- Home

- Virtual Workflow

Learning QuickBooks® Online | Focus on Bookkeeping

Automate YOUR Accounting Workflow Process

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published 2016 | Edited June 1, 2024

WHAT'S IN THIS ARTICLE

Streamline your workflow process - It's important | 6 Steps for selecting apps | QBO's data management tools | Bank electronic access agreements | eCommerce accounting workflow TIPS | Choosing the right app integrations for YOUR business | Other Workflow Chats - Hubdoc, Chrome, PayPal, LedgerDocs

Automating Your Accounting Workflow

Automating Your Accounting WorkflowIt is soooo important these days to continually perfect your online accounting workflow process because ... there are so many apps out there, it's easy to get loooosssstt.

If you want to stay profitable, don't throw your hard earned money away on every app that comes along. Look at your online accounting and bookkeeping workflow to determine if the app will really improve your workflow in terms of productivity and efficiency. BE SELECTIVE.

The easiest way to do this is to STOP and document your process. The benefit to you is that it will also help you onboard new customers or projects so they seamlessly integrate into your existing processes. Notice I said, "your processes" ... not "their processes".

So take a few deep breaths, do some stretches, pour some tea into your favorite teacup, open a window to get some fresh air, make yourself comfortable ... and let's get started.

Why Automate the Bookkeeping Process?

I attended a great webinar by Joe Woodard in January 2018 about how to implement a standard tech stack to serve your clients more efficiently. After taking us through a brief history of the evolution of bookkeeping and what worked and what didn't, Mr. Woodard discussed how to standardize and automate your bookkeeping process.

Emphasis was placed on reminding public / freelance bookkeepers and accountants that when a client hires you, they hire you and YOUR product, YOUR process and YOUR systems. You decide how YOU will deliver those systems. If you are always trying to fit into the client's existing system, your small margin of profit will be eaten up.

If a client is not willing to fit into YOUR existing system, then they may not be a good fit for you and YOUR business. If the client wants you to fit into their existing system and processes, then perhaps what they really want is an employee not a freelance bookkeeper.

In this day and age of technology, bookkeepers need to automate their virtual bookkeeping workflow to stay profitable. So let's chat about the easiest way to get started on this journey ... and it is a journey.

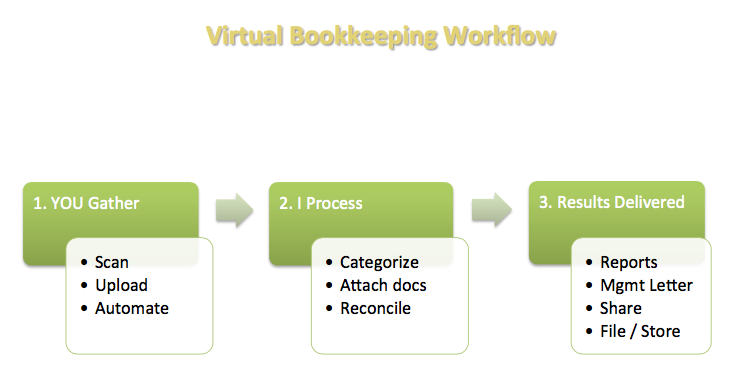

Virtual Accounting Workflow Diagram

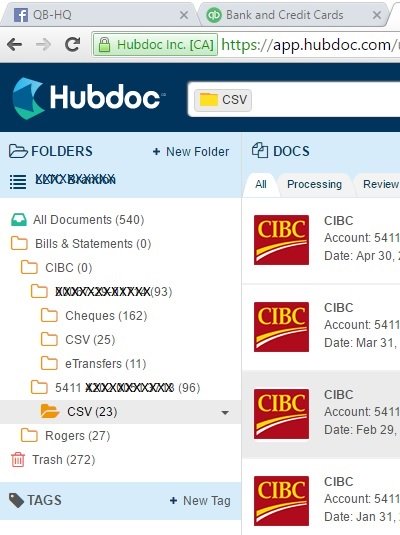

How to explain the virtual accounting workflow to new customers. *This diagram is based on The Freelance Bookkeeper's 2016 webinar "How to automate workflow for virtual bookkeepers".

How to explain the virtual accounting workflow to new customers. *This diagram is based on The Freelance Bookkeeper's 2016 webinar "How to automate workflow for virtual bookkeepers".I took a webinar from Gabrielle Fontaine, PB in 2016 on how to streamline your bookkeeping / accounting workflow. She likes to teach bookkeepers how to organize and run an online home based bookkeeping business. As a result of attending that webinar, I took the time to diagram my workflow process to make it easier to onboard clients. You can see the first page of my initial dip into creating a virtual core workflow above. Clients new to a paperless system can look at the diagram and make it a cinch to understand the virtual accounting workflow process.

Your first step before selecting any apps is to design and document your OWN workflow. Once you've accomplished that task, you will be able to determine if you need to add any apps to give you the results you want. To achieve more efficiencies, you need to know where you are in YOUR accounting workflow and where you want to go BEFORE you can make an informed decision.

My basic accounting workflow diagram has become invaluable to help determine if an app will improve my workflow or make it less efficient. It assists in keeping my hard earned money in my pocket because I have always subscribed to Mike Michalowicz's Profit First formula (even before I heard about it): Income - My Desired Net Income = Expenses (What's left to run your business).

How to Approach Evaluating YOUR Workflow

Kristy Monahan at Dynamic Bookkeeping out in the state of Washington has a great article on The PB&J's of Designing a Workflow. She gets you started by writing out the directions on how to make a peanut butter and jelly sandwich! She recommends approaching it as if your employees and your customers are aliens ... just to make sure you don't miss any steps.

I personally have gotten tired of trying to keep up a detailed written manual of procedures because in this new environment, things keep changing ... and changing ... and changing. Many people now just do up quick videos so when technology changes, they just rerecord the video. I personally hate watching all the videos. I am a reader. I want to be able to skim over the parts that do not interest me.

This is where a picture says a thousand words. I do a detailed flowchart for each of the three pockets in the process:

- You GATHER

- I PROCESS

- Deliver RESULTS to the Cloud (somewhere in that big electronic storage cabinet out "there")

Don't misunderstand. I still have GENERAL written procedures ... with the detail in the flowcharts. I update the flowcharts each time I make a change to my accounting workflow process.

6 Steps For Selecting The Right Apps For YOUR Workflow

What apps should you integrate with QBO?

What apps should you integrate with QBO?In 2017, I took another webinar from Gabrielle on happy "apping" where she provided a six step process to choosing the right app for your business ... because it is not a one size fits all type of solution.

Gabrielle's app accounting workflow process works because she starts with end results desired then creates the road map to get you there. Here is her app selection process:

- What results do you want the app to achieve? Only upgrade to apps if the built in features do not give you the results you want.

- What are the apps must have requirements and functions?

- Where do you search for a solution? Intuit's apps.com is a good place to start.

- How do evaluate your short list of apps?

- Take the app for a test drive. If you are a freelance bookkeeper, try it out on your books ... or ONE client. IT'S OKAY if you test it and decide it isn't doing exactly what you want.

- Adopt the app if your test drive was satisfactory. Roll it out to your other clients.

I'm a member of a few online bookkeeping groups. Many of the bookkeepers use apps ... a lot of apps. I'm noticing that they may not be saving as much time with apps as they planned because of all the bugs that come with SaaS (software as a service). The bugs can flow from one app through the integration to the main product. One day something works ... the next day or even hour it doesn't. It could be because QBO made a change causing the integrated apps needs to be revised too.

You will need to continually revisit your accounting workflow process and reassess whether an app is saving you time and money. Yes, it will be hard to walk away from technology sometimes if it no longer serves you or meets its objective of saving you time. Remember, more is not always better. Sometimes less is more.

When selecting apps ...

"strive for efficiency and convenience over bells and whistles."

Gabrielle Fontaine, PB

A picture comes to mind of an NCIS episode years ago where a computer in evidence was being destroyed by a virus and all the techies were madly typing code to try and stop it. No matter what they did, they couldn't stop it. Gibbs unplugged the computer. Sometimes just entering the data is a lot faster and cheaper than fooling around with technology glitches ... especially if you are running a small home based business.

Make Use of QBO's Data Management Tools

BEFORE purchasing any app for QBO, remember to check out the built-in features that automate your data entry and improve your accounting workflow.

Intuit is always upgrading features. Their most recent additions in Canada at the time of this writing are:

- Practice management and client notes for ProAdvisors

- Hubdoc integration partnership

- Wagepoint advanced payroll integration partnership ... don't worry - basic payroll is not going anywhere ... yet.

- TSheets integration partnership ... I'm told it works seamlessly with QBO and QBD for accurate payroll, invoicing and job costing through automatic employee mobile time tracking.

You may find these features are all you need at this time to begin automating your bookkeeping / accounting workflow.

- Convert as many paper sourced documents to electronic delivery as possible. I'm not talking about scanning your existing paper here ... although you do need to do that too ... but instead of having a statement mailed, request a switch to electronic paperless statements. Ask for invoices to be sent by email or as a PDF attachment. You get the idea. This will allow you to setup up filters to start automatically forward these emails to your document management service ... or have them emailed directly there.

- Don't forget to actually download your eStatements. They often are only available online for a limited time. After that, it will cost you to do it in future ... during an audit for example. I talk about document management apps, like Hubdoc and LedgerDocs, to help you automate this process in another chat.

- Google Chrome is the recommended browser for QBO. Google Chrome can be customized to your preferences, making your life easier.

- If you are comfortable doing so, and are aware of your electronic online banking agreement limitations, utilize the bank feeds feature in QBO to automate your data entry and reduce manual clerical errors. QBO bank feeds automatically pull all your bank and credit card transactions. If you have entered your transactions or had them integrated using a document management app (having source documents to support your transactions gives you audit ready books), it will "match" the transactions.

- Don't forget to setup bank rules in QBO. It will seamlessly process recurring transactions. I personally prefer to review the transactions before allowing them to post, so I rarely set the "post automatically" feature. Bank rules have the capability to let you split a transaction if necessary. This feature can dramatically improve your accounting workflow.

- Use the "memorize transaction / recurring transaction" feature. Personally, for the more complicated transactions, I find it easier to copy an invoice or bill from the previous month and edit it rather than work from the recurring template.

- QBO has a free mobile app you can use to create and view estimates, invoices and sales receipts. It will also let you snap a photo of your expense receipts to attach to your transaction in QBO. Some people throw away their receipts after they've taken the photo, but until CRA comes out and clearly states they will accept pictures of receipts, I'd keep filing the paper receipt away.

Are there risks when you hook up a bank feed?

Are there risks when you hook up a bank feed?Bank Electronic Access Agreements

Back in 2012, I contacted one of the charter banks to determine if granting importing access (or hooking up to online banking feeds) violates their electronic online agreement ... and they said yes it did.

They were aware at this point that people were allowing third parties read access ... and they were not shutting it down ... but it did mean you were not covered for fraud or anything else with your accounts as you had "shared" your account information with a third party.

Given this, in 2012, I recommended you download your transaction file from the bank so you are not sharing your access information and not use software bank feed options. This is not optimum to take advantage of accounting workflow efficiencies.

After talking with one bank, I looked online for all of the Big 5 access agreements. All the agreements with the exception of the Scotiabank had very easy to read electronic online access agreements which stated clearly that you would be responsible for losses if you have shared your access information with a third party aggregator service as it is contrary to your agreement to keep your password absolutley confidential.

This is still a problem in 2017. However, there may be light at the end of the tunnel as banks begin to amend their electronic access agreements to 21st century technology.

Effective October 12, 2017 Royal Bank is changing their electronic access agreement giving you permission to share your password and personal verification questions with an aggregator or account verifier (I'm not sure what the difference is). They will not reimburse you for losses to your Account if you do not comply with any of your obligations under the Security section. If I understand the agreement correctly, this means that your accounts would now be covered for fraud if you comply with your obligations.

That is definitely progress in allowing us to take advantage of accounting workflow efficiencies As I understand it ... for all these software applications to work, they work WITH the banks so they can offer the service. We are familiar with the bank feeds "breaking" due to a programming change by a bank that leaves the software companies to play catchup. So why the banks won't issue their regular retail customers (not just their commercial customers) a unique aggregator ID and password with very limited access is just beyond me.

The next thing I'd love to see would be the banks actually certifying third party aggregators so that the two parties work together to help keep their customers safe online. After all, the banks choose their own third parties to share our account information with to provide services to us ... now they need to take the next step and allow us to use technology to mine OUR DATA safely.

eCommerce Accounting Workflow Tips

I attended an eCommerce webinar by Scott Scharf from Catching Clouds in July 2017. Catching Clouds specializes in eCommerce.

One of Scott's eCommerce accounting tips was ... DO NOT record every transaction in the accounting platform ... and I agree. Instead he suggests you build processes for daily, weekly, monthly and quarterly tasks. Why does he recommend this? Because having every transaction that already resides in another system does not always assist you in compiling accurate financial statements ... it may even make the task harder to do.

His other eCommerce accounting tips (which I fully agree with and already adhere to) were:

- Use a password vault

- Setup 2 factor authentication

- DO NOT use the client's own Amazon Admin account as they will shut down the account if it is shared ... and they can tell when it has been shared. It takes awhile to get back access to the account.

- Make time to manage your data ... watch out for duplicate data and ensure EVERY order is entered into the cloud inventory systems AND sales tax management system which may not be the accounting platform (QBO, Zero, Kashoo, etc).

- Automate your accounting workflow where possible but don't trust the integration until you can prove it provides value and efficiency. Break the integrations that screw up the accounting and build a manual process.

How to Choose Your Apps

It's a journey, treat it as one. Don't rush to your destination. Getting it right is more important.

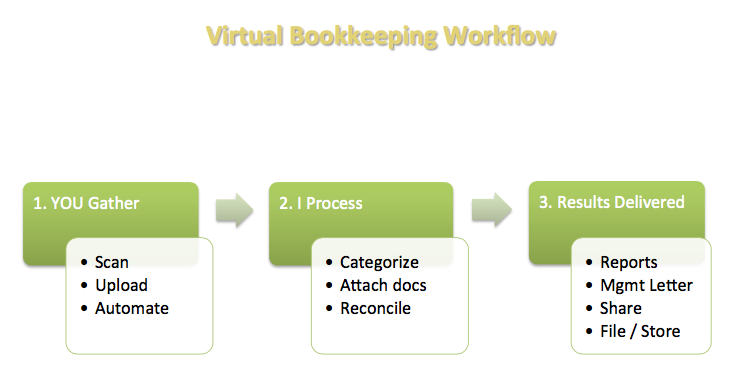

How to explain the virtual accounting workflow to new customers. *This diagram is based on The Freelance Bookkeeper's 2016 webinar "How to automate workflow for virtual bookkeepers".

How to explain the virtual accounting workflow to new customers. *This diagram is based on The Freelance Bookkeeper's 2016 webinar "How to automate workflow for virtual bookkeepers".Still working with the three pockets above, now you begin to decide what apps you want to integrate with your QBO workflow process. Just remember, you only want to add apps if the built-in features and functions are not giving you the results you require.

It's important to keep in mind that improving your paperless workflow is a journey, so complete one journey at a time. By this I mean only bring one app onboard at a time then assess if it is doing what you wanted. Don't try to integrate more than one app at a time.

This is important, so let me say it again ...

Always chose to work only in one pocket at time ... I.E. only bring one app to integrate with your bookkeeping and accounting workflow at at time, then you shouldn't get carried away subscribing to any and all apps out there.

If you have no idea where to start, begin where most of your time is spent or where you have a bottleneck. If your pain point is not receiving all the source documents you need from your client, then start with pocket one and look at document management services. The accounting workflow I have captured in the diagram above is already changing for me as I continue to work towards more efficient data collection and data entry. The most important thing is to start ... and take the first step. Once that is accomplished, take the next step.

Some of the more popular / favorite accounting workflow apps I hear about in bookkeeping groups that integrate well with QBO right now are:

- Hubdoc - pricey but loved by Canadian bookkeepers, a document management app that fetches documents automatically; utilizes OCR; pushes foreign currency transactions to QBO at par - not great as requires manual intervention to correct. Xero acquired Hubdoc in August 2018. (out of Toronto)

- Smartvault - very pricey but has been around since 2008. It was designed for bookkeepers and accountants as a secure central online document storage system. It uses/integrates Docusign (before 2018 used RightSignature) for electronic signing of documents. (a US product)

- LedgerDocs - simple and affordable document collection and management system; perfect if your pain point is collecting documents; introduced bank fetching in June 2018 which is available for an additional fee. (out of Vancouver)

- LedgerSync - automatically collects bank and credit card statements, cheques and deposits then pushes to QuickBooks Online or Desktop once your have coded and approved the data. (based in L.A. with an office in Toronto)

- Receipt Bank rebranded as Dext in February 2021 - automated collection and data extraction of receipts and invoices. Features include rule setting, supplier fetching (June 2018) and bank fetching (September 2018). It has partnered with Sage. After the rebrand the product was reimagined and I'm no longer familiar with it. (was originally a UK product and now has offices many countries around the world)

- Bill.com - automate your bill payment process (a US product)

- Expensify - an affordable app for those who travel and need to submit expense reports (a US product)

- TSheets - mobile time tracking with GPS; reports employee location, time and status; tracked billable time can be used for job costing invoices and preparing payroll faster. It was acquired by Intuit in December 2017 (out of Idaho)

- Wagepoint - small business payroll service (out of Ontario, Nova Scotia and New York)

- Ablii - affordable small business online bill payment solution launched July 2019. I'm not positive but I think Ablii became Nanopay in 2022.(out of Toronto, Ontario)

- Plooto - fixed monthly fee online bill payment solution. As of September 2019, no longer a good solution for SMBs with low transactional volume but still great for businesses that have more than 15 transactions a month. Plooto now also has accounts receivable collection for recurring payments. (out of Toronto)

- Rotessa - affordable, recurring payment collection solution (out of Manitoba)

- Jobber - schedules appointments and is a good fit for residential cleaning, HVAC, lawn care or handyman businesses. (has offices in Edmonton and Toronto)

I'm a less is more type of person but I've heard these apps enhance the bookkeeping / accounting workflow as well:

- Slack - create secure channels to communicate with your clients and reduce your emails and texts (a US product)

- Zapier - automates tasks between web apps. ( US company I think with remote employees in 13 countries)

- 17hats - small business client management system (US company I think with remote employees in other countries)

- Practice Ignition - software to manage your accounting practice (Australian company)

- AutoEntry Sync - enables syncing QBO data in other software such as invoices; forward data to AutoEntry, set up some rules, review and then publish to QBO; leverages AI and OCR technology (originated in Ireland with UK, Australian and US locations)

- WayPay - easy cost effective way to pay and manage business expenses digitally. It offers various funding methods including credit card payments for suppliers who do not accept credit cards. RBC acquired WayPay in July 2019 and has been rebranded as RBC PayEdge. (Canadian company)

- TransferMate - fast way to send and receive international payments (international company with a branch in Toronto)

Some of these apps provide Intuit ProAdvisors with one free subscription for their own business. The developers want you to be familiar with their apps so that you can promote it to your clients.

These are some of the ones that have caught my attention ... but I am very selective in introducing apps (i.e. I've been slow to jump on the app bandwagon)... so I haven't researched all of them.

Here's a topic that gets on my nerves ... personally, I really don't like doing business with companies that will not provide a physical location for their head office on their website ... or at least a mailing address. Honestly why are they hiding? At the very least, tell me your country!!!

And of course ... if you are working virtually in the cloud ... don't forget to have your online cloud backup in place. It is a MUST HAVE.

That's it for today. I hope this takes some of the mystery about all this bookkeeping and accounting workflow chitchat and automated data entry chatter. Crossing my fingers that you found the information useful, practical ... and not too overwhelming ... because I'm right there with you trying to make sense of it all.

I will try and find guest authors to contribute to the site so that the automatic accounting workflow and app mystery can continue to unfold.

It's been great chatting with you.

Your Tutor

QBO Workflow App Integration Chats

Click on any image below to go to the chat.

© 2015 Google Inc, used with permission. Chrome™ browser and the Chrome™ browser logo are registered trademarks of Google Inc. Screen shots © 2015 Google Inc. All rights reserved.

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved. Hubdoc is a trademark of Hubdoc Inc. Screen shots © Hubdoc Inc. All rights reserved. LedgerDocs is a trademark of LedgersOnline Inc. Screen shots © LedgersOnline Inc. All rights reserved. Ablii is a trademark of nanopay Corporation © All rights reserved. Plooto is a trademark of Plooto Inc. Screen shots © Plooto Inc. All rights reserved. LedgerSync is a trademark of LedgerSync, LLC. Screen shots © LedgerSync, LLC. All rights reserved.

Bookkeeping Essentials › Integrating with QuickBooks Online Systems › Bookkeeping and Accounting Workflow