CRA Tax Audit - Part 2

What To Do If You Receive a Tax Review Notice

by L. Kenway BComm CPB Retired

What You'll Find In This Chat

✔︎ 7 steps to follow

✔︎ IRS audit process

✔︎ How to get access to auditor's information

✔︎ How to streamline information in advance

✔︎ Just how bad can CRA make your life ... one scary story

Step by Step Instructions

YOU have just received a tax audit notice saying you're going to be audited. What should YOU do?

Before I begin, I want to let you know that at the end of this article, you will have the opportunity to share YOUR audit story.

Tax Audits - Four Part Series

click on image below to go to chat

Chat 1

Tax Audits The Process |

Chat 2

Receiving a Tax Notice |

Chat 3

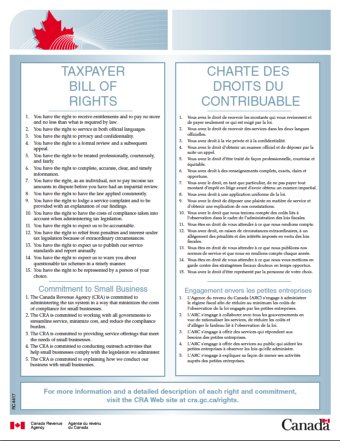

Taxpayer Rights |

Chat 4

Voluntary Disclosure |

IRS Audit Process

Note to my U.S. visitors ... I'm fairly certain this process will assist you too.

However, if your notice is from the IRS, check out their August 24, 2011 Summertime Tax Tip 2011-22 Eight Things to Know If You Receive an IRS Notice.

You can find the article at irs.gov > News & Events> The Newsroom Topics> 2012 Tax Tips> Tax Tip Archive> August 2011 ...

... or bop over to my IRS News page to learn about their new video series called IRS Audit Process.

You've Received A Tax Audit Notice - 7 Steps to Follow

This is over simplifying it but the basic steps if you receive a tax audit notice are:

- Take a deep breath and go get a cup of tea.

- Now read the notice carefully and respond to the time deadline ... it will not go away! Ask for an extension if necessary. You can have a professional bookkeeper, accountant or lawyer represent you. Their fees are deductible on your personal tax return.

- Gather your supporting documents. Organize them and number them. Put together a letter which summarizes what you are submitting, what is missing, any adjustments you filed ... right about now you are probably wishing you had a bookkeeper do your books ;O) Keep copies of everything you are submitting ... just in case CRA loses your documents.

- Take the information to the auditor on time ... then wait for their assessment.

- Attend any interviews requested by the auditor or have your representative attend. Do not volunteer irrelevant or additional information ... just answer the questions. LISTEN to what the auditor is saying. Ask for any additional requests by the auditor to be placed in writing.

- LISTEN to what the auditor is saying and do NOT volunteer additional information. (I thought I'd repeat that just in case you missed it the first time.) ... :o)

- Before you deliver the package or while waiting for the re-assessment, do a tax calculation of the expected outcome of the audit so that when the notice of assessment comes in, you will have a feel for what you are expecting it to say.

GOOD TO KNOW

PWC has a good tax memo that is worth reading about what to do to get access to a CRA auditor's information used to create or support the positions taken.

Tax audits do NOT go smoothly if you are disorganized and don't have supporting documents to back up your claim ... in other your words, the accounting for your small business was done sloppily or by a person without sufficient knowledge.

That's why you want to setup your accounting system to audit proof you and your business as part of your day-to-day operations. Small business bookkeeping is key. It's important to do it right and not wing it.

An excellent resource article titled Canada Tax Audit FAQ can be found at fightthecra.ca . The list of practical questions are answered by tax lawyers at Barrett Tax Law in user friendly language.

A Very Scary Real Life Audit Horror Story

Read this story for just how bad CRA can make your life. This couple lives in the same area where I had my lakefront property for sixteen years (I've moved now) and their problems started in 1996.

I obviously don't know the details except for what CBC interviews divulged. But I suspect a lot of little things went wrong (from leaving the tax auditor alone with his records ... to the tax auditor taking the records and then losing them ...) and they just kept building on each other.

If he had found a way to pay the disputed tax liabilities while arguing his case, he would not have lost everything. The interest and penalties would have stopped and CRA would have had no reason to seize his assets and put them up for sale.

In "The Current" interview, he said his bookkeeper was a professional accounting firm so I'm not sure why he didn't have them represent him during his audit ... but in court it mentioned he failed to let his accountant know the CRA were auditing him.

It's now 2014, eighteen years later ... this is how the story ended. As the newspaper article states, "CRA had launched an investigation because of the number of personal items found when looking at his claimed business expenses [my emphasis] when a routine audit into his income tax was launched in October 1996. ... Unfortunately for Leroux, his bookkeeping methods were chaotic. ... in the end she [the judge] decided Leroux was not eligible for any damages, largely because he failed to file an appeal [my emphasis] before the amounts were registered against his property, waiting 18 months to take that action."

Have you experienced an audit? What did you learn that you can share about YOUR audit story?

Remember in the Canadian tax system, you are guilty until proven innocent. Your best defense is proving due diligence through accurate and honest bookkeeping.

Although this was a situation where everything seemed to go wrong, CRA does convict for tax avoidance and tax fraud. They actually publish their convictions on their website. Just go to the Media Room (or Newsroom .. they keep changing the name). You will find a link to convictions under Products for the Media.

THE BOOKKEEPER'S TIP

Paul Lynch of KPMG and a former CRA official, has tips on how to streamline information ahead of time that will be required if you are audited, or pre-audited (asked to respond to a generic questionnaire prior to an audit).

Mr. Lynch asserts "it’s helpful to document the reasons for transactions while they’re happening. [my emphasis] Having evidence on hand to show how transactions achieve your company’s objectives can lift some of the perceived “taint” from those the CRA may view as solely tax motivated. Document the purpose and tax implications of your transactions in succinct, individual records that include executive summaries."

If you have a professional represent you, they will look at prior year's returns for possible errors or omissions. They will determine your strengths and weaknesses and devise a strategy of how to approach the audit to your best advantage.

You may want to take some time and read Understanding Tax Audits in Canada.

I find when you understand the process, it is less scary. If you have

kept a good set of books, tax audits are more of a nuisance than a

worry.

If you want to know how a chartered accountant (CA) recommends you handle a tax notice and subsequent audit, check out Ken Davidson's October 2012 article titled Revenue Canada Audit: 5 Steps To Get You Through It.

Another article worth reading is the Financial Post's October 10, 2012 article title Small businesses need help when going up against the taxman. Towards the end of the article, it talks about your legal aid options with a new group called "Pro Bono Students Canada".

A January 2, 2013 article by Vern Krishna discusses discusses CRA's unlimited powers and right to seize documents. You can find this article at the Financial Post website.

Have A Great Story About A Tax Audit?

Do you have a great story about what happened when you were audited by CRA? Did you change any of your procedures after you experienced an audit? In hindsight, do you wish you would have done things differently from the start?

... or do you have a CRA tax audit horror story? Share it ... please!

Get creative and add a picture if you think it will improve the presentation of YOUR web page.

What Other Readers Have Experienced

Have you just gone through the audit from h***? Do you need to analyze what happened ... what went wrong?

Here is where my readers share their audit experiences ... what they learned ... what they wished they had done differently if they had another chance. :0(

You can help make Tax Audit Stories better by adding your comments and ratings to each contribution.

After The Tax Audit

I have a client that (prior to me taking over the books) was audited by the CRA. He received a Notice of Reassessment for 3 years with a large tax payable. …

CRA Auditor Makes Error

Check out this story published by CBC about a couple in trouble with the CRA because the auditor added personal loans / borrowed money as income ... and …

CRA Plans for High Net Worth Individuals Audits

In the Deloitte May 12, 2011 free newsletter Weekly Tax Highlights , there is a link to an article by Lorn Kutner titled The CRA places more scrutiny …

Combined Tax Audits

Can the CRA still do combined GST/HST and Income Tax Audits?

I read on CRA site that they were discontinued in July of 2010. Hi Natalie,

…

CTV's W5: A nightmare when the taxman got it wrong

Here is a link to a W5 report on CRA audits gone wrong. It aired on April 3, 2010.

http://www.ctv.ca/CTVNews/WFive/20100401/w5_taxman_100403/

When the taxman calls,

we all cower

Sarah Hampson wrote an article for the Globe and Mail on June 1, 2010 titled When the taxman calls, we all cower .

It is all about a letter she received …

How Not To Freak Out ...

During A CRA Audit

I found this article while searching for something else on Google, so I thought I would pass it along.

I thought the audit story was terrific ... and …

CRA horror stories

Do you publish the stories that people have sent you? If so, where can I view them?

Thank you & I like your site! No one has submitted any …

Additional Resource - CRA Webcasts

CRA has a webcast called What To Expect From An Audit that you may want to watch. It is located at cra-arc.gc.ca> Media> Videocasts> Videos for businesses> What To Expect From An Audit.

This Page May Be of Interest to You

It's been great chatting with you .

Your tutor Lake

Bookkeeping Essentials › Canadian Tax Resources › CRA Tax Audit

Enjoy A Tea Break With

Me Today. Let's Chat!

Use the search feature to quickly find the

information you're looking for.

Join Me On Facebook

Help support this site by "liking" me! Here's where I post current information.

Listed Under Websites NOT Local Business.

This website is NOT associated with the business operating in Bonnyville AB.