- Home

- What's New

The Bookkeeper's Blog ...

Blogs on Good Bookkeeping Practices

Blogs on Good Bookkeeping Practices

Hey You ... Welcome to The Bookkeeper's Blog! Join me as I blog on good bookkeeping practices for work from home bookkeepers and business owners who do their own books.

Here is where you have the opportunity to easily keep up-to-date on new or updated blog pages being posted to the Bookkeeping Essentials web site.

It is my sincere hope that you will learn good bookkeeping practices that help you manage your business finances easily and more efficiently.

To your success! … and, of course, thank you to the readers and viewers of my blog.

Your tutor

This picture is from my day trip to Stuart Lake in 2009. Doesn't looking at this picture just make you want to exhale ... it's okay you're allowed.

Photo courtesy of B. Gale

that we see too late the one that is open.

-- Alexander Graham Bell, Inventor --

Dec 17, 2025

CRA and IRS Interest Rates | Small Business

CRA and IRS interest rates for corporate loans to shareholders, installment sales, under and over payment of taxes

Continue reading "CRA and IRS Interest Rates | Small Business"

Nov 16, 2025

6 Steps to Get Out of Business Debt Without Sacrificing Profit

Business debt isn't a spending problem. It's a habit problem. Follow this 6-step behavioral system to eliminate debt without sacrificing profitability

Continue reading "6 Steps to Get Out of Business Debt Without Sacrificing Profit"

Nov 14, 2025

Form 1099-NEC vc Form 1099-K vs Form 1099-MISC

Explains the IRS Form 1099-NEC vs 1099-MISC vs 1099-K. Understanding the differences, how to file the forms and what the deadlines are.

Continue reading "Form 1099-NEC vc Form 1099-K vs Form 1099-MISC"

Nov 10, 2025

QuickBooks Online New User Interface | 2025 Canadian Rollout

Learn about the QuickBooks Online new user interface rolling out November 10th. Understand what's changing, how to prepare, and what it means for your books.

Continue reading "QuickBooks Online New User Interface | 2025 Canadian Rollout"

Nov 02, 2025

2026 Self Employment Taxes | SECA & CPP

Learn about self employment taxes for business owners working from home. US self employment tax (SECA) & required CPP contributions for self employed in Canada.

Nov 02, 2025

2026 Payroll Tax Deductions | U.S. & Canada

Payroll tax deductions are mandatory for small business owners in U.S. & Canada. What are the employer's and employee's SST rate? What are the CPP and EI rates?

Continue reading "2026 Payroll Tax Deductions | U.S. & Canada"

Nov 02, 2025

CRA News for Home Based Business Owners

CRA news for home based business owners doing their own bookkeeping. Keep abreast of relevant changes and announcements.

Oct 03, 2025

Profit First Method | Your Cash On Autopilot

The Profit First method is a system designed by Mike Michalowicz to help eradicate entrepreneurial poverty. Here's an overview and how to set it up in Canada.

Continue reading "Profit First Method | Your Cash On Autopilot"

Aug 01, 2025

How To Use QuickBooks Online | A Beginner's Guide

Learn how to use QuickBooks Online with step-by-step instructions, screenshots, and tips to help small business owners understand and effectively utilize QBO.

Continue reading "How To Use QuickBooks Online | A Beginner's Guide"

Jan 30, 2025

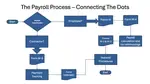

Payroll for a Small Business Owner | Manual For Less Than 10 Employees

Small business payroll (under 10 employees) made easy. Essential tasks, W-2/1099 compliance, and practical tips. Learn and stay compliant!

Continue reading "Payroll for a Small Business Owner | Manual For Less Than 10 Employees"

Jan 30, 2025

Payroll Tax Reporting and Compliance | Manual For Under 10 Employees

Simplify payroll compliance for your small business (under 10 employees). Avoid penalties. Part 2 of this manual covers W-2s, 1099s, year-end procedures, and...

Continue reading "Payroll Tax Reporting and Compliance | Manual For Under 10 Employees"

Jan 30, 2025

Setting Up and Managing Payroll | Manual For Fewer Than 10 Employees

Learn payroll setup and management for US small businesses with under 10 employees. Covers compliance, worker classification, documentation, and best practices.

Continue reading "Setting Up and Managing Payroll | Manual For Fewer Than 10 Employees"

Jan 05, 2025

U.S. Employment Tax Forms | Yearend Guide For Small Business Owners

U.S. employment tax forms W2, W3, W4, I-9 and year-end payroll tasks. A small business owner's guide to closing out the year right.

Continue reading "U.S. Employment Tax Forms | Yearend Guide For Small Business Owners"

Jan 03, 2025

Reminder to log your odometer reading

At the beginning of each year (January 1), you need to record your odometer reading. This figure becomes the last entry for your prior year log. It's a good idea to diarize this date so you don't forget.

Jan 02, 2025

How To Close Your Books in QBO

Closing the books is an important practice for any small business owner. Learning how to use QuickBooks Online to close your books is much simpler than some other accounting programs.

Here's the why, when, and how to close the books in QuickBooks Online (QBO).

Jan 01, 2025

5 Tips for Business Owners Looking to Organize Their Books

What will your New Year's resolution be? If you're like most small business owners, your New Year's resolution will likely have something to do with

Continue reading "5 Tips for Business Owners Looking to Organize Their Books"

Jan 01, 2025

Latest IRS News For U.S. Work From Home Business Owners

Latest IRS news about on 2025 COLA & FICA and information of interest to U.S. business owners who do their own bookkeeping or work from home bookkeepers.

Continue reading "Latest IRS News For U.S. Work From Home Business Owners"

Dec 19, 2024

2025 IRS Standard Mileage Rates Released

The 2025 standard mileage rates were increased by 3 cents to 70 cents per mile driven for business use.

The Tax Cuts and Jobs Act (TCJA) restrictions are still in place for 2025.

Dec 16, 2024

IRS Business Tax Account

The Internal Revenue Service continues to open its Business Tax Account (BTA) to a growing number of business taxpayers while expanding the features available.

New features include tax return, tax account and entity transcripts for the current tax year and some previous tax years.

Sole proprietors have full access to features and business information and can add employees to the account.

Dec 03, 2024

Do You Need a Compilation Engagement Report?

Whether you're a bookkeeper or small business owner in Canada, how do the CPA standards for compilation engagement reports affect you? NTR is now CER.

Continue reading "Do You Need a Compilation Engagement Report?"

Dec 02, 2024

Getting Ready For Yearend

One way to make sure your year-end goes smoothly is to keep an eye on your balance sheet accounts all year long.

You can reduce your yearend preparation costs if you submit a clean set of books. Learn what you need to be doing NOW to have a smooth yearend.

Nov 27, 2024

Comparing Regular vs. Simplified U.S. Home Office Deduction

There are two methods to calculate the home office deduction: Regular Method and Simplified Option. Let's take a look at who qualifies and how each method works.

Continue reading "Comparing Regular vs. Simplified U.S. Home Office Deduction"

Nov 27, 2024

CRA Releases Guidance on Proposed 2024 Capital Gains Inclusion Rate Changes

The CRA has issued guidance on the proposed 2024 capital gains inclusion rate change effective June 25, 2024.

Continue reading "CRA Releases Guidance on Proposed 2024 Capital Gains Inclusion Rate Changes"

Nov 26, 2024

U.S. Self-Employment Income | Self-Employment Tax

Self-employment income is subject to U.S. self-employment tax. You'll find information on estimated taxes, standard mileage rates and U.S. rules for business use of your car.

Continue reading "U.S. Self-Employment Income | Self-Employment Tax"

Nov 25, 2024

Is QuickBooks Desktop Being Discontinued?

Intuit decided that after July 31, 2024, they will no longer sell NEW subscriptions to certain desktop products in the U.S.. Starting April 15, 2025, this will also apply to NEW Canadian desktop subscribers.

Learn which products are affected.

Continue reading "Is QuickBooks Desktop Being Discontinued?"

Nov 18, 2024

Quarterly Interest Rates Announced

IRS have announced that interest rates will decrease for the first quarter of 2025.

Nov 18, 2024

Canadian Bookkeeping Compliance Resource

A Canadian bookkeeping compliance resource. Bookkeeping-Essentials.ca extends an invitation to small business owners in Canada to explore this resource.

Oct 17, 2024

Learning QuickBooks® | Avoiding Common Data Entry Mistakes

For the work from home business owner who does their own bookkeeping, learning QuickBooks® tips to avoid beginner mistakes makes your life a whole lot easier!

Continue reading "Learning QuickBooks® | Avoiding Common Data Entry Mistakes"

Oct 17, 2024

Canadian QBO Conversion Issues | Problems That Aren't Really Problems

Why your balance sheet doesn't match QuickBooks Desktop after a QuickBooks Online-QBO conversion.

Continue reading "Canadian QBO Conversion Issues | Problems That Aren't Really Problems"

Oct 14, 2024

Learning How To Use QuickBooks Online | Internal Control Reports

Learning how to use QuickBooks Online to create & customize reports that assist you in risk management and making informed strategic business decisions on where

Continue reading "Learning How To Use QuickBooks Online | Internal Control Reports "

Jul 29, 2024

Organized Record Keeping Systems For Home Based Offices

A series of chats about record keeping systems to get and stay organized so you can get rid of those drawers of stashed receipts? Simple choices and guidelines to eliminate stress and panic.

Continue reading "Organized Record Keeping Systems For Home Based Offices"

Jul 18, 2024

Current Payroll Tax Rates | Canadian Bookkeeping

Canadian payroll tax rates to help you meet your payroll compliance obligations. CPP rates are released annually in November; EI rates every September.

Continue reading "Current Payroll Tax Rates | Canadian Bookkeeping"

Jun 22, 2024

Do You Need To Download Your Paperless Statements?

Open banking could help download your paperless statements if it ever gets here! Til then, you need procedures to ensure it happens if you want audit ready ...

Continue reading "Do You Need To Download Your Paperless Statements?"

Jun 19, 2024

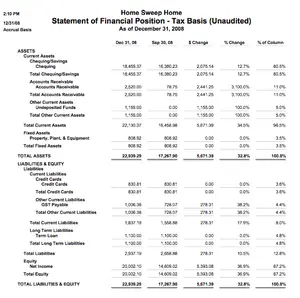

Sample Financial Reports Using QuickBooks® | Bookkeeping Reports

Sample financial reports because sometimes a picture is better than words ... for those who learn by seeing. These bookkeeping reports are a reference point for producing your own financial statements.

Continue reading "Sample Financial Reports Using QuickBooks® | Bookkeeping Reports"

Jun 18, 2024

Common Audit Issues | Focus On Bookkeeping

Focus on Bookkeeping takes a look at the IRS audit techniques for cash businesses, Canadian sales tax common audit issues and examines my research on U.S. and Canadian payroll tax audit issues.

Continue reading "Common Audit Issues | Focus On Bookkeeping"

Jun 18, 2024

Getting Ready For Yearend | Focus On Bookkeeping

A brief look at what you can do NOW and throughout the year to ensure a smooth yearend by having a clean set of books.

Continue reading "Getting Ready For Yearend | Focus On Bookkeeping"

Jun 17, 2024

Definition of Assets and Liabilities | Focus On Bookkeeping

A look at IASB's definition of assets and liabilities from Conceptual Framework for Financial Reporting Review. Revenue recognition criteria is also touched upon.

Continue reading "Definition of Assets and Liabilities | Focus On Bookkeeping"

Jun 17, 2024

Accounts Receivable Collection Procedures

Accounts receivable collection procedures are discussed as well as how to stop providing interest free loans to your clients and customers.

Continue reading "Accounts Receivable Collection Procedures"