How to record interest earned on loan to subcontractor

by Aracelli

(Australia)

Publisher: This post was corrected January 2018. The original entries presented were incorrect. See the comments sections.

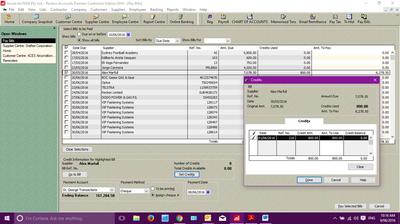

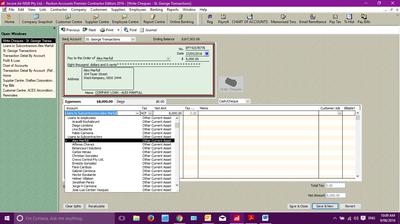

Hi, I need to record interest earned from a loan to one of our subcontractors: loan was $8000 and we agreed on $800 to be repaid fortnightly plus $33 interest,so $833 will be deducted from his invoice payment each fortnightly. I created a cheque on his name for $8000 on the date the money was loaned that came our of my bank (see pic 1 attached), then i recorded a Journal entry (see pic 2,3,4) for the loan repayment of $800) this reduced the loan amount to $7200 (pic 5) and automatically reduces his payment amount by $800 when paying his work invoice that fortnight (pic 6)

I need to know how to record the $33 interest we are earning, how to make it come up in the deductions/ credits log?

Please help!!!!!

Hi Aracelli, sorry I can't see what your screen shots are showing as the print is too small. However I'll quickly walk you through your entries and you can see what you've missed booking:

Contractor's entries:

1. Record the loan:

Debit Loan Receivable (a current assets account) $8,000

Credit Cash in Bank (make the cheque payable to the person you have lent the money to.) $8,000

2. Record the fortnightly repayment of the loan:

Debit Cash in Bank (This total calculates automatically when you use the Deposits screen under the banking menu.) $833

Credit Loan Receivable - principal only $800

Credit Interest Income $33

Subcontractor's entries:

Contractor's entries

1. Record the loan:

Debit Cash in Bank (deposit the cheque you received for the loan.) $8,000

Credit Loan Payable (a current liability account) $8,000

2. Record the fortnightly repayment of the loan:

Debit Loan Payable - principal only $800

Debit Interest Expense $33

Credit Cash in Bank (This records the cheque you made to pay the loan) $833

Hope this helps.

Comments for How to record interest earned on loan to subcontractor

|

||

|

||

|

||