- Home

- Virtual Workflow

- Plooto Workflow

Learning QuickBooks® Online | Focus on Bookkeeping Workflow

QBO - Plooto Workflow Integration

by Gayle Ryan, Marketing Manager

(Guest Author from Plooto Inc.)

Published October 2017 | edited June 14, 2024

WHAT'S IN THIS ARTICLE

What is Plooto? |Simple Transactional Pricing | How Does Plooto Work? | Accounting Automation and Plooto Workflow | Other Workflow Chats

Integrating payments into your cloud accounting workflow

Today, most businesses have begun to use technology for accounting, and many have migrated to cloud services. Despite this shift to technology in many areas of accounting, payments are still done the old-fashioned way. Businesses still rely on antiquated technologies like cheques and wires, and these methods of paying bills and invoices are time consuming, they are expensive, and they don’t integrate well into modern cloud accounting practices. There are some electronic payment services; however, these are primarily consumer technologies that don’t serve business needs very well. There must be a better way.

The pain of payments is the inspiration behind Plooto.

Chat Continues Below Advertisement

What is Plooto?

Plooto is a business to business payment platform that enables small to medium sized organizations to pay all of their domestic and international bills and invoices, completely eliminating cheques and wires. The platform integrates with QBO and other accounting software packages, it auto-reconciles payments with accounting software, and it has a dashboard that enables bookkeepers and accountants to manage all of their clients easily from one central place. Paying bills may never be fun, but with Plooto it can be easy.

Plooto is built for business

Today, many businesses are using consumer technology, such as Interac and PayPal to process payments. While these technologies work well for consumers, they lack functionality that businesses need. For instance, Interac has a cap on the amount of money that can be sent in a day or week, and it can only be used to send money in Canada. PayPal has limitations as well; PayPal transfers must be sent to another PayPal account, it is designed and built for merchants, and there is also no easy way to pay a batch of payments because payment information must be entered for each individual payment. Neither PayPal nor Interac payments auto-reconcile with accounting software.

Plooto addresses all of these limitations.

- Plooto payments can be sent to any bank account - domestic or international (Canada, US, Australia, UK, EU, China, India, and Mexico, with more countries to be added)

- There is no limit on the dollar amount being sent

- It is easy to “mass pay” or pay a batch of invoices from a single screen

- In addition to sending payments, like Interac, you can also collect payments using Plooto

- Plooto reconciles with QBO, QB Desktop, and other accounting software automatically.

Using Plooto, you can process both domestic and international payments (Plooto will convert the currency for you) and you only pay fees on the transactions you make. Plooto prices are lower than bank fees and PayPal.

Plooto is also a technology platform for small and medium sized businesses. There are other payment providers in the US, such as Bill.com, but these are built for enterprises, and the platform is not intuitive or cost-effective for smaller companies.

Good To Know

How does Plooto work?

Plooto is connected directly with your bank account and your payees’ bank accounts. When you make a payment with Plooto, the money is withdrawn directly from your account, and deposited into your payee’s account. Plooto gathers all of the account information from the payee, so there is no need for you to gather and enter that information to make a payment.

Plooto also has a “Plooto Instant” option, where you can pre-fund an account in Plooto if you would like to make payments immediately.

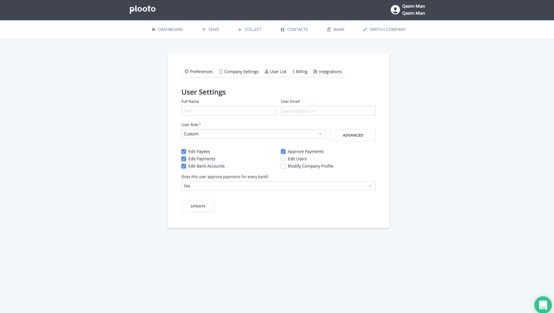

Workflows, payment approvals, and team members are completely customizable. When you add a team member to Plooto, you can set their permissions to approve payments. Every time you add a bank account to Plooto, you are automatically asked who needs to approve payments, and you can select any of the team members that have permission to approve.

Accounting Workflow

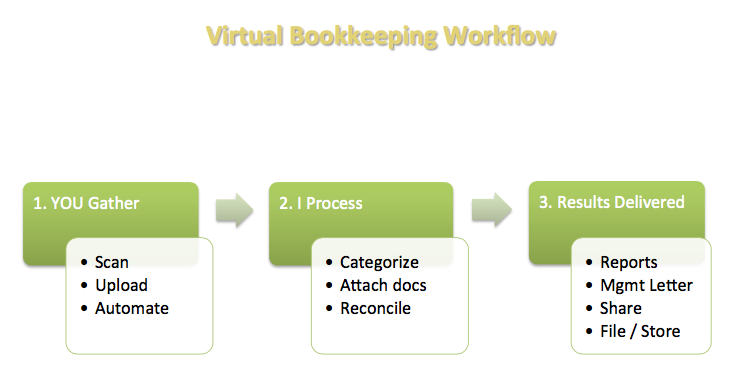

Every business and every accountant will have slightly different workflows, but there are a few key stages that everyone managing books must address.

1. Gather documents (receipts, invoices, etc)

2. Enter receipt and invoice into accounting software (attach docs, categorize, etc)

3. Approve payments (write cheques, wires, etc)

4. Make and collect payments (cheque signatures, go to the bank, etc)

5. Reconcile payments with QBO or accounting software

6. Deliver results (reporting etc)

In a traditional bookkeeping practice, there is a lot of manual or double entry to complete the steps in all of these stages. However, by using cloud accounting software including Plooto, much of the process becomes automated.

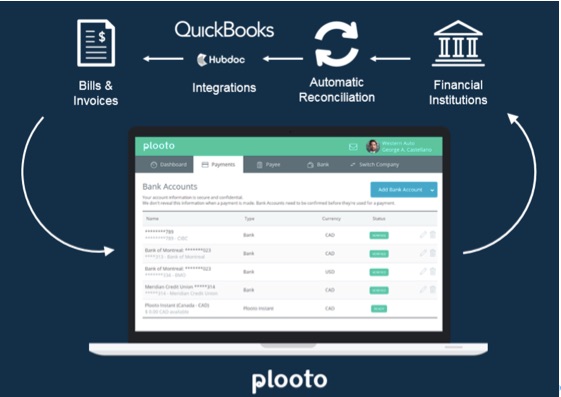

Plooto Workflow

One of the greatest advantages of using Plooto is that it integrates into existing cloud accounting workflows. Using Plooto alongside an accounting software package such as QBO, as well as other cloud accounting applications, your workflow would look something like this:

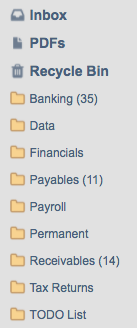

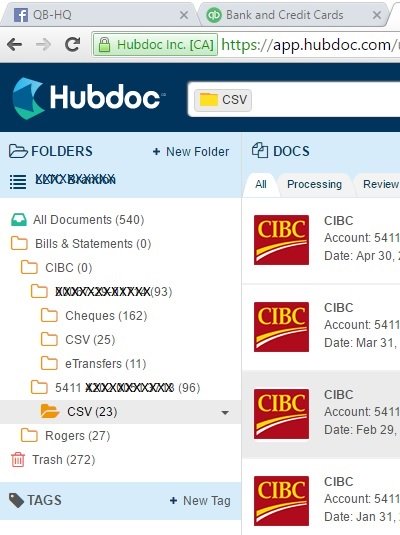

- Use a receipt capture tool (Hubdoc, Receipt Bank) to automatically upload all entries into QBO.

- Select, approve and track payments through Plooto.

- Deliver results (reporting, etc.).

Chat Continues Below Advertisement

Automation with Plooto Workflow

Several steps from the traditional accounting workflow are automated and eliminated when using Plooto, QBO, and a receipt capture tool. There is no need to manually fill out wire information or cheques because Plooto creates ready-made payments with the invoice information uploaded to QBO. Attachments from QBO are also carried over to Plooto, making it easy to approve payments from anywhere. Once the payment is approved and submitted, Plooto automatically reconciles records in QBO, marketing the bill as paid and matching status with the bank feed. The vendor is also automatically sent the remittance details via email and notified that the payment was made.

Integrating Plooto payments into your cloud accounting workflow removes most of the double-entry

processes from your workflow. Plus, businesses have full visibility into the

status of their payments, and all at a lower cost than the banks charge.

Chat Continues Below Advertisement

Using Plooto, you can streamline your workflow and spend more time on the value-add and advisory services that will help to grow your practice.

Get in touch with Plooto to find out more.

QBO Workflow App Integration Chats

Click on any image below to go to the chat.

© 2015 Google Inc, used with permission. Chrome™ browser and the Chrome™ browser logo are registered trademarks of Google Inc. Screen shots © 2015 Google Inc. All rights reserved.

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved. Hubdoc is a trademark of Hubdoc Inc. Screen shots © Hubdoc Inc. All rights reserved. LedgerDocs is a trademark of LedgersOnline Inc. Screen shots © LedgersOnline Inc. All rights reserved. Ablii is a trademark of nanopay Corporation © All rights reserved. Plooto is a trademark of Plooto Inc. Screen shots © Plooto Inc. All rights reserved. LedgerSync is a trademark of LedgerSync, LLC. Screen shots © LedgerSync, LLC. All rights reserved.

Bookkeeping Essentials › Virtual Accounting Workflow › QBO - Plooto Workflow