- Home

- US Small Business Tax Compliance

- Employee Payroll Taxes

- Payroll Tax Deposits

One of the administrative tasks a business owner must attend to if they have employees are federal and state payroll tax obligations including payroll tax deposits.

One of the administrative tasks a business owner must attend to if they have employees are federal and state payroll tax obligations including payroll tax deposits.Payroll Tax Deposits

7 Steps To Meet Your Obligations

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published November 2012 | Updated January 6, 2025

WHAT'S IN THIS ARTICLE

Tip Form 4070 - Tip | Notice 4520 | Forms 940, 941, 944, 941X | FUTA Credit Reduction Rates | FUTA Credit Reduction Rates

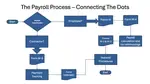

One of the administrative tasks a work from home business owner must attend to if they have employees ... or are self-employed are federal and state payroll tax obligations. I'll walk you through seven steps needed to meet your requirements.

I also hope you leave with a firm understanding of the difference between the deposit requirements and reporting requirements.

Supporting Articles for Federal Payroll Taxes

Small business owners are required to meet the payroll tax deposits obligations I have laid out below. In this chat, I'll walk you through each of the 7 obligations.

|

|

Good To Know

Over and above your federal tax obligations, each state also has their own requirements. Determine your state and local taxes obligations on the U.S. Small Business Administration website.

The following acronyms are referred to in this article. I know it sounds like a foreign language but this should help you sort it out:

FICA = Federal Insurance Contributions Act which established Social Security tax and Medicare tax.

SICA = Self-Employment Insurance Contributions which is both portions (employer and employee) of FICA

FITW = Federal Income Tax Withholding where the amount withheld is determined by employee's current W-4 Form - Withholding Certificate on file with you.

FUTA = Federal Unemployment Tax Act administers the federal government's unemployment program.

SUTA = State Unemployment Tax Acts administers the federal government's unemployment programs.

EPTS = Electronic Federal Tax Payment System; see Publication 966 The Secure Way to Pay Your Federal Taxes; Business users can schedule payments up to 120 days in advance of the desired payment date; The Treasury no longer maintains the Federal Tax Deposit Coupon (form 8109) system. It was discontinued on December 31, 2010 but it seems like just yesterday; (Reference: IR-2010-02)

Tax Deposits vs. Tax Reporting Overview

Tax deposit (you make a payment to IRS) deadline dates are:

- FICA & FITW - Semi Weekly (Wednesdays & Fridays), Monthly (L.T. $50,000) or Annually (L.T. $2,500 / quarter)

- FUTA - January 31, April 30, July 31, October 31

Tax reporting (you file your employer tax returns) deadline dates are:

- Quarterly for Form 941

- Annually for Forms 940 & 944

Keep reading this chat for more details.

Step 1 & 2: Mandatory Payroll Taxes

Steps one and two on mandatory employee withholdings and employer contributions are covered in my chat on Employee Payroll Taxes. Click here for your payroll tax deposit rates ... as well as prior year payroll tax deposit rates.

The self-employed don't get away scot free ... sorry! You get to pay both the employee and employer portions of FICA ... and you must ... as in have to ... submit quarterly income tax payments based on estimates. See my chat on Self Employment Income for more information.

Look for the payroll bookkeeping entries relating to payroll deductions and payroll tax deposits ... if you are unsure how it works or what your bookkeeping software program is recording.

Step 3. Determine Your Remitter Type

Once you've determined your remitter type, click here for your current month payroll tax deposit remitting dates ... your mandatory obligations.

Payroll Tax Deposits

FICA and FITW

Sources: IRS Publication i941 Instructions for Form 941 - Employer’s QUARTERLY Federal Tax Return, and IRS Publication 15 Circular E Employer's Tax Guide

Click here for an overview of the deposit rules for employment taxes.

IRS determines your remitter type by the payroll liability lookback amount. New businesses start out using the Monthly Deposit rules.

| Lookback Period Tax Amounts | Assigned Reporting Period | Form 941 Filing Deadline | Form 8109 Payment Deadline |

|---|---|---|---|

| L.T. $2,500 per quarter (see note 1) | Quarterly | One month after quarter ends | Same as filing deadline January 31, April 30, July 31, November 30 |

| L.T. $50,000 per year (see note 2) | Monthly | One month after quarter ends | 15th following each month |

| G.T. $50,000 per year in prior 2 years | Semi-Weekly | One month after quarter ends | Wednesdays (Thursdays if holiday), Fridays |

FICA and FITW Footnotes

Note 1 You are not required

to make monthly or semiweekly deposits if you have an accumulating tax

liability of less than $2,500 during the current or preceding quarter

for Form 941 (during a calendar year for Form 944 or 945), and

- your taxes are paid in full with a timely filed return, and

- you did not incur a $100,000 next-day deposit obligation during the current quarter.

Note 2 ... and more than $2,500 for the current quarter and the preceding quarter lookback period and you did not incur a $100,000 next-day deposit obligation during the current quarter.

New Businesses, New Employers

New employers' tax liability are set at zero by the IRS. This means if you are a new employer, you will be a monthly depositor for the first year of business.

$100,000 Next Day Deposit Rule

You

must deposit the tax by the next banking day if you have an

accumulating tax liability of $100,000 or more on any day during a

deposit period ... regardless of whether you are a monthly or semiweekly

depositor.

The Lookback Period

- The 2025 lookback period for Form 941 is July 1, 2023 to June 30, 2024.

- The 2024 lookback period for Form 941 is July 1, 2022 to June 30, 2023.

- The 2023 lookback period for Form 941 is July 1, 2021 to June 30, 2022.

- The 2022 lookback period for Form 941 is July 1, 2020 to June 30, 2021.

- The 2021 lookback period for Form 941 is July 1, 2019 to June 30, 2020.

- The 2020 lookback period for Form 941 is July 1, 2018 to June 30, 2019.

Adjustments and The Lookback Period

The lookback period is based on the tax liability as originally reported.

If you subsequently correct errors on or make adjustments to the original return by filing Form 941-X, 944-X, or 945-X, the corrections are NOT taken into consideration for purposes of the lookback period computation.

Annual Filers' Lookback Period

The lookback period is the calendar year preceding the previous year for annual return filers (Form 944 or 945) .

- The lookback period for 2025 tax deposits is the 2023 tax year.

- The lookback period for 2024 tax deposits is the 2022 tax year.

- The lookback period for 2023 tax deposits is the 2021 tax year.

- The lookback period for 2022 tax deposits is the 2020 tax year.

- The lookback period for 2021 tax deposits is the 2019 tax year.

- The lookback period for 2020 tax deposits is the 2018 tax year.

Step 4. Determine Your Credit Reduction Rate

Click here for current FUTA Rates.

Payroll Tax Deposits - FUTA and SUTA

Experience Rating and Credit Reduction

Source: IRS Publication i940 Instructions for Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return

The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Acts (SUTA) are used to administer government unemployment programs. Unlike FICA where the employer supplements the employee contribution, the employer bears 100% of the cost of FUTA and SUTA* program contributions.

*Three states ... Alaska, New Jersey, and Pennsylvania ... assess SUTA on employees as well. In all other states, the employer bears the full burden of unemployment taxes.

Unemployment taxes are calculated and deposited (paid) quarterly.

FUTA is reported and filed annually on form 940 or 940-EZ on or before January 31. The taxable wage base is $7,000 of each employee's annual wages per quarter. Therefore when FUTA is 6%, the maximum an employer pays is $420 per employee per year.

SUTA rates are based on experience ratings. The more frequently your business lays off staff, the higher your SUTA rate. New businesses are assigned an initial industry based rate. Rates are adjusted annually.

FUTA Credit Reduction States and Rates

Updated January 6, 2025

Employers can receive a 5.4% credit (in most states) for paying state unemployment insurance taxes on time and this lowers the effective FUTA rate to just 0.6% if you qualify.

Since 2011, you must include liabilities owed for credit reduction with your fourth quarter deposit. Use IRS Specific Instructions of Schedule A (Form 940) to calculate the tax. Schedule A includes a column for the reduction rate for each state.

You can find a list of FUTA credit reductions on the DOL site. It has gone from 24 states in 2011 to 4 states in 2024 - California, Connecticut, New York, and the Virgin Islands currently have lower FUTA credits due to outstanding federal loans, raising their effective rates to 0.9% (Virgin Islands 4.2%) vs the standard 0.6%. The files are in Excel format and must downloaded.

Background Information

Toolkit writer Robert Steere explains in Unemployment Taxes Will Rise in 2010 "you are unfortunate to live in a state that borrowed from FUA (Federal Unemployment Account) but has not paid back FUA "in a timely fashion".

This means employers in these states will end up paying increased FUTA as the federal tax credit will be reduced by 0.3% for each year they are behind.

Michigan began losing their federal tax credit in 2009 so the minimum FUTA was 1.1% not 0.8%. Their net FUTA jumped to 1.4% in 2010, 1.7% for the first half of 2010, and 1.5% for the second half of 2010.

Look for the four states affected in 2024 on Schedule A of Form 940 which was released sometime in early December, 2024.

Step 5. Remit Payroll Taxes

Payroll Tax Deposit - FICA & FITW

Remitting Dates

Payroll Tax Deposit Source: IRS Publication 15 Circular E - Employer's Tax Guide and IRS; Publication i941 Instructions for Form 941 - Employer’s QUARTERLY Federal Tax Return

Attention EPTPS users, you must schedule your payment by 8 p.m. ET at least one calendar day before the tax due date.

| Deposit Deadline | Tax Type | Tax Period | Form to be Filed |

|---|---|---|---|

| monthly on 10th | Report Tips to Employer | prior month | Monthly Form 4070* |

| monthly on 15th | Payroll Monthly (L.T. $50,000) |

prior month | EFTPS |

Payroll Tax Deposit Deadline Footnotes

EFPTS payments must be scheduled by 8 p.m. ET at least one calendar BEFORE the tax due date.

Semi-weekly deposits are required for over $50,000. They are due on:

- Wednesdays after the payday for Wednesday through Friday paydays; and

- Fridays following for Saturday through Tuesday paydays.

See the IRS Tax Calendar as a handy reference.

In the week there is a federal (not state) public holiday, your Wednesday deposit date is delayed until the next business day.

Payroll Tax Deposit - FUTA

Payroll Tax Deposit Source: IRS Publication 15 Circular E - Employer's Tax Guide

| Deposit Deadline* | Payment | Return To Be Filed** | Tax Period | |

|---|---|---|---|---|

| January 31 Feb. 11 if you timely deposited |

EFTPS FUTA |

ANNUAL Form 940 | 4th quarter prior year | |

| Apr 30 | EFTPS FUTA |

Form 940 | 1st quarter current year | |

| July 31 | EFTPS FUTA |

Form 940 | 2nd quarter current year | |

| October 31 | EFTPS FUTA |

Form 940 | 3rd quarter current year |

FUTA Footnotes

Note 1* - If it exceeds $500 due / owing in any quarter. If during any quarter the FUTA tax is $500 or less, you may carry it over and you do not have to deposit the tax.

Note 2** - Keeping in mind note 1, you must file at least annually. Find your annual reporting deadline here.

6. Submit Employer Federal Tax Returns

Payroll Tax Returns - FICA & FITW

Reporting/Filing Dates

- Form 4070 - Employee's Monthly Report of Tips to Employer

- Form 941* - Employer's Quarterly Federal Tax Return

- Form 944* - Employer's Annual Federal Tax Return

*You file either Form 941 quarterly OR Form 944 as notified by the IRS, not both.

| Filing Deadline | Filing Deadline If All Deposits Made On Time |

Return To Be Filed | Tax Period | |

|---|---|---|---|---|

| 10th of each month | Report Tips to Employer | Monthly Form 4070* | Previous Month | |

| January 31 | February 10 | Quarterly Form 941 | 4th quarter prior year | |

| January 31 | February 10 | Annual Form 944 | Jan-Dec prior year | |

| May 1 | May 10 | Quarterly Form 941 | 1st quarter current year | |

| July 31 | August 10 | Quarterly Form 941 | 2nd quarter current year | |

| October 31 | November 10 | Quarterly Form 941 | 3rd quarter current year |

Payroll Tax Deposit Deadline Footnotes

Note * - Employees who earn $20 or more in tips during a month must report them to their employer. Employees who do NOT report their tips to their employers will report them on Form 4137. Since 2011, this results in the employer receiving a Notice 4520 from the IRS (see below) requesting payment of their share of FICA taxes on unreported tips.

Good To Know

Collecting Employer Taxes On Tips

Rev. Rul. 2012-18 , IRB 2012-26 released on June 25, 2012 provided clarification and updated the guidelines on how to handle tips for tax purposes, which can impact employer tax obligations.

The implementation of these guidelines was extended to 2014 through IRS Announcement 2012-50. For plain English interpretation of the announcement, see the JOA article "Rules distinguishing tips from service charges delayed until 2014" published on December 13, 2012.

Currently, these guidelines are still in effect. The main distinction is:

- Tips are amounts freely given by a customer, typically for service, and aren't subject to mandatory distribution. They are reported in income by employees, and employers are responsible for withholding taxes from these reported tips.

- Service Charges are added to the bill by the service provider as a mandatory fee. These are treated as wages by the IRS, and taxes must be withheld accordingly by the employer.

It's important to categorize these amounts correctly to comply with IRS tax reporting and withholding requirements.

Back on September 29, 2010 the IRS offered a live webinar on Collecting Employer Taxes On Tips.

The purpose of the webinar was to assist employer's with learning about "collecting the employer's share of employment taxes on tips that employees report on Form 4137 Social Security and Medicare Tax On Unreported Tip Income". You used to be able to view an archived copy the event at: http://www.irsvideos.gov/CollectingEmployerTaxesTips/ but irsvideos is no longer operational.

That said, the October 1, 2010 edition of the CPA Daily News reported on the webinar. A quick overview is presented here.

Employers are not liable for its share of the FICA taxes on unreported tips until it receives a “Section 3121(q) Notice and Demand” from the IRS.

This notice instructs the employer to include the FICA taxes shown on the notice their next Form 941 - Employer's Quarterly Federal Tax Return. No interest charges or deposit penalties apply to the employer if the taxes are properly reported and any tax due remitted as instructed ... or if a required deposit is made as instructed on the notice.

FICA taxes on unreported tips notices are expected to begin in the next six months for current tax periods. The CPA Daily News reported that "Employers will receive a Form 4520P “pre-notice” prior to receiving a notice (Form 4520) that requires them to pay the unreported FICA tax. The pre-notice will be issued well in advance of the Form 4520 notice to give employers time to review their records and contact the IRS if they find any discrepancies with IRS records ... "

The IRS has a web page specifically devoted to tips. Tax Topic 761 - Tips - Withholding and Reporting is found on the IRS website under Tax Topics> Topic 761.

7. Submit Annual Unemployment Return

Payroll Tax Return - FUTA

Reporting/Filing Dates

Form 940 - Employer's Annual Federal Unemployment Tax Return

Make sure you are using the form for the right year as the credit reduction information is updated annually by state.

Please note that unemployment taxes are calculated and paid (deposited) quarterly. Find your remitting deadlines here.

| Filing Deadline | Week Day | Filing Deadline If All Deposits Made On Time |

Return To Be Filed | Tax Period |

|---|---|---|---|---|

| January 31, 2019 | Monday | February 10, 2019 | Annual Form 940 | 2018 |

There are seven steps to meeting your federal and state payroll tax deposits requirements. Make sure you follow each one to keep your business running smoothly.

New to Bookkeeping Essentials?

My sincere gratitude to all my readers ... without you I'd have no website. Blessings to you all. My suggestion to you ... enjoy a tall cool glass of lemon water while you click and poke and peek and snoop this site ... perhaps start with the blog which lists the most recent updated articles.