- Home

- Tax Compliance Rates

- Travel/Auto Rates Options

CRA Tax Free Auto Allowances

IRS Standard Mileage Rates

Mileage Rates & Auto Allowances

Mileage Rates & Auto Allowances

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published January 2014 | Edited June 10, 2024 | Updated November 27, 2024

BOOKKEEPER'S HANDY REFERENCE

Quick Links

✔ Canadian Rules and US Rules - Business Use of Your Car

✔ US Business Travel - Standard Mileage Rates and Per Diem Meal Allowances

✔ CRA Auto Rates & Living Out Allowances

✔ Your Options - Sole Proprietor, Employee, Non-Business Travel, Corporations

Let's chat about auto allowances and business travel allowances.

The rules for being able to claim your vehicle expenses related to business use are complex and inflexible ... okay okay ... stop your moaning ... and just get on board with the program if you want to claim your tax deductions!

Some advanced tax planning and meticulous paperwork will help you take advantage of these potential tax benefits.

Grab a cuppa and settle in ... it's complicated!

Business Use of Your Car

Business Use of Your CarCanadian bookkeeping and tax for business use of your personal vehicle is different than the U.S. ... so don't confuse U.S. rules with Canadian rules.

- Canadian RULES >> Business Use of Your Car

- U.S. RULES >> Business Use Of Your Car

I found a great article on Using Your Personal Vehicle for Business Purposes in the U.S.. It discusses:

- Having professional business use coverage on your auto insurance policy;

- The 2 tax deductions available when using your personal vehicle for business - actual vehicle expenses when used full time for business and standard mileage rates when used part-time for business;

- Personal property tax charged on vehicles used for personal use in some states.

Here are your Canadian auto allowance and US Mileage Rate Options for 2024 and 2025:

U.S. IRS Rates For Business Travel

Click on a link to get your answers.

|

Click for Have you been wondering ...

|

Click for Do you have questions about ...

|

Click the links above to find the answers to these questions and more ...

Canadian/CRA Auto Allowances and Living Out Allowances

Have you been wondering ...

- How a sole proprietor claims business vehicle expenses?

- Can a sole proprietor use CRA's auto allowance rates instead of keeping an auto log?

- Can a sole proprietor use CRA's simplified travel rates to claim business vehicle expenses?

- How living out allowances work?

- Can a sole proprietor use living out allowances?

Living out allowances covers meals, lodging, and incidentals and only applies to employees travelling for business. Generally CRA expects sole proprietors to use the detailed method to claim business travel tax deductions. Using Treasury Board / Joint Council rates for client billing of travel expenses is not a problem if that is what has been agreed upon in your engagement letter.

Auto Allowances and Rate Options

As a small business owner that uses the sole proprietor business structure, you report your vehicle expenses on Form T2125 using the detailed method. This means you do have to keep all your receipts ... along with your log book.

Section 8 of CRA's publication IT521R - Motor Vehicle Expenses Claimed by Self-Employed Individuals says:

The Bookkeeper's Tip

Please Note

If for some reason, you decided as a sole proprietor, to risk claiming your vehicle expenses on a per kilometer basis because "it is reasonable", please keep all your vehicle receipts in the event you are audited and your claim is denied by CRA.

"8. To be deductible, "motor vehicle" expenses must be reasonable in the circumstances and supportable by vouchers. (The vouchers need not be filed with the individual's income tax return; however, they must be retained for examination on request.) A claim by an individual for "motor vehicle" expenses calculated on a cents-per-kilometre (mile) basis is NOT acceptable. [my emphasis]

To support a claim where a "motor vehicle" is used in part for business purposes and in part for personal purposes, a record should be kept of total distance travelled and distance travelled for business purposes in a year. The record should contain at least the date, destination and distance travelled for each trip."

Okay, I can hear all of you owner-managers out there saying, "Hey, I'm incorporated, I think I have more options than a sole proprietor to claim vehicles expenses. Am I right?"

Perhaps you might of heard that it's not such a great idea to have the company own your vehicle any more. Is that true?

The Options and Who Can Use What

Work your way through the links below to learn about the various ways to claim vehicle expenses or travel allowances ... and who is allowed to use auto allowances and living out allowances ... because you guessed it ... not everyone can.

Sole Proprietors

Detailed Vehicle Travel Method - sole proprietors must use this method -see Section 8 of IT521R - Must use an auto log

Employees

Tax Free Auto Allowance Rates - for use by employees - must keep an mileage log; NOT available to sole proprietors use

Business Travel Allowances - for use by employees only for meals, board and incidentals

Non-Business Travel

Simplified Vehicle Travel Rates - used for medical expenses, moving expenses, northern resident deductions

Incorporated Business Owners

Personal Vehicle Use - Reimbursement Options for Incorporated Business Owners - requires an auto log

Company Vehicle - Taxable Benefit Rates - Operating Expense based on mileage log

Company Vehicle Standby Charges - Auto Benefits Calculator

Good To Know

Driving To and From Work - Is it a Business Expense?

Driving To and From Work

Driving To and From WorkNormally, if you are self-employed and have an office out of the home, driving to and from work would be considered a personal expense just as it is for a regular employee. However, if you schedule business errands or appointments at the beginning and end of the day, the trip is deductible.

For example, you could schedule an appointment with a client at their place of business on the way to work (your self-employed work place NOT your place of employment as an employee) and go to the office supply store on the way home making the entire trip count as a business expense.

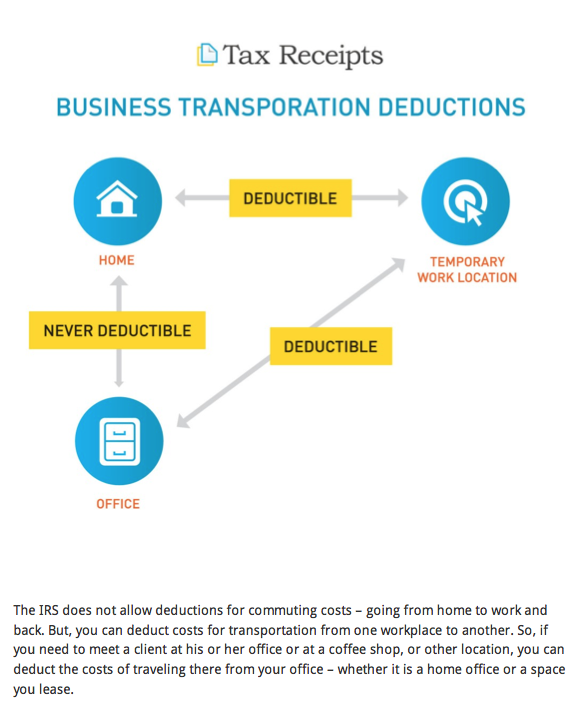

Tax Receipts flowchart sums up the rules beautifully for US residents. It turns out, the rules apply in Canada as well.

Renee Daggett, EA over at Admin Books and author of Your Financial Flight Plan: Pilot Your Business to Profitability points out, "You cannot deduct MILES DRIVEN from your home to your first location unless you qualify and claim the home office deduction".

She makes an excellent reminder that is valid not only in the U.S but also in Canada.

Car Maintenance Expenses and The Sole Proprietor

I am operating a small business out of Ontario. While I do track all my mileage, I wanted to know if I can also include any car maintenance, or services I have had done on my vehicle. I must note that the vehicle is not a dedicated company car. It does get used for personal use as well.

The answer is yes, you sure can for tax purposes ... that's the reason you are tracking your mileage ... so you can prorate your vehicle expenses between business use and personal use. In my article on using your personal vehicle for business purposes, you will find a chart for all the operating expenses you can claim.

You will find some additional information in my section on auto logs as well.

I like to track all my vehicle operating expenses throughout the year to make tax preparation more efficient at year-end and to make sure I don't lose any of my invoices.

If you are incorporated, your options are a bit different. Learn about them here.

No one said small business bookkeeping would be easy. Just develop and stick with a system to keep your paper organized and it won't feel like a chore.

See you on the next page ...

Your tutor

Bookkeeping Essentials › CRA Auto Allowances and IRS Mileage Rates