Focus On Yearend Bookkeeping

Your Questions and My Answers

by L. Kenway BComm CPB Retired

Yearend bookkeeping is just around the corner for most small business owners in Canada and the U.S. Many of you are wondering what you need to do for fiscal year-end ... if anything. After all, can't your accountant take care of that for you.

Well, yes and no. Both you and your accountant benefit when you hand over a clean set of books. I've taken this opportunity to consolidate any questions I've received in the forum and worked them into this chat ... which is all about the "Balances" tier in the pyramid pictured above.

Before we get started, grab your notepad and warm up your tea (my favorite right now is Olive Leaf tea from Suede Hills Organic Farm). Once you are settled, I hope you find answers to some of your year-end bookkeeping uncertainties.

What You'll Find In This Chat

✔ Closing yearend bookkeeping records

✔ Changing your fiscal yearend date

✔ Yearend inventory count

✔ Accruing Accounts Payable

✔ Clean-up for yearend bookkeeping

✔ Accounts Payable Clean-up

✔ Outstanding CRA sales and payroll liabilities

✔ Reconciling to Government Compliance Reports Filed

✔ T4 Reconciliation

Closing your yearend bookkeeping records

Yearend Bookkeeping Records

Yearend Bookkeeping RecordsQuestion: After I give my accountant my QuickBook's file to complete year end for my company, how do I match up my QuickBooks info with the adjustments, etc, that the accountant did?

Are there adjusting entries that I have to do once I get the financial statements back?

Is there a file that my accountant should attach that I can import into QuickBooks so my system matches up?

Any help would be great, thanks.

Answer: As there is more than one to do things, the answer is ... are you ready ... it depends! :0)

If your accountant is just looking at your bookkeeping records and performing yearend and preparation of the financial statements independent of QuickBooks ... in another accounting software package ... then you need to ask your accountant to provide you with your year-end entries so that your books match your finalized financial statements.

In that case you would just enter whatever yearend bookkeeping entries the accountant gives you. You would need to give some thought as to the best way to make the adjusting entry as a journal entry is not necessarily the best choice in QuickBooks.

If your accountant actually works in QuickBooks, you can provide him/her with an accountant's copy. Go to Exchanging files with an accountant for more information.

The advantage of the accountant's review is that you can keep working on your file. S/he will make the necessary changes and send the file back to you to import.

Whether you work with your accountant through uploading / downloading files, remote access, or some other method is up to you and your accountant.

Kevin Lum posted ...

A bookkeeper plays a vital role for the growth of an organization. Whether it's a small or large company, everyone needs a clean set of books. Any problems with financing or your accounts may directly impact the profit of the organization. Thanks for asking for suggestions. Keep posting.

Changing Fiscal Year-end Date

Changing Your Fiscal Year-end Date

Changing Your Fiscal Year-end DateNeeque asks: Is it possible to change the accounting year from June to May instead of January to December?

Answer: As a general rule, sole proprietors in Canada must have a calendar year-end (January to December).

Any changes to your year-end must be approved by CRA. Contact them to see if it is possible in your situation.

Bev asks: I would like to know if a non-profit can change the year-end date. Right now it is a Sept - Aug fiscal year. It would be more convenient for me, the bookkeeper, to have a June year-end. I should let you know that this group does not have to file a tax-return because it was formed before the CRA required non-profits to file (this information came from the accountant that prepares the year-end reports).

Answer: It is my understanding that a non-profit can change their year-end. To do so, I believe you have to contact the CRA to ask permission. Of course, here is the catch 22. I believe to ask permission you have to have an account (business number) with the CRA which means you have to file tax returns. You will also likely be required to have a vote on the issue at your Annual General Meeting.

Here are a few links for your reading pleasure:

http://www.cra-arc.gc.ca/E/pub/tp/it496r/it496r-e.html

http://www.cra-arc.gc.ca/tx/nnprft/menu-eng.html

Do small businesses need to do an inventory count at year-end?

Is an inventory count a necessary yearend bookkeeping procedure?

Is an inventory count a necessary yearend bookkeeping procedure?Lorie from Brampton, Ontario asks ...

I am having a blonde moment right now and I don't know what to do.

Do companies need to do an inventory count at year end? What is CRA's stance on this?

I am doing the bookkeeping for a magazine printing business and it seems like they should be doing a year end inventory count.

The owner says that they don't need to do one because they are on a fixed delivery schedule with their suppliers.

I am looking at the purchases account in QuickBooks. It is really high because all their supplies get entered into purchases. I also see a lot of supplies not used sitting on their shelves before year end time at their store.

I don't know if I should be probing like this or not, but I don't understand what a bookkeeper's job is here in these instances; or how to tackle it.

What's a bookkeeper to do?

Answer: Good yearend bookkeeping practices require a formal inventory count. As the business is using a Purchases account to record their inventory, it suggests they are using a Periodic Inventory System.

This type of inventory system requires a journal entry to be booked at year-end, after the inventory count has been done.

If the owner is not going to do an inventory count as part of their year-end bookkeeping procedures, the accountant needs to know this so they can do a professional estimate and make the adjusting entry accordingly.

In an ideal world, small business owners should be doing inventory counts at year-end. In the real world, this doesn't always happen.

As to what is CRA's stance ... take a look at my short chat on Understanding CRA's Position on GAAP. GAAP follows the matching principle.

You may also want to take a look at CRA's publication IT51R2 Supplies on hand at the end of a fiscal period.

Year-end bookkeeping - do payable accruals include or exclude GST?

Accounts Payable Accruals at Yearend

Accounts Payable Accruals at YearendSharon from Calgary, Alberta asked: My client recorded a year-end payable accrual April 30th as a general journal entry by debiting each invoice amount received to the appropriate expense account.

Example

Dr. Office Supplies 100.00 (GST is included in this amount)

Dr. Advertising 42.00 (GST is included in this amount)

Dr. Maintenance 200.00 (GST is included in this amount)

Cr. Accounts Payable 342.00

When we rolled forward to the new fiscal year May 1st all the expense accounts went to zero.

Because the client included the GST in the total expense amount the GST was never recorded and ITC's were not claimed. In this case do I reverse the accrual May 1st as follows:

Cr. Office Supplies 100.00 (GST is included in this amount)

Cr. Advertising 42.00 (GST is included in this amount)

Cr. Maintenance 200.00 (GST is included in this amount)

Dr. Accounts Payable 342.00

Then would I take each invoice from each vendor and record it as normal.

Example - Invoice 1

Dr. Office Supplies 95.24

Dr. GST 4.76

Cr. Bank

If I do this, am I double counting the expense in both fiscal years and am I capturing the GST correctly in the new fiscal year?

I am just confused what to do because the GST was included in the total expense amounts how to properly accrue and account for it in the next fiscal year.

Answer: When I book accruals for accounts payable, I like to book them to a current liability account called "Accrued Liabilities". That way, as part of my yearend bookkeeping procedures, I can easily review the account to ensure all accruals are/have been reversed when appropriate to do so.

Also the problem usually encountered with booking accruals with no vendor specified to the A/P account is the G/L total for the A/P account will no longer match the subledger so booking each invoice by vendor was excellent.

You are correct in your reversing entry Sharon. You will not be double booking anything because your current year expenses are booking the actuals and the reversing entry backs out last year's estimate. The amount expensed or credited in the current year will be the difference between the estimate and the actual ... which is not a problem.

With regards the GST, I generally book accruals WITHOUT accounting for GST and only account for it when I book the A/P invoice when it is actually recorded on the books instead of just being accrued.

Please note that there is a difference between GST Payable (Balance Sheet account used to allow claiming of ITCs) and GST Expense (Income Statement Account to be used if you are not registered to claim ITCs).

As it sounds like this business owner is a GST/HST registrant, GST should not have been expensed when the accrual was made ... as expenses are now overstated.

Clean-up for Yearend Bookkeeping

Clean-up for Year-end Bookkeeping

Clean-up for Year-end BookkeepingJules from Smithers asked: Are there any blogs for these topics:

1) What account are holiday decorations for the office put into such as Xmas tree, Xmas and New Years banners, Xmas lights etc.? If the amount is large such as an Xmas tree for $112, should it be capitalized?

2) What account are minor balances or bits and pieces put into at year end such as a $0.10 over payment of an account, bank error of $0.50, ATM keying error of $0.03 etc.

3) What is the account "cash over and short" used for? I have never used this account before. What to do with this account if there is a balance of $5 in it?

Answer: Here's the answers to your questions about yearend bookkeeping cleanup:

1) You sort of answered the question yourself when you said the holiday decorations were for the office. I'd code it to "Office Expense" as the amounts don't sound unreasonable. As a general rule, I would only capitalize the amount for the tree if it was over $500.

2) With regards minor balances - the bank related entries should go to your bank reconciliation discrepancies account; I talk about how to handle the small customer overpayments in below.

3) Cash over and short is usually used to record cash outages relating to balancing either the cash register or petty cash. It should be an expense account which will automatically be cleared to the equity section of the balance sheet when the books are closed ... so no entry is necessary. If your account is not setup as an expense account, expense the amount.

Yearend Bookkeeping Procedure - Accounts Payable Clean Up

Accounts Payable Cleanup

Accounts Payable CleanupA small business bookkeeper in Canada asked: I have a few small credit balances from previous years that are still sitting in A/P. I would like to zero out/clear these from QuickBooks® before finalizing my 2009 year and don't know what the correct procedure is.

Answer: If the amount is a small, unpaid balance (a credit in the GL), then I would create a credit memo in QuickBooks® to reverse the expense to the same account as the original purchase. Identify the credit memo to be something like YEA#9 so that it is clearly marked as a Year End Adjusting Entry.

After the credit memo has been created, go into Pay Bills and apply the credit through the "setting credits" button one vendor at a time.

If there a lot of these balances, you may want to temporarily turn on the QuickBooks® preference to automatically use the discount / credit.

You'll find this feature at Edit >Preference >Bills > Company Preferences.

When you look at your Aged Accounts Payable Report, if there are balances in any of the columns ... but the total is zero, then you just need to apply the credits through Pay Bills to clean it up.

From a tax perspective, any accounts payable not paid after two years should be brought back into income as per section 78 of the Income Tax Act (ITA).

Yearend Bookkeeping and Outstanding CRA Liabilities

GST/Payroll Liabilities at Yearend

GST/Payroll Liabilities at YearendNicole from Alberta asked: One of my clients has not paid all that is due for GST and Payroll liabilities for 2012. Their previous bookkeeper was not on top of things. As I am trying to fix everything and get it all up to date, I am unsure how this affects filing for their personal income taxes. Should this all be paid and cleared up before their taxes are filed?

On another note - I noticed that sometime throughout the year, they made an extra payment for payroll liabilities - how do I record this extra payment or apply it to another month's liabilities without mixing it all up?

Answer: Personal tax and business reporting are two separate issues. Always file your tax and compliance return(s) on time, even if you can't pay the amount owing. This means that even if the compliance taxes have not been paid, still prepare, file, and if possible pay taxes owing ... on time. Waiting will just create more penalty and interest charges; something you want to avoid.

When performing your yearend bookkeeping procedures, ensure that the outstanding GST and Payroll liabilities are reflected correctly on the balance sheet.

If the business owner is a sole proprietor, enter the adjusted income statement (year-end procedures have been performed so all accruals, deferrals and adjusting entries have been made) onto the T2125 statement. On page 3 of the schedule you will see a "Details of Equity" section. Fill in the "total business liabilities" which will include your GST and Payroll liabilities if you have done your balance sheet correctly.

Regarding additional payroll liability payment, are you sure the payment was not made to "catch up" previously missed payments?

If you are in QuickBooks, use the Payroll module to record and apply the payment. When you use QuickBooks to do payroll (i.e. have a payroll subscription), one of the modules you will be able to access is the Payroll Module. This is where you setup employees, issue their pay cheques, pay your CRA source deductions. Use this module to pay and apply your payments to outstanding payroll liabilities. There is an Adjust Liabilities icon under the Pay Liabilities tab where you can post your lump sum payment.

When unsure what will happen when posting an entry you are unsure about, the best thing to do if you are working in QuickBooks is to open up a sample company ... they are provided when you install QuickBooks desktop or subscribe to QuickBooks Online ... and play around in it to see what happens. Then once you are comfortable, return to your data file and do your adjusting entry.

New to Yearend Bookkeeping Procedures

Reconciling to Government Compliance Reports Filed

Reconciling to Government Compliance Reports FiledJenny from Canada asked: I need help quick!

I'm new to a small company as an office admin. As part of my duties, I also do a little bookkeeping or data entry which I'm not trained for; but I have experience from my previous job.

However I do not have any experience with regards taking care of the government taxes (GST/HST, source deduction, income taxes, etc).

This month is our year end and I wanted to check how up-to-date we are with those areas. I also want to know how to balance our general ledger accounts with the various statements from the government. Can anyone please help me?

Appreciate it so much!

Answer: I recommend you spend some time going through my website. I designed it as a resource to help bookkeepers with the every day problems they encounter ... account reconciliations being one of those issues if they are not done regularly.

Take a look at the following eBooks (see sidebar) as a start:

- month end procedures - $20 CAD

- bookkeeping checklists - $5 CAD

- monthly financial review - coming in 2016

My chat on account reconciliations may also be of help and should be part of your yearend bookkeeping procedures.

As a general guideline, create an Excel worksheet that shows the information reported to CRA. Add a section to what CRA says they have on record. Calculate and analyze the differences.

Stated another way ... you are basically creating an analysis of information on your records vs. information on CRA statements that was filed during the year; then subtracting the two. You need to investigate any variances to determine in errors were made.

In QuickBooks, you can view your previously filed reports; for example look at the sales tax report, under Reports> Sales Tax> Previously filed reports, to see what your set of books is telling you. You should be able to find the assessment notice online with CRA for what they received.

I'm crossing my fingers that the "close date" function was used each time government report was submitted.

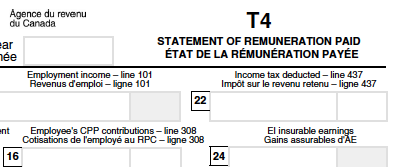

T4 Yearend Bookkeeping Reconciliation

T4 Yearend Reconciliation

T4 Yearend ReconciliationSharon from Thunder Bay, Ontario asked: I have just started doing books for this company.

I have found that in February 2010 some employees were given a $500.00 RRSP contribution (from the employer) as well as, over the year, some employees were also given gift certificates. These amounts were never reported on a pay period or to Revenue Canada. This must be done for the 2010 tax season.

Can I adjust the Gross Earnings on their T4's to reflect the benefits given in 2010 and how do I report these benefits with unpaid source deductions to Revenue Canada?

Answer: You are required to adjust box 14 as well as box 40 for the unreported benefits. These benefits trigger CPP and EI source deductions (as shown in the benefits chart referred to above so you will also have to correct/adjust these boxes on the T4 slip). The taxable benefits may also attract income tax.

Post a paycheque (for each affected employee) for the amount of the benefits and deductions due, with the balance as a payroll advance to be repaid.

IF, and only if, the employer is going to cover the employee portions of the source deductions, gross up employee earnings to reflect this. You would then not require a payroll advance for repayment of the deductions as the employer has covered their portion.

Remit all the additional source deductions with your January payment (for December source deductions).

The same rules / procedures apply for EI underpayment as well.

Other information that may be helpful:

- CRA introduced a new calculator for gifts. It is intended to be used each time a gift is given to an employee. It is a great tool that is easy to use and will reduce payroll reporting errors.

- CRA has an excellent benefits chart that every bookkeeper who does payroll should keep close at hand. It lets you know which benefits attract EI, CPP and/or GST/HST.

- CRA discusses how to handle underpayment of CPP and EI on their site. I give references in my chat, What is a PIER report?".

For CPP underpayment, the CRA website says when you ...

"discover that you have underdeducted CPP contributions, you are responsible for remitting the balance due (both employer and employee share).

You can recover the employee's contributions from later payments to the employee. The recovered contribution can be equal to, but not more than, the amount you should have deducted from each payment of remuneration. However, you cannot recover a contribution amount that has been outstanding for more than 12 months. As well, you cannot adjust the employee's income tax deduction to cover the CPP shortfall.

If you should have made a deduction in a previous year and you recover it through an additional deduction in the current year, do not report the recovered contributions on the current year's T4 slip. Instead, CRA will amend the previous year's T4 slips and send them to you.

The recovered amount does not affect the current year-to-date CPP contributions."

Other Yearend Bookkeeping Resources

- Preparing for Yearend | Focus on Bookkeeping

- Year-end Tax Planning in Canada

- Yearend |Closing the Books

- Calendar vs Fiscal Yearend

- Ask a Canadian Yearend Bookkeeping Question

Good luck with your year-end!

See you on the next page ...

Your tutor Lake

QuickBooks® is a registered trademark of Intuit Inc.

Bookkeeping Essentials › Bookkeeping Training › Yearend Bookkeeping Q&A

Enjoy A Tea Break With

Me Today. Let's Chat!

Use the search feature to quickly find the

information you're looking for.

Join Me On Facebook

Help support this site by "liking" me! Here's where I post current information.

Listed Under Websites NOT Local Business.

This website is NOT associated with the business operating in Bonnyville AB.