- Home

- US Small Business Tax Compliance

- Small Business Tax Information

Useful U.S. Small Business Tax Information

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published in 2009 | Edited June 3, 2024

Exhale, sip a cool glass of water (I prefer mine with lemon slices) while you spend the next few minutes browsing this handy reference for small business tax information you need to know. A good place to start would be the IRS moving timelines.

Once you have looked over the useful information found on this page, I invite you take a few more moments to relax ... and discover some of the other informal chats on good bookkeeping practices found on this site.

Highlights Of This Post

- Business Taxes Filing Deadlines

- Payroll Tax Deposit Deadlines

- Tax Season Business Taxes Filing Deadlines

Good To Know Stuff

- Your Tax Compliance Responsibilities

- Official IRS Receipt Date

- IRS Moving Timeline

- Introductory Payroll Course Information

IRS Interest Rates

- Applicable Federal Rates (AFR) released monthly

- Over Payment of Taxes Interest Rates released quarterly

- Under Payment of Taxes Interest Rates released quarterly

About IRS Due Dates and Late Charges

Advertisement

IMAGE INDEX - Basic Tax Articles for U.S. Bookkeepers

Notice to Site Visitors

I developed this U.S. small business tax information page as a handy reference for myself. While I do my best to ensure it is accurate and complete, I make it available for your use with the understanding that I cannot be held liable for errors and/or omissions.

This page may change as I update this site and collect more information on small business tax information relating to the sole proprietor in the United States ... so I'm going to apologize in advance for those of you who don't like lots of changes.

I am not a U.S. tax professional. I am a retired Canadian who was certified professional bookkeeper in Canada. I'm been slowly learning about U.S. small business tax information as I'm always curious how your regulations are different than Canada's. I took a U.S. online course on basic bookkeeping in 2009 to satisfy that curiosity.

Small business tax information is subject to frequent change and should NOT be confused with advice ... so professional advice should be sought prior to acting on any of this information. Please make yourself familiar with my site policies prior to relying on any of the information on this site.

Here's information I've gathered over the years.

Let's Chat About ...

Tax Compliance and U.S. Bookkeeping

Owning and operating a business in the United States means you have some legal responsibilities. Internal Revenue Service (IRS) requires regular reporting of employment taxes and business taxes. Each state has their own tax related requirements as well. These regulations are often referred to as government compliance requirements.

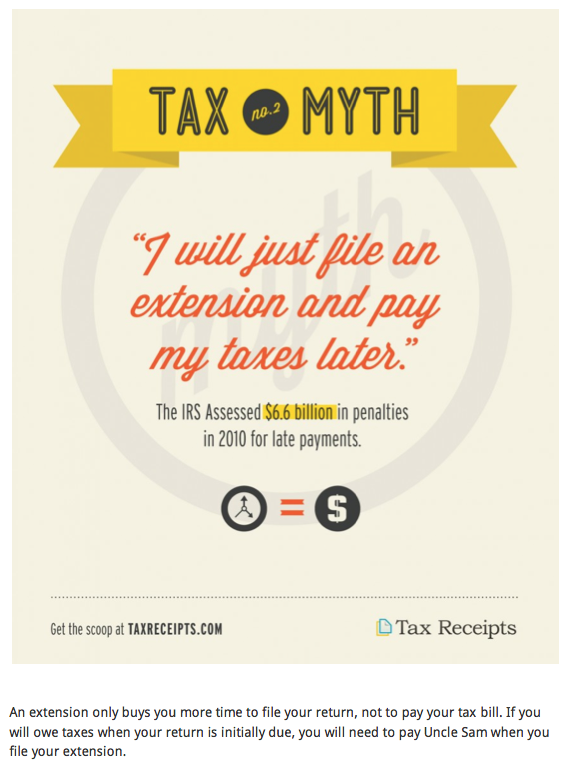

Tax compliance returns and payments should be filed on time. Failure to report and remit by due dates leads to costly penalties and interest charges. Filing extensions for sending in your tax return still require you pay your taxes on time ... it does NOT extend your tax payment/deposit due date.

This site provides some U.S. (and Canadian) bookkeeping information you need to know to put more money in your pocket and avoid these charges.

The Bookkeeper's Tip

A Good Bookkeeping Practice

A Good Tax Compliance Practice

The best way to flush your money down the toilet is to NOT FILE your compliance returns when due. But here's a tip ... even if you can't pay the taxes owing, always file compliance returns by their due dates to avoid pricey penalty charges.

Late filing or failure to file penalties for tax returns are 5% of the tax owing each month to a maximum of 25%.

Interest charges on the balance owing will still apply along with a late payment or a failure to pay penalty of one half of one percent per month to a maximum of 25%.

Calculator.net has a free tax calculator that includes self-employment income to help you estimate and understand your federal, state and local taxes.

Small Business Tax Information Source: IRS Publication 17> What if I made a mistake?> Penalties> Civil Penalties

Good To Know

What is considered the "official" receipt date at the IRS?

Every sole proprietor needs small business tax information about filing deadlines and due dates ... so you can avoid costly penalty and interest charges. So how does IRS determine their "official" deadline date? Here's what I found.

Business compliance deposits and returns received after the due date will be considered on time if you can prove it was mailed in the U.S. on or before the due date. It must also have been properly addressed with sufficient postage.

Monthly tax deposits of $20,000 or more must be received by IRS on or before the due date.

If the due date falls on a weekend or a federal (not state) public holiday, then you have until the next business day. There are two exceptions to this rule for excise taxes:

"For deposits of regular method taxes, if the due date is a Saturday, Sunday, or legal holiday, the due date is the immediately preceding day that is not a Saturday, Sunday, or legal holiday.

Under the special September deposit rules, if the due date falls on a Saturday, the deposit is due on the preceding Friday. If the due date falls on a Sunday, the deposit is due on the following Monday. For more information see the Instructions for Form 720."

IRS allows private delivery services by DHL Express, FedEx and UPS. Don't forget to request written proof of the mailing date. Private delivery services do not deliver to P.O. box addresses. Only the U.S. Postal Service delivers to an IRS P.O. box address.

BOOKKEEPER'S HANDY REFERENCE

U.S. Tax Compliance Responsibilities YOU Should Know

Source: IRS

Make sure you discuss your situation with a professional who can give you small business tax information tailored to your specific circumstances.

| Tax Event | Moving Timeline |

|---|---|

| Collections - Tax Owing |

10 years from the day a tax liability has been finalized section 6502 |

| IRS Refunds |

3 years from the original deadline of the tax return section 6511 or IRS Publication 17> What if I made a mistake?> Amended Returns and Claims for Refunds |

| Amending a Return |

3 years back |

| IRS Audits |

3 years from the day you actually filed your tax return 6 years if you underestimated income any year if you filed a fraudulent return or did not file section 6501 |

U.S. Federal Tax Filing DEADLINES and DUE DATES

Click here for Canadian Filing Deadlines

Quarterly / Annual Deadline Tables

Payroll Related / IC

Tax Deadlines

Business Tax Due Date

Other Schedules

Source: IRS Tax Calendars - Publications 509 and 1518

Business Tax Compliance

Monthly, Quarterly and Annual EXCISE TAX Returns

- Heavy Highway Vehicle Use Tax Return (Form 2290) is due and taxes payable (pay online using EFTPS) on the last day of each month for vehicles first used in the prior month. For example vehicles first used in September; return due and taxes payable on October 31.

- Monthly Tax Return for Wagers (Form 730) is due and taxes payable (pay online using EFTPS) on the last day of each month on wagers first used in the prior month. For example wagers accepted used in June; return due and taxes payable on July 31.

- Quarterly Federal Excise Tax Return (Form 720) is due April 30, July 31, October 31, January 31.

- Annual Tax Return for Wagering (Form 11-C) is due and taxes payable (pay online using EFTPS) on June 30 if you are in the business of taking wagers.

Note that EFTPS payments must scheduled by 8 p.m. ET at least one calendar day BEFORE the tax due date.

Generally, due dates move to the next business day if they fall on the weekend or on a holiday. To find your due dates for the current month, open up the IRS Tax Calendar at tax.gov/calendar. Then select Excise Taxes and go to the month you are interested in.

You can also subscribe / download to the IRS calendar program to have the dates integrate with your mobile or desktop calendar software such as Outlook or iCal. Search for "IRS Tax Calendar for Businesses and Self-Employed" on the IRS website.

Bookkeeper's Small Business Tax Information

U.S. Tax Season Deadlines

Source: IRS Tax Calendars - Publications 509 and 1518

Attention EPTPS users, you must schedule your payment by 8 p.m. ET at least one calendar day before the tax due date.

| Payment Deadline | Tax Type | Tax Period | Form to be Filed | Tax Filing Deadline |

|---|---|---|---|---|

| JANUARY | ||||

| BEFORE Jan 1 | Receive from employees & process BEFORE 1st 2019 wage payments | current year | Form W-4 | Jan 1 |

| Jan 15 | Individuals Est. Taxes |

prior year | Form 1040-ES or EPTPS or credit card | Jan 15 |

| Jan 15 | Farmers Fisherman Est. Taxes* |

prior year | Form 1040-ES or EPTPS or credit card | Jan 15 |

| Jan 15 | C corporate Estimated Tax Installment | 1st installment | see form 1120W | Jan 15 |

| Feb 1 | Personal Taxes if January 15th installment not made |

prior year | see Form 1040, 1040A or 1040-EZ | Jan 31 |

| Jan 31 | Mortgage Interest Statement | prior year | Form 1098 | Jan 31 |

| Jan 31 | Form 941 if deposited all required payments on time | 4th quarter prior year | Form 941** | Jan 31 |

| Jan 31 | Employer's Annual Federal Tax Return | prior year | EFTPS Form 944** | Jan 31 |

| Jan 31 | Employer Annual FUTA Return | prior year | Form 940** | Jan 31 |

| Jan 31 | Annual W-2 to Employees | prior year | Form W-2 | Postmarked or on website before Jan 31 |

| Jan 31**NEW | Paper file* Transmittal of Wage and Tax Statements to SSA | prior year | eForm W-3 and eCopy A of all W-2s Issued | Jan 31 |

| Jan 31**NEW | Electronic Transmittal of Wage and Tax Statements to SSA | prior year | E-Form W-3 and Copy A of all W-2s Issued | Jan 31 |

| Jan 31 | Annual Independent Contractor Reporting | prior year | Form 1099-MISC | Jan 31 |

| Jan 31 | Annual Return of Withheld FIT on Forms 1099 | prior year | Form 945** | Jan 31 |

| Jan 31**NEW | Paper file** Information Returns to SSA | prior year | Forms 1099-B, 1099-S, 1099-MISC | Jan 31 |

| Jan 31**NEW | Electronic Transmittal of Information Returns to SSA | prior year | Forms 1098, 1099, W-2G | Jan 31 |

* You have until Apr 15 to file if you paid your prior year estimated tax payments by Jan 15 of the current year.

**Due date is February 10th not February 1st for filing Forms 940, 941, 944, 945 for the fourth quarter of the prior year if you timely deposited all required payments.

**REMINDER Beginning in 2017, the deadline moved to January 31st for both paper and electronically filed forms. All paper filers and electronic filers for W-2 and W-3 forms as well as 1099 must now be reported to the IRS/SSA at the same time the employees / contractors receive their statements.

| Payment Deadline | Tax Type | Tax Period | Form to be Filed | Tax Filing Deadline |

|---|---|---|---|---|

| FEBRUARY and MARCH | ||||

| Feb 15 | File New Form W-4 | prior year | W-4 | Feb 15 |

| Feb 16 | Begin ITW | prior year | No Form W-4 Rec'd | Feb 16 |

| Feb 28 | Farmers Fisherman Pay Tax Due* |

prior year | Form 1040 or EPTPS or credit card | Feb 28 |

| Mar 15 | S Corporate Tax Return if not filing 6 month extension | prior year | Form 1120S | Mar 15 |

| Mar 15 | Partner's Share of Income, Deductions, Credits, Etc. | prior year | Sch K-1 Form 1065 | Mar 15 |

* You have until Apr 15 to file if you paid your prior year estimated tax payments by Jan 15 of the current year.

| Payment Deadline | Tax Type | Tax Period | Form to be Filed | Tax Filing Deadline |

|---|---|---|---|---|

| APRIL to JUNE | ||||

| April 15 | Corporate Tax Return if not filing 5 month extension | prior year | Form 1120 | Apr 15 |

| Apr 15 | C corporate Estimated Tax Installment | 2nd installment | see form 1120W | Apr 15 |

| Apr 15 | Personal Taxes if NOT filing 6 month extension (Form 4868) |

prior year | see Form 1040, 1040A or 1040-EZ | Apr 15 |

| Apr 15 | Personal Taxes if filing 6 month extension Deposit Estimated Taxes |

prior year | see Form 4868 | Oct 15 |

| May 10 | Form 941 if deposited all required payments on time | 1st quarter current year | Form 941* | May 10 |

| Jun 15 | Individuals Outside the US | prior year | Form 1040 | Jun 15 |

| Payment Deadline | Tax Type | Tax Period | Form to be Filed | Tax Filing Deadline |

|---|---|---|---|---|

| JULY and AUGUST | ||||

| July 1 | Occupational Tax and Registration for Wagering | July 1 prior yr to June 30 current yr | EFTPS Form 11-C |

Jul 1 |

| July 31 | Annual Return/Report of Employee Benefit Plan | prior year | Form 5000 or 5000-Z | July 31 |

| Aug 10 | Form 941 if deposited all required payments on time | 2nd quarter current year | Form 941* | Aug 10 |

| Payment Deadline | Tax Type | Tax Period | Form to be Filed | Tax Filing Deadline |

|---|---|---|---|---|

| SEPTEMBER to DECEMBER | ||||

| Sep 15 | S Corporate Tax Return if Form 7004 extension filed |

current year | Form 1120S | Sep 15 |

| Sep 15 | Partner Taxes if Form 7004 extension filed |

current year | see Form 1065 and Sch K-1 to each partner | Sep 15 |

| Sep 15 | C corporate Estimated Tax Installment | 3rd installment | see form 1120W | Sep 15 |

| Oct 16 | C Corporate Tax Return if 6 month extension filed |

current year | Form 1120 | Oct 15 |

| Oct 16 | Personal Tax Return if 6 month extension filed |

current year | Form 1040, 1040A or 1040-EZ | Oct 15 |

| Nov 12 | Form 941 if deposited all required payments on time | 3rd quarter | Form 941* | Nov 13 |

| Dec 15 | C corporate Estimated Tax Installment | 4th installment | see form 1120W | Dec 15 |

* Nov 2 if you did not deposit payments on time.

BOOKKEEPER'S HANDY REFERENCE

Market Watch - Business Plan Aids-Currency Converters

Here are some links to economic and market data which may be useful small business tax information when putting together your business plan.

Visit TD Wealth Management's Market Resource Center. You will find analysis of global economic performance with emphasis on North America provided by TD Economics. It includes U.S. consumer price index reporting. You'll also have access to a market snapshot, interest rate headlines and investment calculators.

New York Times Markets Overview highlights U.S. and world markets, currencies, consumer rates ... to name a few.

About.com has a good introductory article where you can learn about economic indicators entitled A Beginner's Guide to Economic Indicators. I was unable to find the U.S. equivalent of Canadian Business.com's nice concise summary of Economic Indicators. The Economist.com does have some Weekly Indicators: Economic and financial indicators. I'll keep looking for a concise U.S. small business tax information source for economic indicators.

Trading Economics United States Stock Market Chart - Dow Jones Industrial Average gives you the monthly historical values over a two year period. They also have a banner of economic indicators quoting the interest rate, growth rate, inflation rate, jobless rate, exchange rate and more. I like the historical value chart because I can visually see trending.

Here are links to two currency converters mentioned on the IRS website ... XE Currency Converter and World Currency Converter. You can pick which you prefer.

Monitor Bank Rates.com monitors Savings Rates. You key in your zip code and it finds the best rates near you.

BOOKKEEPER'S HANDY REFERENCE

Introductory Course on U.S. Payroll $9.95 USD

Are you new to payroll bookkeeping? One type of small business tax information that you must keep up with if you have employees is payroll tax ... so are you wondering what U.S. employee payroll taxes are all about?

The Bean Counter has a free online introductory payroll course.

The course is designed for business owners who have no formal bookkeeping training or on the job experience.

The Bean Counter's So You Want to Learn Bookkeeping! Payroll is broken into an introduction and 8 lessons. Here is the course outline as described on the website dwmbeancounter.com:

- The Introduction provides an overview of payroll, employees, and your requirements as a business.

- Lesson 1 Types Of Compensation discusses and explains that an employee's compensation includes not only direct payments (salary and wages) but also indirect benefits known as fringe benefits or "perks".

- Lesson 2 Types Of Deductions discusses and explains the different types of deductions that are taken from an employee's salary or wages such as social security, medicare, federal and state income tax, and other deductions such as health insurance and retirement plans.

- Lesson 3 Calculating Payroll uses a fictitious company called Mom's Secret Recipes to illustrate what calculations are needed and how to do them in order to correctly calculate and pay your employees.

- Lesson 4 Payroll Taxes and Withholdings discusses and reviews how an employer reports and deposits amounts deducted from their employees' wages and salaries and also how an employer is required to "match" amounts deducted for social security and medicare.

- Lesson 5 Payroll Records illustrates and discusses the records needed by employers to properly documents and record their employee's wages and salaries and deductions taken.

- Lesson 6 Self Employed reviews and explains what self employment tax is, who is required to pay this tax, and how to properly calculate, report, and deposit this tax.

- Lesson 7 Government Regulations presents a brief overview of the federal and state laws, rules, and regulations that you as a business owner or manager need to be aware of.

- Lesson 8 What You Should Know summarizes and reviews the major points covered in this tutorial.