- Home

- Basic Bookkeeping Practices

Small Business Accounting

Learn Basic Bookkeeping Practices

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published 2010 | Edited May 29, 2024

WHAT'S IN THIS ARTICLE

Accounting Process | Bookkeeping Process | Good Bookkeeping Practices | Creating Audit Trails | Recording Bookkeeping Transactions | Procedures and Checklists | Performing Reconciliations and Month-End Procedures

Staying hydrated staves off fatigue and concentration issues.

Staying hydrated staves off fatigue and concentration issues.Small business accounting hasn’t changed much over the years. It is an age old system designed to keep financial records in an organized way. However, the accounting tools have changed substantially over the years.

Small business or large corporation, by law, if you operate a business, you are required to keep adequate financial records.

In this article, you will find information on everyday problems about how to do basic bookkeeping for a small home-based company. It is a free bookkeeping resource for small business owners working from a home office.

Fill up your glass of water, get comfortable and let's begin!

Advertisement

The process of basic accounting is designed to introduce internal controls to safeguard the assets of the business because employees have access to these assets. Out of that process comes ...

... the products. The products of basic accounting are the financial reports.

The basic accounting process consists of:

- choosing a filing system that best fits your own organizational style

- meeting government record retention requirements

- establishing the recording system

- putting internal controls in place

- monitoring the accounting system for accuracy

- interpreting the financial reports to help you make sound business decisions

This basic accounting process also referred to as the accounting cycle is discussed in The Accounting System and The Financial Reporting. As a self-employed business owner, you want to become familiar with accounting process basics.

Success is not defined by obtaining everything you want,

but by appreciating everything you have.

-- Unknown --

Here, in The Bookkeeping Practices, is where the basic bookkeeping process takes place. It consists of:

- creating audit trails to protect your business

- recording routine bookkeeping transactions and the not-so-routine bookkeeping transactions that meet basic accounting standards

- performing reconciliations to prevent fraud and assure auditors your books are accurate and complete

- performing month-end procedures in accordance with basic accounting concepts and principles

- making adjusting entries when necessary

- running the balance sheet and income statement reports monthly for management review

These are the regular bookkeeping chores that have to be done utilizing good bookkeeping practices or everything becomes disorganized and tedious.

Yesterday is a cancelled check. Tomorrow is a promissary note.

Today is cash ... Spend it wisely.

-- Unknown --

This section of the website will cover the daily, weekly, monthly, quarterly and annual tasks of small business accounting and transactions you need to watch out for ... so your financial product(s) - your financial statements - are accurate and timely ... to help you run your business.

Good To Know

There is some information in chats that is specific to Canadian sole proprietors. When possible, I try to find U.S. references for my American visitors.

I have created separate pages that deal specifically with U.S. tax compliance. It is a work-in-progress.

In general, SMALL business accounting and good bookkeeping practices between the Canada and the U.S. are similar. Canada switched to new GAAP standards called ASPE (Accounting Standards for Private Enterprise) in January 2011.

The US converged to similar standards called FRF for SMEs (Financial Reporting Framework for Small and Medium-Sized Entities) in June 2013 ... so the accounting standards are actually in transition during that current time. If you had a small private business with no debt, you probably didn't notice the change in standards.

It should be noted that Canada adopted ASPE as GAAP compliant while FRF for SMEs was adopted as a non-GAAP alternative for SMEs that require reliable statements.

Executive Summaries

So let's get started. Below you will find executive summaries of each chat I've put together in this section ... instructions on the practical side of doing your books ... week in and week out throughout the year.

Just click on the link your choice and you'll go right to the information that brought you here today.

|

Good Bookkeeping Practices

|

5 Articles on

Recording Basic Bookkeeping Transactions

|

Always Have an Audit Trail

|

How to Record Basic Bookkeeping Entries

|

Small Business Accounting Rules

|

|

Capital Lease versus Operating Lease

|

|

GST Input Tax Credits and ...

|

6 Articles on

Basic Bookkeeping Procedures and Checklists

|

Common Audit Issues in Canada and the U.S.This chat looks at the IRS audit techniques for cash businesses, Canadian sales tax audit issues and examines my research on U.S. and Canadian payroll tax audit issues. Read more here. |

|

Small Business Accounting Reconciliations

|

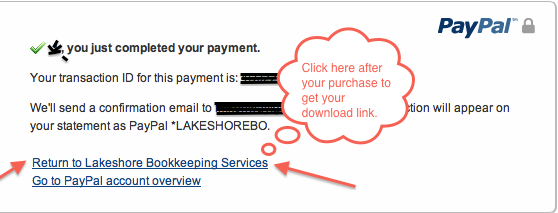

Where to Find Your Download Link   |

Basic Accounting and Bookkeeping Checklists

|

|

1 eBook $5 CAD |

Save 10% when you buy both of my eBooks.

$22.50 CAD

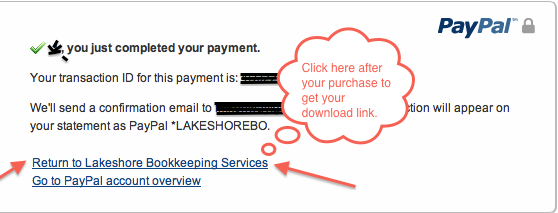

Where to Find Your Download Link   |

Pre-MonthEnd Bookkeeping Checklist

|

|

Invest $20 CAD in your business! |

Save 10% when you buy both of my eBooks.

$22.50 CAD

Small Business Accounting

|

|

Small Business Accounting and Bookkeeping Help

|

Wrap-Up

The goal of small business accounting procedures and processes is to help you package your work, maintain your files, record your transactions, and perform your reconciliations the same way all the time.

Consistency helps reduce errors and omissions. Streamlining your basic bookkeeping processes saves you time and gives you control over your numbers … freeing up your time to figure out how to make more money!

Happy posting!

See you on the next page ...

Your tutor

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Click here to subscribe to QuickBooks Online Canada. I do not receive any commissions for this referral.