Welcome to this issue of The Bookkeeper's Notes newsletter focusing on good bookkeeping practices. I would like to wish all my subscribers a happy valentine's day.

If you are a regular site visitor, you know that Bookkeeping-Essentials.com is committed to educating and providing support to ... work from home business owners. I sincerely hope you find this newsletter useful and practical.

If you like this e-zine, feel free to forward it to a friend. You'd be doing me a huge, huge favour. If a friend did forward this to you and you like what you have read, please subscribe by visiting my site.

In this issue I decided to tackle dealing with incomplete documentation in Focus on Bookkeeping and company vehicles in Focus on Payroll. Of course I've also updated news from the CRA and IRS.

Under feature products, I introduce you to an Excel Bookkeeping Course which includes hands on, pre-formatted templates with raw data so you can work alongside the instructor.

In The Forum, you'll find links to some Unanswered Bookkeeping Questions ... and an announcement of the seasonal closing of the "Ask a Free Bookkeeping Service".

This newsletter gives you access to the links of a handful of web pages that are password protected … my newsletter subscribers have exclusive access to these bookkeeping lists and procedures. You will need The Insider's Pass (a password) to access them, which you will find in the last section of the newsletter.

Given the size of the site now ... it has over 500 web pages, I seem to be doing more maintenance of web pages to keep the information current than I do creating new content. As a result, I've added a new section to the newsletter called New Pages, Additions and Revisions ... really original eh! You'll find this section at the very end of the newsletter.

One of my goals for the website this year is to go out and find products and services that can help you do your bookkeeping. As a result of my searches, some of the new pages are product or service related. If you have found a product or service that helped you with your bookkeeping, I'd love to hear from you.

For work from home business owners doing their own books, you may find this service useful … a general review of your ledger. This service is for those who want assurance they are on the right track. I'll perform a high level review of your general ledger to see if there are any obvious problems. You may choose to have me walk you through the problems and how to correct them. If you are interested, send me a message on my contact form.

I also work with bookkeepers just getting into the business to answer their questions through phone conferences or online meetings. Feel free to get in touch with me if you are interested in this service which requires purchasing prepaid hour(s) of time (one hour minimum).

I apologize that I am behind on creating a Bookkeeper's Directory. Any bookkeeper who contacted me after the last newsletter, please know you all made it in and will receive your complimentary posting as promised.

If you would like to be listed in the directory, the price is $25 for one year. If you are a bookkeeper and don't have a website, I will also create a full web page (on my site) featuring your business, if desired, for $75 a year (includes directory listing). You can revise it and update it as often as you want; however each revision to your web page will be $25.

A quick reminder ... in Canada, most T-slips are due at the end of February. Check out my tax season due date reminder table here ...

In the U.S., W-2s and 1099-MISC should have gone out by the end of January. Check out my business tax and tax season calendar tables here ...

As we are approaching the last months of winter, I share with you a picture my neighbour ... neighbor for my American readers :0) ... took of a woodpecker feeding on the suet block she made.

It is my sincere hope that the information I provide on Bookkeeping-Essentials.com, and in this newsletter, will help you learn good bookkeeping practices to manage your business finances easily and more efficiently. It can be tough coming up with ideas on what to write about. If there is something you'd like me to cover, please drop me a line.

To your success! ... and, of course, thank you for subscribing to this e-zine.

Until next time,

Laura (aka Lake) :0)

Lakeshore Bookkeeping Services

BComm CPB

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this e-zine or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using my site content for any reason whatsoever.

In This Issue ...

- Feature Product - Excel Bookkeeping Lessons on Workpapers

- In the Forum - Ask a Free Bookkeeping Question Is Closing For Tax Season

- Focus on Bookkeeping - Dealing With Incomplete Documentation

- Focus on Payroll - Company Vehicle, A Benefit Or A Trap?

- Recent Canada Revenue Agency (CRA) News

- Recent Internal Revenue Service (IRS) News

- The Insider's Pass - The Current Password is Here

- New Pages, Additions and Revisions - Enjoy a cup of tea while you browse

Click on the logo to see the course curriculum.

Taught from a Canadian Perspective

This issue I'd like to introduce you to a "hands-on" course on how to setup Excel bookkeeping workpapers to analyze your business data in 10 easy lessons.

Michaela Ditchfield, CPB of MD Accounting Resources leads these classes sponsored by the IPBC.

What Will You Learn In This Course

You will learn how Excel can be used to develop bookkeeping workpapers (we are not talking about synoptic journals here) to aid in the analysis of company records. This course will provide hands on sample raw data and the following bookkeeping workpaper templates:

- hyperlinked summary of workpapers and checklists for clients, workpaper files, management reports, aged receivable past due, gross profit, top 10 and bottom 10 customers, sales by item, sales by revenue centre, sales by salesperson, top 10 sales items, budgets and forecasts, and financial statements

- a GST/HST (Canadian sales tax) workpaper

- Canadian payroll workpapers with examples highlighting employment status, group health benefits, and proration of vacation pay for mid year hires or termination of employees

- a loan payment workpaper

- various workpapers showing how to use your customer lists for data mining

- various workpapers including examples of how to calculate and rank profit on the sale of inventory

- how to create a workpaper that analyzes salesperson performance including which salesperson created the most profit for the business

- how to create a comparative income statement with visual trending embedded in the workpaper for powerful management presentations

Is This Course For You

This course is delivered over a 10 week period. Each of the 10 Microsoft Excel bookkeeping workpaper lessons, taught from a Canadian perspective, are structured as follows:

- You receive a recording of each lesson to download (it is not streamed) for your own personal use; to be viewed as many times as you want. It may not be sold or used for commercial purposes.

- Each lesson is 60 minutes in length followed by up to 30 minutes of questions and answers (Q&A).

- Included with each lesson is a pre-formatted Excel workbook (in MS Excel version 2010) pre-filled with Canadian raw data samples for you to follow and practice "in class" as the instructor walks you through the lesson using raw data.

- Following each lesson, homework will be assigned by email to practice what you learned along with the answer key to the assignment.

- After each lesson, you are emailed a pdf file of written responses to the Q&A asked during the lesson, prepared by the instructor.

- BONUS - Access to the instructor by email for one week following each lesson when you purchase all ten lessons.

As each lesson builds upon the other, it is to your benefit to complete each homework assignment prior to the next lesson.

You can purchase individual lessons or receive a discount by purchasing all 10 lessons as a package.

Laura Recommends Excel Bookkeeping Workpapers

I attended the course last fall, and Michaela's teaching style was professional and easy to follow. I especially liked being able to work in the same spreadsheet she was in so I could solidify the skill / feature being taught. I don't know about you, but it always looks easy when someone else is doing it! I found her examples to be relevant to bookkeeping in Canada.

As with all products purchased through Bookkeeping Essentials, I earn a small commission each time YOU purchase a product through the links in this newsletter or throughout the site. It's an extra step that allows me to continue to provide free resources to visitors just like YOU.

Click on the picture to see the course curriculum.

In the Forum - Ask a Free Bookkeeping Question Is Closing For Tax Season

Ask a Free Bookkeeping Question will be closed from March 1 to June 15, 2012.

During this period, please use the customized search boxes found throughout the site to see if your question has been asked and answered previously.

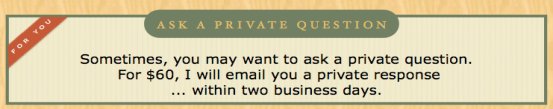

... OR if you would like me to personally answer a bookkeeping question for you, my Ask A Private Bookkeeping Question service is still available. My fee is $60 per question. The rate will be rising to $75 per question on June 15th.

Until March 1, please take the time to visit ... Unanswered Bookkeeping Questions and share your knowledge.

I invite bookkeepers who use this site as a resource to respond to these questions ... or any other posting on this site. As my way of saying thank you to you for giving back to other bookkeepers and small business owners, please "sign" your post with YOUR name and the name and address of YOUR business ... a way to promote your business at no cost.

If you could add source references when you respond ... I'd be over the top with delight!

Greg from The Small Business Doer, author of the article Banking Assists Business Record Keeping, caught an error of mine in one of the forum postings and took the time to post how he handled the transaction. I really appreciated it because, like many bookkeepers out there, I worry about not recording something correctly ... and I am ALWAYS learning. The reality is I do have a very small practice. I have NEVER gotten 100% in an exam. I am not a certified accountant who is up-to-date with the latest in GAAP and undergoes formal practice reviews. I am not a tax specialist ... but I decided to share my notes on what I've learned with you for free anyway. I'm not trying to denigrate my knowledge, just acknowledge that I can grow and become a better bookkeeper when you share your knowledge too. You need to know, I use these notes for my reference too!

Here are four questions I haven't had time to answer:

Jennifer could use help with GST/HST input tax credits for an MLM business.

Perhaps you have an opinion for Tami on How To Record (or Not Record) Direct Selling Transactions.

If you live in Alberta, perhaps you will be able to help out Kelsey who is wondering about the benefits of having the business own the vehicle (see the comment section for this posting).

Melanie is looking for information on how to switch a set of books from cash basis to accrual basis.

For the people who submit their questions through my contact form, you need to answer "Yes" to the question, "May I publish your comments?", to allow me to respond to your question in the forum ... or you need to purchase a private question. If neither of these options have been utilized, I do apologize but your question will remain unanswered.

For people who post a question in the forum without including their email address, you need to know you may miss the response I give in the event I reclassify your post to an existing forum posting with the same or similar topic.

Purchase your private bookkeeping question here ...

Focus On Bookkeeping - Dealing With Incomplete Documentation

Bookkeepers everywhere often have to deal with incomplete documentation ... and wonder how to handle it.

Anne Cabrera of Sowing Seeds Accounting Services in Richmond, B.C. contributed an excellent article on her research and experience when encountering lack of "proof of purchase" source documents.

Please take time to read her forum posting ... AND please take time to add your audit experience for income tax AND for GST/HST tax. Sharing your experience helps other bookkeepers and business owners alike.

For my U.S. visitors, a bookkeeper from Ohio (sorry no name or business name was left to give you details) also made a posting on this topic. I'd be interested in knowing how the IRS deals with incomplete documentation during an audit.

Another useful forum post on this topic can be found at AR Reconciliation Mess. It has links to several other posts as well.

A quick word about backwork. The above post talks about booking unmatched invoices or payments to the accounts receivable module.

While running items through accounts receivable and payables is a great internal control ... when I am doing backwork, if it is clear I have a match between a bill (proof of purchase) and a receipt (proof of payment), or I'm recording regular preauthorized payments, I won't bother running it through accounts payable. I'll book it directly to the appropriate expense account if the purchase and payment are on the same day or in the same month.

Why? When possible, I try to keep in mind what I was taught ... I was hired to do bookkeeping for the client, not for me. By this I mean, the client is looking for information on financial reporting to help him/her run the business. Why record two entries for internal control purposes when one will do?

Do keep this in mind however, internal controls are really important when a bookkeeper is an employee (as opposed to a freelance bookkeeper) and doing real time entry of the data.

Improve Your Cash Flow

Actively Manage Your Accounts Receivable

Click here for more information.

30 day money back guarantee.

Focus on Payroll - Company Vehicle, A Benefit Or A Trap?

I thought we'd chat about the company car this issue, a very high level overview with references where you can find more detailed information.

As many articles I read pointed out, the company car can be a worthwhile taxable fringe benefit ... but it can also be a tax trap and audit trap for those ignorant of the rules. Canada - The Company Car

Back in the good old days, it was clearly a perk and employee benefit to have a company car. Stephen Thompson CA CFP TEP and author of 167 Tax Tips for Canadian Business (my version is from 2009) explains that nowadays it is often simpler to own your vehicle personally.

This is a complicated area with a very specific set of rules ... and one that CRA audits regularly.

CRA's website explains very concisely the three parts to the taxable benefits pertaining to the company car:

- the standby charge ... PLUS ...

- the operating cost benefit ... MINUS ...

- any employee reimbursements for the benefits (which must have been made no later than 45 days after the end of the year).

These requirements mean your records will need to track operating expenses like gas, oil, repairs and insurance separately from capital costs / leasing expenses; which you are doing if you are doing your bookkeeping correctly.

It should be obvious that CRA will expect a mileage log to substantiate your business travel.

Form RC18 is a worksheet that lays out how to calculate automobile benefits while chapter 2 of Guide T4130, Employers' Guide – Taxable Benefits and Allowances explains the various components. On the website under Payroll> Benefits and allowances> Automobile and motor vehicle benefits are some useful links as well.

CRA's online automobile benefits calculator has made it much easier to determine any taxable benefits arising from the company car. Check under payroll> automobile benefits and allowances.

Because company cars always have a personal use component, it means taxable benefits have to be calculated and included on the T4 information slips issued to employees each February. This personal use component is calculated according to CRA's standby charge and operating benefit rules.

So what is considered personal use of the company car? Availability of the vehicle for unrestricted use during non-business hours. It's important to note that driving to and from work is considered a personal expense even if the employer (that would be you) insists the vehicle be taken home.

As the standby charge calculates the benefit an employee receives from having the vehicle available for personal use, employees can avoid the standby charge that attracts a taxable benefit if company vehicles are kept on company property during non-business hours.

Standby charges can be substantial because they are based on the capital cost of the vehicle. CRA allows you to reduce the standby charge if you can show these conditions exist:

- An employee is required to use the automobile to perform their duties,

- The employee's business use of the car is more than 50% of the kilometres driven, and

- The employee's personal use of the car is less than 1,667 kilometres per month, or 20,004 kilometres per year.

Capital cost claims have restrictions pertaining to luxury vehicles ... generally defined as vehicles over $30,000. You can however deduct CCA, interest and borrowing costs subject to the limitations.

If the company car is leased, there are limitations pertaining to deductions as well.

Click here to find the current and historical limits for company vehicles.

The operating cost benefit calculates any part of the operating costs paid by the employer (that would be you) on amounts relating to the employee's personal use of the vehicle.

Form RC18 lays out the two options available regarding the taxable benefit for operating costs, one of which requires a written election prior to the end of the year.

If you would prefer to use reference material other than CRA, I found three excellent references for you:

Reference One: As PricewaterhouseCooper Canada'a (PwC) Car Expenses and Benefits; A Tax Guide explains the decision to provide a company car depends on what your goals are. Are they to "have the least amount of record keeping combined with the smallest possible taxable benefit" or do you want to "minimize employer cost while maximizing employee benefits"? This comprehensive guide is available to download and includes numerous planning technique tips for the employer and the employee.

Reference Two: Your Personal Tax Planning Guide 2011-12 prepared by Ontario's Certified General Accountants has a good summary on the use of a company vehicle (see page 16) along with 3 related excellent tax planning tips. You can download this guide from the CGA Ontario website.

Reference Three: BDO has an Automobile Expenses & Recordkeeping tax bulletin available for download. If you go right to the end of the bulletin, there is a really nice summary of the automobile benefit amount and deduction limits.

I apologize for not providing links but they change regularly. Just bing/google the titles (in italics or bolded) and you should have no problem locating the references supplied.

United States - The Company Car

Let's start with ... it's complicated ... just keep in mind that business use must be substantiated by a mileage log IRC 274(d).

The IRS publication Taxable Fringe Benefit Guide, chapter 14 (employer's perspective) and publication 463 Travel, Entertainment, Gift, and Car Expenses, chapter 6 (employee's perspective) contains useful information about the employer-provided vehicle.

Auto useage is categorized into three separate areas to facilitate three different valuation options:

- business use valuation options

- vehicle cents per mile rule if test criteria is met Reg. §1.61-21(e); OR

- automobile lease value rule Reg. §1.61-21(d)

- personal use other than commuting valuation

- treated as wages and subject to withholding and payroll taxes based on (generally) the fair market lease value of the vehicle Reg. §1.162-2(d), Reg. §1.132-5(b); OR

- reimbursed by the employee Reg.§1.61-21(c)

- personal commuting to and from work use valuation

- the commuting rule subject to conditions being met Reg. §1.61-21(f)

- not available to control employees

Make sure you read about the rule differences between records provided by the employee and records not provided by the employee. Remember, personal vehicle use is taxable compensation and must be included in an employee's W-2 as wages.

Fair market value of vehicles have limits that cannot be exceeded.

Employees using company cars do not need to keep mileage logs if the vehicles are never used for personal purposes or personal use is commuting only. See the guide for tests that must be met to qualify. If conditions are met, the employer must have internal controls in place that monitors use of the vehicles.

Because you have options as to how to claim these deductions ... and because generally the method can't be changed once selected ... here is definitely a case where a small business owner should get professional advice so as to maximize employee benefits while minimizing employer costs.

I did find a great reference you may want to check out ... 2010-2011 Payroll Reference Manual authored by Baden, Gage & Schroeder, LLC. It includes a year end checklist and an annual reconciliation worksheet in addition to sections on annual charges; year end reporting and taxation of fringe benefits; legislative developments / recent court decisions; and form review and revisions. Company car information and forms can be found on pages 23-25 (rules), page 26 (fringe benefit calculation form), and page 27 (annual lease value table).

Next issue, we'll look at the second option available to employees ... instead of the company car, use of your personal vehicle for business.

Because this is a complex area, as I mentioned earlier, please check with your accountant, as I very well may have misunderstood or misinterpreted what I was reading.

Humour by Advice ... with Dr. Julia Chicken

Recent CRA News ... and Other Government News

CRA announced in January that Wage Loss Replacement Plans (WLRP) are now considered income and subject to CPP contributions.

2011 simplified vehicle travel rates were released early in 2012. You'll find the rates here. Simplified travel rates are used for calculating medical travel, northern living allowance and moving expenses.

2012 employee auto allowance tax rates were released late December. You'll find the rates here here. Employees who use their personal vehicle for business purposes utilize these tax free kilometer allowance rates. This allowance is not available to sole proprietors.

A reminder that a new online service, Submit An Inquiry begins April 16, 2012 at CRA. You will be able to receive written responses when questions are asked online.

A new web page on the CRA website has all the online service links available for businesses. No more searching numerous pages ... it is all on one page ... definitely one of my favorite pages now. You access it by choosing slide show number 3 on the home page. I haven't figured out how to get to it from the menu yet except to search for "Businesses: save time-go online!".

Prescribed interest rates for the first quarter of 2012 held steady. The last rate change was July of last year when corporate rates for overpayment of taxes was introduced. Find the interest rate tables here ...

You can find a list of new or revised publications for excise tax or GST/HST in the winter 2012 newsletter issue No. 83. Some that caught my eye are GST189 - General Application for Rebate of GST/HST; GST489 - Rebate Application for Provincial Part of HST (if you have a home office, you'll need this form); 9-1 - Taxable Benefits (Other Than Automobile Benefits); and 9-2 - Automobile Benefits.

Recent IRS News and Related News

Standard mileage rates that came into effect January 1, 2012 can be found on the Self-Employment Tax page.

The IRS has some record keeping tips on YouTube. Just search for Tax Tips:Record Keeping. The video is more about data retention requirements than organizing the receipts themselves.

While at YouTube, you may also want to check the IRS video on Common Tax Return Mistakes.

The IRS put up a webpage (Headliner Volume 317) listing the FUTA credit reduction amounts certain states must adjust on their unemployment tax liability on Form 940. You can read more about FUTA credit reduction rates here ...

The SSA/IRS Reporter Winter 2011 issue had an excellent article by the American Payroll Association on preparing for year-end. It contained a checklist that runs from December through to the end of February. While too late to use for this year, you may want to save a copy of the article for next year.

Of course it is not news now, but the Temporary Payroll Tax Cut Continuation Act of 2011 passed and extends the SST withholding rate at 4.2 for the employee portion. Circular E has been updated to reflect the new rates. This rate expires at the end of February unless it is extended to the end of 2012. See the FICA rates for 2012 here ...

IRS Notice 2012-09 was released and provides interim guidance for 2012 Forms W-2 pertaining to employer health care coverage reporting.

IRS interest rates for the second quarter of 2012 should be released soon. Once they are released, you'll find the interest rate tables here ...

A quick refresher can be found in IRS Tax Tip 2012-16 Tax Tips for the Self-Employed. For example, point 6 reminds you that:

"To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your field of business. A necessary expense is one that is helpful and appropriate for your business. An expense does not have to be indispensable to be considered necessary."

In the IRS Tax Tip 2012-27, you'll find information on tax law changes for 2011 federal tax returns. It is worth a quick scan.

The Insider's Pass

The Insider's Pass gives you access to the pages in Bookkeeping Essentials that are available only to newsletter subscribers ... my way of saying thank you. Here's how it works. The pages listed below will only be partially viewed by all visitors. To view the entire article, you will need your Insider's Pass for access. The password will change with each newsletter … every two months. So if you ever forget, you will always find the most current password in your current issue of The Bookkeeper's Notes.

The current password is LoveLife (it is case sensitive) ;0) Here is a list of the pages which are password protected so that only my very important subscribers ... that would be YOU :0) ... have access.

Internal Controls

No password page

Password protected page

Bookkeeping Checklists

No password page

Password protected page

Bookkeeping Entries - Journal Entry Examples

Routine Bookkeeping Entries - No password page

(Accounts Receivable, Accounts Payable, Inventory)

Common Bookkeeping Errors - No password page

(Capital Assets, Banking, Taxes, Year-end)

Password protected page

Month End Procedures

No password page

Password protected page

Adjusting Entries

No password page

Password protected page

Monthly Financial Review or How to Supervise Your Bookkeeper

No password page

Password protected page

New Pages, Additions and Revisions

I often add new pages or rework one existing page into two or more pages if it has gotten too long. Over the next year, I will also be consolidating forum posts. Where a topic has been popular, I may remove the forum post and replace it with an article on the subject.

Most of the page additions this month were pages about products or services I thought would be of use to my readers.

As it is tax time, I've made the T2125 tax articles accessible on the navigation bar.

The Virtual Online Bookkeeper is an eGuide book available for purchase. It was developed by a Professional U.S. Bookkeeper who has created a bookkeeping practice from the ground up twice. It includes instructions for your internal business system setup. Read more here ...

An Interview with Brook Duncan, the author of The Paperless Document Organization Guide and The Unofficial ScanSnap Setup Guide. Read more here ...

I split up the Handy Bookkeeper's Reference into two pages - CRA News and Small Biz News.

As receipts organization is a hot topic at this time of year, I reorganized the left hand side navigation bar to highlight this area. For those of you who love to file receipts by tossing them on the floor of your vehicle or in your purse, please do consider reading the article on The Vehicle System of your organizing receipts.

If you are a self-employed boookkeeper, consider taking a look at one professional bookkeeper's tested and proven system for organizing files and receipts. Consider setting up your clients up on the system right from the get go.

For those who have no bookkeeping background but have been charged with doing a relative's books, learn basic bookkeeping with John Day as your instructor.

For those who have no bookkeeping background but have been charged with doing a relative's books, learn basic bookkeeping with John Day as your instructor.

This wraps up this issue of The Bookkeeper's Notes newsletter. I'll touch base with you again in the early spring. See you in April.

Comments? Ideas? Feedback? I'd love to hear from you. Just reply to this e-zine and tell me what you think!

|

For those who have no bookkeeping background but have been charged with doing a relative's books,

For those who have no bookkeeping background but have been charged with doing a relative's books,