- Home

- Financial Statements

- Balance Sheet

How To Read Your Balance Sheet

For The Business Owner Working From Home

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published February 2009 | Edited June 3, 2024

Quick Links

✔ Balance Sheet Formula

✔ Assets, ASPE Temporary Investments

✔ Accounts Receivable

✔ Inventory

✔ Capital Assets, ASPE PPE

✔ Liabilities, ASPE Callable Debt & Income Tax

✔ Accounts Payable

✔ Equity

Sidebar chats

✔ IFRS and ASPE came into effect in 2011

✔ IFRS vs US GAAP

✔ Bank reconciliations

✔ Invoicing of accounts receivable and monthly statements

✔ Inventory Count & Delivery Charges

✔ Cost Principle and Conservatism Constraint

✔ How to book your loan payment

✔ A "cheat" table for debits and credits

Stay hydrated by drinking water to stave off fatigue and concentration issues.

Stay hydrated by drinking water to stave off fatigue and concentration issues.The balance sheet reveals how healthy your business really is. It's a bit like showing someone your private parts! So careful who you show it to.

Do you ever feel confused about the balance sheet? You are soooooo not alone! I hope your jug of lemon water is ready ...

We’ll begin with the basics of reading and understanding this financial statement.

Then, in a separate article, we’ll go beyond the basics to ratio analysis which uncovers interesting stuff about your business like how:

- Liquid (ready cash) you are;

- To quickly measure long term operating results;

- Efficiently your business runs;

- Solvent (do you have too much debt) you are;

and more …

Let the fun start now ... as you discover the relationships between the numbers and begin to understand how they affect your business.

Advertisement

Learning How To Read Your Internal Financial Reports

Tools for the Home Based Business Owner

How Your Financial Plan Is A Road Map

How Your Financial Plan Is A Road Map Why You Want The New NTR Report

Why You Want The New NTR Report--Overview--

It shows:

- How much cash is in the bank;

- What your business owns;

- What your business owes;

- How much you have invested in your business; and

- How much money your business has made ... or lost ... since inception.

It reveals:

- How your business finances its operations, and

- What your business purchased with your financing.

When we crunch a few numbers in the next section, some very interesting stuff is uncovered - such as how efficiently run your business is.

--The Balance Sheet Formula--

This report gets its name because all the accounts must sum to zero

... soooooo the sheet balances! Get It? Here's how it does it.

What you own - (What you owe + Your capital contributions

+ Cumulative profits since inception) = Zero

Restated in accounting language

Assets - (Liabilities + Owner’s Equity) = Zero

or you could rearrange it like this

Assets - Liabilities = Owner’s Equity

or perhaps like this

The Accounting Equation

Assets = Liabilities + Owner’s Equity

This means that the assets you have in your small business were obtained through any or all of three different sources:

- debt - someone else’s cash;

- capital contributions - your cash; or

- reinvested profits - the business’s cash.

If we put this into a formula, it would look like this

Source of Assets = Debts + Capital Investments + Reinvested Profits

or we could say

Source of Assets = Someone else's cash + Your cash + The business's cash

I can see you thinking ... What's my point?

The idea I want you to see is that the balance sheet is relevant to you as a business owner. You can play around with the formula and rearrange it or rename the parts to something you remember and understand. It doesn't have to be in accounting language.

“Now more than ever, knowledge is

the difference between financial success and failure.”

Louis Rukeyser of The Educated Investor™ and

the long-running TV show, Wall $treet Week With Louis Rukeyser

Answers to the Quick Quiz on Critical Information. 1-D, 2-C, 3-J, 4-E, 5-F, 6-A, 7-I, 8-H, 9-G 10-B

--The Report Format--

The balance sheet is usually presented in one of two formats.

In Canada, the balance sheet format lists each group directly under the other in the order shown.

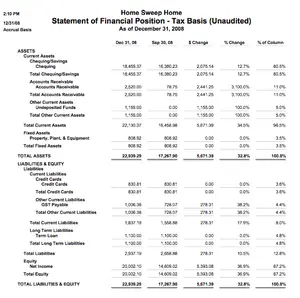

If you are a visual learner, this sample financial report of a very basic balance sheet may be helpful to you. You can get a look at what an actual balance sheet looks like ... just in case you have never seen one before.

Another format used in various parts of the world is listing Assets down the left hand side of the page and Liabilities and Owner's Capital down the right hand side.

Let's Chat About ...

International Financial Reporting Standards and ...

Accounting Standards for Private Enterprise

Just so you know ... Canada revised / updated their GAAP (Generally Accepted Accounting Principles) to IFRS (International Financial Reporting Standards) and ASPE (Accounting Standards for Private Enterprise) in January 2011. Effective January 2012, there is also an Accounting Standard for Not-For-Profit Organizations (ASNPO). I am not up on the new IFRS reporting standards, except for a few articles I've read, as they don't affect my clients.

All the major accounting firms have up-to-date examples of IFRS consolidated financial statements. Many of them can be downloaded in PDF format. The IFRS balance sheet has changed to look like this:

Consolidated Statement of Financial Position

Assets

Non-current

Current

Total Assets

Equity and Liabilities

Equity

Equity attributable to owners of the parent

Non-controlling interest

Total Equity

Liabilities

Non-current

Current

Total Liabilities

Total Equity and Liabilities

Source: Grant Thornton IFRS Example Consolidated Financial Statements

These new reporting changes apply mostly to publicly traded companies or companies requiring international financing.

KEY TAKEAWAY

Most small businesses in Canada switched to Accounting Standards for Private Enterprise (ASPE). You do not need to be concerned with the very complex IFRS reporting standards.

Accounting Standards for Private Enterprise (ASPE)

The Accounting Standards Board (AcSB) has developed a "made in Canada" financial reporting standards for private enterprises call Accounting Standards for Private Enterprise (ASPE). You can keep up to date on annual changes to ASPE on their web page Accounting Standards for Private Enterprises. It's just not very user-friendly and you have to wade through a lot of stuff. That said, one of their current 2024 projects is to explore and propose practical solutions for the most complex portion of the ASPE Handbook.

The CICA website, rebranded as CPA Canada, has a downloadable Accounting standards for private enterprises (ASPE): Summary resource guide if you are looking for information.

BDO Canada has a very user- friendly website. You'll find their ASPE Knowledge Centre helpful.

The standards were released in December, 2009 and went into effect January 1, 2011. As a result, you will find some notes throughout this site if I'm aware the new standards affect your financial reporting system. I don't keep up-to-date on this stuff like a practicing CPA would.

Update June 2024

CPA Canada's website (formerly CICA) initially had links to sample / model / illustrative IFRS Financial Statements. Their site is hard to navigate since rebranding but the last time I looked they were charging a fee to access them.

That said, I mentioned earlier, all the major accounting firms do have examples available to download. It is a good idea to make a note to check annually because new models are released each year incorporating any changes that have occurred.

The CICA had a lot of statements to choose from in each category including statements categorized by industry.

IFRS versus US GAAP

Technical Differences ... Principles vs. Rules IFRS versus US GAAP

International accounting standards (IFRS) are principle based and designed towards flexibility. US GAAP is rule based and designed towards conservatism.

An article title Overview of Transition Between GAAP and IFRS by Noelle Diehl highlights a few of the technical differences between the two standards.

- LIFO is prohibited under IFRS because "although it effectively matches the current revenues with expenses, it doesn't properly match the true flow of inventory, and costs can quickly be outdated."

- Under GAAP, extraordinary items are listed separately as they are not considered part of operating income or loss and you don't want them to distort it. Under IFRS they are line items reported together and not segregated.

- Development costs do not have to be expensed under IFRS as they do under GAAP. You have the option to capitalize (report them on your balance sheet instead of the income statement) and amortize them under certain conditions.

- On your balance sheet, PPE are valued at cost under GAAP. Under IFRS these assets are revalued at year-end to reflect material changes in market value. This also affects depreciation which has to be recalculated based on the revised market value of the assets.

This comparison was IFRS vs. U.S. GAAP. One of Canadian GAAP standards is IFRS.

Now that we've covered why balance sheets can look differently from one business to another, we'll briefly review each component of the balance sheet then move on to the ratio analysis.

Income Statement vs. Balance Sheet

When you look at the balance sheet, keep in mind that the information is for a specific date in time. Think of it just like a photograph of how your business looked at that moment in time ... a snapshot frozen in time.

The income statement is more like a video. It represents activity in your business over a particular period in time. The period varies and you have to read the heading to figure it out. It could be a month, a quarter, a year.

The results (whether you made a profit or loss for the period) of the income statement show up in the owner's equity section of the balance sheet.

This concept gets answered incorrectly most often in my accounting test. So here is a summary:

It's All About The Timing

- Income statement - activity during a specific time period

... Balance sheet - value on a particular day - Income statement - is like a video or a movie

... Balance sheet - is like a snapshot or a photograph. - Income statement - calculates net profit or loss

... Balance sheet reports the profit or loss from the income statement in the Owner's Equity section.

Bank Reconciliations

Learn about bank reconciliations and other account reconciliations by clicking here.

There are five basic categories of assets however the three main categories that probably affect your business are ...

- Current Assets

- Capital Assets (Fixed Assets or Capital Outlays)

- Other Assets

Current Assets

Current assets list things the business owns that are liquid (can be turned into ready cash within one year). This would include:

- cash in your bank account(s)

- petty cash

- any temporary investments

- your accounts receivable (money customers owe you)

- your inventory (recorded at cost not sales price), and

- any prepaid expenses such as insurance or rent.

GAAP UPDATE

Temporary Investments ... and ASPE

Have you wondered if the new Accounting Standards for Private Enterprise (ASPE) that came into effect on January 1, 2011 affected temporary investments on your balance sheet ... like GICs and stocks?

Grant Thornton (www.grantthornton.ca), in their Catalyst Winter 2010 newsletter, says yes.

GICs will continue to be measured at amortized cost, as will privately owned stock.

Amortized cost is defined as the original cost plus or minus repayments, amortization and impairments.

For GICs, accrued interest (interest earned but not paid out until the GIC matures) is added to the carrying amount of the GIC ... which is the same as existing GAAP ... so no change there.

Publicly traded stocks

will be treated differently than existing GAAP. They will now be measured at fair market value (FMV). The quoted market price is to be used as the FMV. The transitional adjustment to FMV is recorded through retained earnings, not profit or loss. However, ongoing fluctuations will be recorded through profit or loss.

The Bookkeeper's Tip

Improve Cash Flow

Prompt Invoicing of Accounts Receivable

Accounts receivable represents amounts your customers owe you. Improve your cash flow by invoicing promptly, no delays. Presenting the invoice at the completion of the sale is the best.

Then follow up with monthly statements if the account is outstanding. If you are using a bookkeeper, ask that it be part of the regular routine. I use QuickBooks software and it is very easy to go in and run statements to send out to customers.

Consider requesting a customer deposit. If you do receive customer deposits, learn how to book the entry correctly the first time in How to Record and Apply a Customer Deposit or Prepayment.

The sooner you get your cash, the less likely you are to run into cash flow problems. Remember you are not a bank and there are a lot of ways to accept credit card payments these days. Check out Square and PayPal as two easy solutions to eliminating the need for A/R in small businesses. The fees charged offset your labour costs for managing your outstanding Accounts Receivables.

The Bookkeeper's Tip

A Good Bookkeeping Practice

Inventory Count

The purpose of an inventory count is to ensure the general ledger equals the actual merchandise on hand and to account for theft, breakage, obsolescence and shrinkage.

You should perform an inventory count as close to the last day of your fiscal year-end as possible. If a portion of your inventory contains large dollar value items, you should try to do a quarterly inventory count on these items.

The bookkeeping entries to record after you have performed your inventory count are found in The Income Statement - You Want To Understand Profitability.

Inventory is recorded using one of two methods. Which one do you use?

Inventory and Delivery Charges

Record any shipping and/or delivery charges as part of your inventory cost. Do not expense it.

The cost of shipping or delivery of inventory will get expensed when the item is sold as part of the cost of goods sold.

Joanna Tompkin's book, Accounting for Big Kids which I believe is now out of print, explains that when you purchase inventory from the United States, there are Landing Costs.

The landed costs include the vendor's invoice, US exchange, duty, freight and possibly other charges. All of the landed costs get included as part of the cost of your inventory to be expensed only when an inventory item is sold.

Let's Chat About ...

Two Basic Accounting Guidelines

The Cost Principle and The Conservatism Constraint

A basic principle in GAAP accounting is to generally (there are some exceptions) record purchases at their actual cost instead of their current market value. This eliminates guesswork and bias which leads us to an accounting constraint. This is called the cost principle.

The constraint of conservatism states that accounting should be fair and reasonable. Some accounting entries require judgments, estimates, opinions and a choice of different methods of reporting. When making these decisions, try to never overstate or understate the transaction. Always lean towards the conservative choice.

The general rule is ... when you are uncertain about two choices of values ... book the entry that records the lesser asset amount and/or the lesser profit amount.

That was then, this is now ...

Please note: In Canada, the cost principle was modified with the new Accounting Standards for Private Enterprise (effective in 2011) which moved in part towards International Financial Reporting Standards (IFRS) ... which is either historical cost or current valuation (IFRS IAS 16).

Under IFRS rules, revaluation to the current value is used when the fair value can be measured reliably ... and revaluations on method, useful life and residual value are reviewed annually. See GAAP Updates for more information on the new standard for the booking of temporary investments and plant, property and equipment. The U.S adopted FRF for SME (Financial Reporting Framework for Small- and Medium-Sized Entities) as an alternative to GAAP in 2013. You can download a 2018 FRF for SME guide from the Journal of Accountancy.

KEY TAKEAWAY

For most small businesses without investors, using historical cost is the easiest method to use. Unless there is a valid reason to switch to the current valuation method, stick with historical cost reporting.

Capital assets are things you own that have a life longer than one year such as your tools, equipment, office furniture, computers and computer software. It can also include land (and improvements), buildings and vehicles.

You will also see capital assets referred to as Fixed Assets. (Read about why here.)

Formally on the balance sheet, they are usually referred to as Plant, Property, and Equipment (PPE).

As a general rule, if the capital outlay (fixed asset) is under $500, you can expense it instead of capitalizing it. (Since the repair regs came into effect in 2014 in the U.S. this amount is generally under $200 as well as units of property with economic useful lives of, or that would be used or consumed in, 12 months or less.)

More for Americans >> Blast from the past: Tax planning with the repair regs.

I like to set up my chart of accounts so that my fixed assets are grouped by CCA group classifications ... to make tax preparation easier.

If you take a close look at your chart of accounts, you will probably also see accounts in the capital asset section called amortization.

The amortization accounts are used to allocate a portion of the original cost of your capital outlay to your expenses on the income statement. We'll talk more about this account when we look at the income statement.

OTHER ASSETS

For our purposes here, and to keep it simple, other assets is going to include anything else you own that doesn't fit into current assets or capital assets.

GAAP UPDATE

Plant, Property and Equipment ... and ASPE

Have you wondered if the new Accounting Standards for Private Enterprise (ASPE) that came into effect on January 1, 2011 affected how you report capital assets?

Grant Thornton (www.grantthornton.ca), in their Catalyst Winter 2010 newsletter, says no ... but you had a one-time opportunity on transition to re-measure an asset to fair market value (FMV).

If adjusted, you used the amount as cost for depreciation purposes going forward. The newsletter points out there are positive and negatives ... so they wrote an article specifically on this subject. Look for IFRS the "fair value" decision on their website. The article states that "it is not a popular choice of other comparable countries that have already transitioned to IFRS".

If you make the election, additional disclosures were required for the first year only ... and the adjustment was recorded through retained earnings, not profit or loss.

The June/July 2010 issue of CA Magazine (www.camagazine.com) had an article titled What's Changed?. It noted a change in the recording of asset retirement obligations.

The measurement has been simplified. "ASPE requires it to be measured at the best estimate of the expenditure required to settle the current obligation at the balance sheet date."

The current obligation is to measure it at fair market value which can involve complications at times.

--Liabilities--

What the business owes -- Other people’s cash

Debts -- Source of cash for purchase of business assets

For our purposes, there are two basic categories of liabilities that affect your business. They are ...

Current (Short Term) Liabilities

Long Term Liabilities

Current Liabilities

Current liabilities list debts the business owes that are due and payable within one year. This would include:

- bank overdrafts

- credit card balances

- lines of credit

- accounts payable (money owed to others like your suppliers)

- payroll payable

- most types of taxes payable, including HST/GST Payable and income tax payable

- dividends payable, and

- customer deposits

You will also find in this section (if applicable):

- accrued liabilities, and

- the current portion of your long term debt

Accounts payable are created when you purchase goods and/or services on credit ... meaning your supplier allowed you to take the item without paying for it at the time of purchase.

As noted above, the accounts payable account is found in the current liability section of the balance sheet. To locate Accounts Payable on your Trial Balance, you need to become familiar with your Chart of Accounts, as it is your blueprint to your accounting system. If you can't find Accounts Payable in your chart of accounts, it may be called Trade Payables.

Accounts Payable is not part of the income statement. However, when you initially book your account payable (you buy supplies or services on credit), your purchase may show as an expense on your income statement. I say "may" because if you purchased a capital asset, the expenditure will not show up on your income statement.

A good practice to get into is to use your Aged Accounts Payable Report to help you manage your cash flow.

GAAP UPDATE

Callable Debt ... and ASPE

Have you wondered if the new Accounting Standards for Private Enterprise (ASPE) that came into effect on January 1, 2011 affected the way you report callable debt?

The June/July 2010 issue of CA Magazine (www.camagazine.com) has an article titled What's Changed?.

The article explains that callable debt ... and debt obligations expected to be refinanced ... is now included in Section 1510 Current Assets and Current Liabilities of the CICA Handbook.

There is now an example provided of the presentation format of callable debt under current liabilities on the balance sheet.

Long Term Liabilities

Long term liabilities are debts you owe that have a life longer than one year such as:

GAAP UPDATE

Income Tax Payable ... and ASPE

Have you wondered if the new Accounting Standards for Private Enterprise (ASPE) that came into effect on January 1, 2011 affected how you report income taxes payable on your balance sheet?

Grant Thornton (www.grantthornton.ca), in their Catalyst Winter 2010 newsletter, says yes ... now you have options that do not require unanimous consent of all the shareholders.

Many of the differential reporting options under the existing Canadian GAAP pre 2011 were integrated into the new standards as policy choices.

When accounting for income taxes, you can now choose between the taxes payable method or the future income taxes method.

The newsletter explained that it was unclear of the impact of adopting the taxes payable method on taxable income and taxes as CRA had not issued any direction yet on whether they would accept pre-tax accounting income as the starting point.

BDO (www.bdo.ca) shows an example of the taxes payable method in Appendix B of their article, Filling the GAAP: New Standards for Private Companies.

Let's Chat About ...

How to Record Your Monthly Loan Payment

When entering a loan payment to the books, always remember that only the principle portion gets booked to the loan account (on the balance sheet). The interest portion of the payment is expensed (on the income statement).

The entry looks like this:

Debit Bank Loan - principal only (on balance sheet under long term liabilities see The Bookkeeper's Tip below)

Debit Interest Expense (on the income statement)

Credit Cash in Bank (on balance sheet under current assets)

The bank will be more than happy to provide you with an amortization (depreciation) schedule … or you can run your own. It will show you the split between your principal and interest expense.

If you get a monthly statement, you could reconcile the account to the statement each month. It is a good bookkeeping practice to verify any of your balance sheet account balances to third party sources.

Each year end, you will look at your loan statement for the year (you may have to request a copy) and make any needed adjustments to the loan balance ... booking the difference to interest expense.

The Bookkeeper's Tip

A Good Bookkeeping Practice

Current Portion of Long Term Debt

Each year-end, your accountant will make an adjusting entry for the current portion of your long term debt. The adjusting entry reclassifies the amount of principle due in the coming year to a current liability account. You don't need to concern yourself with this entry or this account during the year except when you are balancing your loan to the banks records. You will need to remember to add the current liability account and the long term liability account together when balancing your loan balance. Book the principal portion of all your loan payments during the year to the long term liability account.

How to account for your business loan proceeds can be found in the article How to Record Common Bookkeeping Entries.

--Equity--

The owner’s investment in the business -- The business’ cash

Source of funds to purchase assets for the business

In this section of the balance sheet, you will find your cash investment in the business (Owner’s Equity) along with your owner's draws, and current year net income or loss.

Owner's Equity is also referred to as owner’s investment or owner’s capital. Have you noticed I've been switching the terminology? When you see any one of these terms on a balance sheet, you know the business in not incorporated. It will be a sole proprietorship or a partnership.

If the business is incorporated, this section of the balance sheet would contain a line for share or stock capital and for retained earnings.

Professionally prepared financial statements normally have just one line showing called Owner’s Capital. All the categories discussed above still exist in separate subaccounts in their general ledger. However, for financial reporting purposes, they have consolidated the accounts into one line.

It is also worth noting that the net income (loss) amount reported should match the net income (loss) on the income statement.

I'll chat a bit more on this section of the balance sheet during the Income Statement discussion coming up shortly.

What I'd like to mention right now is that equity means how much you have invested in your business. But don't confuse it with the worth of your business. ... Why?

Remember the cost principle says to record assets at the original cost (in most cases). This means that you cannot look at the equity section of your balance sheet and think that is how much your business is worth.

To do a very rough determination of the current worth of your business, you would have to adjust your assets to their market value. That would give you a better idea of your business' worth.

However, to determine the real value of your business, you will have to factor in growth potential, quality of your assets, your market position ... just as an example.

The point I really wanted to make is that the equity section of your balance sheet does not represent the worth of your business.

Wrap-Up

This concludes the first discussion on the balance sheet. Before we move on to ratio analysis, we’ll look at the income statement.

I know, I know. I said earlier we'd do ratio analysis next but ... I've changed my mind! You get to do stuff like that when it's your own website.

However, before we do that, I thought I’d take a sec to see if you are ...

… confused about all the debits and credits being thrown around?

You'll like my "cheat" table. It should unscramble the confusion for you.

Before you go, why don't you test your balance sheet knowledge.

It's been great chatting with you.

Your Tutor

Return to Previous Page - Reading Financial Statements