Reverse GST Filing

by Laverne Dee, Deetailed Bookkeeping Services

(Innisfil, ON)

Oops, I didn't file the prior sales tax return in QuickBooks.

Good Morning Laura,

Just a quick question: Do you know if you can reverse GST filing in QuickBooks desktop??

I have a situation where I filed the June 30/10 GST report but didn't do the March 31/10 one, now I can't go back and do both reports for filing in QuickBooks. I have taken care of CRA; not a problem!!!

Thanks.

Hi Dee,

Check in the Intuit community forum. Search for the term "reverse sales tax filing". Intuit deletes posts but the last one I found was at:

https://community.intuit.com/questions/692301-how-to-reverse-sales-tax-filing .

Basically it explains that you should take a backup copy of your company file. Then go in and delete the June journal entry made by the software when you filed the sales tax return. The journal entry you want is look for number GST/HSTCA000#. Now you are good to go.

If you've been making entries to "closed" periods after you filed your GST report it may not be an exact match when you "refile" in QuickBooks. I would scan your GST register (or your exception reports) to find the transactions posted after your March return was filed and change the date to April 1 (the start of the June quarter.) Then file your March return. Check to make sure it matches your return filed with CRA. If yes, then file your June return.

On the chance that you took a backup copy BEFORE you did your filing, you could always restore your copy before you did the filing.

Return to Learning QuickBooks.

GST Filing in QuickBooks®

by Mary Jones

(Canada)

Tracking transactions posted to a period already filed with CRA

I am new to QB (QuickBooks®).

I would like to know how to clear the last report from filing GST on line.

The last person did not clear the report and now it is reporting the previous quarter when I run the report as well as the current reporting period.

Hello Mary,

I think what you are asking is ..

... how to show the prior quarter GST report (filed with CRA) as filed in QuickBooks® ... because the prior bookkeeper filed the report online with CRA ... but did not "file" the report in QuickBooks®.

This is what I would do if there are not a lot of transactions involved.

- Run the GST/HST Return Report for the last quarter that it was filed.

- Compare it to the report filed (form GST 34-2). Hopefully they are the same.

- If they are the same, I would print the Summary (GST/HST Return Report) and Detail (Tax Agency Detail Report) reports to attach to the GST return filed. I do this step to audit proof the return.

- Now, I would go to Manage Sales Tax and file the report in QuickBooks®. This should mark each item as filed so that when you run the current quarterly GST report, previously filed items should no longer show up.

- Set your closing date to the last date of the return you just "filed" ... so no other transactions can be posted to it.

- If they are not the same, I would try and identify which transactions were posted after the GST filing date using the Audit Trail report. Customize the reporting dates for the period to be ... the next day after the GST report was filed to today's date.

- Edit any transactions posted after the GST report had been officially file with CRA.

I would change the transaction dates to the first day of the next unfiled period ... AND make a memo note too showing the date of the original transaction ... so you can trace it back to the source documentation should the need arise.

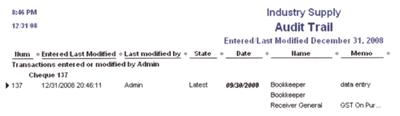

In the example shown in the picture above (sorry about the picture size), let's assume that the current date is January 25 and that you filed the GST report to CRA on October 21.

(For this example, I would customize the audit report dates to be from October 22 to January 25.)

You can see a transaction was posted on December 31 ... but back dated to September 30. July 1 to September 30 GST reporting has already been filed ... so I would change the date of this transaction to October 1 with the memo as explained above. - Now rerun your GST/HST Return Report. If you have caught every transaction, the QuickBooks® report for the last filed period (July 1 to September 30 in this example) should match the one filed with CRA.

- Once you have them matched, follow steps 3 to 5 above.

When you have filed both reports, I would take a back-up and ensure the file name had an identifier on it like 4th q 2008 GST. I do this to audit proof my GST return. If I'm ever audited, I can pull the file up if need be.

An Alternative Approach

If you can't reconcile the prior period ... or your volume of transaction is large, your next step would be to process the two reporting periods in QuicKBooks as one period.

Now, take the amounts shown in the Summary report ... and subtract out the amounts already reported to CRA.

The amounts you are left with would be reported in the current filing.

Finally, be sure to set the closing date and take your back-up.

This is how I would approach it Mary. Let me know how you make out.

QuickBooks and QuickBooks ProAdvisor are registered trademarks and/or registered service marks of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Comments for GST Filing in QuickBooks®

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||