How to Create an Audit Trail

Protect Yourself and Your Business

by L. Kenway BComm (Retired CPB)

What You'll Find In This Chat

- Separating Business From Personal Expenses

- Keeping Your Receipts - includes CRA's criteria on what a legitimate receipt must contain

- Learn What is NOT a Legitimate Receipt for Tax Purposes

- Scanned / photo receipts

- Sequential Documents - Cheques and Invoices

- Tracking Cash

- Expense Reports

- Paying Yourself

- Journal Logs - includes what to do when a receipt is not issued

- The Mileage Log

- Driving To and From Work

An audit trail provides protection in the event of a dispute or tax audit. It can also protect your business against fraud ... and it's a good bookkeeping practice.

This is the third chat in my series on good bookkeeping practices categories.

What Is An Audit Trail?

Technically speaking, an audit trail is when there is a visual indication of a procedure having been done or a transaction having been made ... follow the money.

I

won't cover fraud protection on this page ... but I have covered it in

two other chats; my chat on internal controls and my chat on the

monthly financial review ... both chats are available free when you

subscribe to my ezine.

For now, just keep in the back of your mind that good internal controls and segregation of duties is essential to reduce the possibility of fraud in your business.

Today we will focus on how to create audit trails and audit proofing ... so I hope your teacup is full and the tea hot. Let's get started by chatting about the cash myth.

Advertisement |

If you deal all in cash with poor record keeping ... thinking that no audit trail will enable you to avoid taxes, then you need to learn more about the powers of CRA and / or the IRS. If you are going to take stupid risks, at least educate yourself to the full extent of taking these risks so you go in with your eyes wide open ... do NOT accept what your buddies say as fact. I'm fairly certain that government finance departments in most countries around the world have similar powers. |

That said, here are some tips on how to audit proof your record keeping to protect yourself and your business.

Click here to continue reading.

THE BOOKKEEPER'S NOTES ON

So What are Good Bookkeeping Practices?

I like to break good bookkeeping practices into seven categories:

Click on an image to go to the chat.

|

1. Get yourself organized. Enter your data regularly. |

2. Use computer software so you can mine your business data. |

3. Learn to create audit trails as you go. Some are super easy to implement. |

|

4. Reconcile your bank statement, credit card and vendor statements regularly. |

5. Comply with federal record retention requirements. |

6. Learn to avoid what gets sole proprietors in trouble with the CRA/IRS. |

|

7. Prepare and file your U.S. and Canadian government compliance reports (sales and use tax, employment and payroll tax, worker's compensation and income tax) on time. Remit the amounts owing. Don't have the money? Don't worry. I have a tip for you; just follow the country link you run your business from. |

This Audit Trail is Ridiculously Easy to Implement

Separate Business From Personal

DO THIS

Canadians report their business income for tax purposes on form T2125 Statement of Business or Professional Activities. Americans report their sole proprietorship income on Schedule C.

An easy, recommended, and essential method to track all your business income is to have a separate bank account and a separate credit card for your business affairs.

NOT THIS!

It is not a good practice to write cheques (checks for my American visitors) for business expenses on your personal bank account; or charge business expenses on your personal credit card.

Robert Wood, U.S. tax lawyer and Forbes columnist also recommends you "avoid dual-purpose goals" such as taking your vacation with your best client or claiming your expensive hobby as a business.

good bookkeeping practice

THE BOOKKEEPER'S|TIP

Sole Proprietor Banking Accounts

If you are a sole proprietor, the bank and credit card accounts just have to be separate ... they don't have to be "business" accounts with the bank or credit card agency ... which often results in higher / additional service charges.

Because legally you are your business, the "non-business" accounts can be opened in your name even though you will use them for business purposes. This keeps more money in your pocket.

LET'S CHAT ABOUT ...

A Basic Accounting Principle

Business Entity Concept

A basic GAAP principle is the Business Entity Concept. This principle provides that the accounting for a business should be kept separate from the personal affairs of its owner.

This is not to be confused with the legal concept where, if you are a sole proprietor, you are your business.

If / when you are audited by the Canada Revenue Agency or the Internal Revenue Service, they will want to see proof of your business income and expenses claimed. One way to provide that proof is ...

Use your bank account to deposit all your business income (including cash) and pay all your business related expenses. Instead of reaching into your pocket to pay for business expenses with your personal funds, use your business credit card, use your debit card for your business account or write a cheque/check from your business's bank account.

This type of visual audit trail allows you to avoid intermingling business transactions with your personal accounts. It just makes everything more complicated than it needs to be when the two are mixed. It increases the risk of overstating your business expenses by reporting personal expenses on your T2125 or Schedule C, which is not allowed ... or inadvertently understating your business income.

Mixing the two makes the preparation of your taxes likely to cost more as the preparer may have to wade through your personal transactions if you didn't bring organized information.

Small business owners should be aware that CRA and IRS like to examine transactions between family members.

Keep ALL Your Receipts for an Audit Trail

Keep all of your receipts and make sure they are legible. This is a lot harder to do than it sounds. The key is having a system in place to handle your receipts.

GOOD TO KNOW

Does The IRS Need Receipts?

The short answer is "yes, with some exceptions".

The longer answer can be found by a visit to Wayne Davies' blog at Self Employment Tax Deductions Today answered this question in detail on January 25, 2011.

The blog made reference to Mr.Cottrell's TC Summary Opinion 2003-162 found at law.onecle.com.

Mr. Cottrell ruled:

(a) "The taxpayer bears the burden of proof, which means the presentation of adequate documentation to support the deductions claimed on tax returns."

(b) "It is also the taxpayer's responsibility to maintain records sufficient to enable the Commissioner to determine the correct tax liability."

(c) "The taxpayer must substantiate both the amount and purpose of the claimed deductions."

(d) "Under certain circumstances, where a taxpayer establishes entitlement to a deduction but does not establish the amount of the deduction, the Court is allowed to estimate the amount allowable."

(e) "However, there must be sufficient evidence in the record to permit the Court to conclude that a deductible expense was incurred in at least the amount allowed."

Mr. Davies recommends photocopying and storing all receipts for three years along with your bank and credit card statements so you have proof of purchase and proof of payment.

His various blogs discuss exceptions to the "need a receipt" rule in the U.S..

1. If you are a sole proprietor or partner, meals related to an overnight business trip can use the Per Diem method (see IRS publication 1542). Corporations may NOT use this method.

2. You can use the Mileage Rate method to deduct vehicle expenses ... but you DO NEED an auto log to use this one.

Cancelled cheques, credit card statements, and bank statements are great to construct (or re-construct) your bookkeeping records. However in Canada and the U.S., they are not considered to be a legitimate business receipt for the purpose of tax deductions ... like debit and credit card slips, you need them in addition to your receipt, to show proof of payment ... and they are third party source documents.

Third party source documents provide the auditor with verification of the transaction from an outside third party ... an excellent audit trail. If you are wondering if the IRS (Internal Revenue Service) accepts photo receipts, click here for more information.

LET'S CHAT ABOUT ...

Audit Trails and Downloading Bank Transactions

(using your accounting software package)

DON'T DO THIS!

A word of caution when using the terrific feature most small business accounting software packages have - downloading your banking transactions.

You will have to discipline yourself to ensure you have the supporting documents for each transaction you download if you want your accounting system to be audit proof.

Establish some kind of procedure to make sure this is done. It is too easy on a busy day to just download and accept the transactions.

DO THIS

I prefer to enter all transactions using the source document OR ...

to use one of the receipt scanning services out there that captures the data off the scanned receipt automatically ...

then use the download for reconciling only. But that's just me because I'd rather have the pain now than sometime in the future when I get audited ... and it costs a fortune to track down supporting documents three or four years after the fact. Losing the entire deduction from lack of supporting documentation ... means I (or YOU) would have to cough up back taxes and interest and penalties. Now that's just downright nasty!

IF you are going to work through the bank feed screen, BEFORE you MATCH or ACCEPT a transaction, make sure you attach the source document.

Remember the cardinal rule - no supporting document - no deduction! :-( Don't forget to create your audit trail if you want to audit proof your bookkeeping system.

Okay, I'm going to say this one last time. Don't mix your personal purchases with your business purchases.

If you are shopping and have both types of expenses, ask the cashier to ring up two separate orders ... with a smile of course!

And do I have to say it? ... Pay each one from the appropriate place - personal purchases from your personal funds and business purchases from your business account or your business credit card.

And don't forget about this receipt tip especially if there is no product/service description on the invoice ... or this meal tip.

..................................................cash flow

THE BOOKKEEPER'S|TIP

A Simple Way to Track Your Cash When Just Starting Out

Cash flow is king, especially when you operate a small business. Having a method to track and manage your cash flow (which is different than calculating your profit or loss) allows you to decide if you need to borrow funds to cover a shortage, or when you should buy supplies, and when to pay for those supplies.

When you are just starting out in your business, a very simple method of keeping on top of your cash flow is to rely on your cheque book register or use personal finance software like Quicken (which is based on cheque writing). Quicken's advantage over the manual method is you can download your transactions so it saves keying time.

Once a month, you will need to reconcile your cheque book register to your bank statement transactions. (I can hear you asking "Why Lake?" ... You wouldn't want to spend money you don't have and get yourself in hot water, would you?)

If you don't have a lot of transactions (Mr. Stephen Thompson, CA and author suggests less than 150 transactions a year), this is a very simple method to stay on top of the cash running through your business ... and still have an adequate audit trail for your transactions.

A Visual Audit Trail

Sequential Documents - Cheques and Invoices

The most obvious visual audit trail that you would be familiar with are documents that have a numerical sequence such as cheques (checks for my American visitors) or invoices. To keep a tax auditor satisfied, and YOU if you have a bookkeeper doing your books, you need to have numbers sequentially accounted for.

This means that if an invoice or cheque is voided, the document is still kept and processed as a void. My article on Internal Controls explains the proper way to void a cheque.

In QuickBooks, you can print a Missing Cheque Report to verify that you have accounted for every cheque. Keep it on hand for your audit trail.

Audit Trails and Invoicing

As mentioned above, it is important to track all numerically sequenced invoices, even void ones.

What I didn't say was, write an invoice for every job you perform and ring through the till every sale you make. Skimming has consequences and can cost you dearly if detected by or reported to Revenue Canada or the IRS.

You may want to read a short overview of what your responsibilities are ... they apply whether you hire a bookkeeper or do your own bookkeeping.

good bookkeeping practice

THE BOOKKEEPER'S|TIP

Preparing Invoices for Your Customers

A best practice when issuing invoices / receipts to your own customers is to identify and separate the individual sales taxes clearly. Have your GST/HST registration number visible on your invoice.

With the implementation of different provincial HST rates in Canada in July 2010, your invoices should also indicate the tax rate ... for example if it is a Ontario customer, HST @ 13% or GST/HST @ 13%.

For provinces that charge GST + PST such as BC, the invoice should list the two taxes separately ... for example, GST @ 5% on one line and PST @ 7% on the next line. Do NOT combine the two!

This good bookkeeping practice makes it easy for your customers to create their audit trail ... and, for some, your bookkeeper's data entry easier, faster, more efficient ... which keeps more money in your pocket.

I'm fairly certain that this tip would also be useful to U.S. bookkeeper's that have to deal with recording and reporting sales and use taxes.

Audit Trails and Tracking Cash

One habit many small business owners have is to take cash out of the business bank account and go pay their bills. (I'm not talking about you of course!) :o) This makes proving an audit trail to your tax assessor tough.

Or they may even reach into their own pocket to pay someone using their own personal funds. (I know this is something you would never do!) ;-)

It's imperative in both of these instances to keep your receipts as proof of purchase and/or proof of payment and submit them to your bookkeeper (that's you if you are doing your own books!).

By the way, if you keep part of the cash received from customer payments instead of depositing it into your business bank account to (a) purchase business supplies or (b) as a personal withdrawal for yourself, your bookkeeper needs to know that too ... it's a nice way to be kind as it will make the bank reconciliations much easier.

So let's be clear here. There is no problem doing business with cash ... as long as you have documentation to support the transaction. Without the documentation, your legitimate expense claim may be disallowed which takes money out of your pocket by increasing your income tax payable. You need documentation to prove the expense was business related.

good bookkeeping practice

THE BOOKKEEPER'S|TIP

How To Record Cash Not Deposited To The Bank In QuickBooks®

You or your bookkeeper should:

1. Record the cash payment received by applying it to the outstanding invoice sitting in accounts receivable. This places the funds into the Undeposited Funds account and clears the receivable.

2. Make a bank deposit and in the deposit window, show the cash was not deposited by completing the bottom line of the deposit window. This may create a nil bank deposit if you you took all the cash ... or "deposited" the cash to your cash account (instead of your business bank account) so you can show how it was spent.

Expense Reports - Keep it to a Minimum

Let's suppose you do spend your own personal funds on business purchases or even put something on your personal credit card (No ... don't even think about having an account in your books for your personal credit card ... remember what I said above - don't mix business and personal funds!) ...

... and you want to be paid back. You don't want to make a capital investment in your business at this time. You'd prefer the cash back. (I know you're not going to make a habit of this right?)

Right about now you are probably wondering, "How do you invoice yourself for business expenses? Is there a way to get my personal funds back and still provide an audit trail?"

The answer is "Yes". You record money from your pocket spent on items relating to your business by submitting an expense report to your bookkeeper. (Don't forget to attach all the receipts to the report. No receipt, no tax deduction!) This is a MUST procedure for incorporated companies if you want to claim ITCs.

If you like online technology and software, and want to automate your expense report process a bit, look into Expensify as a possible solution.

The bookkeeping entry to record the expense report is:

DEBIT each individual expense item (20 receipts means 20 separate lines of data entry) and CREDIT Owed to Owner (a current liability on your chart of accounts)

Then when you need the cash, write a cheque to yourself for the total amount on the expense report. This bookkeeping entry will be recorded as follows:

DEBIT Owed to Owner (a current liability on your chart of accounts) and CREDIT Bank (a current asset in your chart of accounts)

There are special rules to reimburse expenses related to your vehicle.

How to Enter Expense Reports in QuickBooks

If you are using QuickBooks, I like to create the current liability account using the account type "credit card". I name the credit card account "Owed to Owner" ... or you could replace "owner" with the name of the individual.

When I receive the expense report, I treat it just like a real credit card statement and enter each item on the expense report through the Credit Card screen. Make sure you code every item to the proper expense account.

To reimburse the owner, I use the Write Cheque screen and code the cheque to the Owed to Owner credit card account ... reducing the outstanding amount. Make the cheque payable to the owner (individual's name) NOT cash.

Free Expense Report Spreadsheet

Before you can enter the expense information into QuickBooks, you need a form for the employee or owner to submit.

Here are two good expense reports that will keep your audit trail intact.

Microsoft has a free Expense Report template (Excel 2010) at office.microsoft.com> Templates> Excel> Expense report.

If you like paperless cloud based applications, you may be interested in trying out Expensify It to capture your receipts and produce your expense report. It can even sync with QuickBooks if you are into that type of process.

Notebook/Journal/Log Audit Trails

Keep a notebook or journal with you to record any expenses where it is customary to not issue a receipt such as parking meters, coin car washes, and phone booth telephone calls. The journal, for these types of transactions, is your audit trail.

What about other transactions where it is common practice to issue a receipt but you don't have one?

Stephen Thompson CA, CFP, TEP states in the book "167 Tax Tips for Canadian Small Business" that if you have a business expense that you did not get a receipt for, you just have to record ALL the details of the transaction to get your tax deduction but suggests getting a receipt whenever possible.

It is my understanding that this may be okay for the odd transaction, but if you had a tax audit and did not have receipts to support your claim(s) (no audit trail), CRA can deny the deductions.

During a tax audit, I could see an auditor letting a few transactions through (due to materiality) but if it was prevalent, I'm fairly certain many of the unsupported claims would not be accepted.

Mr. Thompson then goes on to say (when discussing GST) that "to claim an input tax credit, you must (my emphasis) have invoices or receipts containing certain information ... if the receipt or invoice for a purchase ... does not contain the proper information, the government can deny the input tax credit on the purchase."

As mentioned earlier in this chat, CRA are now routinely denying ITCs due to lack of supporting documentations. Of course, as also noted, there are always exceptions to the rules. See CRA's ITC exceptions to invoice requirements for more details.

So no invoice or no receipt? You definitely lose your ITC.

(Prior to 2011, it was common practice for the CRA to conduct an income tax audit and GST audit at the same time. In 2011, CRA discontinued combined audits. Auditors are developing more expertise and in-depth knowledge in this specialized area. This change was a direct result of BC and Ontario switching to HST in 2010.)

It used to be if I signed up for preauthorized payments of bills, I never received an invoice or a statement of account. However now, all vendors I have preauthorized transactions with, issue either an invoice and/or a payment receipt every month. My guess is too many business customers were requesting back copies of invoices when they were audited ... but I could be wrong.

As a member of the Canadian Bookkeepers Association, our code of ethics states, "A CBA Member, in conducting business, will obtain evidence or other documentation to establish a reasonable basis for any recorded transaction." Follow this link to learn why.

Best practice? Create an audit trail and get a receipt ... especially if you want to audit proof your tax return and claim your ITCs.

Second best practice? If you don't have a receipt, create an audit trail by logging the particulars in your journal including the reason you don't have a receipt. The onus is on you to prove it was a business related expense. If you choose to claim any of the related ITCs, understand you are vulnerable during an audit and the ITCs may be denied.

The Business Journal - A Good Habit

I would also like to mention this tip I received from an Evelyn Jacks (a Canadian tax expert) publication back in the late 90's when I was starting my business. I'm sorry but I can't remember which of her publications it came from. She recommended that when you start your business you keep a Business Journal. Journalize all your business activities:

- the reason you are undertaking them; and

- how they will increase your expectation of profit

to meet the "expectation of profit" test. The Business Journal provides an audit trail and will also help support the general statement that business expenses are deductible if they are reasonable.

This is especially important if your business has a hobby aspect or personal aspect to it. You will need to prove that you are carrying on your business in a commercial manner in case CRA challenges the deductibility of expenses that create a loss.

Having a set of accurate and up-to-date bookkeeping records ... showing you have many transactions ... will assist in showing CRA you are running your business as a commercial enterprise.

From what I've read, many U.S. tax experts also recommend a journal ... so this good practice applies to both Canadian and American sole proprietors.

So keep in mind that this means at some point, your business should be successful which means you will pay taxes. There are only five reasons people pay no taxes.

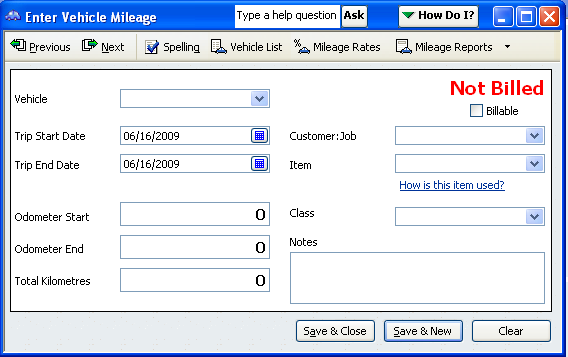

The Mileage Log - A Very Important Audit Trail

If you use your vehicle for both business and personal use, only the business portion is deductible.

In addition to the auto log to support your claim, you also must have all supporting auto receipts (see Section 8 of IT521R) including:

- fuel,

- maintenance,

- insurance,

- lease and/or purchasing documents.

My personal preference is to pay for your personal vehicle expenses through your personal accounts, but enter the information into your business records as expenses. At year-end, make an adjusting entry to back out the personal portion.

Why is this my preference? Receipts don't get lost and it's easier to input a bit of data each week/month than it is to enter all those vehicle expenses in at year-end when a deadline is looming.

U.S. Rules For

Business Use

Of Your Car

Unlike Canada, the IRS allows you to deduct your actual expenses OR use their standard mileage rate. Both methods are based on your business mileage ... as personal use of your vehicle is not an allowable deduction.

You will need a log of some type to show your mileage and the purpose of your trip.

A

CBS article suggested that GPS devices (like OdoTrack) and precise calendar entries

could be used to support your claim ... but the old fashioned paper log book for your audit trail works too.

You may also want to read the IRS publication Revenue Procedure 2009-54 or publication 463 Travel, Entertainment, Gift, and Car Expenses.

Remember that to deduct business use of an auto, you must be able to substantiate three things ...

(1) the business purpose;

(2) the date and destination of your business related trip or errand; and

(3) the amount you are claiming as a deduction.

Use your auto log as an audit trail to help you substantiate your claim.

Your auto log should record the date, the mileage and a description of destination and the reason for the trip if it is not obvious.

At the beginning of each year (January 1), you need to record your odometer reading. This figure becomes the last entry for your prior year log.

Remember you are allowed to add mileage for all your business errands such as going to:

- business lunches and/or functions,

- the bank,

- the mailbox,

- the office supply store

- the bookkeeper's office

On June 28, 2010, the Finance Minister announced a new simplified logbook for motor vehicle expense provisions. The information can be found under A to Z index> Businesses> M> Motor vehicle expenses (automobile) sole proprietor/partnership> Documenting the use of a vehicle on the CRA website.

I took a quick glance at the new "simplification".

In order to claim your business vehicle expenses you will need a base year mileage log as proof of your entitlement.

The new method will make it a little easier to prove your claim as there are now alternative records that you can use as your audit trail to substantiate your claim and your guesstimates.

I think it will still be easier to keep a log book for the whole year .. because after you have established your base year, you need to keep a three month log each year to prove your twelve month log is still applicable. If your usage changes by +/- 10%, you need to go back and track 12 months of use to use as your new base.

I think it is harder to stop and start procedures. You already have the habit anyway ... so I'd wouldn't give up my auto log.

Under the old method, it would be tough going without a full year mileage log as your audit trail ... and very likely your deduction would have been denied or arbitrarily reduced. I definitely don't want to go through an audit where the auditor doesn't agree with my estimates. Under the old rules, this is how an audit could end up with a ruling like this fellow.

Feb 25th, 2009 Diaz vs. the Queen et al (Federal Court of Appeal) The taxpayer's auto claim was reduced by 72% because he did not have auto mileage logs to present to the court. Instead he produced an auto log from the 1999 taxation year and said this was the basis for his deductions. The court felt his method was too arbitrary and the business income did not reflect the need for substantial auto expenses. As there was not sufficient evidence to conclude the Minister's assessed mileage allowed was incorrect, the onus of proof was not met and the appeal was dismissed.

This is one area which is audited regularly and it will be a lot of work (interpret this as time and money) to defend your guesstimates without a full log book or the new simplified log book. Your best defense is still a well documented defence.

These new rules mean that CRA will expects you to be able to provide evidence demonstrating that the business trip claimed in your log was actually for business. You will need to show them appointment diaries or service call logs or other appropriate documentation.

Conclusion? ... Create your audit trail and ... log it ... or you create the potential to lose the tax deduction!

If you want more information on tax savings for the work from home business owner ... or where you claim your auto expenses on your tax return, check out my series on Home Business Taxes - A Tax Planning Opportunity in "The Tax" section.

Driving to and from work, is it a business expense? Click here to find out.

These are what I consider to be good practices ... where an audit trail will provide you with adequate audit proofing should you ever have a tax audit.

Protect yourself.

Make yourself fully aware of the consequences of skimming.

That's it for my two cents worth on how to create an audit trail.

See you on the next page ...

Your tutor Lake

Screen shots © Intuit Inc. All rights reserved.

Bookkeeping Essentials › Small Business Accounting › Audit Trail

Enjoy A Tea Break With

Me Today. Let's Chat!

Use the search feature to quickly find the

information you're looking for.

Brian Tracy's

Click here to receive Brian Tracy's FREE Goal Setting Success Guide!

Join Me On Facebook

Help support this site by "liking" me! Here's where I post current information.

Listed Under Websites NOT Local Business.

This website is NOT associated with the business operating in Bonnyville AB.