Refund of HST

by Corinne

(Fairview, AB)

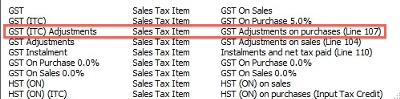

ITC Adjustment Setup

Good Day!

First of all, thank you for your great website! You answered lots of questions already, but I still have a few...

We import goods from the States and of course at the border we have to pay GST. Last year we got charged HST (was their mistake) and finally we got the money back. Unfortunately I couldn't figure out how and where to balance it in QB.

Plus, paid income tax from the previous year, where do I record this?

Thank you for your help and have a great day!

Corinne

Hi Corrine,

As a general rule, when you get a refund, you post it back to the account where the original entry was booked. In this case, I believe that would be your GST/HST payable account. I also assume you claimed the HST ITC. If that is the case, then this is what I would do:

I have included three snap shots above. You need to click on each one to move to the next one.

In the first snap shot titled "ITC Adjustment Setup", I am showing you how I usually setup an item for line 107 of the GST/HST Return.

I would prepare a journal entry as shown in the second picture above (HST Refund Journal Entry) ... except I forgot to remove the "x" in the adjusting entry box before I took the snapshot ... sorry about that.

You can see I am debiting the bank and crediting GST/HST Payable.

In the third picture with the caption "GST HST Report", I am illustrating where on your GST/HST report the adjustment will show up.

With regards your income paid for the prior year. I am assuming you are a corporation. If this is the case, I think this is the entry you are looking for:

You would debit Corporate Tax Payable and credit Cash in Bank.

You might want to review this other forum post on how to book your corporate tax instalments and accrue your corporate tax payable in the prior year.

Post back if you aren't clear on anything I've said Corinne.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Screen shots © Intuit Inc. All rights reserved.

Comments for Refund of HST

|

||

|

||

|

||

|

||

|

||

|

||

|

||