- Home

- Home Business Taxes

- Home

- Home Business Taxes

The T2125 Statement of Business Activities

Index for Self Employed Home Business Taxes

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published in 2010 | Updated April 15, 2024

Bookkeeping-Essentials.ca

Tax Primer For Sole Proprietors in Canada

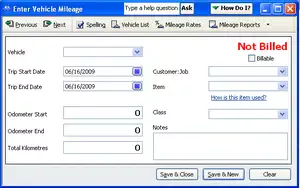

Click on any image below to go to the Bookkeeping-Essentials.ca article.

Advertisement

Canadian bookkeeping done properly assists in tax preparation. This index provides links to articles about basic tax savings and tax benefits for the self-employed business owner working from home.

Be ahead of the game this year, and learn about your tax planning opportunities before you lose tax deductions or get yourself in trouble with the CRA.

Then implement bookkeeping procedures so you capture what you need throughout the year.

MORE >> Canadian Income Tax Compliance for Small Business