- Home

- Financial Statements

How To Your Read Financial Statements

For The Home-Based Business Owner

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published February 2009 | Edited June 13, 2024

What You'll Find In This Chat

- Making It Relevant To You

- Basic Accounting Equations

- Quick Quiz

- The Materiality Constraint and The Cost Benefit Constraint

- Do You Need GAAP or ASPE Financial Statements?

- 2021 New Compilation Standards

- What Will A CPA Require to Prepare a CER package?

- ASPE Update - Statement of Cash Flow

This is the first article in a series on how to read your financial statements. It is not meant for readers interested in learning about investing.

This series has been written for the small business owner who works from home and does their own bookkeeping ... and wants to know how to use the financial reports to help them make sound business decisions.

If you want to skip the introduction, feel free to go directly to the balance sheet and income statement chats ...

... but you will miss the discussion on whether you need GAAP financial statements if you do.

If you are in a BIG HURRY, you will also find brief overviews of the balance sheet and income statement in "The Road Map" section of this site.

Learning How To Read Your Internal Financial Reports

Tools for the Home Based Business Owner

How Your Financial Plan Is A Road Map

How Your Financial Plan Is A Road Map Why You Want The New NTR Report

Why You Want The New NTR ReportAdvertisement

Help getting all your ducks in a row

- Do you prepare financial statements monthly?

- Do you review them once they are prepared?

- Do you understand what they are saying about your business?

- Are you sure they are accurate and make sense?

A 2% decrease in brain hydration can result in short term memory loss and trouble with math computations. Hydrate!

A 2% decrease in brain hydration can result in short term memory loss and trouble with math computations. Hydrate!Fill up your water glass then don't forget to sip. Did you know that staying hydrated has been linked to better concentration and enhanced short-term memory?

Let's begin learning how to read your financial reports and evaluate the information. Together we will uncover your business's financial health, problems, and potential outlook.

The goal is to enable you to apply sound accounting and bookkeeping principles to improve your operations. It's time to remove that dark cloud that seems to hover over your head every time you pick up a financial report.

Reading financial statements is not that difficult, once you understand the layout of the reports and the language being used.

Following is a brief "story" that relates your every day tasks of running a business into "financial statement language" ... kind of like a foreign language dictionary.

Financial Statements in Everyday Terms

Making it relevant to you

Take a second and think (dangerous I know!) about what

information you use to run your business every day. Just like running

your home efficiently, to run your business you need cash (sitting in the bank account - current asset).

You need to make a sale (make money - earn revenue) so you can get paid (money coming in the door - accounts receivable) so you can buy stuff for the business (expenses) then pay the bills (money going out the door - accounts payable).

Maybe you took out a loan (other people's cash - company debt - liability) on your equipment (stuff the business owns - capital assets) and now you make a loan payment (money out the door - reduces debt).

When you started the business, you probably put in some of your own money (your investment - owner's contributions - increases equity).

You are always keeping your eye on your investment by controlling costs

(expenses) and monitoring your actual performance to your budget (plan).

In your budget, you planned for a profit (to make money - business's cash - retained earnings).

And let's not forget, you need to eat and put a roof over your head (pay cheque - owner's draw - decreases equity).

Are you starting to see a picture here?

To run your business efficiently, you need to know how much profit (from the income statement or retained earnings) you are making (that's why you are in business) and determine how much cash you have. (Don't confuse cash flow with net profit.)

To run your business efficiently, you need a method of keeping track of all the people who owe you money (accounts receivable) and who you owe money to (accounts payable and loans). You need a method to keep track of all your business possessions (assets) you have accumulated.

All the items listed above are found on your financial statements using a tried and true system recognized all over the world. It is the language of money and finance.

In this series of articles, you will learn about some basic equations such as:

Assets - Liabilities = Equity ... where ...

Equity = Owner's Equity + Net Income (Loss) ... and ...

Net Income (Loss) = Income - Expense

Quick Quiz - Critical Information

Have you been wondering, "What business decisions could be made using the income statement or balance sheet?" or ...

"What are some of the critical pieces of business information for you to keep track of to help you run your business? "

To get an idea of the answers to those questions, take this quick quiz. See if you can match a business question asked in column A with where you find the correct financial statement information in column B.

| Column A Your Question |

Column B Where to Find the Answer | ||

|---|---|---|---|

| 1. |

Who owes your business money? |

A. |

Indirect Expenses on the Income Statement |

| 2. |

What does your business own? |

B. |

Accounts Payable on the Balance Sheet |

| 3. |

How much is the business spending? |

C. |

Office Furniture and Equipment (or Assets) on the Balance Sheet |

| 4. |

What have you invested in the business? | D. |

Accounts Receivable on the balance Sheet |

| 5. |

What are your sales? How much are you bringing in? | E. |

Owner's Equity on the Balance Sheet |

| 6. |

What is your business overhead ... the money you have to spend even if you don't make a sale ? | F. |

Revenue on the Income Statement |

| 7. |

What cash do you have on hand? |

G. |

Liabilities on the Balance Sheet |

| 8. |

Is your business making or losing money? | H. |

Net Profit / Net Loss on the Income Statement |

| 9. |

How much is the business in debt? |

I. |

Bank Balance on the Balance Sheet |

| 10. |

Who does your business owe money to? |

J. |

Expenses on the Income Statement |

The answers are found on the Balance Sheet Essentials page. Na, uh, uh ... no clicking until you've tried to come up with your own answers! ;-)

If you were to go to the bank and apply for a loan for your business, the loans officer would ask to see your Balance Sheet and your Income Statement. (If you don't have a set of financial statements and you are a sole proprietor, the bank will probably accept your T2125 (Canadian) or Schedule C (U.S.) from your most current tax return.) Why?

Because, if you know how to read it, it tells the bank whether you are earning a profit or losing money ... whether you are carrying too much debt. This is important if you are going to be asking them to loan you more money.

The Bookkeeper's Tip

A Good Bookkeeping Practice

Prepare your internal financial statements once a month. It provides you with a summary of your business activities. Familiarize yourself with a basic overall understanding of how they work. Why?

It will help answer the every day business questions asked above in the quiz.

You can also use the information to make future decisions about your business activities. It will give you have a better understanding of your tax obligations and assist you in reducing your taxes legally.

Does once a month sound too onerous? Quarterly is acceptable too for a small business.

Let's get started by looking at the balance sheet and see what it reveals to the banker about your business.

In the coming days, we will also look at the income statement, cash flow statement, and ratio analysis.

Oh and by the way, your banker will probably also want to see a business plan.

Let's Chat About ...

Two Basic Accounting Guidelines (GAAP)

The Materiality Constraint and The Cost Benefit Constraint

Accountants are normally required to use GAAP for financial statement presentation. However, accounting must be practical.

In case you didn't know, GAAP was developed mainly for publicly owned companies. There are a lot of rules and guidelines that really aren't useful or practical for SMEs (small and medium enterprises) to follow ... which is why Canadian ASPE was introduced in 2011 and a US financial reporting framework (FRF) for SMEs in 2013. So this is where these two guidelines become extremely useful.

The cost benefit constraint says the accountant must always consider the cost of complying over the additional accuracy gained. If it would be too hard or expensive AND there is no real difference (material effect) if the rules are ignored ... the materiality principle says you can temporarily ignore the rules.

This means that the net income should not be significantly affected ... also it should not cause the reader of the statements to make a different judgement or decision.

There is no one line that distinguishes material from immaterial. So what is material?

How about if you look at your net income and ask, "Would the user of the report make a different decision if the net income changed by 5% in either direction? ... or you could choose a specific number instead of a percentage ... say $200 or $500 or $1000 (for a home business). Your choice would depend on your situation. If $1000 represented 50% of your net income ... that would not be a good choice for your threshold. Financial statements need to be close enough to ensure a decision can be made.

The general rule is that an item or amount is considered material if it will influence or change the reader of the financial statement to make a different decision.

Another point to keep in mind ... I can't remember where I read this to give you the source ... materiality is an accounting concept. It does not exist in the Tax Act. The Tax Act relies on reasonable for the circumstances and made with the expectation of profit as its measuring stick.

Both of these constraints require professional judgement as you can see. This is what CPAs are trained to do, use professional judgement.

Let's Chat About ...

Do You Need GAAP or ASPE Financial Statements?

The above discussion on having financial statements for your banker raises the question ...

Do you, as a home-based business owner or small business owner, need to spend money having an accountant prepare a set of financial statements that conform to generally accepted accounting principles (GAAP)?

To answer that, you need to know that GAAP was initially developed for public companies that had to report to third parties. These third parties were usually investors and they needed access to financial information to make good investing decisions ... or the third party could be bankers (or other creditors) who loaned money to the companies.

So if you are a small business owner with little to no debt and are active in your business ... do you really need to have financial statements prepared to meet third party reporting requirements? Your main concern is paying your taxes and having information to run your business.

The answer - No. You can have your financial statements prepared on an income tax basis

instead of GAAP. This is an acceptable practice if your financial

statements are not widely distributed and mainly for internal use. ...

particularly if you do not require review or audited statements for the

banker or insurance agent.

Before I discuss what this means to you, I'll bring you up-to-date on this ongoing battle in the accounting world.

On April 29, 2009, the Canadian Accounting Standards Board (AcSB) released a proposal to have a "Made in Canada" GAAP for private companies that would take effect January 2011. This is when Canada switched from GAAP to international financial reporting standards (IFRS) for publicly traded companies or companies who want to raise equity or debt financing on the world stage.

This new standard was approved and released in December 2009. It is called Accounting Standards for Private Enterprises (ASPE) and went into effect on January 1, 2011.

ASPE accounting is generally seen as good bookkeeping practices. If you book your entries properly every day throughout the year, it is fairly easy to prepare your financial statements ... but tax does treat some items differently than ASPE.

As long as your financial statements clearly indicate the standard used for preparation, it is an acceptable practice for small business owners. I believe the practice is actually called 'other comprehensive bases of accounting' (OCBOA) ... at least it is in the U.S. ... I'm not so sure if it applies to Canada as well.

The differences between tax basis and ASPE basis is usually related to measurement issues. So what differences are we talking about here. Here are three of the most common that probably affect you.

- Amortization is reported at CCA tax rates instead of economic or useful life.

- Bad debts is reported using the specific write-off method. Doubtful accounts reserves are also done on a specific set of accounts not as a general allowance.

- No deferred taxes requirement.

2021 NEW COMPILATION STANDARDS

Effective for all fiscal periods ending on or after December 14, 2021, a new standard was introduced by the Audit and Assurance Standards Board of Canada for compilation engagements previously referred to as Notice to Reader (NTR) engagements. The NTR is now called the Compilation Engagement Report (CER) and includes a note on the basis of accounting as well as clarifying management's responsibilities and the accountant's responsibilities.

The CER package usually includes:

- A Notice to the Reader ( A Disclosure Statement)

- A Balance Sheet

- An Income Statement

- A Cash Flow Statement (I think this may be optional)

- Notes to the Financial Statements

Small business owners will need to chat with the third party users of their financial statements to determine if they require compilation (no assurance) engagement statements or if internal financial statements with notes are adequate for their purpose. This is an important discussion to have if you are not required to have ASPE financial statements ... or it may mean you need to provide reviewed (limited assurance) or audited (reasonable assurance) statements.

The new compilation engagement statements may only be prepared by licensed public practice CPAs (I.E. external CPA). The report must include additional information not previously disclosed in a Notice to Reader report; which includes management's responsibilities for the information provided, the CPA's responsibilities of what actions were or were not performed, along with the basis of accounting used.

The reasoning behind this restriction is that the CPA must apply professional judgement and consider the reasonability of the information provided by the client.

Why would you need an NTR set of financials? Some examples are:

- Applying for a bank loan

- Possibly for the annual report to owners or shareholders

- Reporting to investors

- Possibly when filing a corporate income tax return

- Selling your business

If none of these apply to your situation, you would likely be able to use your internally prepared financial statements if you can assure a third party of the accuracy and completeness of the financials.

Under the new standard, CPA's can no longer compile and issue financial statements when preparing the corporate tax return. CPA's are now permitted to prepare corporate tax returns based on internally financial statements without the NTR disclosure.

For more information on these changes, please read Grant Thornton's excellent overview titled "Canada's compilation engagement standard is changing: A summary for management" available online.

What will a CPA require to prepare an CER package?

- Your internally prepared balance sheet, income statement, and cash flow statement.

- Your trial balance

- Your general ledger

- You business's bank and credit card statements

- Your reconciliation reports for each bank and credit card account (this ensures all transactions are captured)

- A list of all expenses paid from your personal funds (and a note as to whether they have been included in your internal financial statements)

- Your accounts receivable aging report (shows who owes the business money)

- Your accounts payable aging report (shows who the business owes money to)

- A fixed asset continuity schedule (this is a schedule that tracks all capital assets acquired by the company and the cumulative depreciation taken for each type of asset)

It is my understanding CPAs would prefer your financial information was prepared by a reliable bookkeeper. It gives them a certain level of confidence that the financial and tax records are in good order.

You may not have a fixed asset continuity schedule. However, if you have booked your assets by CCA class with sub accounts for Original Cost and Accumulated Depreciation, this may suffice. You would need to customize a report to print out the information from the start of your business. Another source for this information would be your past tax returns.

GAAP UPDATE

Statement of Cash Flow ... and ASPE

Have you wondered if the new Accounting Standards for Private Enterprise (ASPE) that came into effect on January 1, 2011 affected which financial statements need to be prepared?

BDO (www.bdo.ca), in their Private Enterprises: Decisions to Make on the Road to New Standards article, said statements of cash flow must always be presented under ASPE. It is NOT optional.

Keeping in mind the new December 14, 2021 standards for compilation engagements, and depending on your situation, there may be more differences. A

Compilation Engagement Report and Notes to the Financial Statements, which are an

integral part of your statements, can be prepared to explain any

accounting policies that differ from ASPE reporting ... if you are going

to be presenting the financial statements to a third party.

The notes still need to disclose contingent liabilities, going-concern considerations, risks and uncertainties.

Tax basis statements may include non-taxable revenue and non-deductible expenses.

Tax basis financials do not require a cash flow statement ... and the title of the statements must be modified to show the basis of accounting.

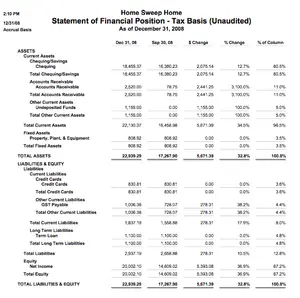

I like to rename the Balance Sheet to Statement of Financial Position - Tax Basis (Unaudited) and ensure there is a footnote saying Notice to Reader - Statement prepared on an income tax basis not ASPE. It could also be called Statement of Assets, Liabilities and Equities - Income Tax Basis.

I like to rename the Income Statement to Statement of Operations - Tax Basis (Unaudited) and ensure there is a footnote saying Notice to Reader - Statement prepared on an income tax basis not ASPE. It could also be called Statement of Revenues and Expenses - Income Tax Basis.

The main benefit to you, besides reduced costs to prepare this type of statement, is that it is easier for you to understand what it is saying.

If you have to submit statements to your banker or insurance agent on a regular basis, check that it's okay to switch to tax basis statements. Also check to see whether they will require a CER or if your internally prepared financial statements are sufficient.

Speaking of bankers ... be aware that the new Accounting Standards for Private Enterprise (ASPE) that came into effect on January 1, 2011 affected your financial ratios ... and therefore your covenants. Grant Thornton (www.grantthornton.ca), in their Catalyst Winter 2010 newsletter recommended "initiating and maintaining communications with your lenders and legal counsel to keep them abreast of issues" that had an impact on your covenants.