- Home

- Basic Bookkeeping Practices

- Create An Audit Trail

How to Create an Audit Trail

The Way To Audit Ready Books

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published 2009 | Revised May 31, 2024

WHAT'S IN THIS ARTICLE

What is an Audit Trail? | Keep All Documents | Cashflow Management Tip | Separate Business Accounts | Basic Entity Concept | Does IRS Need Receipts? | Use Accounting Software | Sequential Documents | Customer Invoices | Track Cash | Undeposited Cash | Expense Reports | Recording No Receipt Transactions | Mileage Log | US Rules For Business Use Of Your Car

More For Canadians >> Why You Want a CRA Audit Trail

This is the third chat in my series on good bookkeeping practices categories.

An audit trail provides protection in the event of a dispute or tax audit. It can also protect your business against fraud ... and it's a good bookkeeping practice.

Recognize that because our tax system is self-assessing, small business owners are targeted for audits more frequently than employed workers. By taking a systematic and proactive approach to creating an audit trail so future audits go smoothly, you will be ahead of the game.

Your goal by the end of this exercise is to have accurate and complete financial business records. This will require properly recording, categorizing all business transactions ensuring every bookkeeping entry is supported by documentation. This is one instance where you must be meticulous. Keep a list of discrepancies or issues that arise to investigate and resolve after all your data is in.

Advertisement

What Is An Audit Trail?

An audit trail is a verifiable record that provides evidence of your business's financial history. Think of it as a detailed roadmap that shows how transactions are processed and tracked in your organization. Good audit trails make it easy for auditors to understand the movements of your funds without having to play detective.

I won't cover fraud protection on this page ... but I have covered it in my chat on internal controls. For now, just be aware that good internal controls and segregation of duties is essential to reduce the possibility of fraud in your business.

Today we will focus on how to create audit trails through audit proofing your procedures and processes ... so top up your water glass and let's get started by looking at some tips on how to audit proof your recordkeeping.

Be proactive here. Don't wait to get all your ducks in a row right before the auditor comes knocking.

Click here to continue reading.

The Bookkeeper's Notes On

So What are Good Bookkeeping Practices?

Getting your ducks in a row means tackling nine key areas. Don't worry. We'll take them one at a time:

8. File compliance reports and remit the amounts owing on time.

8. File compliance reports and remit the amounts owing on time.Get busy and start gathering your financial documents.

- Collect all available financial records, including bank statements, credit card statements, invoices, and receipts.

- If some documents are not available online, contact your bank or service providers to retrieve them now while they are still available and not archived. It's very costly to do this step in four years time right before an audit.

- Moving forward, setup a system to keep all of your receipts and make sure they are legible. This is a lot harder to do than it sounds. The key is having a system in place to handle your receipts.

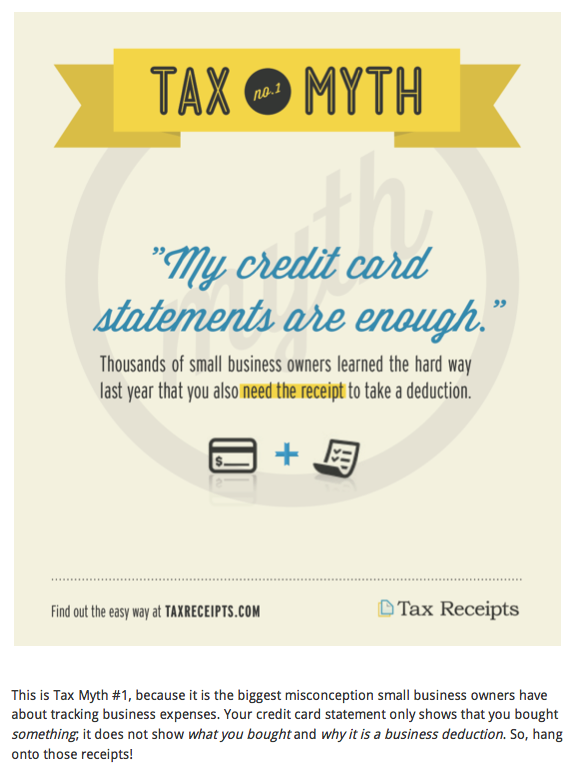

Cancelled cheques, credit card statements, and bank statements are great to construct (or re-construct) your bookkeeping records. However in Canada and the U.S., they are not considered to be a legitimate business receipt for the purpose of tax deductions ... like debit and credit card slips, you need them in addition to your receipt, to show proof of payment ... and they are third party source documents.

Third party source documents provide the auditor with verification of the transaction from an outside third party ... an excellent audit trail. If you are wondering if the IRS (Internal Revenue Service) accepts photo receipts, click here for more information.

If you are out and about shopping and go to the checkout till with both business and personal purchases, ask the cashier to ring up two separate orders. Pay each purchase from the appropriate place - personal purchases from your personal funds and business purchases from your business account or your business credit card.

KEY TAKEAWAYS

- Gather all your source documents and organize them to ensure you have supporting documentation in the event of an audit.

- Understand bank and credit card statements only provide proof of payment not proof of purchase. You need receipts for proof of purchase.

- Going forward, always keep business transactions separate from your personal transactions.

The Bookkeeper's Tip

Cashflow Management

A Simple Way to Track Your Cash When Just Starting Out

Cash flow is king, especially when you operate a small business. Having a method to track and manage your cash flow (which is different than calculating your profit or loss) allows you to decide if you need to borrow funds to cover a shortage, or when you should buy supplies, and when to pay for those supplies.

When you are just starting out in your business, a very simple method of keeping on top of your cash flow is to (1) go no tech and rely on your cheque book register or (2) go low tech and use personal finance software like Quicken (which is based on cheque writing). Quicken's advantage over the manual method is you can download your transactions so it saves keying time. It also makes it easy to look stuff up later.

Once a month, you will need to reconcile your cheque book register to your bank statement transactions. (I can hear you asking "What! Why?" Simply to ensure you don't spend money you don't have and get yourself in hot water and of course to be certain you've captured all the transactions.)

If you don't have a lot of transactions (Mr. Stephen Thompson, CA and author suggests less than 150 transactions a year), this is a very simple method to stay on top of the cash running through your business ... and still have an adequate audit trail for your transactions.

DO THIS

Canadians report their business income for tax purposes on form T2125 Statement of Business or Professional Activities. Americans report their sole proprietorship income on Schedule C.

An easy, recommended, and essential method to track all your business income is to have a separate bank account and a separate credit card for your business affairs.

Yikes, you are in business and haven't been doing this!

If your business transactions are currently co-mingled with your personal expenses:

- Start by sorting them out sooner rather than later.

LOW TECH - If you can download your bank and credit card transactions into an Excel spreadsheet, then you can create two separate lists of income and expenses - one for personal and one for business.

NO TECH - If you are working with paper statements, go through each statement and mark a P for personal or B for business beside EVERY bank or credit card item. - Enter or upload the business transactions into an accounting software program like QuickBooks Online. Historical transactions from setting up the bank feeds may help but each bank has different timelines for how much data is available through the feed the first time you use it.

You need to have self discipline to maintain your records manually. If that's not you, hiring a freelance bookkeeper takes this task off your list while allowing for a tech savvy bookkeeping solution.

AFFORDABLE TECH - Use one of the many apps out like there MoneyThumb Online that converts a PDF bank statement automatically into QuickBooks Online format for uploading. - Try to construct a business account using your statements and any memory of transactions. Add notes to a transaction if clarity would help during an audit. If you are using QuickBooks Online, attach any paperwork you have to support the transaction. An auditor wants proof of purchase and proof of payment for expenses.

NOT THIS!

It is not a good practice to write cheques (checks for my American visitors) for business expenses on your personal bank account; or charge business expenses on your personal credit card.

If you don't have a separate business bank and business credit card, run, don't walk, to your bank now today and:

- Open up a separate account for your business;

- Apply for a second credit card that you use solely for your business expenses.

- When setting up your business bank account, create an email business account if you don't already have one and register it for Interac auto deposits. (Sorry I don't know what the equivalent for Interac is in the U.S. or if it offers auto deposits of funds received by email directly to your business bank account.)

- If you shop online a lot, then open up a business PayPal account, link it to new business bank account and new business credit card. Make all online business purchases from there.

Let's Chat About ...

A Basic Accounting Principle

Business Entity Concept

A basic GAAP principle is the Business Entity Concept. This principle provides that the accounting for a business should be kept separate from the personal affairs of its owner.

This is not to be confused with the legal concept where, if you are a sole proprietor, you are your business.

Be Proactive Not Reactive

If / when you are audited by the Canada Revenue Agency or the Internal Revenue Service, they will want to see proof of your business income and expenses claimed. Ways to provide that proof are:

- Use your bank account to deposit all your business income (including cash).

- Use your bank account to pay all your business related expenses.

- Instead of reaching into your pocket to pay for business expenses with your personal funds, use your business credit card, use your debit card for your business account or write a cheque/check from your business's bank account. Please don't make the payee "Cash".

Intermingling business transactions with your personal accounts increases the risk of overstating your business expenses by reporting personal expenses, or inadvertently understating your business income, on your T2125 form or Schedule C, which is not allowed.

KEY TAKEAWAYS

- Maintain separate financial accounts for your business affairs. Do not mingle them with your personal accounts.

- Utilize tech tools to help you organize your transactions systematically.

- Going forward, setup a system to keep your business documents organized. They will help you provide proof during an audit of proof of purchase and/or proof of payment.

Good To Know

Does The IRS Need Receipts?

The short answer is "yes, with some exceptions".

The longer answer can be found by a visit to Wayne Davies' blog at Self Employed Tax Deductions Today answered this question in detail on April 16, 2015.

The blog made reference to Mr.Cottrell's TC Summary Opinion 2003-162 found at law.onecle.com.

The Court ruled:

(a) "The taxpayer bears the burden of proof, which means the presentation of adequate documentation to support the deductions claimed on tax returns."

(b) "It is also the taxpayer's responsibility to maintain records sufficient to enable the Commissioner to determine the correct tax liability."

(c) "The taxpayer must substantiate both the amount and purpose of the claimed deductions."

(d) "Under certain circumstances, where a taxpayer establishes entitlement to a deduction but does not establish the amount of the deduction, the Court is allowed to estimate the amount allowable."

(e) "However, there must be sufficient evidence in the record to permit the Court to conclude that a deductible expense was incurred in at least the amount allowed."

Mr. Davies recommends photocopying and storing all receipts for three years along with your bank and credit card statements so you have proof of purchase and proof of payment.

His various blogs discuss exceptions to the "need a receipt" rule in the U.S..

1. If you are a sole proprietor or partner, meals related to an overnight business trip can use the Per Diem method (see IRS publication 1542). Corporations may NOT use this method.

2. You can use the Mileage Rate method to deduct vehicle expenses ... but you DO NEED an auto log to use this one.

Use Accounting Software

Audit Trails and Downloading Bank Transactions

Invest in and use accounting software to properly record all sorted transactions. Tech tools like QuickBooks, Sage, or Xero also help in generating necessary reports which might be needed during the audit. These tech tools automatically log entries with timestamps and user details.

During an audit, the auditor might examine:

- The controls around access to bank feeds - make sure only authorized personnel have access to set up and manage the bank feeds. This ensures the integrity of the financial data is maintained and reduces the risk of unauthorized access.

- The security of the data transmission - make sure bank feeds are setup up properly through secure channels and do not violate any privacy laws.

- The accuracy of transaction recording - make sure transactions are recorded accurately in the accounting software. Mismatches or errors could raise concerns during an audit. This can be minimized by using the bank feeds for reconciliation purposes only. As well, regular reconciliations help an auditor verify the accuracy of the transaction data pulled from bank feeds.

As long as these areas are adequately managed, using bank feeds should not create problems during an audit for a small business owner.

DON'T DO THIS!

Using bank feeds as a primary source for booking transactions can streamline the accounting process and increase efficiency. However, whether to rely solely on bank feeds for data entry or use them alongside other processes depends primarily on the nature and complexity of your business’s financial transactions.

One downside of booking transactions solely through the bank feed is not taking the time to attach your documentation to support the transaction. Unsupported expenditures may get denied during an audit due to lack of supporting documentation. Be honest, are you really going to be able to find that receipt for the auditor three years later if you didn't have it when you were booking the transaction?

Keep on reading for what I think makes it easy to have audit proof books.

DO THIS

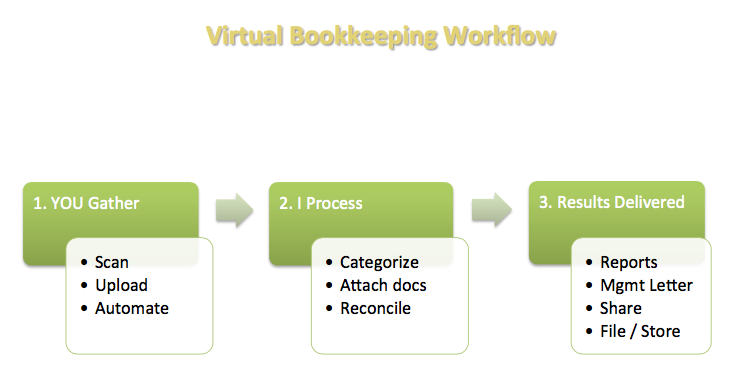

I'm going to introduce you to a very low tech solution to audit proofing your books using the virtual workflow presented above. You choose if you are going to semi-automate the process or fully automate the process.

I prefer to use a document management app like LedgerDocs to enter all transactions using the source document. Using a variety of methods, the source documents can be automatically sent to the document manager waiting for processing sort of like an old fashioned inbox, only this one is electronic. LedgerDocs is like an electronic filing cabinet but more.

I like this method because it ensures the supporting document is attached to the QuickBooks (or other software) transaction making your books audit ready.

After pushing the source documents to the accounting software, then I use the bank feeds (downloaded transactions) for reconciling only. I setup bank rules so that certain transactions such as bank fees are automatically booked or transactions under a certain dollar value can be posted automatically without a manual review. All other transactions are manually reviewed before posting for accuracy as sometimes dates and amounts are similar and can cause mismatching if booked automatically.

If you decide that your business data volume supports using the bank feed screen to book your transactions, at some point in your process, make sure you attach the source document. Don't skip this step. Also, please don't use the auto post using this data entry method. Review every transaction manually. For example, I book bank service charges through the bank feed.

Remember the cardinal rule - no supporting document - no deduction! :-( Don't forget to create your audit trail if you want to audit proof your bookkeeping system.

KEY TAKEAWAYS

- Maintain comprehensive documentation for each transaction, including invoices, receipts, and contracts. These documents are critical for audits and financial analysis.

- Ensure that digital or physical copies of relevant documents are easily accessible and well-organized.

- Although I haven't discussed it, protect your data from loss due to technical failures or cyber threats by implementing regular backups. Store your backups in multiple locations or use cloud storage solutions for enhanced security. Rewind for QuickBooks is one backup solution.

- Okay, I'm going to say this one last time. Don't mix your personal purchases with your business purchases.

A Visual Audit Trail

Sequential Numbering of Documents - Cheques & Invoices

Avoid gaps in invoice numbers. Sequential invoicing helps prevent fraud and simplifies the audit process. It makes it easier to check if any documents or transactions are missing and ensures that your records are accurate and orderly. And , of course, use the forms in sequential order.

The same goes for your cheques. Numbering cheques make it easier for a small business owner to track payments for bookkeeping and accounting purposes. Each cheque has a unique number, allowing payments to be traced and verified, ensuring they match the financial entries in business accounts. Keep them under lock and key limiting who has access to them. Why? To prevent fraud.

When doing your bookkeeping, always record "voided" invoice numbers and voided cheques. It maintains the audit log ensuring each document has been accounted for.

Audit Trails and Invoicing

As mentioned above, it is important to track all numerically sequenced invoices, even void ones.

What I didn't say was, write an invoice for every job you perform and ring through the till every sale you make. Skimming has consequences and can cost you dearly if detected by or reported to Revenue Canada or the IRS.

You may want to read a short overview of what your responsibilities are ... they apply whether you hire a bookkeeper or do your own bookkeeping.

More for Canadians >> Best Practice When Preparing Customer Invoices & Receipts

Audit Trails and Tracking Cash

It's perfectly fine to conduct transactions in cash, provided you keep thorough records. If you lack documentation, there's a risk that legitimate expenses won't be accepted during an audit, potentially increasing your taxable income and costing you money. Always ensure you have proof that the expenses were for business purposes.

One habit many small business owners have is to take cash out of the business bank account and go pay their bills. (I'm not talking about you of course!) :o) This makes providing an audit trail to your tax assessor tough. It would be smarter to setup a regular "pay cheque" for yourself and have the funds electronically transferred to your personal account on "pay days". For clarity, keep your fingers out of the cash drawer or bank account unless it is a prescheduled transaction.

Or some business owners may even reach into their own pocket to pay someone using their own personal funds. (I know this is something you would never do!) ;-) It would be smarter to use that credit card you got for your business expenses. For clarity, stop using your personal funds to pay business expenses. If the business needs an infusion of cash, make one lump sum owner's contribution from your personal bank account to your business bank account or apply for a bank line of credit.

It's imperative in both of these instances to keep your receipts as proof of purchase and/or proof of payment and submit them to your bookkeeper (that's you if you are doing your own books!). Your bookkeeper will do up an expense report to reimburse you but only if you have supporting receipts. Remember no receipt, no deduction.

By the way, if you keep part of the cash received from customer payments instead of depositing it into your business bank account to (a) purchase business supplies or (b) as a personal withdrawal for yourself, your bookkeeper needs to know that too ... it's a nice way to be kind as it will make the bank reconciliations much easier. This next tip shows you how to record this type of event. It would be smarter to deposit the entire customer payment just in case a payment dispute arises.

The Bookkeeper's Tip

A Good Bookkeeping Practice

How To Record Cash Not Deposited To The Bank In QuickBooks®

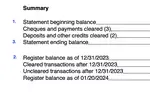

You or your bookkeeper should:

1. In the accounts payable module (not the banking module), record the cash payment received by applying it to the outstanding customer invoice sitting in accounts receivable. Deposit the funds to the account called "Undeposited Funds" not the bank account. This clears the receivable and show it is paid.

2. Make a bank deposit. In the deposit window, select the customer payment from the list of outstanding deposits. Next, show the cash was not deposited to the bank by completing the bottom line of the deposit window. This will create a nil bank deposit if you took all the cash; or a partial bank deposit if only part of the funds were deposited. You can code the cash not deposited to your cash account (instead of your business bank account) so you can show how it was spent, or code it to Owner's Draw if you spent it all on personal lifestyle expenses.

Expense Reports - Keep It To A Minimum Or For Certain Activities Like Business Trips

Let's suppose you do spend your own personal funds on business purchases or even put something on your personal credit card (No ... don't even think about having an account in your books for your personal credit card ... remember what I said above - don't mix business and personal funds!) ...

... and you want the business to pay you back. You don't want to make a capital investment in your business at this time. You'd prefer the cash back. (I know you're not going to make a habit of this right?)

Right about now you are probably wondering, "How do you invoice yourself for business expenses? Is there a way to get my personal funds back and still provide an audit trail?"

The answer is "Yes". You record money from your pocket spent on items relating to your business by submitting an expense report to your bookkeeper. (Don't forget to attach all the receipts to the report. No receipt, no tax deduction!) This is a MUST procedure for incorporated companies if you want to claim ITCs.

You Need To Use An Expense Report Form

Here's A Free Expense Report Excel Spreadsheet

Before you can enter the expense information into QuickBooks, you need a form for the employee or owner to submit.

Here are two good expense reports that will keep your audit trail intact.

Microsoft has a free Expense Report template (Excel 2010) at office.microsoft.com> Resources> Templates> Excel> Expense report.

Don't forget to attach all your receipts to the expense report.

If you like paperless cloud based applications, you may be interested in trying out Expensify to capture your receipts and produce your expense report. It can even sync with QuickBooks after being approved if you are into that type of workflow.

If you like online technology and software, and want to automate your expense report process a bit, look into Expensify as a possible solution.

- The bookkeeping entry to record the expense report is:

DEBIT each individual expense item (20 receipts means 20 separate lines of data entry) and

CREDIT Owed to Owner (a current liability on your chart of accounts) - This bookkeeping entry to reimburse the owner the funds will be recorded as follows:

DEBIT Owed to Owner (a current liability on your chart of accounts) and

CREDIT Bank (a current asset in your chart of accounts)

There are special rules to reimburse expenses related to your vehicle.

Here are two examples of how to enter and pay the expense report in QuickBooks.

How to Enter Expense Reports in QuickBooks Desktop

If you are using QuickBooks desktop, I like to create the current liability account using the account type "credit card". I name the credit card account "Owed to Owner" ... or you could replace "owner" with the name of the individual.

When I receive the expense report, I treat it just like a real credit card statement and enter each item on the expense report through the Credit Card screen. Make sure you code every item to the proper expense account.

To reimburse the owner, I use the Write Cheque screen and code the cheque to the Owed to Owner credit card account ... reducing the outstanding amount. Make the cheque payable to the owner (individual's name) NOT cash.

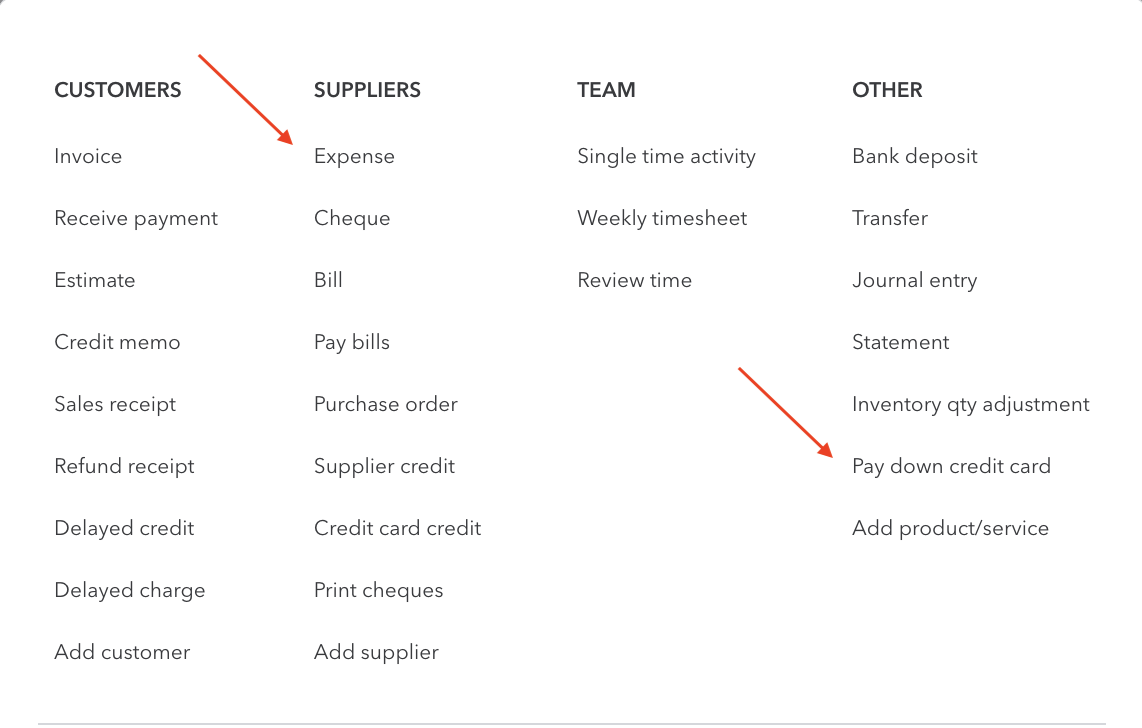

How to Enter Expense Reports in QuickBooks Online

If you are using QuickBooks Online, do the following:

- Open a current liability credit card account on your chart of accounts. Call it "Owed to Owner". This allows us to use the accounts payable module to record all the expenses instead of a journal entry.

- Setup the owner as a supplier. Call it [Insert Owner's Name] Expense Reports.

- Using the "Expense" option, choose the Payee to equal the supplier we just created, choose the "Owed to Owner" credit card for the payment account. I usually use something like "Exp Rpt MMDDYY" as my reference number. Enter in the expense report line by line so each expense gets categorized correctly. Do not enter it as a lump sum amount. Make sure you record the sales tax correctly.

- Then when you need the cash, use the "pay down credit card" item. Select the "Owed to Owner" credit card and the Payee to be the supplier "[Owner's Name] Expense Report". Choose the bank account you are paying from. Complete the amount paid and date.

- This doesn't actually make the bank transaction so you need to (1) transfer funds to the owner's personal account, or (2) send an Interac transaction to the owner. You could write a cheque but why would you do that? Cheques usually cost more to process these days.

Keep a notebook or journal with you to record any expenses where it is customary to not issue a receipt such as parking meters, coin car washes, and phone booth telephone calls. The journal, for these types of transactions, is your audit trail.

What about other transactions where it is common practice to issue a receipt but you don't have one?

Stephen Thompson CA, CFP, TEP states in the book "167 Tax Tips for Canadian Small Business" that if you have a business expense that you did not get a receipt for, you just have to record ALL the details of the transaction to get your tax deduction but suggests getting a receipt whenever possible.

It is my understanding that this may be okay for the odd transaction, but if you had a tax audit and did not have receipts to support your claim(s) (no audit trail), CRA can deny the deductions.

During a tax audit, I could see an auditor letting a few transactions through (due to materiality or it is a recurring payment and you had the receipt for previous payments) but if it was prevalent, I'm fairly certain many of the unsupported claims would not be accepted.

Mr. Thompson then goes on to say (when discussing GST) that "to claim an input tax credit, you must (my emphasis) have invoices or receipts containing certain information ... if the receipt or invoice for a purchase ... does not contain the proper information, the government can deny the input tax credit on the purchase."

CRA are now routinely denying ITCs due to lack of supporting documentations. Of course, as also noted, there are always exceptions to the rules. See CRA's ITC exceptions to invoice requirements for more details.

If you do have a legitimate business expense and you lost the receipt the receipt, go ahead and claim it but do not claim your input tax credit. You need a receipt to claim an ITC.

So no invoice or no receipt? You definitely lose your ITC.

(Prior to 2011, it was common practice for the CRA to conduct an income tax audit and GST audit at the same time. In 2011, CRA discontinued combined audits. Auditors are developing more expertise and in-depth knowledge in this specialized area. This change was a direct result of BC and Ontario switching to HST in 2010.)

It used to be if I signed up for preauthorized payments of bills, I never received an invoice or a statement of account. However now, all vendors I have preauthorized transactions with, issue either an invoice and/or a payment receipt every month. My guess is too many business customers were requesting back copies of invoices when they were audited ... but I could be wrong.

I used to be a member of the Canadian Bookkeepers Association. Their code of ethics stated, "A CBA Member, in conducting business, will obtain evidence or other documentation to establish a reasonable basis for any recorded transaction." This was in part to avoid third party civil penalties.

KEY TAKEAWAYS

- Best practice? Create an audit trail by getting and filing a receipt ... especially if you want to audit proof your tax return and claim your ITCs.

- Second best practice? If you don't have a receipt, create an audit trail by logging the particulars in a journal including the reason you don't have a receipt. The onus is on you to prove it was a business related expense. If you choose to claim any of the related ITCs, understand you are vulnerable during an audit and the ITCs may be denied.

For self-employed workers, establishing and maintaining a business diary of business activities is a businesslike strategy that may save your bacon during an audit. Especially for those in the early stages of their business, this practice offers several advantages. Documenting your intent and strategy demonstrates:

- the reason you are undertaking them and how you expect it to increase your profit;

- your decision making process during an audit;

- improve your decision making as you work through in writing your plans that may lead to better outcomes;

- your progress and may be motivational to you when things aren't going the way you planned;

- a method to review what worked, what didn't, and how your strategies changed and evolved over time.

What are some of the best practices when it comes to keeping a business diary?

- Make Regular Entries: Make it a routine to update your business journal daily or after significant business activities.

- Details are Crucial: The more detailed your entries, the more useful your journal will be during an audit.

- Digital Tools: Digital tools can offer backups, accessibility from various devices, and security through encryption. However, journaling if you are trying to seek creative solutions is often best done with pen and paper for it to solidify in your subconscious.

- Periodic Reviews: Periodic reviews can provide insights into any trends in business and may help you with strategic planning.

KEY TAKEAWAY

Apart from being a good habit, a business diary can be a crucial tool to support items questioned by an auditor when they are not satisfied with the supporting documentation you have presented. This is especially true if you are just starting your business and not yet making a profit.

This is especially important if your business has a hobby aspect or personal aspect to it. You will need to prove that you are carrying on your business in a commercial manner in case CRA challenges the deductibility of expenses that create a loss. Showing CRA you are running your business as a commercial business by having accurate and up-to-date books along with your business diary can assist in a positive outcome.

Keep in mind that this means at some point, your business should be successful which means you will pay taxes. There are only five reasons people pay no taxes.

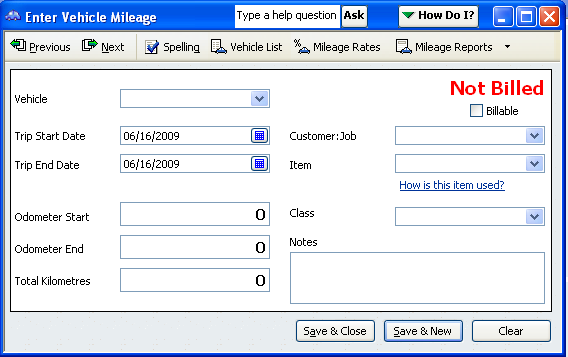

If you use your vehicle for both business and personal use, only the business portion is deductible.

In addition to the auto log to support your claim, you also must have all supporting auto receipts (see Section 8 of CRA's IT521R) including:

- fuel,

- maintenance,

- insurance,

- lease and/or purchasing documents.

My personal preference is to pay for your personal vehicle expenses through your personal accounts, but enter the information into your business records as expenses. At year-end, make an adjusting entry to back out the personal portion.

Why is this my preference? Receipts don't get lost and it's easier to input a bit of data each week/month than it is to enter all those vehicle expenses in at year-end when a deadline is looming.

More for Canadians >> CRA Mileage Log Requirements

U.S. Rules For Business Use Of Your Car

Unlike Canada, the IRS allows you to deduct your actual expenses OR use their standard mileage rate. Both methods are based on your business mileage ... as personal use of your vehicle is not an allowable deduction. You will need a log of some type to show your mileage and the purpose of your trip.

Here's an overview of the U.S. rules for business use of your car:

Deduction Methods

1. Actual Expenses Method:

- Includes gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation or lease payments.

- Calculate the percentage of business use based on mileage.

- Can be more beneficial for newer, more expensive vehicles or those with high operating costs.

2. Standard Mileage Rate:

- Use the standard mileage rate released every December. The rate is cents per mile.

- Simpler to calculate but may result in a lower deduction for some vehicles.

- Cannot be used if you've claimed accelerated depreciation or MACRS on the vehicle in previous years.

More >> IRS Standard Mileage Rates and Notes

Depreciation:

- If using actual expenses, you can depreciate your vehicle.

- Luxury Auto Rules limit the amount of depreciation you can take annually.

- Special rules apply for SUVs and trucks over 6,000 lbs gross vehicle weight.

Substantiation:

To deduct business use of an auto, you must be able to substantiate three things:

- The business purpose

- The date and destination of your business-related trip or errand

- The amount you are claiming as a deduction

Recordkeeping Requirements:

- Maintain a log to show your mileage and the purpose of each trip.

- Include date, destination, business purpose, and odometer readings for each trip.

- For mixed-use trips, separate business and personal mileage.

- Keep receipts for all actual expenses if using that method.

- Use your auto log as an audit trail to help you substantiate your claim.

- Contemporaneous logs are preferred by the IRS.

What is a contemporaneous log? A contemporaneous log is a record of your business vehicle usage that is created at or near the time of the actual use. The term "contemporaneous" means occurring or existing at the same time, so a contemporaneous log is one that you maintain in real-time or very close to real-time, rather than creating it after the fact. In the event of an audit, a contemporaneous log is considered strong supporting evidence for your vehicle expense deductions.

Technology and Record-Keeping:

- GPS devices and precise calendar entries can support your claim. GPS tracking laws by state can vary. Most states have a law around GPS tracking while others surprisingly don’t. On a federal level, fleet companies are legally entitled to track their own vehicles.

- Consider using apps like MileIQ, Everlance, or TripLog for automated mileage tracking.

- Traditional paper logbooks are still acceptable for audit trails.

Additional Considerations:

- Parking fees and tolls related to business use can be deducted separately, regardless of which method you choose.

- If using a personal vehicle for business, you can deduct the business portion of interest on your auto loan.

- For self-employed individuals, mileage to and from your first and last business stop is deductible.

- For employees, commuting is generally not deductible, but travel between work locations is.

Special Situations:

- If using multiple vehicles for business, you must use the actual expenses method for all vehicles.

- Leased vehicles have specific rules regarding deductions and income inclusion.

Tax Planning and Strategy:

- Calculate your deduction using both methods for the first year to determine which is more beneficial.

- Consider using a dedicated vehicle for business to simplify recordkeeping and maximize deductions.

- Be aware of how vehicle deductions interact with other business deductions and your overall tax situation.

- If considering a vehicle purchase, timing it near year-end could affect your current and future year deductions.

Audit Risk and Preparation:

- Vehicle expenses are a common audit trigger, especially for self-employed individuals.

- Be prepared to provide additional documentation if requested by the IRS.

- Consider keeping a small notebook in your car for manual backup of electronic records.

State Considerations:

- Some states have different rules or rates for vehicle deductions.

- Check your state's specific guidelines, as they may differ from federal rules.

Additional Resources:

- IRS publication 463: Travel, Entertainment, Gift, and Car Expenses

Remember, while this information provides a overview at the time of writing, tax laws can change.

KEY TAKEAWAY

- If you use your personal vehicle for business purposes, an auto logbook is a requirement not an option. It substantiates your claim and auditors will ask to see it.

Driving to and from work, is it a business expense? Click here to find out.

Wrap-Up

These are what I consider to be good practices ... where an audit trail will provide you with adequate audit proofing should you ever have a tax audit. Protect yourself. Make yourself fully aware of the consequences of skimming.

That's it for my two cents worth on how to create an audit trail.

See you on the next page ...

Your tutor

Screen shots © Intuit Inc. All rights reserved.

Bookkeeping Essentials › Small Business Accounting › Audit Trail