- Home

- Basic Bookkeeping Practices

- Learning QuickBooks

Avoiding Beginner Mistakes While Learning QuickBooks Online

Published February 2010 | Edited October 17, 2024

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

NEXT IN SERIES >> A Beginner's Guide to Learning QuickBooks Online

Quick Links

What's in this article:

- Accounts Receivable

- Recording Sales

- Entering Online Business Income

- Accounts Payable

- Posting Expenses

- Banking and Your Cash

- Learning Keyboard Shortcut Keys

Quick links to other articles on the site:

- Hubdoc-QBO bank feed data integration

- Optimize QBO workflow with a Chrome browser

- PayPal data sync to QBO

Learning QuickBooks Online to avoid beginner's mistakes ... gives you a hint about what this chat is all about ... tips on how to use QuickBooks® Online software modules correctly. A fair bit is intuitive, but there are few things you need to avoid if you don't want messy books.

While I will chat about tips about learning how to use QuickBooks Online, please understand that this page is directed to work from home small business owners who do their own bookkeeping. This chat is not intended to instruct the "power" users or advanced users of QuickBooks Online ... there are a lot of sites out there that cover that material better than I ever could.

Avoid beginner mistakes while learning QuickBooks Online to

Avoid beginner mistakes while learning QuickBooks Online toA Word of Caution: Intuit continually revises QuickBooks Online to make it more robust. It's likely that how I did something in 2013 does not work in 2024. That said, you should be able to figure out where menu item sits now, make the adjustment, and still stay on track following my steps.

We are not going to be shooting the breeze about QuickBooks® POS software ... or a whole lot about advanced inventory ...

... just useful QuickBooks® tips, tricks and traps that will hopefully make your bookkeeping time more efficient ... and enjoyable ... so you have accurate financial information to make smart business decisions.

So fill up your water glass so you stay hydrated and let's get started.

Advertisement

Learning QuickBooks® ... The Workflow Tips

I want to start by saying that you need to be kind and patient with yourself as you are learning QuickBooks®. The program was designed for small business owners and is user friendly ... but there are a few things that have to be done a certain way.

Here are links to a few tips on QuickBooks® procedures that you should learn to ease your learning curve and make your bookkeeping go smoothly:

Vendors - Accounts Payable - Expenses

- When to use Pay Bills vs Write Cheques

✔ Pay Bills is used if the bill you are paying is sitting in Accounts Payable

✔ Write Cheques/Expense is used if the bill you are paying was NEVER entered into AP - How to adjust GST ITCs for meals and entertainment

✔ CRA only allows you to claim 50% of your input tax credits for meals

Customers - Accounts Receivable - Sales

- When to use Invoice vs Sales Receipt

✔ Invoice is used if YOU are extending credit to your customer. It places the amount in Accounts Receivable.

✔ Sales Receipt is used if the customer is paying you with cash, debit card or credit card at the time of the sale. The amount does not get posted to AR. If a credit card is used, the AR is the credit card company's problem, not yours. - When to use Receive Payments vs Make Deposits

✔ Receive Payments is used if the invoice being paid is sitting in Accounts Receivable

✔ Make Deposits is used if an invoice was NEVER issued and entered into AR - The Bookkeeper's Alert on customer payments and Make Deposits

- How to enter customer prepayments / deposits on account in QuickBooks

- How to record net online sales revenue (less any service fees) directly deposited to your account

The Bookkeeper's Tip

How To Record Online Business Income

NEVER use Bank Deposit (QBO) or Make Deposits (QBD) in QuickBooks to record online business income. Interest income ... okay. Earned business income ... not okay. Why?

An important concept when learning QuickBooks is to remember it has modules ... one for customers, one for suppliers, one for employees, one for banking.

You need to use the correct module to enter your data if you want it to report properly. Otherwise garbage in, garbage out as they say.

In the case of online business income such as affiliate fees, eBook sales and webinar sales, you must enter it into the customer module if you want your sales tax reports to federal, provincial, state and/or territorial governments to report correctly.

Most affiliate income earned online is not paid out immediately. If you use the accrual basis of accounting, you should be creating a bill at the end of each month for the amount you have earned. When the money is deposited to your account anywhere from 10 days to 6 months later, use Receive Payment to record the receipt of cash.

If the amounts you are earning are immaterial, for example you receive a $50 payment about every 6-12 months, it would be acceptable to not setup Accounts Receivable each month and just create a Sales Receipt when the money is deposited to your account or you receive the cheque/check in the mail.

Other information on doing business online:

- How to setup your chart of accounts to capture online income

- How do you classify web related outlays like domain registrations, web hosting services, and web design services?

- CRA and eBay income earned online

- Recording out-of-province sales

- Canadian business and US online purchases

- GST/HST rules for internet income (online sales)

H E L P ! My A/R ledger is out of balance!!!!

When learning QuickBooks, sometimes you goof. (GASP) If your Accounts Receivable ledger balance does not equal your Accounts Receivable subsidiary ledger balance, then you know you've goofed somewhere in your process. Check:

- Your Open Invoice report to ensure payments were applied to invoices. If they haven't, they will show up in the Open Invoice report. Tip - there should be no 'deposit' transaction type. Any 'Payment' transaction types are likely due to overpayment of the account but you need to verify.

- Your Open Balance report (only available in QBD) if your Undeposited Funds account is growing or you can't find customer payments. Look to see if any deposits were made directly through Make Deposits or even the banking register bypassing the Accounts Receivable subsidiary ledger. You can create your own custom report in QBO using the 'Transactions by Account' report.

The Bookkeeper's Tip

A Good Bookkeeping Practice

Naming Convention For AR and AP

QuickBooks doesn't allow you to use the same name for a person or business who is both a customer and a vendor. Here's the workaround:

When you have a business or person that is both a customer and supplier, use this naming convention:

Joe's Plumbing - c ... for the customer (c) name and Joe's Plumbing - v (or s) for the vendor (v) / supplier (s) name.

No more guessing the various names, initials, abbreviations!

Banking - Cash

- A good way to record cash taken when it is not deposited in the bank

- How to reimburse the owner for expenses paid with personal funds

- How to handle stale dated cheques in QuickBooks

- How QuickBooks undeposited funds account works

- How to deposit loan proceeds received in QuickBooks

- How to handle NSF (bounced) cheques

- How to handle a refund to a debit card In QuickBooks desktop and online

Company - Period End Closing

Government Compliance

- When to delete vs void a transaction

- How to write-off a bad debt

- The best way to make adjusting entries in QuickBooks

- How to file GST/HST in QuickBooks® using the Quick Method

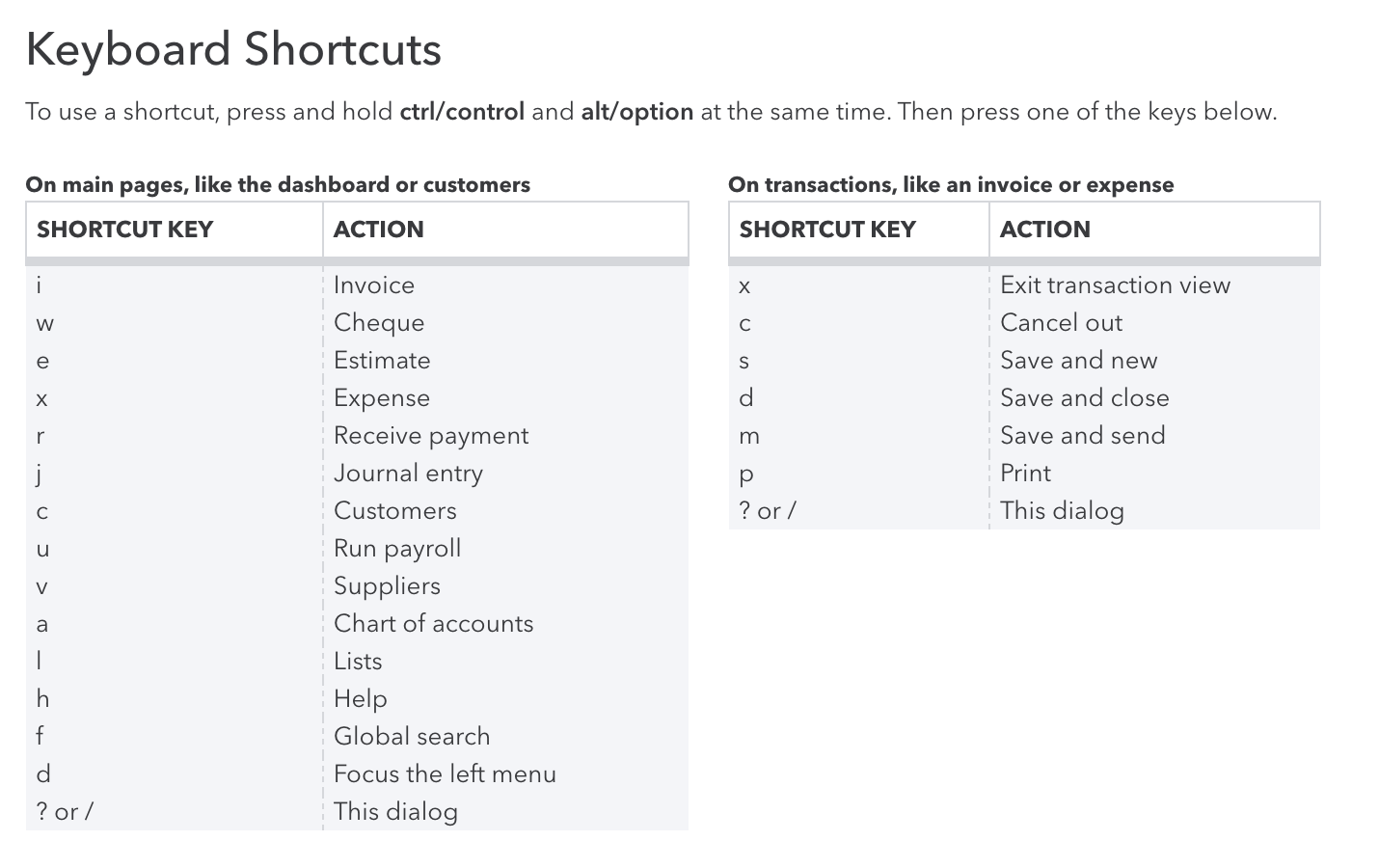

Learning QuickBooks® ... The Shortcuts

The QuickBooks Online accounting system has keyboard shortcuts to make data entry more efficient.

Access this list by simultaneously holding down the Control + Alt (Option on Mac) + '?' keys

Access this list by simultaneously holding down the Control + Alt (Option on Mac) + '?' keysA few activity shortcut keys that are very useful in QuickBooks Online ...

- Ctrl + Alt + A ... brings up your COA but I prefer use my bookmark on the left navigation bar to get to my COA.

- Ctrl + Alt + I ... quickly opens a customer invoice.

- Ctrl + Alt + X ... quickly opens an expense transaction form.

Date Shortcut Keys

Applies to QBO & QBD

In any date field, these keys are the best way to quickly and accurately enter a date:

- Today = T

- YeaR: Y = beginning of year R = end of year

- MontH: M = beginning of month H = end of month

- WeeK: W = beginning of week K = end of week

- + or – = forward or back quickly

As you can see, the keys are easy to remember because they are tied to what you want to accomplish and they are not case sensitive ... one of the reasons these are my favorite keys ... I can actually remember them with no effort. That is great accounting system design.

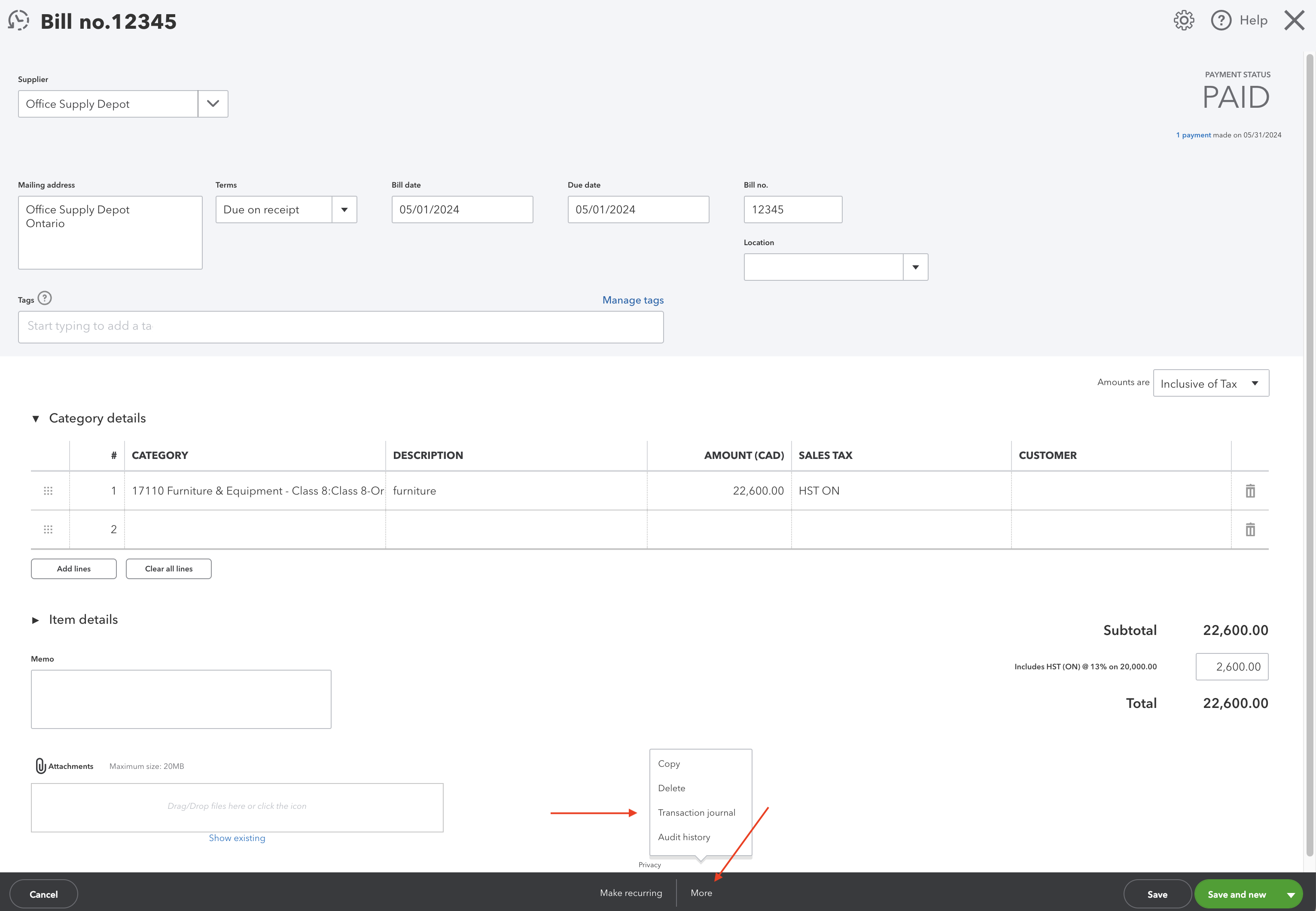

Viewing A Transaction Journal In Accountant Friendly Format

Intuit makes it product to be user friendly to small business owners who most likely don't know technical accounting terms. That's why the data entry forms in the various modules makes data entry so easy.

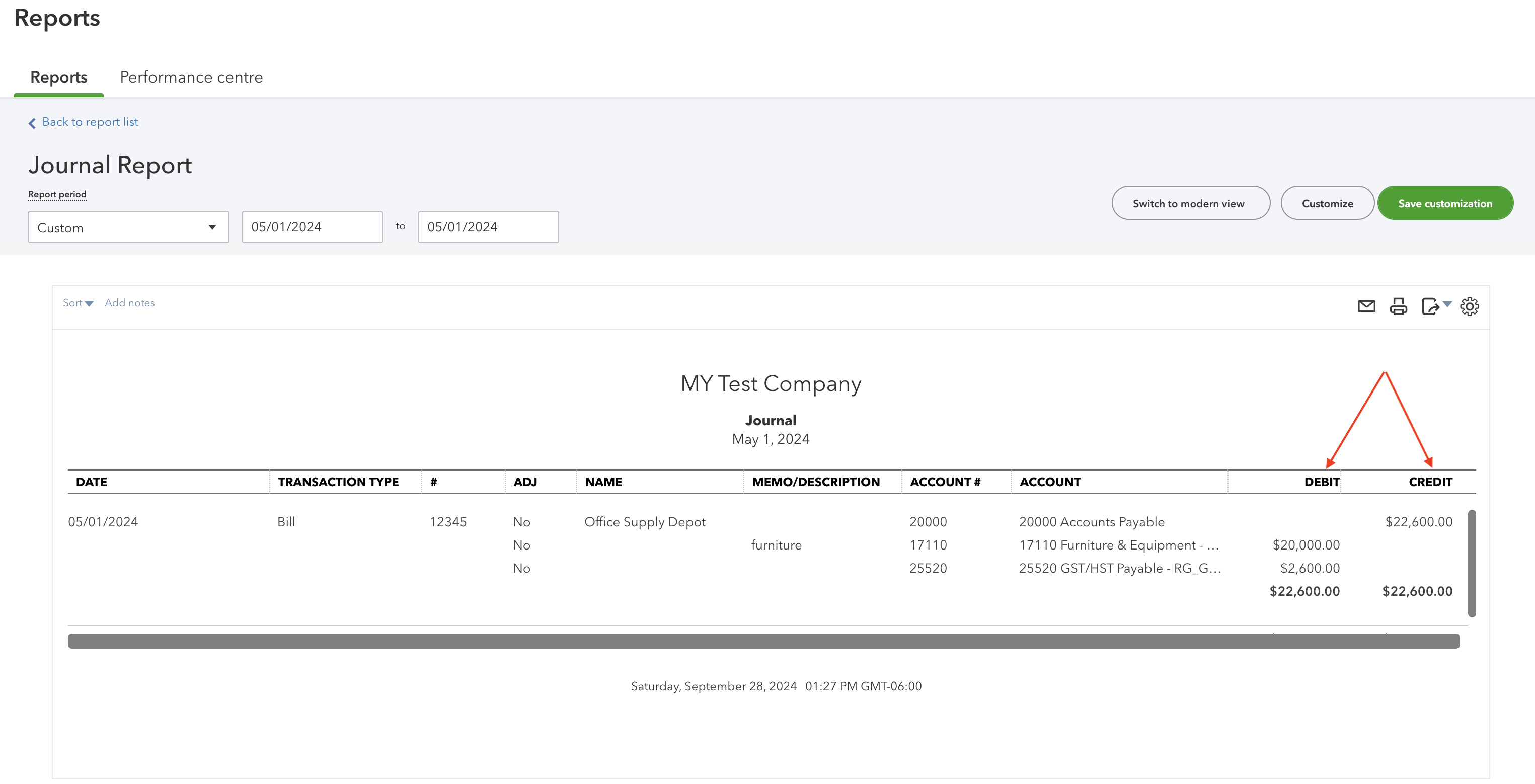

Bookkeepers and accountants often prefer to see a QBO transaction entry form in a journal format so they can see the debits and credits booked by the QBO friendly form 'behind the scenes'. QBD had the shortcut key 'Ctrl Y'. QBO does not have this shortcut key. So how does QBO it?

In the QuickBooks online, look for "More" in the transaction you are in ... usually found at the bottom center of the form. (See screen 1 shot below.) You will see "transaction journal" in the popup menu. Click on it to get the journal report for the entry. (See screen 2 shot below.)

Screen 1 - How to Access the Transaction Report Using The 'More' Button

Screen 1 - How to Access the Transaction Report Using The 'More' Button Screen 2 - Accountant Friendly View of the Transaction Journal

Screen 2 - Accountant Friendly View of the Transaction JournalLearning QuickBooks® ... The Reporting

Follow these links for customized QuickBooks® reports and other useful information to assist the management of some of your balance sheet accounts.

- What Are QuickBooks® Closing Procedures

- How to Track Top Customers

- How to Track Customer Deposits

- How to Track Construction Holdbacks

- How to Track Cheques Issued (and invoices)

- How QuickBooks® Handles HST/GST

- if you are an HST/GST registrant

(GST collected vs GST paid [ITC]) - if you are NOT an HST/GST registrant

The Forum is Now Closed

Learning QuickBooks® Questions & Answers

Visitors Have Already Asked ...

Click below to see the contributions that have been made already. While you can no longer add new posts, feel free to check out what's already been covered.

You can help make Learning QuickBooks® better by adding your comments and ratings to one or more contributions.

How To Record A Double GST Payment?

I pay my GST annually once a year. I went to the bank and did so through the teller on October 15th for $500.00.

On November 30th, the bank pulls …

How to record interest earned on loan to subcontractor

Publisher: This post was corrected January 2018. The original entries presented were incorrect. See the comments sections.

Hi, I need to record …

New Company - New Books

I have a client who has been in business for a few years as a sole proprietor. Now they have incorporated. The accounts are kept on QuickBooks.

Do I …

Sales Tax on Paid Parking Tickets

Hi there,

I am trying to enter some expenses for the partners of the business and am not sure what to do when the receipt does not have the taxes broken …

Daily Sales Summary

Our company has a website selling a high end product. As the company bookkeeper I enter each sale into our accounting software as a receivable. Once …

Fixing a QuickBooks Mess

How do I correctly fix a badly managed set of QuickBooks that hasn't been properly managed since 2010.

Specifically, how do I get the QuickBooks records/data …

How To Track Customer Deposits

I need a program that will let me track cash deposits made in advance of purchase even when no final amount has been determined. There is no time limit …

Year-end Trial Balance Report

Our company year-end date is Nov 19th. I did not enter a Closing Date in the Accounting Preferences. However, in Company Information, I had to enter a …

Entering GST/HST Late Filing in QuickBooks®

Due to circumstance,s the company I just started working for was unable to file a complete GST/HST report last quarter.

Their bookkeeping was several …

How to Fix Entries Already Reconciled

How do you adjust year end entries if they already have been reconciled.

Example: I did a journal entry for an asset under misc withdrawls, for the …

Sales Receipt Requirements

Hi,

My son is just starting his very own small-business. (He is 13). I am setting him up to use QuickBooks in its most simple form (sole proprietorship) …

HST From Purchases

Hello,

I have a question regarding entering the HST paid from purchases into QuickBooks software.

The corporation is registered for the GST/HST (although …

Recording PayPal Fees

How to deal with payment processor skimming?

I'm at a non-profit organization. If somebody donates, say, $10 through PayPal I have to issue a $10 …

How to Recover Lost Data in QuickBooks

I might have deleted some entries that change the numbers in the balance sheet.

How could I use the backup file to get the previous numbers without …

QuickBooks Receive Payment

Adjusting Accounts Receivable For Deposited But "Unreceived" Payments. BEST Solution ... Follow The QuickBooks Process.

Hi,

I have a bad habit …

Petty Cash

Petty cash has been set up.

Let's say I paid Cindy (employee) $10.50 (includes GST only) from Petty Cash for Parking Expense.

In QuickBooks, …

Sales Tax Return Already Filed

I am using my newly purchased QB and filed my current quarterly Sales Tax Return.

Now I am entering data retrospectively for the last fiscal year. …

QuickBooks Bank Reconciliation

Bank Reconciliation-has not been performed in two years

Hello,

I started assisting a small business with their bookkeeping records. Apparently …

Refund of HST

Good Day!

First of all, thank you for your great website! You answered lots of questions already, but I still have a few...

We import goods from …

Accountants Copy

Accountants Copy of over 200mb books ... and mysterious password

When the books are too large, instead of being able to email, the Accountants Copy …

Personal Expense on Business Account

I failed to follow one of the basic guidelines you mention on the web site. I charged personal items to the company credit card and paid the credit card …

Entering Invoices from a Supplier

This may be a silly question, however; I'm very new to bookkeeping and Quickbooks and see a potential problem with how our accounts were set up.

Initially …

Loan Proceeds Not Deposited To Bank

How do I record an asset paid for in installments and financed by a lender?

New to Quickbooks and double entry accounting. I understand most of …

Reverse Sales Tax Filing in QuickBooks

Good Morning Laura,

Just a quick question: Do you know if you can reverse GST filing in QuickBooks desktop??

I have a situation where I filed the …

QuickBooks Conversion

I have a customer account that used to be a Partnership - the one partner has signed off and the other has assumed all business liabilities - I now need …

Vendor Prepayments

What is the best way to deal with vendor prepayments in QB?

Client wrote a cheque for $1,900 to a vendor for a leasehold improvements item. There …

Payroll Liability Refund

Recording Tax Agency Credit in Quickbooks

Hi,

Our church uses Quickbooks Pro for accounting but we don't use the payroll module (only 1 paid …

Foreign Exchange Transactions

Income lost to foreign exchange rate changes.

I have received a cheque for payment in US dollars.

The (exchange) rate has changed and I am losing …

Interest Received in a Deposit

How do you show interest received in a deposit using QuickBooks?

I'm not sure exactly what you are asking ... so I'll answer in two parts.

…

Customer Deposits

What account should I use for deposits (received) in advance from clients?

I am using QuickBooks.

I need to know where I should deposit the payment …

Cost of Goods Sold

In a Resale Printing Corporation

How can I use this account in my business if I do resale of the printing jobs like ...

... business cards, flyers and more?

Is it right to use Cost …

QuickBooks®

Recording a Direct Deposit

How can I show fees associated with an ACH (automated clearing house) deposit in QuickBooks®?

I am doing very basic bookkeeping for a friend. She has …

Self Assessing PST

Hi,

I live in BC and setting up bookkeeping file for my first client and I have to self asses PST on couple of purchases out of country. It is equipment …

Entries for Graphic Artist Business

My partner is a graphic arist. He produces work (brochures, for example), and has them printed at a local printer company, then they invoice him and he …

Setting up QuickBooks

Setting up previous year balances for accounts when starting in Quickbooks

I started using Quickbooks Pro 2010 at the beginning of the year and …

Accounts Receivable Clean Up

An accounts receivable has been sitting now for 1 year. I want to write it off as a bad debt.

How do I get it out of the accounts receivable and put …

Reconciliation Issues with ...

General Journal

I did not reconcile my accounts before filing my sales tax (didn't think to do this, now I know).

I've now reconciled my accounts and found numerous …

Reimbursed Expenses

Hello,

I am trying to figure out whether or not I should include recoverable expenses in line 101 of the HST report.

I work for a patent agency. …

Payment of Owner's Expenses

How do I set up an account to reimburse owner for

expenses paid?

I talk about how I like to setup my "Owed To Owner" account in QuickBooks …

QuickBooks Version

Hi,

Can I work on QuickBooks Pro 2007 for QuickBooks 2009 files?

Thanks a lot. Hi Maria,

I'm not exactly sure what you are asking.

…

QuickBooks Online FX Transactions and Conversion

I am really at lost regarding the booking my foreign exchange transactions & conversions, and need your help! Here is my situation:

Our books are in …

Inventory Entries for Restaurant

I would like to know how to transfer inventory totals into my QuickBooks. Inventory is done monthly for the restaurant/pub, but not tracked through QuickBooks. …

Downloading QBO Attachments in a Batch Not rated yet

While reading and participating in various online bookkeeping groups, I noticed the question is arising as to how you can download all the attachments …

Credit Card Bank Account Not rated yet

The company I work for has a credit card bank account and their main bank account. The person who does the bookkeeping (not me) has set up the accounting …

QuickBooks Online Vs. Desktop Not rated yet

I am starting a bookkeeping company for small businesses which I'd like to run solely on the Cloud.

I am wrestling with whether to purchase QB's desktop …

Inventory Assembly Not rated yet

We have a small manufacturing company. We buy a metal part from one company (first part number), then send that part to a powder coater (second part number), …

COGS Help Not rated yet

I am a bookkeeper for a painting contractor.

Can you tell me if the paint and the brushes, rollers, etc that he purchases for a specific job is considered …

Credit Card Data Entry Not rated yet

I just started using QuickBooks so I'm pretty new. I've just added our MasterCard account. Now I have all these transactions to add or split which is …

Lease - School Assignment Not rated yet

Which type of lease these are, please explain.

(a) Firdous limited is intended to acquire an asset for one season that is consisted of 6 months. Hefty …

Recording CBSA Assessed GST as ITC? Not rated yet

Hi, I'm having trouble figuring how to record GST assessed by CBSA (Canada Border Services Agency) on goods imported.

We purchased the items as supplies …

Recording Pension Income Not rated yet

How do you record Old Age Security (OAS) income being deposited directly into bank account?

Should I use record deposit but which account is it coming …

QST set up Not rated yet

Can someone help with setting up QST ITC in QuickBooks?

Currently I am splitting out the PST portion to the expense account.

Thanks.

…

Missing Sales Tax Codes Not rated yet

I have a cheque that was issued to pay HST to CRA. The cheque was entered without a sales tax code and is now showing up as an unassigned item and throwing …

GST Mapping Changes Not rated yet

I accidentally changed the GST mapping in my company account. How do I fix it? The program won't let you change from a dollar amount to a % and vice …

HST Credit Not rated yet

Hi !

Last quarter I had a credit on HST and I filled the tax return as it showed me in the Sales Tax report.

After I filled , some stuff was changed …

Trucking Fees From Vendors Not rated yet

When we receive an invoice (and goods) from our vendor(s), we are charged trucking, which I have set up under "Other" in Expenses.

However, we also …

Memorized Transactions Not rated yet

I cannot balance my memorized transaction because "ghost amounts" keep appearing from before and I cannot clear them. I have even deleted the memorized …

Cost of Goods Sold Not rated yet

I recently took a job cleaning up books for a Canadian corporation. And cleaning is an understatement! However in good spirit and in a desire to learn, …

Wrong account entries Not rated yet

I am learning QuickBooks and I am using my household like a company to record my expenses to practice and learn.

By mistake I recorded the expenses …

QuickBooks File Set up Not rated yet

Is there a certain specific way to set up a company file in QuickBooks? I have heard from some business people that their QuickBooks company file was …

Quickbooks Clean Up Not rated yet

I have a few transactions from 2010 that include some duplicate credits and duplicate bills along with some old credits. These are showing up on my Profit …

Adjusting Journal Entries With HST Not rated yet

I am trying to enter my adjusting journal entries from my accountant.

One of them consists of five lines:

1 accounts receivable

2 hst on purchases …

Cost of Goods Credit Cards Not rated yet

Hi,

80 to 90% of all my customers pay with a credit card as we operate an online store.

Should the per sale credit card charge (discount rate) be …

QuickBooks Journal Entry Rules Not rated yet

I have quarter-end journal entries (JEs) to make that look like this:

DR Other Receivables

CR Capital Stock

DR Other Receivables

CR GST Payable …

Items Multiple Unit of Measure Not rated yet

How do or can I assign an item to have 2 units of measure? ex. Flooring at 21 sq.ft per box.

If I needed 1000 sq.ft type in 1000 sq.ft under "qty", …

Prepayment to Foreign Vendor Not rated yet

I am using QuickBooks and have made a payment on account to a US vendor. I do not have a US bank account.

I have applied the prepayment to invoices …

Booking Meals & Entertainment Expenses Not rated yet

Hi There,

I am using QB and was wondering how I should book the meals and entertainment expenses given that they only have a 50% eligibility.

Do …

Printing Customer List With Balances Not rated yet

I can't print Transactions:Invoices:and only a portion of the list. Hello Nancy,

I'm not sure where you are at ... but when I want to print …

Paying Bills in QuickBooks® Not rated yet

Hey there!

I am using QuickBooks® to do the bookkeeping for a company with many bank accounts.

I understand how to enter in vender bills to the …

That's it for today. I hoped you enjoyed this introduction to learning QuickBooks® and found the information useful, practical ... and not too overwhelming.

It's been great chatting with you.

Your Tutor

12 Part QuickBooks® Primer

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Click here to subscribe to QuickBooks Online Canada. I do not receive any commissions for this referral.

Home > Bookkeeping Forums > Learn How To Use QuickBooks Forum

Bookkeeping Essentials > Developing Your Accounting System > Learning QuickBooks