- Home

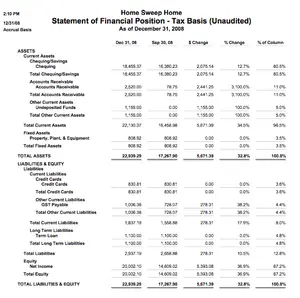

- Financial Statements

- Basic Cash Management

Basic Cash Management

Quick Accounting Training

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published February 2014 | Edited June 3, 2024

Quick Links

✔ Difference between profit and cash flow

✔ Free cash management calculators

✔ Create your own cash flow spreadsheet

✔ 5 ways to improve cash flow

✔ How to set pre-planned AP payment priorities

Cash flow is a barometer of your business’ health. As long as you have cash flowing in and out of your business, you can keep the doors open for business, even if you are not profitable.

Profit is NOT Cashflow!

Because managing YOUR cash is essential to to running YOUR business, let me start this chat by saying that YOUR cash flow is different from your profit and loss. It's important to UNDERSTAND this difference.

The income statement includes:

- non-cash entries like amortization of capital assets;

- sales from accounts receivable (the cash has not been received yet);

- expenses from accounts payable (the cash has not been paid out yet);

- loan proceeds and owner contributions never hit the income statement (the cash received is recorded on the balance sheet); and

- adjusting entries to match expenses with revenues ....

... just to name a few differences. The thing you MUST learn to have a successful business is cash management. Will you make mistakes at first? Of course ... but learn from them and build your lessons into your cash management plan so you're not blindsided again.

Five ways to improve your cash flow

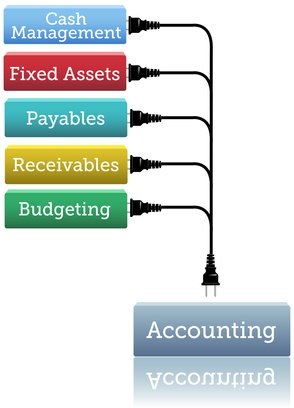

Use accounting software to help you manage the flow of cash coming in and going out of your business. For many small service oriented businesses, QuickBooks Online is good fit enabling you to get a handle on maintaining a positive cash flow (more money coming in than is going out). Consider ...

- Prompt invoicing, improving on accounts receivable collections (increase the flow of money coming in the door) or consider not accepting credit at all ... GASP!! You are a small business NOT a bank. Does your hairdresser float you a loan? Does the restaurant where you grab lunch say, "Hey why don't you run a tab"? QuickBooks Online allows you to invoice customers in real time and accept mobile payments.

- Setting pre-planned priorities on accounts payable payments so you can pay your vendors on time (read more below on how you can CONTROL the flow of cash leaving the business). QuickBooks Online can help you make real time decisions.

- Cutting expenses in a way that will not affect the long term viability of your business (reduce the amount of money going out the door). QuickBooks Online can help you automate your data entry ... increasing your data accuracy ... enabling you to make the critical decisions necessary.

- Reducing your inventory (free up cash) by using Quickbooks Online inventory features. QuickBooks Desktop is a better choice if you require complex inventory tasks such as assembly or units of measure.

- As a last resort (for me) securing a small business loan. I prefer to have all my financing well in place long before I ever need it, so I can manage it rather than have it manage me. I like sleeping at night so I don't want to have zero or negative working capital (drain my cash). Sometimes planning to draw on the line of credit is a good solution ... as long as you are also disciplined enough to pay it down as quickly as possible. QuickBooks Online is a FULL accounting package. It doesn't just track your invoicing or print out an expense report. It can track your financing as well.

Get in the habit of monitoring and managing your cash daily. QuickBooks Online's bank feeds make it easy to do.

The reason to pre-plan accounts payable priorities, as part of your financial plan, is so that you are not making bad decisions when YOU ARE IN A CRISIS. You have thought out your financial plan when you were not stressed and you were thinking clearly.

Setting clearly laid out procedures will also help you reduce transactional costs. For example, tax compliance bills should receive different treatment than capital asset invoices, professional fees or utility services. S p r e a d i n g p a y m e n t s o u t o v e r t h e m o n t h instead of paying everything at once doesn't leave you vulnerable.

Timing your accounts payable payments is part of cash management to avoid cash crunches. Decide ahead of time who gets paid first ... and try to be consistent with each supplier. For example, here's one list that may suit your industry:

- Payroll and payroll taxes ... you want to stay on the good side of CRA and IRS;

- Sales and income tax installments ... you really don't want to be on the radar of the CRA or IRS as government remittances have priority status over lenders and suppliers in a bankruptcy;

- Rent / mortgage payments ... you need to keep the doors open to earn income to pay all your bills;

- Insurance premiums ... unexpected stuff happens that is out of your control;

- Utilities ... customers can't shop in the dark and you want to be able to turn on your electronic devices; and finally

- Suppliers ... if you are short on cash when you sit down to pay your bills, consider making partial payments to your suppliers. That way everyone gets some payment and your credit rating stays intact.

IF you are someone who would rather calculate things on the back of an napkin or in an Excel spreadsheet, I'll show you how to do just that.

Here's your quick accounting training ... a fast manual method of calculating your cash flow:

- Get your cash on hand from your latest bank statement.

- Add (+) your expected cash receipts (how much money you think will be coming in the door) for the next _______ ( you fill in the blank for the time period - a week, a month, a quarter, a year) ...

- Subtract (-) your cash disbursements (money you estimate will be paid out to cover fixed and variable expenses) for the next _______ ( you fill in the blank for the time period - a week, a month, a quarter, a year) ...

- Add (+) in any saving account balances your business has ...

- Subtract (-) your GST/HST funds collected and held in trust for the Receiver General ...

- Subtract (-) your payroll source deductions due to the Receiver General ...

- Subtract (-) your provision for income taxes so you have funds due at tax time (remember there are no source deductions paid on your net profits while you're earning them) ...

- Equals (=) projected cash at the end of the period.

If the amount is positive, you will have cash on hand.

If it is negative, I hope you have overdraft protection on your account because you are going to be short of cash.

Cash

flow expert Michael Nolan recommends an 8 week cash flow forecast in

his April 10, 2009 New Hampshire Business Review article titled, "How to

get control of your cash flow".

Mr. Nolan suggests paying

attention to detail and striving for accuracy. Why? "The better we

forecast the better we will understand the sources and uses of the funds

in this organization."

"Many business failures are profitable when they go under;

[...] Cash flow is critical, but not intuitive."

Build A Better Business Plan by Palo Alto Software

Utilize Cash Management Calculators

Have you ever asked yourself at any point while running your business, "Hey where did all my cash go?". Well your Cash Flow Statement shows you. If you are not utilizing this statement, you are missing a big chunk of information.

Once you've asked the first question, the next question that usually arises can be a big stumper when you first start your business is, "How do I forecast my cashflow?". Here are a few options.

This is a cash flow calculator

that pictorially shows you the difference between profit and cashflow.

Their site says that it is a fact "many business failures are profitable

when they go under; [...] Cash flow is critical, but not intuitive."

The

calculator allows you to input your numbers to receive a quick overview

of your cash flow situation. Experiment so you can see and understand

the effect the different factors have on your cash flow.

And because everyone is different ... here is another cash flow calculator that you may like better.

Improve your cash management by using these cash flow tips. If you are stumped as to why you are always short on cash, learn to read your cash flow statement to help you solve the puzzle.

More >> Consider implementing Mike Michalowicz's Profit First method for the self-employed.

Use these calculators and reports to help you monitor your cash flow and meet your financial planning goals. Remember, good cash management can help you stay afloat during those first critical years of starting a business when you may be operating at a loss.

Profit is the goal but cash management is KING. Learn to manage your business cash. Take CONTROL of your business finances.

See you on the next page ...

Your tutor

Learning How To Read Your Internal Financial Reports

Tools for the Home Based Business Owner

How Your Financial Plan Is A Road Map

How Your Financial Plan Is A Road Map Why You Want The New NTR Report

Why You Want The New NTR Report