- Canadian Bookkeeping Compliance Resource

- GST HST In Canada

- Place of Supply Rules

Place of Supply Rules For GST & HST

Charge the Right Rate!

By L.Kenway BComm CPB Retired

Updated April 1, 2024 | Edited April 22, 2024 | Originally published on Bookkeeping-Essentials.com in 2010

WHAT'S IN THIS ARTICLE

General Rule | Closely Connected | Specific Place | Out of Province Sales | Participating Province | Online Sales | FAQ | Sales Tax Codes

NEXT IN SERIES >> How To Claim Input Tax Credits

Sales tax is based on customer location with exceptions of course.

Sales tax is based on customer location with exceptions of course.Effective July 1, 2021, non-resident and remote vendors of consulting services, digital products, and online platform services are required to charge, collect and remit GHT HST on sales to consumers located in Canada.

Effective May 1, 2010, the rules for place of supply pertaining to intangible personal property and services changed. They are based on customer location instead of supplier location with one exception. This means you need the customer's address.

Pieces Of The Puzzle Coming Together

HIGHLIGHTS OF THIS POST

- General Rule of Supply

- Most Closely Connected With The Supply

- Specific Place of Supply Rules

- Out of Province Customers

- Online Internet Sales | Virtual or Electronic Commerce

FAQ About Place of Supply Rules

- Place of Supply Rules for Internet Sales Purchased From Inside Canada

- How Internet Sales From Outside Canada Affect GST/HST | Non-resident Sales Tax Rates

- Can You Claim A GST ITC For US Purchases? | Place of Supply Rules for US Purchases

- Place of Supply of Rules Checklist for Exporting Commercial Goods

- Place of Supply Rules for Selling Remote Assistance Services to the US

- What are the QST registration rules for businesses that do not have a physical presence in Quebec (non-residents)?

- Do Alberta businesses have to invoice for HST? Do Alberta contractors charge HST when working in another province?

- Can I Claim HST ITCs for services bought in another province in order to provide services or training in Alberta where there is no HST?

- Do I charge HST to Alberta residences?

- Do I charge Ontario consumers ONT HST if my company is in BC?

general rule of supply

Place of supply rules are broken into four general categories:

- Tangible personal property (TTP) generally refers to property that can be physically moved. The tax rate is usually based on where the goods are delivered.

- Real property generally refers to immovable property. It is taxed on the province where the property is located.

- Services are generally tax based on the location of the customer ... it is no longer based on your location except if the Special 90% rule applies.

- Intangible personal property (IPP) generally refers to an item of value that cannot be touched such as intellectual copyrights. Under the new rules, The tax rate is usually based on where the IPP can be used where location of receiver / recipient is a factor.

As the supply rules apply to sales made in Canada and are based on the customer's location not yours, make sure you take the time to review and update your customer addresses on an ongoing basis. Auditors will require this during a sales tax audit.

I created a table of Sales Tax Rates across Canada as a Handy Bookkeeper's Compliance Reference for you when invoicing.

Place of Supply Rules

most closely connected with the supply

CRA harmonized sales tax publications make reference to the phrase, "most closely connected with the supply". A presentation by lawyer Cyndee Todgham Cherniak says CRA will interpret this by looking in this order:

- The business address of the customer where the business has the most contact during providing services.

- The business address of the customer who hired the business.

- The business address of the customer on the invoice billed to the customer.

Place Of Supply Rules

specific place of supply rules

There are a lot of specific place of supply rules that apply to any supply made after April 2010. Here is a list where the general rule of supply does NOT apply:

- personal services

- services in relation to real property

- services rendered in connection with litigation

- services in relation to a location-specific event

- passenger transportation services

- services supplied on board planes, trains, etc.

- baggage charges and child supervision

- services related to a ticket, voucher or reservation

- freight transportation services

- postage and mail delivery service

- telecommunications services

- customs brokerage services

- repairs, maintenance, cleaning and alterations, etc relating to goods

- services of a trustee with respect to a trust governed by an RRSP, RIF or RESP

- premium rate telephone services

- computer-relates services and internet access

- air navigation services

CRA's Technical Information Bulletin B-103 Place of Supply Rules under the HST can give you more detail.

Place Of Supply Rules

Out of Province Customers

The question often arises, especially with online internet sales; what are the rules pertaining to GST HST tax rates on out of province sales? Here's my understanding.

Place of supply rules come into play when you buy or sell out of your province. There are four supply categories ... each with separate rules and specific differences for certain groups:

- goods,

- real property,

- services,

- intangible personal property.

In general, if you reside in an HST province (called participating province), and make a sale to a GST province (called a non-participating province), you would reduce the tax charged from the HST to the GST rate.

However, if the out-of-province customer picked up the goods in your province, then you must charge the full HST rate. Either way it is tax neutral to you as you get to claim all relevant ITCs associated with the sale if you are a GST/HST registrant.

And generally, it's the opposite if you are a non-participating province (GST) and sell to a participating province (HST). You must charge the HST rate to out-of-province sales unless the customer physically picks up the goods in your province.

Reference: GST/HST for digital economy businesses: How to charge and collect the tax

Participating vs Non-Participating Provinces

In Canada, 'participating' and 'non-participating' provinces are terms referring to their involvement with the Harmonized Sales Tax (HST).

The Harmonized Sales Tax (HST) is a blended combination of the federal Goods and Services Tax (GST) and the provincial sales tax (PST). The provinces that use the HST are known as 'participating provinces'. As of currently, the participating provinces are Newfoundland and Labrador, New Brunswick, Nova Scotia, Ontario, and Prince Edward Island.

On the other hand, 'non-participating provinces' either only apply the federal GST without a provincial sales tax or they continue to apply both taxes separately. Those provinces which do not use HST are British Columbia, Saskatchewan, Manitoba, and Quebec. Alberta and the territories of Nunavut, Northwest Territories, and Yukon don't have provincial sales tax, thus they only apply the GST.

The reasons some provinces decided against the HST vary. Economic factors, political considerations, and public opinion have all played role in these decisions. For instance, when British Columbia initially switched to HST, there was a significant public backlash leading to a province-wide referendum in which the citizens of BC voted to return to a separate GST/PST system.

In some cases, provinces may believe that maintaining their own PST gives them greater control and flexibility over their taxation and revenue. They might also be wary of the administrative transition costs and potential business implications of moving to HST.

Cross Border Digital Products and Services

Online Internet Sales | Virtual or Electronic Commerce

Do you have to charge GST HST on internet sales (online sales) in Canada? Have you been wondering what CRA's views on virtual income and expenses are?

New rules for digital economy businesses are effective July 1, 2021. Generally, digital platforms are required to register and collect the GST/HST from you on such supplies that they make to you as a Canadian consumer, and on such supplies made by non-resident vendors to you that they facilitate through their platform.

The purpose of these new rules are to level the playing field between domestic and international service providers.

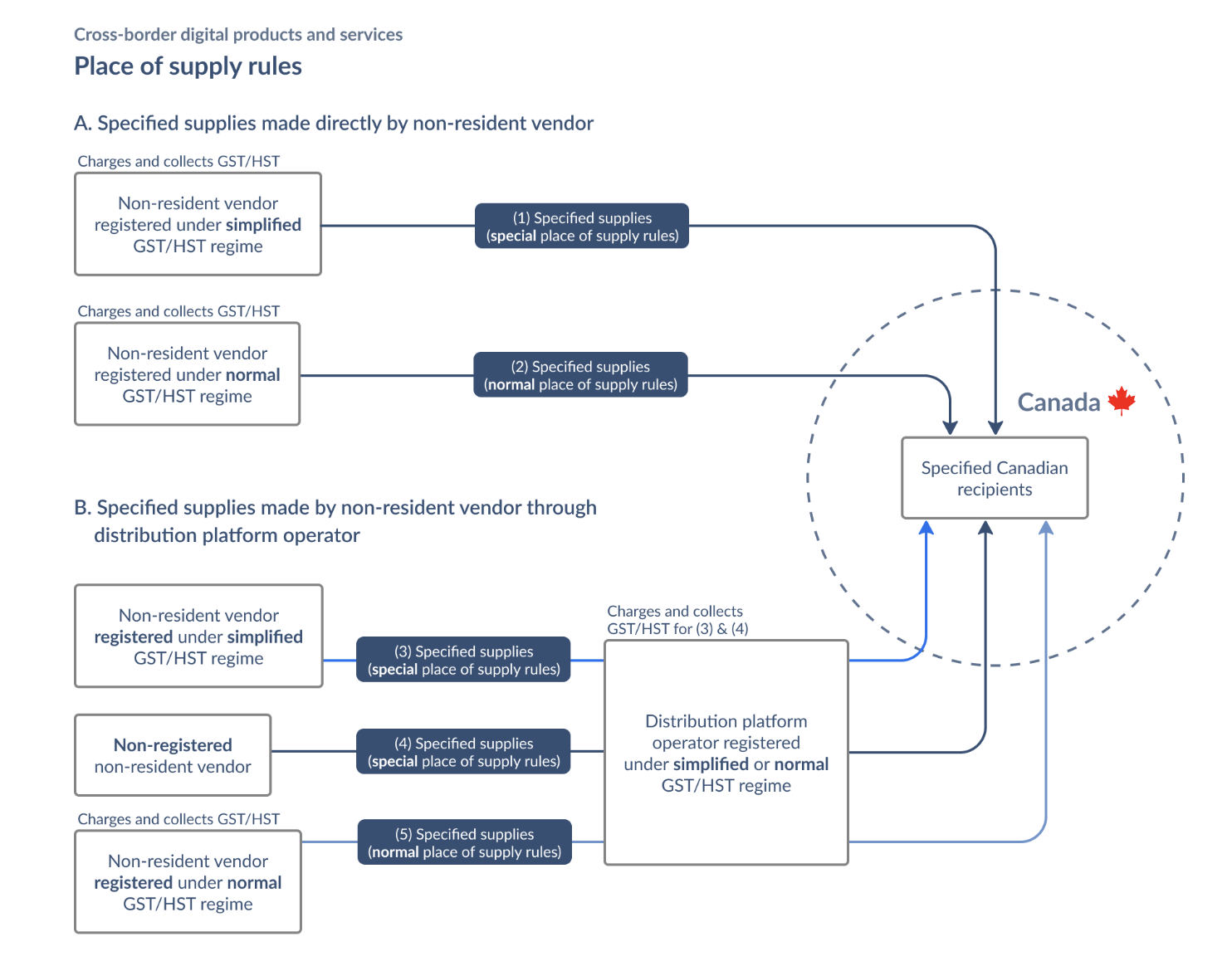

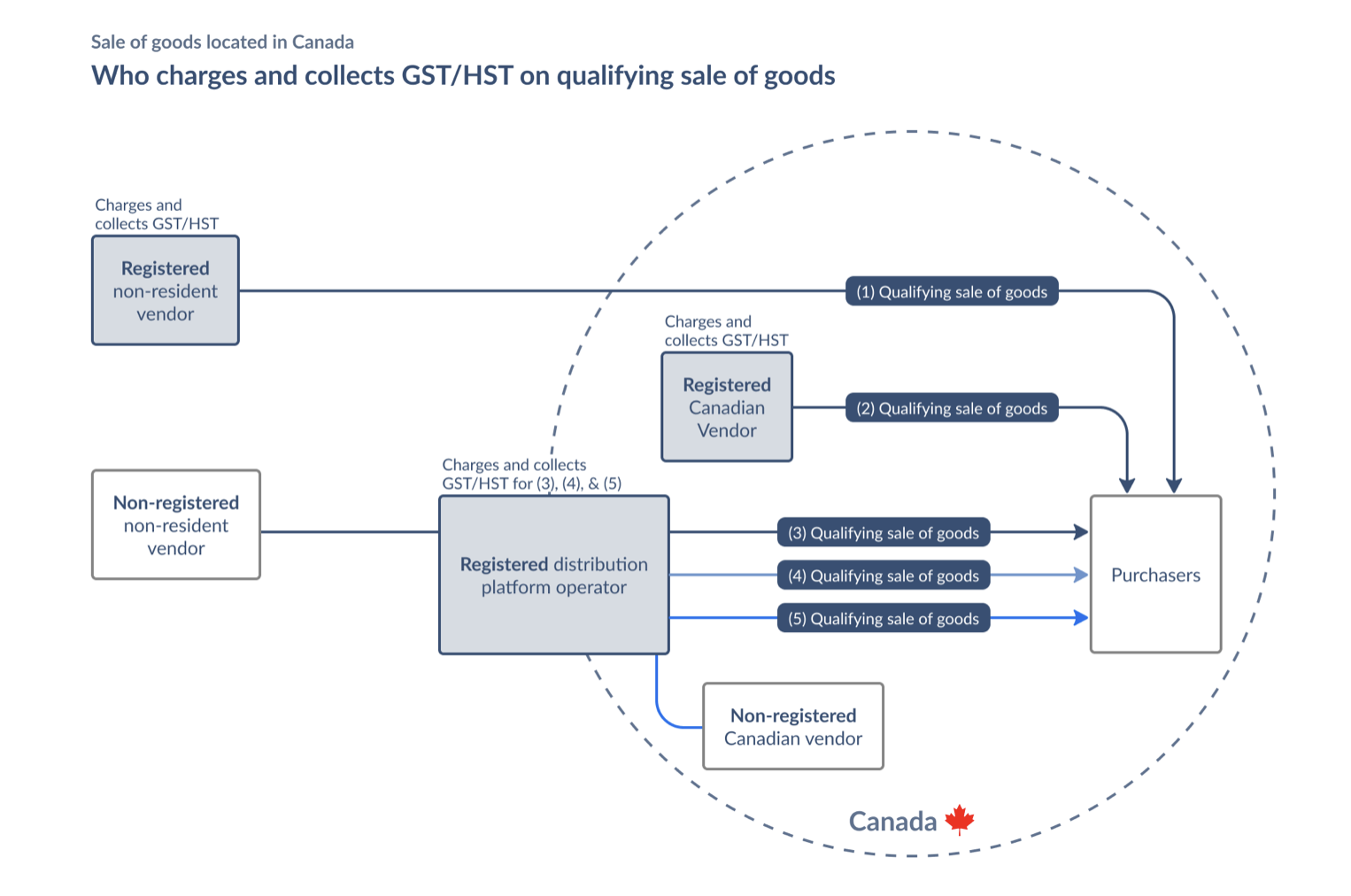

The flowcharts below are from CRA online information about digital economy businesses. They help you see who charges and collects GST HST on cross border digital products and services.

Please refer to CRA's website for definitions of the various terms.

CRA's article on GST/HST for digital economy businesses | Cross-border digital products and services

CRA's article on GST/HST for digital economy businesses | Cross-border digital products and servicesDo you have to charge GST/HST on internet sales (online sales) in Canada? Have you been wondering what CRA's views on virtual income and expenses are?

Canadian electronic income (income earned online) is treated the same way as traditional commerce income. Income taxes and value added taxes (GST/HST) apply to both.

When CRA talks about virtual or electronic commerce, it relates to supplies made and transacted over the internet. For their purposes, there are two types of electronic supplies:

- supplies of intangible personal property; and

- supplies of a service.

Specified supplies generally refers to IPP situated outside Canada and services consumed outside of Canada. It can also refer to short-term accommodation.

CRA clearly state that a supply made by electronic means is NOT a supply of tangible property.

For the purposes of GST/HST:

- Web hosting and web design are considered a service (not a telecommunication service which has different supply rules).

- Downloads (digitized products) are considered intangible property.

- Packaged software (shipped) is considered a good.

Bloomberg Tax published Canada’s Indirect Taxes: A Guide for Digital Service Providers authored by Aleksandra Bal. Under Practical Considerations, she explains, "Non-resident businesses selling digital services to Canadian customers need to determine where their customers are located in Canada as the the tax rates vary by province. ... [Foreign sellers] generally have no tax collection and registration obligations in respect of sales facilitated by online marketplaces."

CRA's article on GST/HST for digital economy businesses | Cross-border digital products and services

CRA's article on GST/HST for digital economy businesses | Cross-border digital products and servicesQualifying sale of goods generally refers to stock held for sale in the ordinary course of business.

Reference: GST/HST for digital economy businesses: How to charge and collect the tax

Tracing History - Online Sales Rules Before Jul 1, 2021

Prior to the new rules for digital economy businesses coming into effect, here's how things worked.

Canadian electronic income (income earned online) was treated the same way as traditional commerce income. Income taxes and value added taxes (GST HST) apply to both.

When CRA talked about virtual or electronic commerce, it related to supplies made and transacted over the internet. For their purposes, there were two types of electronic supplies:

- supplies of intangible property; and

- supplies of a service.

CRA clearly stated that a supply made by electronic means is NOT a supply of tangible property.

For the purposes of GST HST:

- Web hosting and web design were considered a service (not a telecommunication service which has different supply rules).

- Downloads (digitized products) were considered intangible property.

- Packaged software (shipped) was considered a good.

Ernst & Young had an excellent article on the tax issues surrounding cloud computing and its borderless nature. Cloud computing was defined as "share infrastructure in which large pools of systems are linked to provide IT services". It had a list of questions the cloud business user and the cloud service provider should have covered/considered. See TaxMatters September 2012.

FAQ About Place of Supply rules

Place of Supply Rules for Internet Sales Purchased From Inside Canada

Place of Supply Rules for Internet Sales Purchased From Inside Canada

If you are shipping goods inside of Canada that were ordered online over the internet, GST/HST applies.

After April 30, 2010, the general rule if you are electronically selling services or intangible property to a Canadian resident is ... the GST/HST rate applies according to the location of the end user/customer. As of May 1, 2010, it is no longer based on the location of the where the service originated.

That means these rules apply to the purchase of digitized products like eBooks and services such as web hosting and web design.

How Internet Sales From Outside Canada Affect GST/HST | Non-resident Sales Tax Rates

How Internet Sales From Outside Canada Affect GST/HST | Non-resident Sales Tax Rates

If you are shipping goods outside of Canada that were ordered online over the internet, the goods are zero rated (which is different than exempt) and therefore NO GST/HST is collected.

The general rule if you are electronically exporting services or intangible property to a non-resident person (defined as the billing address is outside of Canada without a permanent establishment in Canada) who is not a GST/HST registrant, you do NOT charge GST/HST as it is zero rated.

I understand this to mean electronic supplies (intangible property and services) are zero rated if exported.

Check CRA's GST/HST Technical Information Bulletin B-090 GST/HST and Electronic Commerce for more details.

It is worth mentioning that eBay sellers were selected for audits in the fall of 2009. Their online income should have been reported on Form T2125 when filing their personal tax returns ... and applicable GST/HST should have been collected and remitted.

Place of supply rules are complex ... you don't know what you don't know. No one said small business taxes in Canada would be simple. If you feel you need specialized advice in this area, you may want to visit the website of David Sherman, Canadian tax lawyer.

Reference: CRA GST/HST on imports and exports

Can You Claim A GST ITC For US Purchases? | Place of Supply Rules for US Purchases

Can You Claim A GST ITC For US Purchases? | Place of Supply Rules for US Purchases

A forum question stated the following: I was wondering if we can claim the GST input tax credit for business goods & services purchased from the US? Some places do charge it to Canadian customers and it's visible on their receipts, but others do not.

Secondly, if we earn an income from a US source, do we claim GST on that as well?

Yes you can claim your GST ITCs on U.S. purchases. Just check out that they are a valid GST/HST registrant first. The amount you can claim should be clearly shown on the invoice / receipt and show their registration number. If it doesn't I email them and request the information for my business records.

As you noticed, not all your U.S. purchases are charged GST/HST. That is because only U.S.businesses with a permanent establishment or presence in Canada must register and charge the tax. I talked about this when discussing online / electronic income above.

Generally, U.S. income is zero rated, so you don't charge GST/HST ... but you need to make this decision pertaining to your business under the new place of supply rules. That means most, not all, of your affiliate / commission income from the U.S. is zero rated.

Here is the general rule again for digital sales originating in Canada and exported to the U.S.

If you are electronically exporting services or intangible property to a non-resident person who is not a GST/HST registrant, you do NOT charge GST/HST as it is zero rated. A non-resident is defined as the billing address is outside of Canada without a permanent establishment in Canada.

Effective July 1, 2021, digital sales imported to Canada changed. See information on this presented earlier in this article.

Place of Supply of Rules Checklist for Exporting Commercial Goods

Place of Supply of Rules Checklist for Exporting Commercial Goods

If physical goods are exported, Customs will charge all duties and taxes when it crosses the border. If physical goods are imported, Customs will charge the applicable taxes and duties necessary.

If you are exporting goods outside Canada, review this checklist for exporting commercial goods from the Canada Border Services Agency (CBSA) before you export. It was designed to be used with their step-by-step exporting guide.

If you export to the U.S. The Canadian Trade Commissioner Service has a guide for Canadian businesses exporting to the U.S.. This is an archived publication so be sure to also click on the CUSMA link.

The Global Affairs Canada website states "Canada believes that electronic commerce provides new ways of doing business, opens new business opportunities and that it is still commerce rather than a new sector. Canada considers that existing multilateral agreements and frameworks already apply to electronic commerce" ... "From an international trade policy perspective, what is needed is greater clarity in applying existing international trade rules to electronic transactions."

I started out this research trying to determine if any of the states in the U.S. had eCommerce sales/use tax on Canadian internet transactions. Check out this 2019 US Sales Tax Guide for Canadian eCommerce Sellers published by Baranov CPA.

You may be interested in this chat about CBSA Duties and GST Payable.

Place of Supply Rules for Selling Remote Assistance Services to the US

Place of Supply Rules for Selling Remote Assistance Services to the US

If you sell remote assistance for software services to US do you charge HST, state taxes or nothing?

Remote selling refers to digital or remotely provided products, services, and intangible personal property such as consulting services, digital products, and online platform services. They include but are not limited to:

- Accounting, advertising, consulting, and legal services, etc. delivered remotely

- Investment management services

- Memberships in non-profit organizations

- Mobile apps

- Music and video streaming

- Online courses

- Video games

It is my understanding that when you export your services to the US, sales tax is zero rated. The July 1, 2021 digital business economy changes (discussed earlier) applied to importing to Canada.

The rules may be slightly different if the US business has a permanent establishment in Canada.

If you have a business presence in the U.S., the rules are different. I have no experience with or knowledge of U.S. state tax requirements. However, it is my understanding that use tax applies only to tangible personal property for U.S. businesses / residents at this time. I believe all sales from outside the U.S. fall under international tax treaties.

I recommend that you seek the professional advice of a CA or CGA to ensure correct treatment of your revenue stream ... preferably a cross border specialist.

What are the QST registration rules for businesses that do not have a physical presence in Quebec (non-residents)?

What are the QST registration rules for businesses that do not have a physical presence in Quebec (non-residents)?

Effective January 2019, Quebec introduced new QST registration rules for Foreign Specified Suppliers (FSS) and Specified Digital Platform (SDP) operators. Canadian Specified Suppliers (CSS) went into effect September 2019 .

These rules affect businesses that do not have a physical presence in Quebec, are not QST registered and sell Quebec consumers services, certain goods or intangible goods such as downloads of digital music, software, movies, TV shows or games.

Three QST Suppliers Criteria*

1. An FSS is a supplier who:

- does not carry on a business in Canada;

- does not have a permanent establishment in Canada;

- is not registered for GST/HST purposes; and

- is not registered for QST purposes under the regular QST system.

2. A CSS is a supplier who:

- does not carry on a business in Québec but does in other provinces;

- does not have a permanent establishment in Québec;

- is a GST/HST registrant; and

- is not registered for QST purposes under the regular QST system.

A non-resident supplier who is a GST/HST registrant is a CSS and not an FSS, since as a registrant it is considered to be carrying on business in Canada.

3. An SDP is a digital platform where an operator:

- enables another person who is an FSS or a CSS to make a taxable supply in Québec of an intangible product or service through the use of a digital platform; and

- controls the essential elements of the transaction between the non-resident supplier and the Québec customer such as billing, the terms and conditions of the transaction and the terms of delivery.

The small supplier rule applies. This means the threshold for registration is $30,000 based on sales made to individual consumers in Quebec in the preceding 12-month period.

A December 2018 KPMG Tax NewsFlash pointed out, "Although the new rules will no longer require specified Quebec consumers to self- assess QST on supplies received from suppliers outside Quebec, these self- assessment rules will continue to apply to other customers in Quebec that purchase supplies from suppliers outside Quebec, including suppliers registered under the new QST registration system. For example, an entity that is registered for QST purposes will not qualify as a specified Quebec consumer and may still be required to self-assess QST on supplies purchased from non-resident suppliers if those supplies are not inputs into the entity’s commercial activities."

If you have Quebec sales, contact your accountant on how to implement these place of supply rules.

*Reference: BDO's article "Tax Alert - Application dates approaching on new QST registration rules for non-residents" is a still a good read for those needing more information. The BDO article explained this system is strictly a QST collection system on sales made to consumers in Quebec so there are no offsetting ITCs.

Do Alberta businesses have to invoice for HST? Do Alberta contractors charge HST when working in another province?

Do Alberta businesses have to invoice for HST? Do Alberta contractors charge HST when working in another province?

Yes.

Place of supply rules for goods are still based on where the good is delivered to your customer ... they did not change. This means if your customer was in your store purchasing goods, the customer is located where your store is.

New place of supply rules for services and intangible personal property are now based on the province of the customer ... which may not be the same place as where the work is performed. This means if your customer is in a non-participating province (GST), you would charge GST only. If your customer is in a participating province (HST), you would charge HST.

Can I Claim HST ITCs for services bought in another province in order to provide services or training in Alberta where there is no HST?

Can I Claim HST ITCs for services bought in another province in order to provide services or training in Alberta where there is no HST?

It is my understanding that any purchase that includes GST/HST, which was made to run your business with the expectation of making a profit, is eligible for claiming ITCs ... as long as you are a GST HST registrant.

However, with the new place of supply rules, if your business is established in Alberta, the services purchased in the other HST province should no longer charge you harmonized sales tax. You should be charged only GST as the tax is now based on where the customer is located and/or receiving the service.

Do I charge HST to Alberta residences?

Do I charge HST to Alberta residences?

It depends on whether the Alberta resident is physically in your store or you are shipping goods to them. Take a look at GST/HST Out of Province Sales and GST/HST Electronic Sales in Canada.

Do I charge Ontario consumers ONT HST if my company is in BC?

Do I charge Ontario consumers ONT HST if my company is in BC?

Depends. If they purchase goods or services while in BC, then you charge BC sales tax. If you ship the goods or deliver the service online to the consumer in Ontario, then you charge ONT HST.

Read my overview of the HST place of supply rules where you will find the different supply categories to help you decide what amount to apply.

See CRA GST/HST Technical Information Bulletin B-103 Harmonized Sales Tax Place of Supply Rules for determining whether a supply is made in a province.

You may also want to check out the CRA GST/HST Info Sheets GI-053 to 084 dealing with specific place of supply rules that do not fall under the general rules.

I summarized the general rule for out-of-province sales tax rates earlier in this article.

If you have internet sales, you can may be interested in CRA's views on virtual income and expenses discussed earlier in this article especially with the new digital business economy rules that comes into effect July 1, 2021..

Understanding Taxable, Zero-Rated, Exempt and Out-of-Scope Supplies

How you code your transactions in a software platform like QuickBooks® Online Canada is important for the correct classification on your sales tax return. Taxable, zero-rated, and exempt coded transactions are included in line 101 sales. Out of scope transactions are used in QuickBooks® to facilitate items that are not to be included in line 101 of your GST HST return.

| Goods and Services | Description | Sales Tax Rate | Tax or Non-Taxable | Claim ITC? |

|---|---|---|---|---|

| Taxable Supplies | All goods and services unless listed as exempt or zero-rated; the rate varies depending on the province or territory | GST-5%, HST-13%, HST-15% | Taxable | Yes |

| Zero-rated Supplies | Basic groceries, prescription drugs and dispensing fees, feminine hygiene products, medical devices, items that would be fully taxable except they are exported outside Canada including services to non-residents of Canada | 0% | Taxable | Yes |

| Exempt Supplies | Residential rent, used residential housing/complexes, long-term residential accommodation, most health, medical, and dental services, child care services, personal care services, tolls, legal aid services, many educational services, music lessons, most financial institutions and insurance services (think bank fees, interest, loan payments, and insurance premiums), some non-profit services | Exempt | Non-Taxable | No |

| Out of Scope Supplies | Nontaxable goods and services reported on your balance sheet such as tax payments, loans, owner draws, transfers between bank accounts, wages, pension payments. Using this code means it will not show up in your GST HST Sales line 101. Note the initial setup of capital purchases are an exception. | 0% | N/A | No |

Need more information? You will find a more complete listing of taxable and exempt items on the CRA website's publication about General Information for GST/HST Registrants.

Sidebar: I'm a dance fan ... can you believe that music lessons are HST exempt and dance lessons aren't? (Well there is an opportunity for some dance lessons to be HST exempt if you are a non-profit. See CRA's RC4081 page 11.) What's up with that? Both are performing arts! I just don't get it!!!!!

General Reference: CRA Publication 3-3 Place of Supply