- Home

- Good Bookkeeping Practices

- Learning How To Use QuickBooks Desktop

- CBSA Duties and CBSA GST

Learning QuickBooks Online | Focus on Bookkeeping

How To Record CBSA Duties and CBSA GST

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published February 2019 | Edited June 10, 2024

How to record CBSA duties and CBSA GST payable in QBO.

How to record CBSA duties and CBSA GST payable in QBO.CBSA is the acronym for the Canada Border Services Agency. Recording CBSA import duties and CBSA GST payable on goods brought into Canada in QuickBooks®Online isn't intuitive. I really had to research the best way to handle these transactions to ensure I didn't circumvent the Sales Tax Module.

After seeking advice in various bookkeeping forums and groups, as well as touching base with my good friend Google, I came up with a plan. I'll walk you through how I decided to record CBSA duties and the GST payable on product imported into Canada for resale.

As with inventory returns, I found booking CBSA GST payable and import duties to be a somewhat intricate process so if your stomach starts to feel like it is tied in knots just thinking about doing these entries, while sitting in your chair ... or better yet, stand up, take a short break to lift your arms overhead and ...

© 2018 Flowing Zen Studio LLC and Anthony Korahais

© 2018 Flowing Zen Studio LLC and Anthony KorahaisS-T-R-E-T-C-H.

Add a few torso twists for good measure to clear your mind before you dive into this chat.

Grabbing something like a glass of water before you start is also good. Hey you'd be following the new Canada Food Guidelines released in January 2019 that recommends making water your drink of choice.

I don't know if the method I have chosen is the best way to handle booking CBSA import duties and GST payable using QuickBooks®Online, but it got me the results I needed. It ensured inventory was not understated, cost of goods sold was not overstated, and sales tax was recorded in the sales tax module.

A Word of Caution: Intuit continually revises QuickBooks Online to make it more robust. It's possible that how I did something in 2019 does not work in 2024. That said, you should be able to figure out the work around and still stay on track following my steps.

Here are the steps I used in 2019.

Chat Continues Below Advertisement

How To Handle CBSA Duties in QuickBooks® ONLINE

For this example, I will continue with the shipping containers purchased in my chat on inventory returns. If you remember, I allocated the CBSA duties to the cost of the container to ensure my inventory cost was not understated and my cost of goods sold was not overstated. I also booked all container purchases using the Out of Scope sales tax setting because we needed to pay Canada Services Border Agency, not the container supplier, the import duties and sales tax due once the containers arrived in Canada.

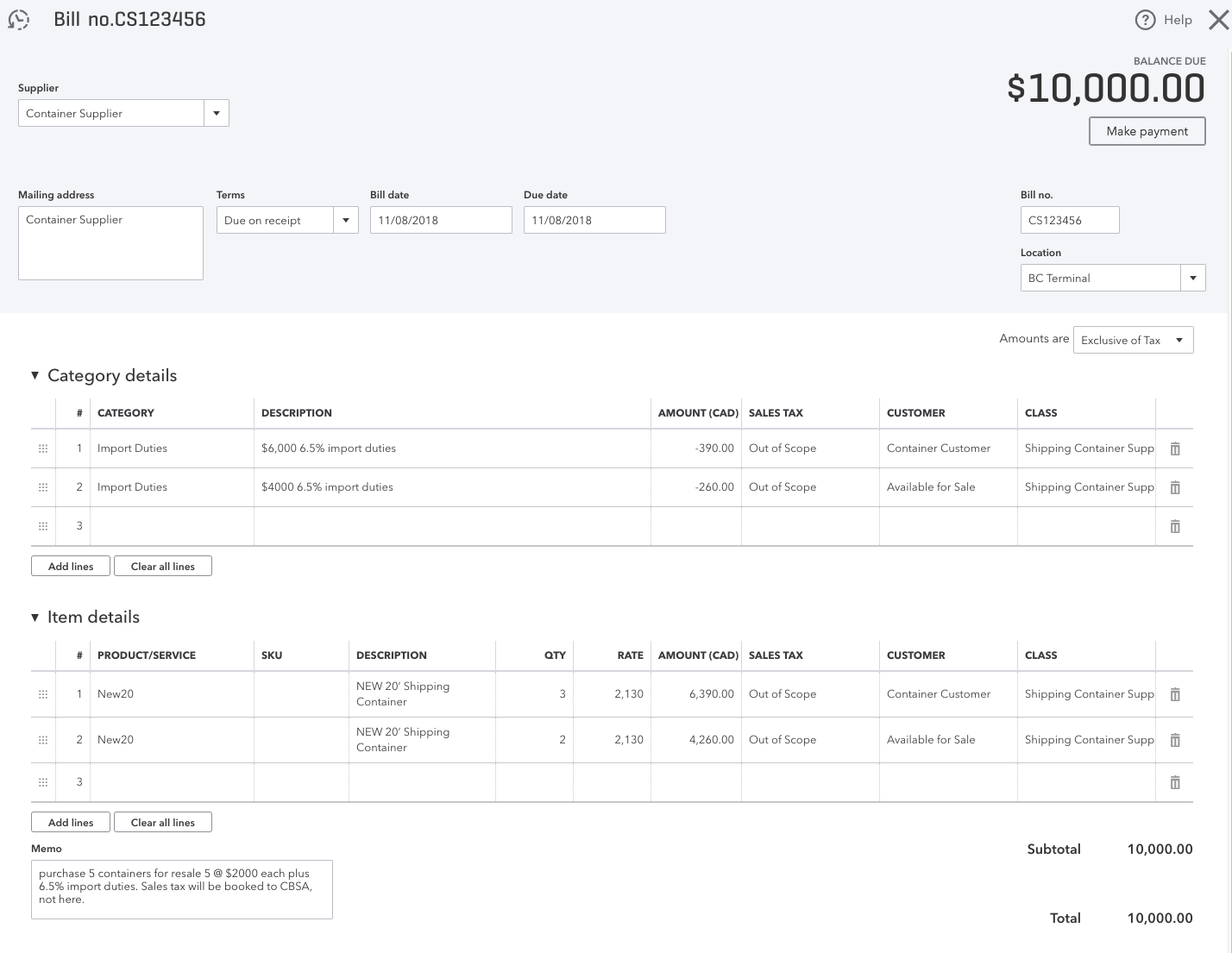

Just to refresh your memory, here is a quick reminder of how I booked the purchase of the shipping containers I will be self assessing for CBSA duties and CBSA GST. I purchased five (5) containers. Three (3) containers were pre-sold to a customer while two (2) were place into inventory and available for sale.

Purchase of Containers from Supplier

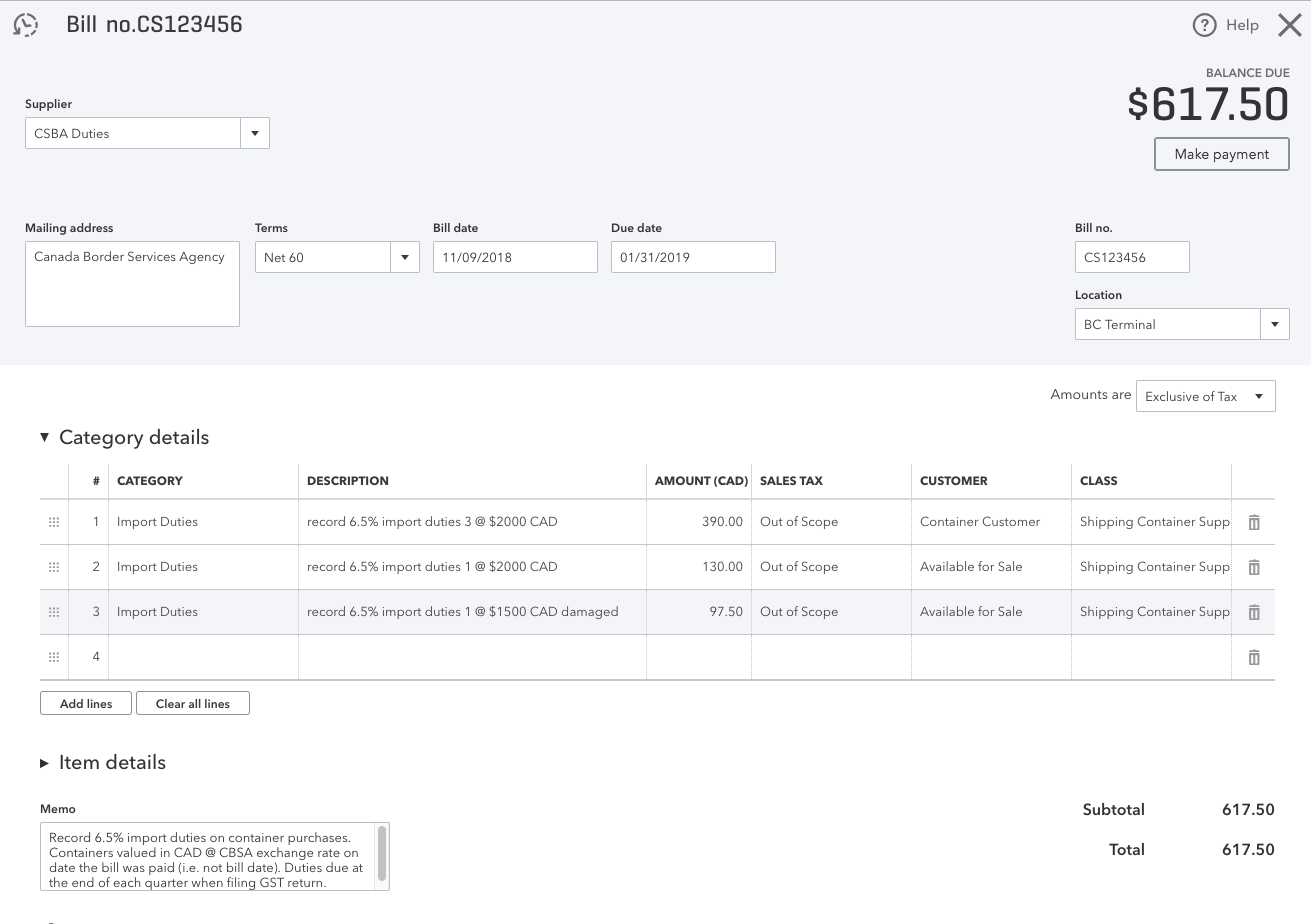

Purchase of Containers from SupplierNext create a supplier called CBSA Duties if you don't have something similar already setup in QBO ... then follow these steps:

- Create a bill. Date the entry on the same date as the day the supplier bill was paid, not the date the supplier invoice was issued. This is the date you will need to select the correct CBSA foreign exchange rate. For this example the paid date will be November 9, 2018 ... one day after the supplier bill was received.

- Set the due date to be the same date as your quarterly GST return is due. In this example it is January 31, 2019.

- Input a Bill No. I use the container supplier's bill number to tie the import back the purchased being assessed the duty.

- If you are tracking locations, input the location where the shipping container entered Canada.

- While I didn't do it in this example, set the "Amounts Are" box to "Out of Scope" as you will be booking the associated GST separately in another entry when we calculate and record the GST payable. Doing this saves you from having to change the Sales Tax code on every line.

- Manually calculate the 6.5% import due and enter it on the first line using the GST sales tax code. As I need to track who the containers were sold to and their associated expenses to get an accurate gross profit per customer, I also input the customer who purchased the container. As I also want the gross profit per container, I enter the shipping container supplier in the class field. Ensure you enter the data under the "Category Details" section of the screen and NOT the "Items Detail" area. ... wandering off the topic ... Intuit used to call this section "Account Details" but as they like to tinker just to keep us on our toes, it is now being called Category Details. As much as I love Intuit products, in my humble opinion, this particular change did not add any obvious value to the users of QBO. I'd rather they spend their time fixing other facets of the platform that really need their love!

- Make good memo notes and attach any relevant documents to the entry.

- Save and close your entry.

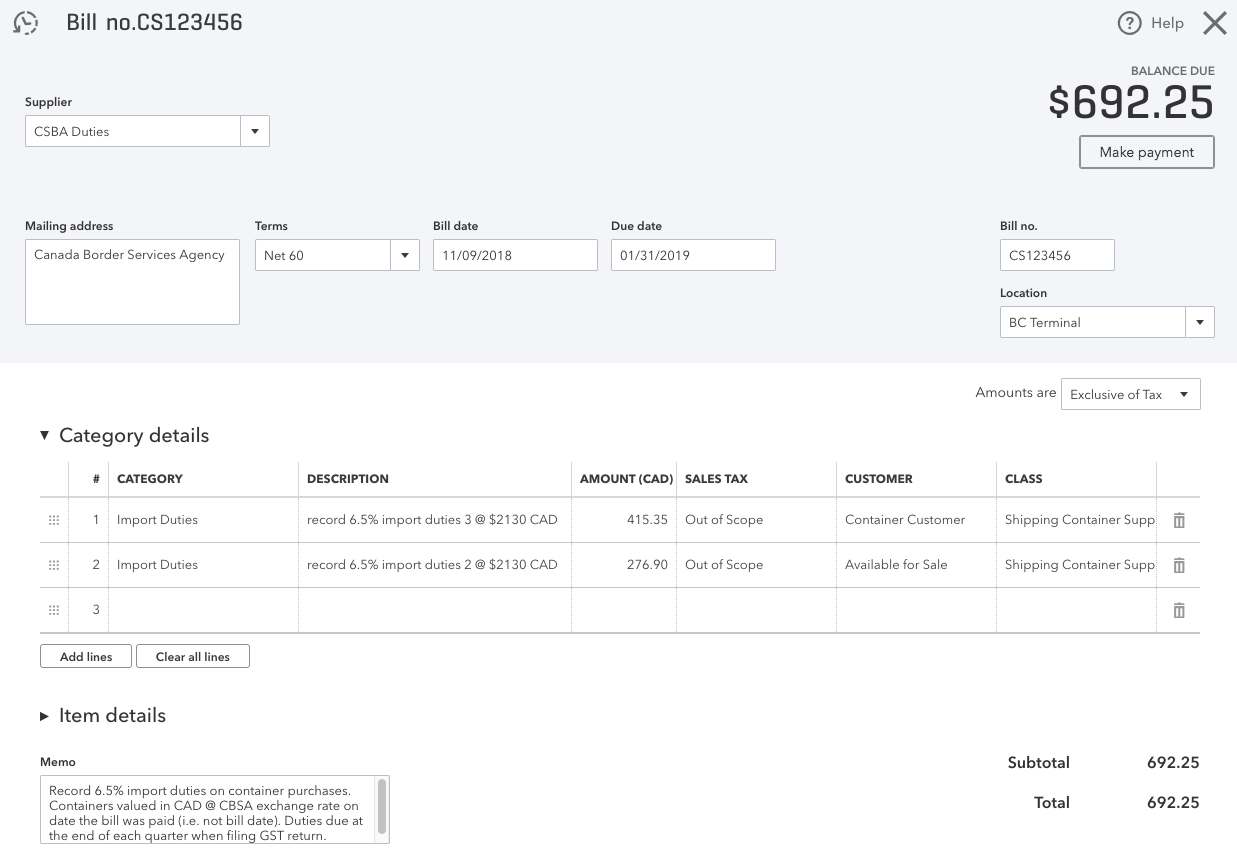

Here is a snapshot of the CBSA Duties entry I made in QuickBooks Online. I'll explain further down in the chat why this entry is not correct.

Example of self assessed CBSA import duties bill in QBO

Example of self assessed CBSA import duties bill in QBOChat Continues Below Advertisement

How To Handle CBSA GST in QuickBooks® ONLINE

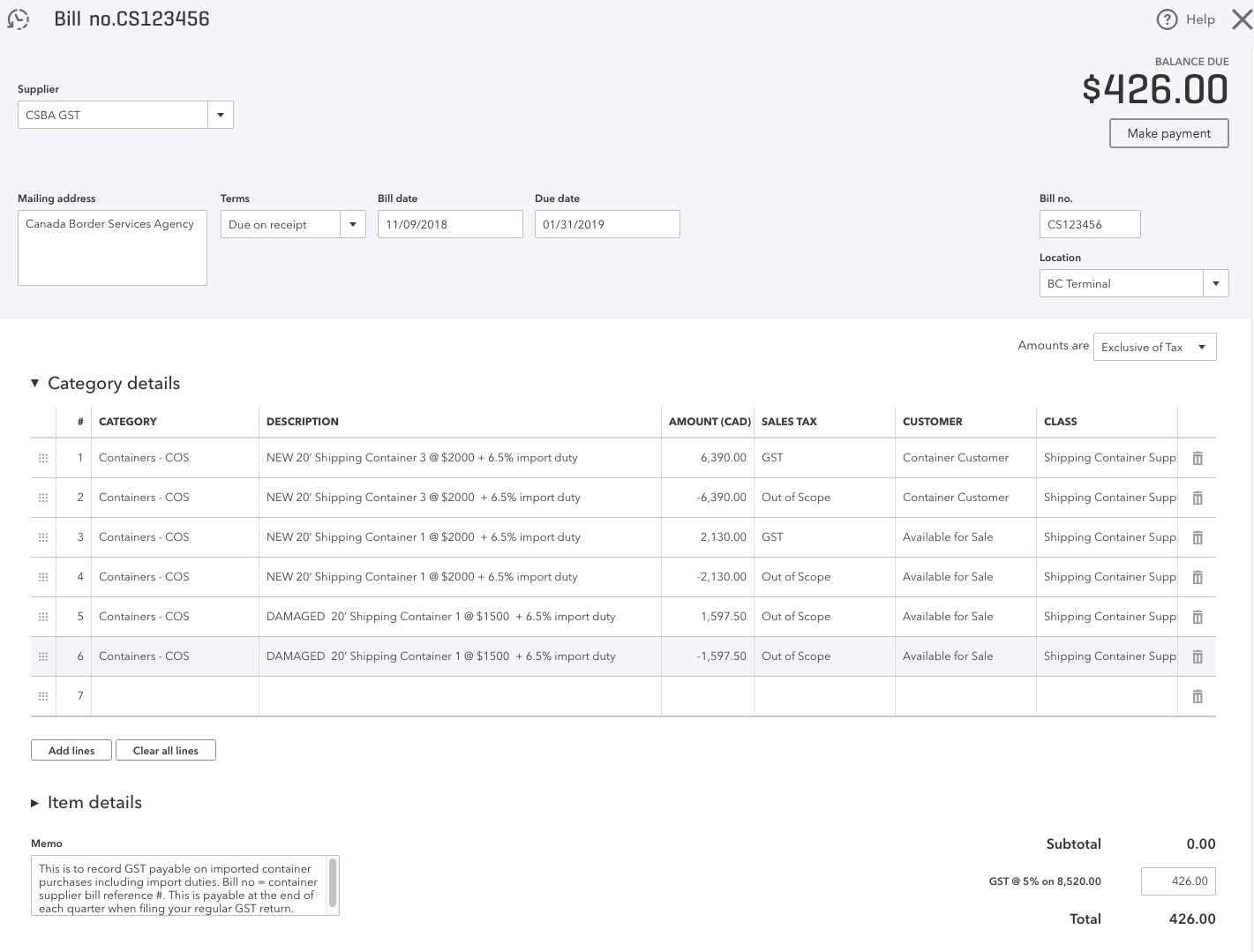

Let's book the GST Payable now. I like to record my CBSA GST under a different supplier than CBSA duties.

Setup a supplier called CBSA GST if you don't have something similar already setup in QBO. Once you've done that, follow these steps to record the GST Payable on the imported shipping containers.

- Create a bill. Date the entry on the same date as the day the supplier bill was paid, not the date the supplier invoice was issued. This is the date you will need to select the correct CBSA foreign exchange rate. For this example the paid date will be November 9, 2018 ... one day after the supplier bill was received.

- Set the due date to be the same date as your quarterly GST return is due. You can see below, I forgot to do this before I took the screen shot. In this example it should be set to January 31, 2019. That is when the 2018 fourth quarter GST return is due. This doesn't mean you can't pay the bill earlier, just that this is the date it must be paid to avoid late penalty and interest charges.

- Input a Bill No. I use the container supplier's bill number to tie the import back the purchased being assessed the duty.

- If you are tracking locations, input the location where the shipping container entered Canada.

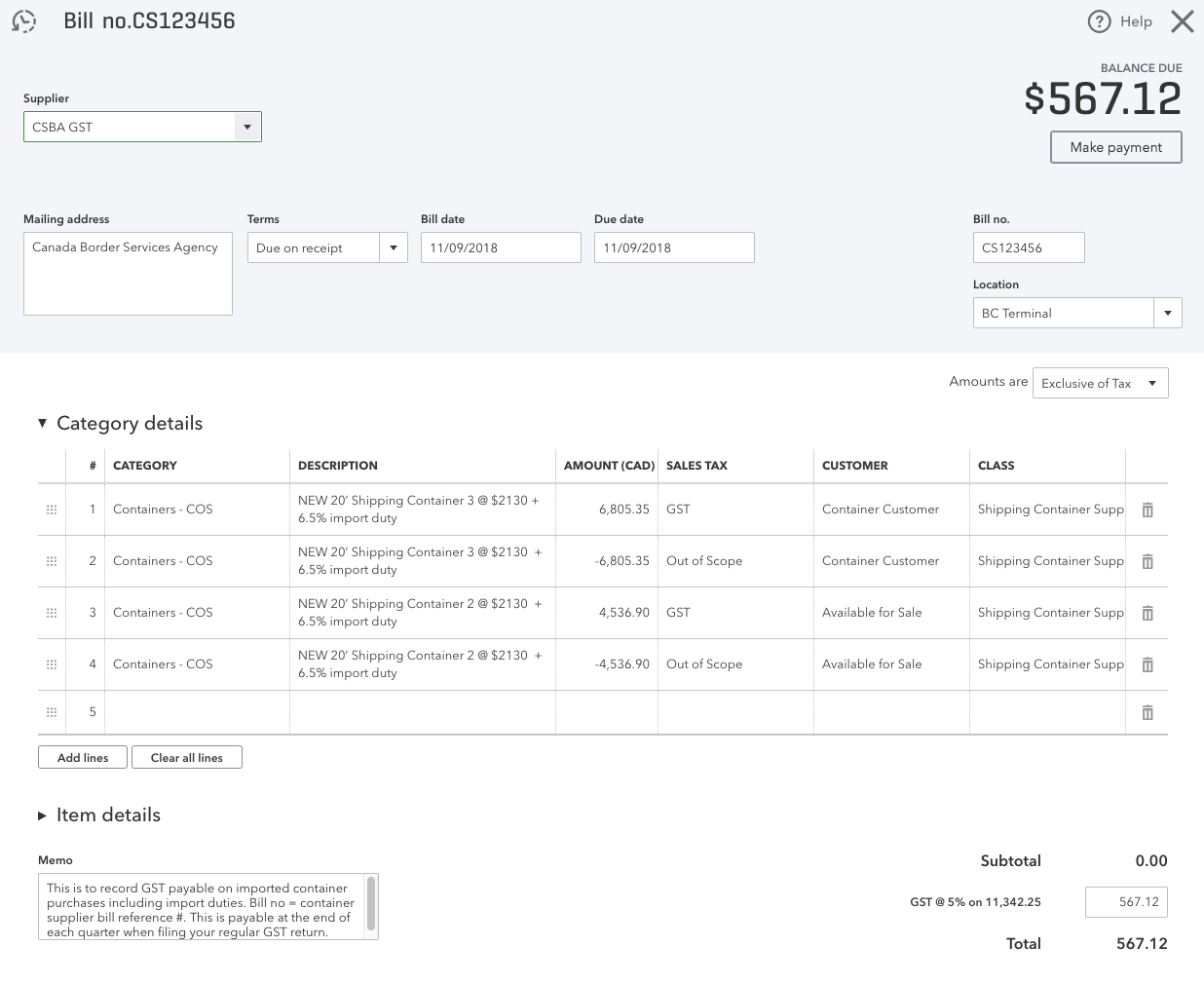

- Check to make sure the "Amounts Are" box is set to "Exclusive of Tax".

- We need to get the GST payable into the sales tax module, so in the "Category Details" area, select your Cost of Goods Sold account for your shipping containers. Enter the value of the containers PLUS the 6.5% import duties into the amount field. Set your sales tax code to GST and fill in the customer and class fields so that your gross profit by customer and container calculates properly.

- On the next line, we need to back out the value of the containers as the purpose of this entry is to get the GST Payable into the sales tax module and record your GST liability to CBSA. To do this, select your Cost of Goods Sold account for your shipping containers again but this time enter the SAME amount as a negative number. I CHANGED the sales tax code to Out of Scope. (Oops!) This was my bad. The sales tax code should be set to Exempt so that the gross value of the goods is also backed out of the sales total in your Sales Tax module. Fill in the customer and class fields so that your gross profit by customer and container calculates properly.

- Take a look at your Bill Subtotal at the bottom right hand side of the form. It should be zero if you entered everything correctly. The GST payable should be showing and equal the Bill Total. If not, you need to go back and figure out where you went wrong.

- Make good memo notes and attach any relevant documents to the entry.

- Save and close your entry.

Here is a snapshot of the CBSA GST entry I made in QuickBooks Online. I'll explain further down in the chat why this entry is not correct.

Example of self assessed CBSA GST bill in QBO

Example of self assessed CBSA GST bill in QBOGood To Know

Another Way to Enter

CSBA GST

Some bookkeepers prefer to enter $0.01 in the amount field instead of the value of the goods. They then manually input the GST payable into the GST field on the bottom right of the screen. This works too.

The reason I didn't choose this method is:

- I want to associate the cost of the goods with the sales tax payable;

- I want the platform to calculate the sales tax payable;

- I worry that if someone opens the entry to look at it after I have booked it (it might even be me doing that!), there is a chance the manually entered GST will be lost and revert to zero. I just don't want to take the chance of that happening; and

- I think it is easier during an audit for the auditor to see the gross value of the goods purchased.

Next Step - Check The Accounts Payable Report

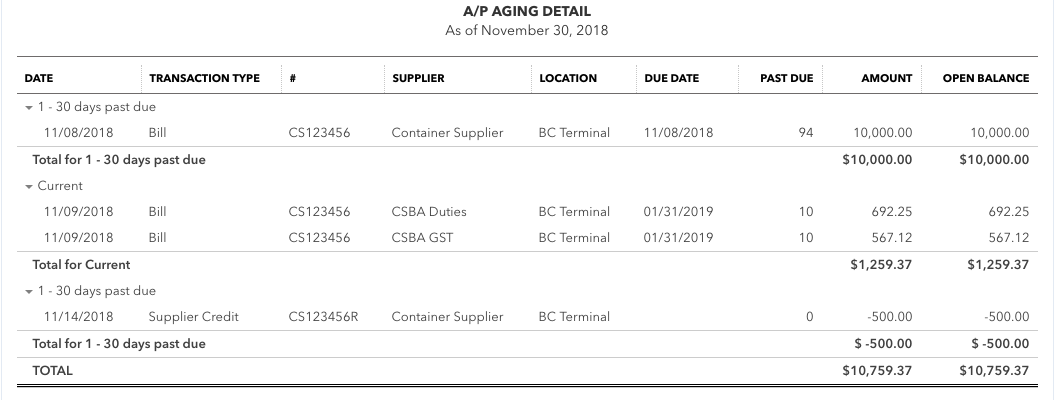

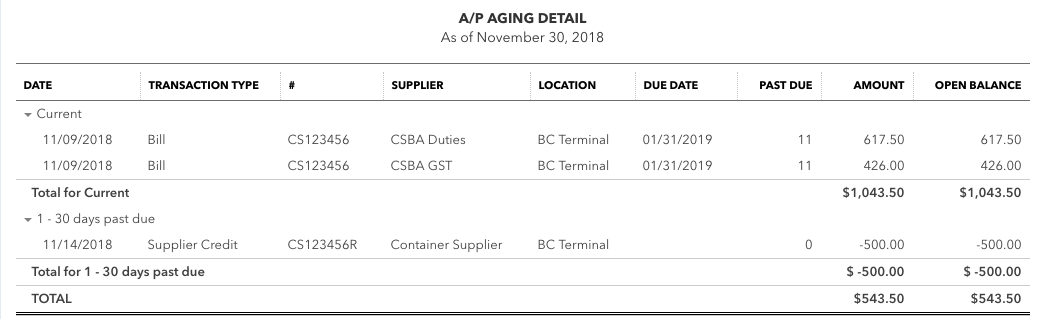

Let's take a look to see if our Accounts Payable module is correctly reflecting the liabilities associated with the purchase of the five (5) shipping containers.

Run the Accounts Payable Detail Report. To simplify this example, I did filter the Suppliers so that only the ones I'm using in this example show up.

Example of Accounts Payable Detail report in QBO

Example of Accounts Payable Detail report in QBOLooking at the details, you can see the invoice outstanding for the $10,000 of shipping containers purchased. This is NOT correct. I forgot to pay this invoice on November 9th as that is the day we booked the CBSA duties and GST Payable because this is when they become a liability. If I had paid the bill ... like I was supposed to ACK ... , it would not have shown up in this report.

Under current details, you will see the CBSA duties bill and the CBSA GST bill we entered. I made some calculation errors when self assessing but I caught them when I analyzed the income statement. (This is discussed in the next section in the chat.)

You should also notice that the $500 refund for the damaged containers is showing up from my inventory refund chat. This is correct because the supplier credit will be applied to a future purchase.

I made all the necessary corrections; reran my payables report. (You can see the revised Accounts Payable report in the next section of the chat.) Everything looks goods on the second go round, so let's take a look at the effect these transaction had on the income statement.

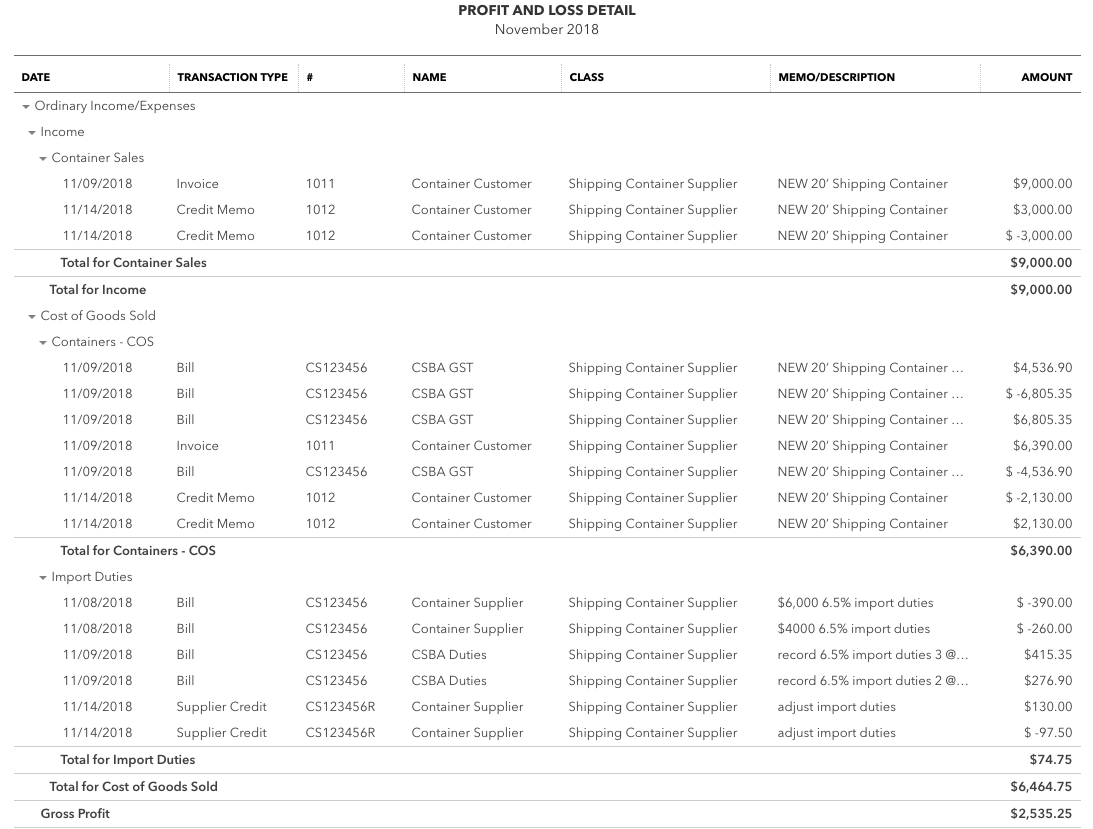

What Happened On The Income Statement

Bookkeeping is MORE than just data entry. It is extremely important that you review your work to ensure it makes sense and you haven't made any data entry errors. This section of the chat is going to show you how I reviewed my work and found errors that need to be corrected.

Below is a snapshot of the detailed income statement. You may have to zoom in on the picture to see the detail. A couple of things to notice.

- The container sales show the sale of the three (3) containers to our customer. It also shows swapping the damaged container for the replacement container. This was discussed in the chat about how to return damaged inventory.

- There are a lot of transactions showing under the Cost of Goods Sold (COGS) for Containers. It shows the booking of the GST pertaining to the five (5) containers - three (3) sold to the customer and two (2) available for sale. This is an in and an out pairing as we only wanted to get the GST into the sales tax module not remove unsold containers from inventory.

- You can see the swapping of the damaged container and placing it back into inventory. This event occurred because I issued the credit memo to the customer.

- Everything nils out except the cost the containers sold to the customer. When I issued the invoice, QBO automatically removed the containers from inventory and moved the cost of the containers to the Cost of Goods sold on the income statement.

- CBSA duties look wrong. Why isn't it zero because I have allocated the import duties to the cost of the container all the way along? I've made a mistake somewhere. Let's go find it.

Detailed Income Statement

Detailed Income StatementAfter going back and looking at the CBSA duties entry, I see my mistake. I calculated the import duties on the cost of the container plus duties. I should have calculated it solely on the cost of the container. Here is the correct entry.

Corrected CBSA Duties Bill

Corrected CBSA Duties BillI also calculated GST owing incorrectly. I forgot to include the $500 refund we received for the damaged container plus I doubled up on the duties as $2130 included the duties already. I really should have booked the effect of the refund separately as it happened on November 14th (after we paid the bill on November 9th), but for simplicity's sake in this example I corrected the data in the original bill. Here is the revised entry.

Corrected CBSA GST Bill

Corrected CBSA GST BillNow that I've corrected my mistakes and checked that CBSA import duties are netting to zero as expected, it's time to take a look at the revised Accounts Payable report and a few other views of the income statement ... one by customer, one by class and one by supplier ... just so you see the effect the entries had on these groups. It is interesting.

Revised Accounts Payable Report

Revised Accounts Payable ReportThe revised Accounts Payable report shows the corrections I made to the CBSA duties and GST bills ... as well, the Supplier container bill no longer shows up. It turns out I had paid the bill but I had dated it as 2019 and not 2018. Once I corrected that data entry error, it is removed from the Accounts Payable report.

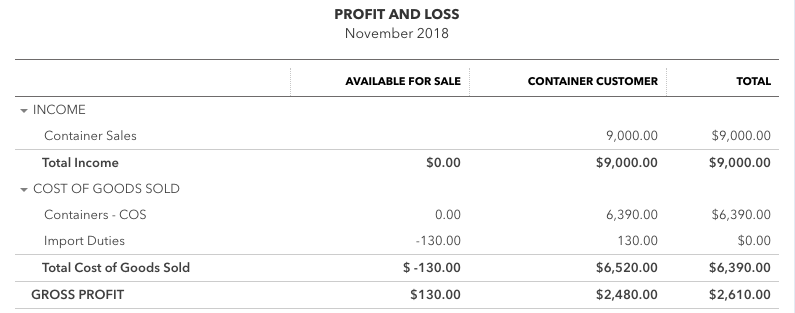

Income Statement by Customer

Income Statement by CustomerHmm, the Customer view of the income statement isn't what I was expecting. Notice the $130 from replacing the damaged container is allocated between the customer and inventory on hand. I'm not sure why that is happening so I'll have to think about it ... but the net effect is correct so let's move on for now. I think it will have something to do with the Customer's credit memo and how FIFO works in QBO.

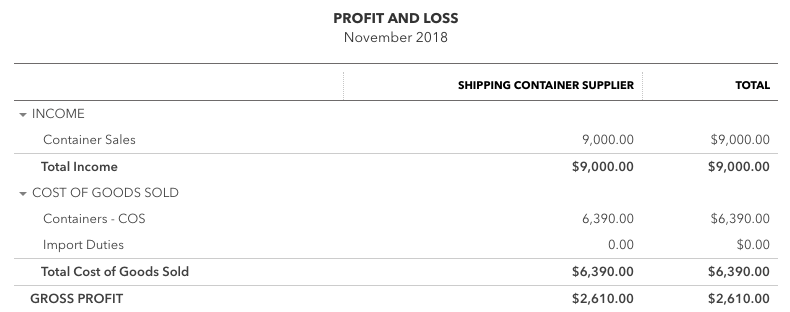

Income Statement by Class

Income Statement by ClassThis Class view of the income statement is what I was expecting.

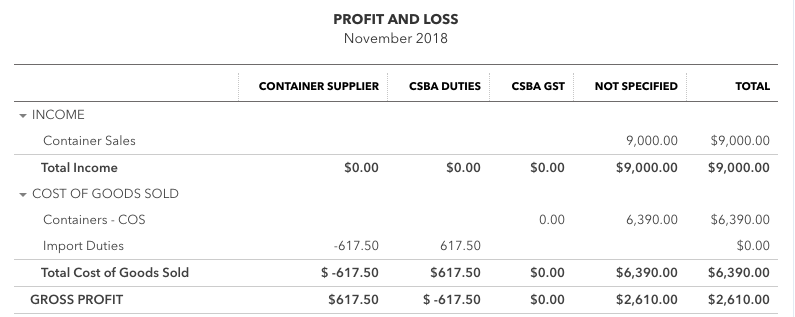

Income Statement by Supplier

Income Statement by SupplierThe Supplier view is interesting. While the CBSA duties column shows the allocation to the cost of the container, CBSA GST column is blank. There is a reason for this. Do you know what it is? The GST expense does not show up on the income statement because GST payable is sitting on the balance sheet.

Each view shows something slightly different. When analyzing the CBSA duties and GST costs this way, you can see it looks like it really wasn't absolutely necessary to allocate the cost of the duties to the container because I am tracking every direct cost back to the customer and supplier. If I had not done the allocation, the import duties would have reported accurately on the income statement instead of being buried as part of the cost of container ... but the cost of inventory on the balance sheet would have been understated and the cost of goods sold would be overstated because the goods associated with the costs haven't been sold yet. Running the income statement by supplier will quickly let the business owner see the amount of duties paid.

The CBSA duties and GST look goods. Except for the slight issue with the Customer view of the income statement, anomalies have been explained ... I'll give some thought as to why that is happening ... but in the meantime, I can now move on to the next bookkeeping entry sitting in my inbox.

Recap CBSA Duties and CBSA GST Steps

- Book your container supplier bill adjusting the cost per unit for any landed costs associated with the inventory (for example import duties). If you aren't sure how to do this, I cover this in my inventory returns chat.

- Pay your container supplier bill. Make a note in your mind that every time you pay a container supplier bill, you need to create two more bookkeeping entries - one for CBSA duties and one for CBSA GST.

- Self assess and create the CBSA bill for import duties to record your liability. Date it the same date as the bill payment date of the shipping containers. Due date is the date your quarterly GST return is due.

- Self assess and create the CBSA bill for GST payable to record your liability. Date it the same date as the bill payment date of the shipping containers. Due date is the date your quarterly GST return is due.

- Run your A/P Aging Details report and verify that everything booked as anticipated.

- Run your Income Statement by Customer, Class and Supplier to see if everything is showing up as expected.

- Correct any errors you find during your analyze of the Accounts Payable and Income Statement.

QuickBooks Online is a powerful accounting platform for small businesses. However it is not always easy or intuitive on how to enter certain transactions like CBS duties and CBS GST. I've captured my research in these notes so I don't forget ... because I use my website as a bookkeeping resource that I too refer to often! As a matter of fact, this site is bookmarked as one of my favorites.

Hopefully this chat smoothes your journey in learning QuickBooks Online. Now your learning break is over and it is time to get back to entering those supplier bills that attract CBSA duties!

It's been great chatting with you.

Your Tutor

12 Part QuickBooks® Primer

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Click here to subscribe to QuickBooks Online Canada. I do not receive any commissions for this referral.

Home › Bookkeeping Systems › Recording CBSA Duties and CBSA GST in QuickBooks Online