QuickBooks Online FX Transactions and Conversion

by Lin

(Alberta, Canada)

QBO Multi-Currency Transactions

I am really at lost regarding the booking my foreign exchange transactions & conversions, and need your help! Here is my situation:

Our books are in CAD (reporting currency), and we have some US clients that we occasionally invoice and receive payments from. We have bank accounts in both CAD & USD for our activities.

We invoice our US clients in USD and receive payments in USD, then we deposit them in our USD bank account until we are ready to convert them into CAD with the bank.

In Quickbooks (QB) we set up those US clients in USD currency as well. I have two questions:

1. When we invoice the US clients (in USD) and then received payments later (in USD), quickbooks calculates a Foreign Exchange Gain/ Loss on the amount for the different FX rates when invoice was created and payment received. Is that Correct?

2. When we convert the USD into CAD with our bank (sell USD cash and buy CAD cash with our bank), what entries should I enter for this transaction? Is there FX gain/loss again?

Desperately need some help on this. Thanks.

Lin,

I've put some snapshots of QuickBooks Online (QBO) in the photo gallery at the top of the web page. Please refer them as you read the following:

I chose to to use an expense rather than income to illustrate how QBO handles foreign currency transactions.

If you have multi-currency turned on in QBO, it handles

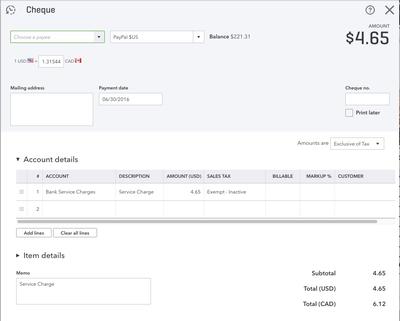

The US bank charges in a US bank account shown in Pic 2 above are $4.65 USD. QBO books the following journal entry "behind the scenes":

DEBIT Expense - Bank Service Charges $6.12 CAD

CREDIT US Bank Account $6.12 USD

When you look in the QBO bank account register/ledger you will see two columns - one in US dollars for $4.65 and one in CAD dollars for $6.12.

For any transaction in QBO, you can see the journal entry booked by clicking on "More" at the bottom of the data entry screen and then click on "Transaction Journal".

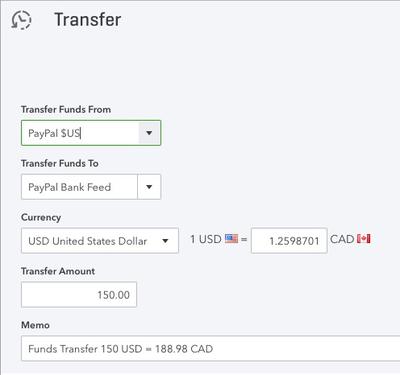

When you make a transfers of funds between two currencies in QuickBooks Online, see Pics 3 and 4 above for what happens.

In my example (Pic 3) I am transferring $150 USD from a US bank account to a Canadian bank account. QBO converts the $150 at the stated exchange rate (which you can input if you don't like the default). In this case the CAD value is $188.98. Translated into debits and credits, the bookkeeping entry is:

DEBIT CAD bank account $188.98

CREDIT exchange $39.98

CREDIT USD bank account $150.00

The "behind the scenes" journal entry (Pic 4) booked by QBO only shows the CAD values, and does not book the exchange, as follows:

DEBIT CAD bank account $188.98

CREDIT USD bank account $188.98

Hope this helps. Remember, QBO does all the "work" for you if you have multi-currency turned on.

Return to Learning QuickBooks.