- Home

- US Small Business Tax Compliance

- Employee Payroll Taxes

- Payroll for a Small Business Owner

Payroll Essentials for Small Businesses with 10 or Fewer Employees

Published August 2011 | Revised January 30, 2025

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

NEXT SECTION >> Part 1 - Payroll Setup and Management

JUMP TO >> Table of Contents

Payroll for a Small Business Owner in The U.S.

Welcome to Your Small Business Payroll Manual!

If you have less than 10 employees, running payroll for your small business in the Unites States doesn't have to be overwhelming. This manual breaks down the process into clear, manageable steps that will help you handle payroll with confidence and accuracy.

Let's face it. Handling year-end payroll can feel overwhelming, especially when you're juggling all the other demands of running your small business. While everyone else is enjoying evenings, weekends or holidays with their families and friends, you are wondering about W-2s, 1099s, and tax deadlines.

But here's the thing, payroll doesn't have to be a source of stress. With the right tools and knowledge, it can become just another part of your routine—one that runs smoothly without constant worry. I created this manual for a small business owner with fewer than 10 employees. It will cover (almost) everything you need to know about:

- Managing payroll throughout the year - From hiring your first employee to processing monthly payroll.

- Understanding SSA and IRS worker and employment tax forms - there are a lot of them!

- Completing your year-end payroll obligations - I've included a task list and a checklist.

- Avoiding common small business payroll mistakes - there are tips and red flag alerts too!

I have broken everything down into what I think are simple, manageable steps. So grab your favorite beverage (water with lemon is mine right now), find a quiet spot (maybe turn off your phone for a few minutes too), and let's tackle this together. By the time you finish this manual, you'll have a plan for handling your small business payroll with confidence, not only at year-end but all through the year.

Purpose of This Manual

This manual was prepared for small business owners like you who manage payroll for less than 10 employees. My aim was to provide practical answers to four questions:

- What do you need to do?

- When do you need to do it?

- How do you do it correctly?

- Where do you find help if you need it?

In doing so, I tried to emphasize the unique challenges and subtleties faced by small businesses like yours.

How to Use This Manual

The manual is organized into four main sections:

- Setting Up and Managing Payroll - Start here if you're new to payroll. This section covers everything from worker classification to selecting the right payroll software.

- Tax Reporting and Compliance - Essential information for when you're dealing with annual tax filing obligations.

- Maintaining and Improving Operations - Best practices and problem-solving to help your payroll process evolve with your business (sorry, still working on this one).

- Reference Guide - It supports the manual and your day-to-day needs. You'll find detailed information about worker and employment tax forms. There are links in the manual to guide to right spot in the reference guide.

Quick Start Guide

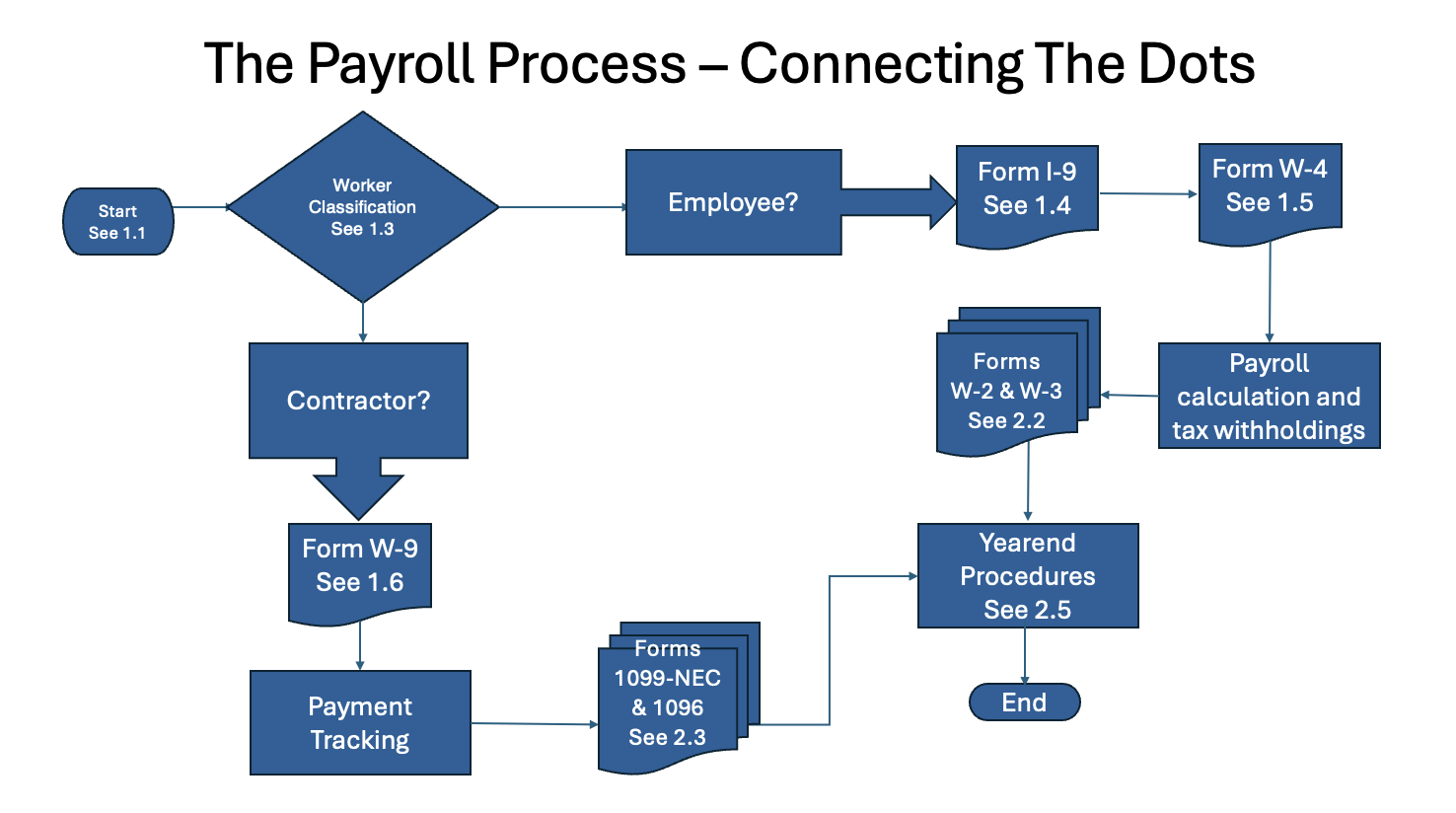

For those times when you need information fast, use this Quick Start Guide. You can see it has a Payroll Process Overview Flowchart. This handy visual aid shows you the connections between all different forms and procedures, from onboarding new hires to handing out tax slips and performing year-end payroll procedures.

A flowchart showing an overview of the payroll process.

A flowchart showing an overview of the payroll process.See how to connect the dots between the different forms and procedures.

You'll also find specific flowcharts for the I-9, W-2, W-3 processes. A flowchart helps you see the forest for the trees.

Need to handle something specific right now? Here are some common tasks and where to find them:

- Setting up a new employee → Part 1: Form I-9 and W-4 sections

- Classifying workers correctly → Part 1: Worker Classification section

- Processing payroll → Part 1: Payroll Processing section

- Filing year-end tax forms → Part 2: Year-End Procedures section

- Completing tax forms → Reference Guide

Important Contact Information

- IRS Employer Assistance: 800-829-4933

- Social Security Administration: 800-772-1213

- Your State's Department of Revenue: [Insert your state's number]

- Your State's Department of Labor: [Insert your state's number]

Table of Contents

Part 1 - Setting Up and Managing Payroll

- What You Must Have Now (For Businesses with Fewer Than 10 Employees): State and local requirements, worker's compensation insurance, FUTA, SUI.

- Introduction to Payroll Compliance: Overview of federal, state, and local regulations.

- Worker Classification Employee vs. Independent Contractor: Discussion and best practices on proper classification to avoid misclassification, including IRS tests and potential consequences of misclassification and a checklist.

- Form I-9 Employment Eligibility Verification: Detailed completion instructions, compliance requirements, document retention, E-Verify, and anti-discrimination practices.

- Form W-4 Employee's Withholding Certificate Processing and Compliance: Employer responsibilities for processing W-4s, handling employee exemptions, and addressing changes in withholding. Focus on compliance.

- Form W-9 Request for Taxpayer Identification Number and Certification: Hiring independent contractors requires different forms and is a different process than hiring employees.

- Payroll Software and Technology: Suggestions on selecting and implementing payroll software, timekeeping systems, and other relevant technologies.

- Payroll Processing and Recordkeeping: Best practices for data entry, calculations, reporting, and maintaining accurate records (physical and electronic), data security, and privacy. Includes wage and hour laws.

- Payroll Accounting and Reconciliation: Integrating payroll with accounting systems, reconciling payroll data, generating reports, and resolving discrepancies.

- Compliance changes at the 10-employee threshold: Benefits administration, OSHA and increased complexity.

- Wrap-up

Part 2 - Tax Reporting and Compliance

- Introduction to Payroll Reporting: Overview of yearend procedures.

- Forms W-2 Wage and Tax Statement and W-3 Transmittal: Step-by-step preparation and filing instructions (including electronic filing), troubleshooting common errors, and reconciliation procedures. Deadlines and penalties.

- Forms 1099-NEC Nonemployee Compensation and 1096 Transmittal: Detailed instructions for reporting contractor payments, backup withholding, and filing requirements. Deadlines and penalties.

- Federal, State, and Local Payroll Taxes: Overview of federal requirements, plus a summary of state and local variations in tax rates, filing deadlines, and forms. Depositing taxes.

- Year-End Payroll Procedures: Comprehensive instructions for completing year-end tasks, including W-2 and 1099 filing, reconciling payroll data, and preparing for the new year.

- Final Thoughts

Part 3 - Maintaining and Improving Payroll Operations

(coming soon)

- Internal Controls and Fraud Prevention: Best practices for establishing internal controls to preventing payroll fraud and ensure accurate payroll processing.

- Troubleshooting Common Payroll Issues: Solutions to common problems and errors, such as incorrect withholding, wage garnishments, and correcting errors on tax forms.

- Staying Updated on Payroll Regulations: Resources for ongoing education and updates, including IRS publications, professional organizations, and payroll news sources.

- Glossary of Payroll Terms: A comprehensive glossary of technical payroll terms relevant to employers and payroll professionals.

Reference Guide - Employment Tax Forms

- SSA / IRS Tax Information Slips and Returns - Definition

- The Starting Point - Forms I-9, W-4, and W-9

- Tax Reporting and Compliance - Forms W-2, W-3, 1099-NEC, 1096

- Small Business Year-End Payroll Checklist

Note: Tax rates and regulations change frequently. Always verify current rates and requirements with the appropriate government agency.

Remember: The Reference Guide section contains detailed instructions for completing the required forms, while the main manual sections explain the broader payroll process and requirements.

Need help right now? Start with Part 1 if you're new to payroll, or go directly to the Reference Guide if you need help completing a specific form.

The Bottom Line

At the bottom of the manual, you'll find "Featured Items" that include the five parts of this manual and three insightful supporting articles. These resources aim to make things easier for you, providing targeted help whenever you need it.

Remember, tackling payroll may seem daunting at first, but it will become a manageable part of your business operations with patience and persistence. Let's get started and turn payroll into one of the smoother aspects of your day-to-day business activities!

Payroll for a Small Business Owner (A manual for less than 10 employees)