024 --- PST QST GST HST Rates

| Province |

GST/HST Rate (%) |

PST/QST Rate (%) |

Combined Rate(%) |

|---|---|---|---|

| Alberta | 5 | not applicable | 5 |

| British Columbia (3) | 5 | 7 | 12 |

| Manitoba | 5 | 7 Jul 2019 8 Jul 2013 7 before Jul 2013 | 12 13 12 |

| New Brunswick | 15 Jul 2016 13 Apr 2013 | not applicable | 15 13 |

| Newfoundland & Labrador (6) | 15 Jul 2016 13 Apr 2013 | not applicable | 15 13 |

| Northwest Territories | 5 | not applicable | 5 |

| Nova Scotia (5) | 15 | not applicable | 15 |

| Nunavut Territory | 5 | not applicable | 5 |

| Ontario | 13 | not applicable | 13 |

| Prince Edward Island (1) & (2) | 15 Oct 2016 14 Apr 2013 5 before Apr 2013 | 0 current 10 before Apr 2013 | 15 14 15.5 |

| Quebec (1) & (4) | 5 | 9.975 Jan 2013 9.5 Jan 2012 8.5 Jan 2011 7.5 July 2010 |

14.975 14.975 13.925 12.875 |

| Saskatchewan |

5 5 | 6 Mar 23 2017 5 before Mar 23 2017 | 11 10 |

| Yukon Territory | 5 | not applicable | 5 |

Sales Tax Rates Notes

- In Quebec (until December 31, 2012) and Prince Edward Island (until March 31, 2013) only, the GST was included in the provincial sales base. PST was charged on GST explaining the higher than expected combined rate.

- PEI implements HST on April 1, 2013. They raised the rate on October 1, 2016.

- BC re-implements PST + GST on April 1, 2013 after 2011 referendum. 7% is the general rate. PST rates vary between 7% and 12%.

- QST harmonized with GST on January 1, 2013 but is not considered HST. Quebec is NOT classified as a participating province. The total tax did not change as the new rate now consists of 9.975% = 9.5% x 1.05%. The QST now applies BEFORE GST. PST is no longer charged on GST. Financial services are also exempt instead of zero rated.

- Nova Scotia announced in 2012 an intention to reduce the HST in 2014 to 14% and again in 2015 to 13%. However in February 2014, the Nova Scotia Finance Department announced it cannot afford to lose the revenue and did not proceed with the previous government's HST rate reductions.

- Newfoundland and Labrador’s 2016 budget reintroduces the 15% Retail Sales Tax (RST) on insurance premiums for property and casualty insurance policies. The RST had been imposed on these premiums until January 1, 2008, when it was rescinded.

Three Accounting Methods Available For Reporting GST HST

You have three options available for reporting your GST HST to the CRA. Two require you meet certain criteria and file an election with CRA.

GST HST Regular Accounting Method

How To File A GST HST Return in Canada

The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are integral components of the Canadian tax system for businesses. Both taxes are levied on most goods and services sold or supplied in Canada. As a business owner, you may have the responsibility to collect and remit these taxes to the Canada Revenue Agency (CRA).

Here is a step-by-step guide on how to file your GST/HST return in Canada.

1. Registration: Begin by checking if your business needs to register for the GST HST program by visiting the CRA's website or consulting with your accountant. Typically, you need to register if your business's taxable sales exceed CAD$30,000 in a single calendar quarter or across four consecutive calendar quarters.

When does it become mandatory to register for GST HST?

If you own a business in Canada, you must register for GST and collect it if your annual sales is greater than $30,000. Registration under $30,000 in sales is optional.

If you are starting up your business and your sales will be less than $30,000, you should still consider registering. It allows you to recover your input tax credits (ITCs) on start-up costs and normal purchases.

2. Accurate Record Keeping: Make sure you keep a record of all transactions to accurately calculate the total amount of GST/HST you have collected and the amount you have paid during any given reporting period. I like QuickBooks® Online Canada sales tax module which makes the tracking of your GST HST collected and paid effortless.

GST HST Return Calculation Of your net Sales Tax Due is:

GST/HST Collected on Sales (line 105)

- GST/HST Input Tax Credits (line 108)

= GST/HST Amount to Remit to CRA (line 109)

A negative number on line 109 means you will be receiving a refund.

3. Fill Out a GST HST Return: You can get the GST HST return form (GST34-2) from the CRA. The return contains two crucial parts- line 105 for the GST HST collected or that becomes collectible and line 108 for claiming your input tax credits (ITCs). Use the information from your bookkeeping system to fill out these sections. This method of reporting GST HST is called the regular reporting method.

4. Calculate Net Tax: Subtract your ITCs from the total GST HST collected or that became collectible. If the value is positive, it’s the amount you owe and must remit to the CRA. If the value is negative, I.E. if your ITCs exceed your GST HST collected, CRA sends you a refund ... Whoo Hoo!. See the sidebar which lays out the calculation.

HABITS MADE EASY

If you signed up for direct deposit during GST HST registration, the refund goes right into your business account, usually within 2 weeks of filing online. It's great. No running to the bank. You met your compliance obligations and got your money quickly and easily.

5. File Return: Depending upon your business type and preferences, there are several ways to file this return. These include (a) online using CRA’s My Business Account, Represent a Client, or third-party software, (b) by mail, (c) in-person at a participating Canada Post outlet, or (d) at a CRA tax centre or office.

MOVE OUTSIDE YOUR COMFORT ZONE

When paper filing, you should be using the original personalized GST HST return form that CRA sends you. However, as you are working on establishing new compliance habits, I encourage you to step outside your comfort zone and try CRA's online services.

6. Keep Records: Keep your invoices and other tax records for at least six years from the end of the year they relate to. You'll need these if the CRA asks you to verify your claims.

AUDIT READY

Take note, you are required to maintain adequate books and records in order to report and pay your GST HST. GST/HST Memorandum 15-1 General Requirements for Books and Records has information on how these books should be kept. GST/HST Memorandum 15-2 Computerized Records also has information on books and records obligations.

7. Meet Due Dates: Ensure you know your company’s due dates for filing. Late or missed filings may result in penalties. Typically, the due date is one month after the end of your reporting period.

KEY TAKEAWAYS

Filing a GST HST return involves registering for the tax program, maintaining accurate transaction records, completing the GST HST return form, calculating the net tax, filing the return correctly, and observing all due dates. Adherence to these steps is crucial to staying compliant with Canadian tax laws. If you find this process complex, consider hiring a bookkeeper to do your books and file your compliance reports. Remember, you are aiming for consistency not perfection for all your compliance obligations.

NEW HABITS

If you have registered for My Business Account with CRA, you will have online access to your account information. My Business Account is a real time saver ... no more waiting on the phone to speak with an agent ... just look it up yourself 24/7. I love it!

Of course the phone option, where you can speak with an agent, is still available to you if you can't find what you are looking for.

GOOD HABIT

Since May 2009, CRA Agents are required to identify themselves by providing you with their first name and reference number. It is a good practice to record the agent's name and agent reference number especially if you ask for and follow their advice.

I learned, while taking my H&R Block tax course, that CRA is not bound by the information the agents provide. However, having the agent's name and number may assist in having penalties and interest waived in the event of a dispute. If you are skeptical about what the agent is telling you, phone CRA back at another time to confirm the advice given.

Alternative 1 - GST HST Accounting Method

Master The Simplified Method of Accounting for GST HST: A Brief Guide

The Simplified Method for claiming Input Tax Credits (ITCs) in Canada is for small businesses who find it challenging to track and allocate Goods and Services Tax (GST) and Harmonized Sales Tax (HST) for their business expenses.

Who Can Use The Simplified Method of Accounting For GST HST?

Eligibility:

RC4022 General Information for GST/HST Registrants lays how the eligible registrants for this method of reporting GST HST. Businesses eligible for the Simplified Method must meet all of the following conditions:

- Your annual worldwide revenues from taxable property and services (including those of your associates) are $1 million or less in your last fiscal year.

- Your total taxable supplies (including those of your associates) for all preceding fiscal quarters of the current fiscal year must also be $1 million or less. These limits do not include goodwill, zero‑rated financial services, or sales of capital real property.

- You have $4 million or less in taxable purchases made in Canada in your last fiscal year. The $4 million purchase limit does not include zero‑rated purchases, but it does include purchases imported into Canada, as well as the GST/HST paid or payable on those purchases and importations.

The Process To Claim Using the Simplified Method

How it works:

This method removes the need to calculate the exact amount of GST/HST paid or payable on each purchase. Instead, it is based on the actual GST or HST paid on all eligible expenses.

Here are the four steps on how to claim using the Simplified Method of Accounting:

Step 1: Add up your ITC eligible business expenses.

Step 2: Multiply your calculated ITCs by each appropriate simplified sales tax rate.

Step 3: Add any adjustments allowed by the CRA if they apply.

Step 4: Include this total in your line 108 calculation.

Now let's look a bit deeper into each step.

Step 1 - Add up your ITC eligible business expenses.

The business multiplies the total amount paid for eligible expenses (including the GST or HST) by a specified percentage for each sales tax (see calculation below) to determine the ITCs that can be claimed on the GST HST return.

If you make purchases in both participating (HST) and non-participating (GST) provinces you will need to separately add up your taxable purchases based on the sales tax rate you paid.

The CRA Guide explains your totals will include:

- the GST or the HST

- non-refundable PST (only for GST-taxable purchases)

- taxes or duties on imported goods

- reasonable tips

- interest and penalty charges related to purchases taxable at the GST or the HST rate

- reimbursements paid to employees, partners, and volunteers for taxable expenses

- capital personal property and improvements to such property if you use the property more than 50% in your commercial activities

There is a long list of purchases that you are not permitted to include. Click the RC4022 link above to see it. It includes but is not limited to expenses you have not paid sales tax on such as salaries, insurance, interest, exempt or zero-rated purchases and purchases from non-registrants.

How To Calculate The Simplified GST & HST Rates

Step 2 - Multiply your ITCs calculated in step one by each appropriate simplified sales tax rates.

The simplified GST & HST rates for purchases are calculated as follows:

- - - Current GST or HST rate / (100 + Current GST or HST rate) = Simplified Rate - - -

For example:

- For GST @ 5%, the simplified tax rate would be 5/105 times total purchase amount including GST = GST paid (ITC).

For example - 5/105 times $2456.89 including GST = $116.99 GST paid - For HST @ 13%, the simplified tax rate would be 13/113 times total purchase amount including HST = HST paid (ITC).

For example - 13/113 times $2456.89 including HST = $282.65 HST paid - For HST @ 15%, the simplified tax rate would be 15/115 times total purchase amount including HST = HST paid (ITC).

For example - 15/115 times $2456.89 including HST = $320.46 HST paid - For QST @ 9.975%, the simplified tax rate would be 9.975/109.975. times total purchase amount including QST = QST paid (ITC).

For example - 9.975/109.975. times $2456.89 including HST = $222.84 QST paid

Step 3 - Add any adjustments permitted by CRA if they apply. Again, click on the RC4022 link above to find out what they are.

Step 4 - Include this total in your line 108 calculation. After completing line 105 Sales Tax Collected, remit any resulting amount to the CRA when you file your return. If the resulting amount is a refund, filing online is the fastest way to receive your refund.

AUDIT READY

For businesses using the Simplified Method, it's important to ensure that ITCs are not claimed on any purchases that are exempt or those that are not applicable for tax credits.

Alternative 2 - GST HST Accounting Method

Where To Find The Quick Method GST HST Rates

This is another reporting option available for reporting GST HST.

With this method, you still collect GST HST but you only remit a fixed percentage of the tax collected to CRA. There is a reduction in paperwork because you are not tracking your GST HST expenses.

The Quick Method remittance sales tax rates are based on the province where your permanent establishment is located. CRA publication RC4058 Quick Method of Accounting for GST/HST provides the charts of remittance rates businesses use to estimate the GST HST paid.

As HST rates vary between provinces, some businesses may have more than one remittance rate. Rates are categorized into 2 categories: (a) goods purchased for resale and (b) providing services.

You need to track your sales by three groups:

- non-participating (GST) provinces

- participating (HST) provinces by rate; and by

- non-eligible sales and personal use "sales".

Here is a brief process on how to claim using the Quick Method:

1. Multiply your total expenses (including GST & HST) by the appropriate rate from the CRA chart to estimate your ITCs.

2. Subtract this estimated ITC amount from the GST & HST you collected over the same period.

3. The resulting amount is what you remit to the CRA.

AUDIT READY

For businesses using the Simplified Method, it's important to ensure that the ITCs are not claimed on any purchases that are exempt or those that are not applicable for tax credits.

Learn More>> Master The GST HST Quick Method of Accounting

Tracing History

Historical Sales Tax Rates: Regular & simplified --- 1991 to Present

| Period | GST | HST | NL HST |

NB HST |

NS HST |

PEI HST |

BC HST |

QST/GST Harmonized |

|---|---|---|---|---|---|---|---|---|

| Oct 1, 2016 on | 5% | 13% | 15% | 15% | 15% | 15% | -- | 9.975% /5% |

| Simplified rates* | 4.762% | 11.504% | 13.043% | 13.043% | 13.043% | 13.043% | -- | 9.070%/4.762% |

| Jul 1, 2016 on | 5% | 13% | 15% | 15% | 15% | 14% | -- | 9.975% /5% |

| Simplified rates* | 4.762% | 11.504% | 13.043% | 13.043% | 13.043% | 12.281% | -- | 9.070%/4.762% |

| Apr 1, 2016 to Jun 30, 2016 | 5% | 13% | 13% | 15% | 15% | 14% | -- | 9.975% /5% |

| Simplified rates* | 4.762% | 11.504% | 11.504% | 13.043% | 13.043% | 12.281% | -- | 9.070%/4.762% |

| Apr 1, 2013 to Dec 31, 2015 | 5% | 13% | 13% | 13% | 15% | 14% | -- | 9.975% /5% |

| Simplified rates* | 4.762% | 11.504% | 11.504% | 11.504% | 13.043% | 12.281% | -- | 9.070%/4.762% |

| Jan 1 2013 to Mar 31, 2013 | 5% | 13% | 13% | 13% | 15% | -- | 12% | 9.975% /5% |

| Simplified rates* | 4.762% | 11.504% | 11.504% | 11.504% | 13.043% | 12.281% | 10.714% | 9.070%/4.762% |

| Jul 1 2010 to Dec 31, 2012 | 5% | 13% | 13% | 13% | 15% | -- | 12% | -- |

| Simplified rates* | 4.762% | 11.504% | 11.504% | 11.504% | 13.043% | -- | 10.714% | -- |

| TRANSITIONAL | RULES | BEGAN | MAY 1, | 2010 | ||||

| Jan 1 2008 to June 30 2010 | 5% | 13% | 13% | 13% | 13% | -- | -- | -- |

| Simplified rates* | 4.762% | 11.504% | 11.504% | 11.504% | 11.504% | -- | -- | -- |

| Jul 1 2006 to Dec 31 2007 | 6% | 14% | 14% | 14% | 14% | -- | -- | -- |

| Simplified rates* | 5.660% | 12.281% | 12.281% | 12.281% | 12.281% | -- | -- | -- |

| Apr 1 1997 to Jun 30 2006 | 7% | 15% | 15% | 15% | 15% | -- | -- | -- |

| Simplified rates* | 6.542% | 13.043% | 13.043% | 13.043% | 13.043% | -- | -- | -- |

| Jan 1 1991 to Mar 31 1997 | 7% | -- | -- | -- | -- | -- | -- | -- |

| Simplified rates* | 6.542% | -- | -- | -- | -- | -- | -- | -- |

Historical Notes On Sales Tax Rates in Canada

- GST is the goods and services tax. It has been in effect in Canada since January 1, 1991. Quebec administers their GST sales tax (called QST) while the CRA administers the GST and HST for the rest of Canada.

- HST is the harmonized sales tax. It has two parts ... the federal GST part and the provincial part. HST rates are currently in effect in Newfoundland, Labrador, New Brunswick, Nova Scotia, PEI and Ontario. These provinces are also referred to as participating provinces as they participated in the transition to HST.

- Alberta and the three territories utilize GST rates as their only sales tax rate (I.E., they do not have a PST or RST). Alberta and the territories are also referred to as non-participating provinces as they did not switch to HST.

- PST is a provincial sales tax and may also be referred to as a retail sales tax (RST). PST rates are currently in effect in British Columbia, Saskatchewan and Manitoba. See the notes below on Quebec. The table above excludes PST but the current rates table at the beginning of this page include PST. These provinces are also referred to as non-participating provinces as they did not switch to HST.

- HST transitional rules for BC and Ontario were released by CRA, BC Ministry of Finance and the Ontario Ministry of Revenue. The HST transitional rules were effective May 1, 2010 to June 30, 2010.

- In July, 2009, the Campbell government announced that BC would switch to HST effective July 1, 2010 ... and they did. However, it was short lived. Due to the results of a province wide referendum held in 2011, BC transitioned back to GST + PST from HST on April 1, 2013 .

- Quebec harmonized their sales tax effective January 1, 2013. However, unlike other provinces, QST remains a separate provincial tax. Reference - The Excise and GST/HST News 87 explained Quebec will NOT be considered a participating province for GST/HST purposes.

- PEI was the last province to switch to HST. The HST rate at 14% was effective April 1, 2013. PEI announced they would raise the rate to 15% effective October 1, 2016.

- New Brunswick announced in their 2016 budget that HST would increase on April 1, 2015 to 15% from 13%.

- Newfoundland Labrador had proposed to increase the HST to 15% on January 1, 2016. This proposal was cancelled on December 14, 2015. The rate increase went through on July 1, 2016.

History Sales Tax Rates

July 1, 2010 Transition to HST

2010 was a transitional year as the sales tax rates and rules were in transition across Canada to implement HST. New place of supply rules came into effect on July 1, 2010. Sales tax charged was no longer based on the supplier's location; it was now based on the customer's location.

Here is a snapshot frozen in time of what the sales tax rates were before and immediately after HST was introduced.

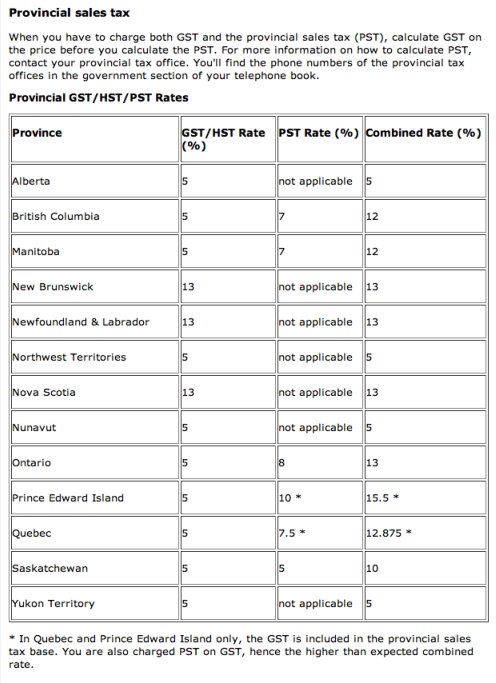

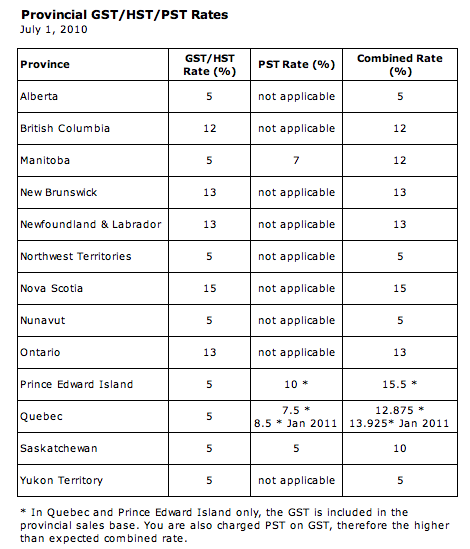

PST QST GST HST rates before July 1, 2010

PST QST GST HST rates before July 1, 2010 PST QST GST HST rates on July 1, 2010

PST QST GST HST rates on July 1, 2010Source: Canada Business website [no longer available]. What I really like about the tables are the inclusion of the effective combined rates for PEI (prior to April 2013) and Quebec (prior to January 2013) as they charged PST on GST.