- Canadian Bookkeeping Compliance Resource

- Small Business Tax Obligations

- Tax Compliance for Small Business

Tax Compliance For Small Business

Learn Your Tax filing Deadlines and Obligations

By L.Kenway BComm CPB Retired

Edited April 5, 2024 | Updated January 14, 2024 | Originally published on Bookkeeping-Essentials.com in 2011.

2024 TAX ALERT

CRA's prescribed interest rate on overdue taxes for the first and second quarter of 2024 is a whopping 10%. If you are going to owe income taxes this year, make sure you file and pay taxes owing by April 30th. Interest on unpaid balances will compound pretty swiftly at 10%.

New business owners tend to put off their tax compliance responsibilities and obligations until the end of their first year. It's better to get all your ducks in a row from the start.

Get all your ducks in a row so you can file on time!

Get all your ducks in a row so you can file on time!What exactly is tax compliance for small businesses in Canada?

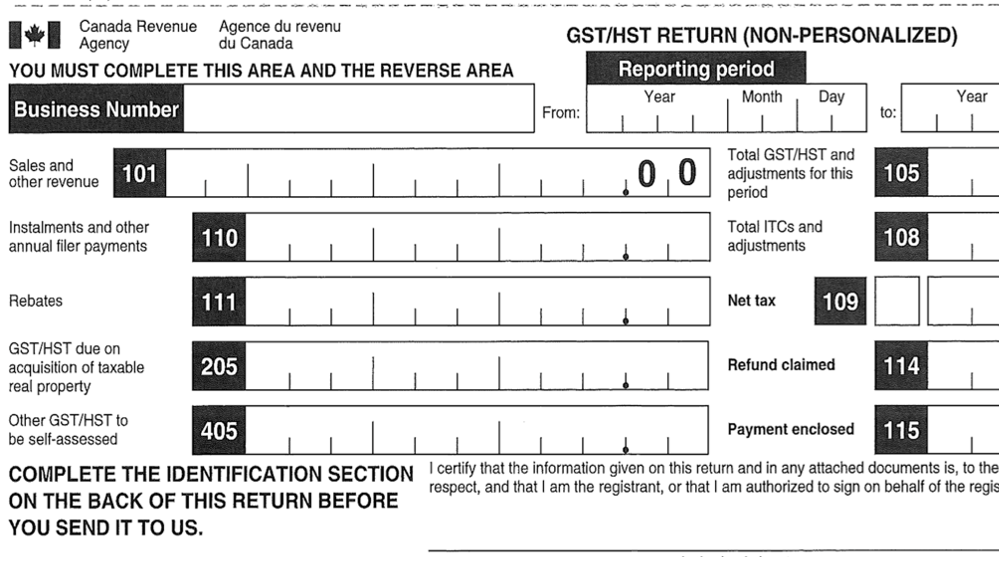

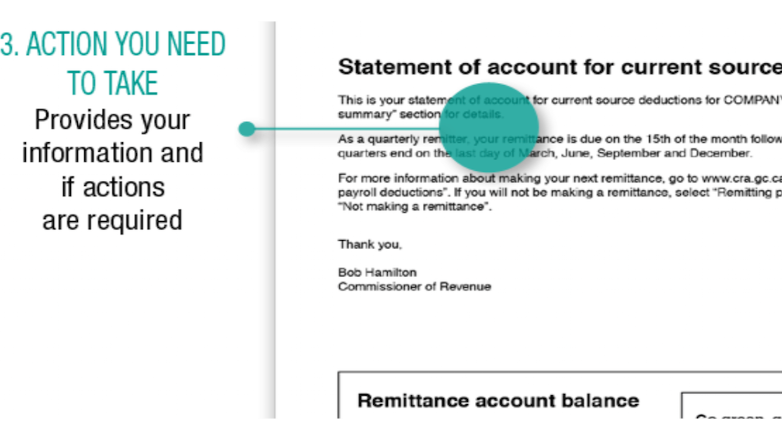

Tax compliance for small businesses refers to meeting all your responsibilities and obligations to report and file your sales taxes (GHS HST PST), payroll taxes (source deductions and employer contributions), business income taxes as well as other government taxes or forms such as records of employment (ROE) when necessary. Basically tax compliance is about staying onside of all the tax laws pertaining to operating a business in Canada.

Compliance Deadlines

- Quarterly PD7A - 15th following end of calendar quarter

- T4 slips - Last day of February

- Annual Returns - June 15

- Quarterly Returns - end of month following end of fiscal quarter

- T1 Sole Proprietor - June 15 to file; balance due April 30

- Installments - quarterly on 15th

- T2 active - 6 months after yearend; balance due 3 months after yearend

- T2 passive or PSB - 6 months after yearend; balance due 2 months after yearend

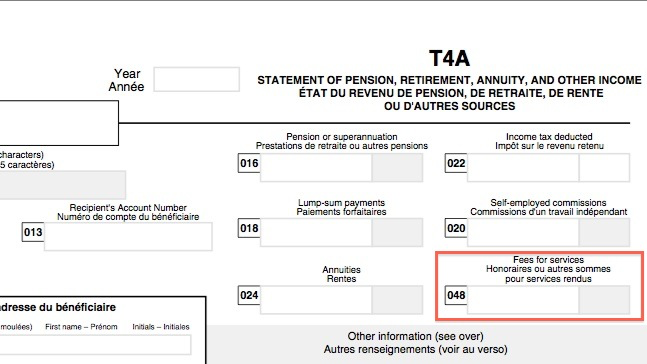

- T4A - Last day of February

- T5018 - Six Months After The End Of The Reporting Period You Have Chosen

CRA WANTS YOU TO BE A DUCK

If it looks like a duck, swims like a duck, quacks like a duck, it is probably a duck. If you are a small business owner in Canada, you must look like a duck, swim like a duck, and quack like a duck. How do you do this? You can get a business license, purchase business insurance, have a business bank account, select a credit card you use only for business expenses, and buy supplement business coverage on your personal vehicle if you use it for business because you want to be a duck! You do. You really do! Why? Because CRA wants you to be a duck.

NEW BUSINESS OWNERS

New business owners tend to put off their tax compliance responsibilities and obligations until the end of their first year. By this time everything has piled up making you want to walk away instead of dealing with all the paperwork. When you do finally sit down to wade your way through the mess, you don't remember a lot of the little things needed to have an accurate set of books. This is where tech can be your friend. Scan your receipts as you go with notes or email/upload them to a document management app like LedgerDocs again with notes. If you make a HABIT to do it right there in the store or restaurant, you won't be second guessing yourself later.

If you want your business to succeed past year five, make it a HABIT to file and pay your compliance taxes on time. If you can't pay, be responsible by still meeting your reporting requirements, and making payment arrangements with the CRA. Sticking your head in the sand won't make the problem go away; it will only get worse.

-- Get all your ducks in a row. -- Save yourself some headaches. --

To make it easier for you to develop the HABIT of getting and keeping all your ducks in a row, I've put all your basic deadlines pertaining to tax compliance for small business into one site. I hope this free resource saves you time in your busy, over-scheduled day.

The time for a map is before you enter the forest. Here's your map to meeting your tax compliance obligations.

Help getting all your ducks in a row

What are you looking for? GST deadlines, payroll deadlines, business income tax, independent contractor deadlines ... WHAT! There are deadlines for independent contractors?

Pieces Of The Puzzle Coming Together

HIGHLIGHTS OF THIS POST

If it looks like a duck, swims like a duck, quacks like a duck, it is probably a duck!

- More Help On Getting All Your Ducks In A Row

Where do you want to go now? Income tax, GST, payroll, or independent contractor deadlines.

- Tax Compliance for Small Business

Owning and operating a business in Canada means you have some key legal issues you need to consider.

There is now a requirement with respect to government remittances other than income taxes to disclose the amount payable on the balance sheet at the end of the period.

Yeah that's right. Your banker is going to know if you are behind in remitting your sales tax collected or source deduction remittances. Another good reason to get all your ducks in a row!

- Sidebar: Funny Thing About Habits

When you have the right foundation, good money management and compliance practices becomes effortless; feeling good overall about your business is a side benefit as the puzzle pieces start to lock into place.

SMALL BUSINESS INCOME TAX DUE DATES

Spouse's T1 return filing deadline changes to your sole proprietor filing deadline with is June 15th. However taxes owing must be paid by April 30th which shouldn't be an issue if you have been remitting your quarterly installments.

Your required quarterly installments are determined each year when you file your return. Check your notice of assessment when it arrives for details on the amount your are required to pay.

Corporate tax compliance deadlines vary depending on whether you have active or passive income, or are classified as a personal services business. You have three installment options to choose from.

Do you have unremitted GST HST owing, unremitted source deductions, or unpaid corporate income taxes? Then you have a problem. Obligations surrounding tax compliance for small businesses in Canada means you have opened yourself up to a director's liability.

Tax Compliance for Small Business in Canada

What is tax compliance for small business? As mentioned in the introduction, the Canada Revenue Agency (CRA) requires regular reporting of Canadian sales tax, payroll taxes, and income taxes. Each province and territory has its own tax-related requirements as well. These regulations are often referred to as government compliance requirements.

Owning and operating a business in Canada means you also have some key legal issues you need to consider. Queen's Legal Aid says, "The sole proprietor can be held personally liable for all debts and obligations of the business. This risk extends to any liability incurred by any of its employees. Thus, the owner may be held personally responsible for things such as unpaid debts or legal actions that arise against the business."

Government Remittances ... and ASPE

ASPE (Accounting Standards for Private Enterprise) that came into effect on January 1, 2011. ASPE replaced GAAP (Generally Accepted Accounting Principles). It resulted in a new tax compliance for small business requirement.

The disclosure requirements under ASPE were reduced ... and simplified. One significant disclosure was added.

ASPE affected how you report government remittances on your financial statements. There is now a requirement with respect to government remittances other than income taxes to disclose the amount payable at the end of the period.

The reasoning behind this is that lenders are the primary users of small business financial statements. Lenders view the status of government tax compliance remittances as important because they have priority status in a bankruptcy.

Remember, to have a profitable long-term business in Canada, you must look like a duck, swim like a duck, and quack like a duck. You do this by learning good tax compliance habits.

Sidebar: Funny thing About Habits

This is the year I start making my health a priority and establishing new habits. I have time! I'm retired now. In hindsight, I should have started earlier.

Funny thing about habits. I'm currently reading Fiber Fueled - The Plant-Based Gut Health Program by Dr. Will Bulsiewicz. He's a gastroenterologist and as a newly retired person (meaning age related stuff), I find myself in the position of needing to improve my gut microbiome ... for a whole slew of reasons not the least of which is to reduce inflammation - the root of most disease. Hence reading his book.

You'll be happy to know ... or not ... I'm having good results following the Diversity Diet. It's an inclusion diet and easy to follow. No calorie counting. You don't have to stop eating stuff you are already eating ... but you may find the more you follow the program, some of your food choices may change by choice. You just have to aim to have 30 different plant based foods a week to improve your gut microbiomes which should improve the rest of your physical and mental health. Apparently most of us only eat ten.

Anyway Dr. Will gives great advice, some of which you can apply to the rest of your life. His take on habits is spot on. So the diatribe following is based on information in one of his emails ... I'm on his mail-out list. I found the truth of what he said can be applied to other areas of my life ... and to your business.

Dr. Will says, "When you have the right foundation, good health and feeling good overall becomes effortless." The same goes for your business. When you have the right foundation, good money management and compliance practices becomes effortless; feeling good overall about your business is a side benefit as the puzzle pieces start to lock into place.

A quote from his book says, "It’s time for us to redefine health care and acknowledge that health during our lifetime is the sum of all the small choices we make minute by minute, day by day. One choice, whether good or bad, makes little to no difference in the grand scheme of things. People don’t drop dead from having one cigarette. But if you create consistency, a pattern, then you are amplifying that choice over time."

This truism can also be applied to your business. Think about it. I mean really stop and think about it. How often do you justify tossing aside getting your compliance reports filed and paid on time because of a few bad choices you made yesterday or last week or dare I say last year? Do you just unconsciously decide that there is no point in trying to maintain consistency in meeting your tax compliance deadlines because you'll just mess it up?

Do you stop the habit of brushing your teeth ... WHAT? What do teeth have to do with your business? Hear me out! ... Do you stop the habit of brushing your teeth twice a day because one day you chose not to? Not **!!##% likely. You likely still brush your teeth because it's good for you and it's a habit ... it's a habit! Perfection is not the objective, consistency is.

You can get to the same place with the compliance reporting requirements of your business. It might require a bit of jigging on how you are managing your cashflow and managing your daily receipts ... but I bet I can help you find a system to put your cashflow management pretty much on auto pilot if you are willing to think and move outside the box you are currently in.

Okay we'll pick this thread up later. For now, back to tax compliance in Canada.

Tax Compliance In Canada

2024 Indexation Adjustments Of Personal Tax Rates

CRA has released the 2024 indexation adjustment for personal income tax and benefit amounts in a fact sheet. The chart reflects an indexation increase of 4.7% for 2024 and compares the indexed amounts to the 2021 to 2023 tax years.

Most of our tax and benefits rate are indexed to inflation. It affects your tax bracket thresholds, CPP contributions and EI premiums, TFSA and RRSP limits, and Old Age Security payments.

The tax and non-refundable tax credits take effect on January 1 annually. Most benefits are effective July 1, 2024 as they are tied to the filing of your prior year return.

More >> General tax and benefit filing deadlines

Tax Compliance for Small Business

Income Tax Filing Deadlines for the Self-Employed

Click here for Corporation T2 Deadlines

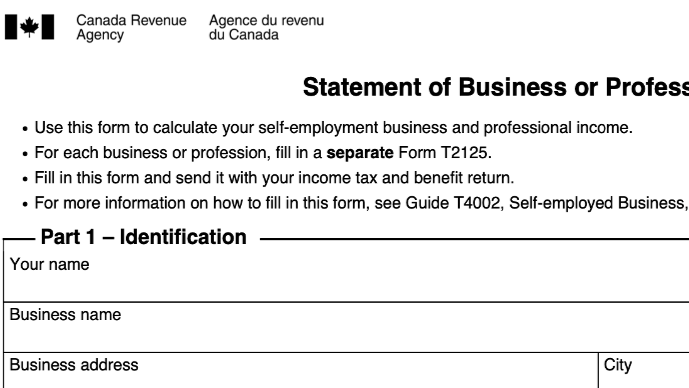

The self-employed file their business return on Form T2125 found in T1 package. If the deadline date falls on a weekend or holiday, it moves to the first business day following.

| Return Type | Filing Deadline | Balance Due Deadline (see note 1) |

Installments Due (see note 2) |

Spouse's Return |

|---|---|---|---|---|

| T1 (T2125) | June 15th each year | April 30th each year | 15th of March, June, Sep, Dec | same due dates as your business returns |

Self-Employed Tax Notes

Note 1

To avoid interest charges, pay your taxes owing by the Balance Due Date of April 30th, even if you are filing later. Don't know how much tax is owing - your bookkeeper or accountant will be happy to ESTIMATE the amount for you to pay. Another option is to use one of the many tax calculators out there to do your own estimate. I personally like the tax calculator at tax tips.ca.

Note 2

Your required quarterly installments are determined each year when you file your return. The requirement kicks in at the $30,000 threshold. There are several instalment calculation options. Talk to your bookkeeper or tax preparer ... or check out your most recent Notice of Assessment from Revenue Canada. You will not be required to make any installments if you are under the threshold.

2023/24 DUE DATES (See Note 2)

Self-Employed Quarterly Tax Installments

| Tax Type | Filing AND Payment Deadline | Tax Period | Form to be Filed |

|---|---|---|---|

| Annual Installment Farmers, Fishermen | December 31, 2023 | 2023 | reminder mailed in Nov |

| 4th Tax Installment | December 15, 2023 | 2023 | INNS3 E or T1162A |

| 1st Tax Installment | March 15, 2024 | 2024 | INNS3 E or T1162A |

| 2nd Tax Installment | June 15, 2024 | 2024 | INNS3 E or T1162A |

| 3rd Tax Installment | September 15, 2024 | 2024 | INNS3 E or T1162A |

| 4th Tax Installment | December 15, 2024 | 2024 | INNS3 E or T1162A |

Tax Compliance In Canada

Income Tax Filing Deadlines for Corporations T2

CCPCs file their business return using a T2 income tax return. If the deadline date falls on a weekend or holiday, it moves to the first business day following.

| Ownership Type (see note 1) |

Balance Due Deadline (see note 1) |

Filing Deadline (see note 2) |

Installments Due (see note 3) |

|---|---|---|---|

| CCPC personal services business | balance due 2 months after year-end |

6 months after year-end | last day of month |

| CCPC with passive investment income | balance due 2 months after year-end |

6 months after year-end | last day of month |

| CCPC active business income only | balance due 3 months after year-end |

6 months after year-end | last day of month |

Corporation Tax Notes

Note 1

Small Canadian-controlled private corporations (CCPC) must meet conditions for 3 months due date. If the CCPC earns investment income, payment deadline is 2 months after year-end.

- Active business income (ABI) EXCLUDES personal services business income and specified investment business income (also referred to as passive income) such as rents from property and interest, dividends or royalties from investments. This affects your payment deadline for income taxes.

Note 2

Watch out - A return MUST be filed even if taxes owing are ZERO OR your company is inactive.

Note 3

There are three installment options to choose from. Choose the one that lets you pay the least amount in installments. CCPC may be eligible for quarterly installments if criteria are met ... one of which is a perfect compliance history. Another reason to start the way you mean to go on and establish good compliance habits. Make it a part of who you are.

Good Compliance Habit

Directors' Liability for Compliance Taxes

Do you have unremitted GST HST owing, unremitted source deductions, or unpaid corporate income taxes? Then you have a problem. Obligations surrounding tax compliance in Canada mean you have opened yourself up to a director's liability. As a company director, please make it a habit to ensure all source deductions, payroll, and income tax remittances are always up-to-date!

The Toronto tax firm Rotfleisch & Samulovitch Professional Corporation's website, TaxPage.com, has excellent information on Director Liability for Unpaid Taxes.

The conditions under which a director is personally liable for unpaid compliance taxes are examined. It is essential to meet your tax filing deadlines to avoid liability. The article explains that:

- Under the Income Tax Act, a director and his/her corporation are liable for failure to deduct, withhold, or remit the required income tax, payroll, or GST amounts, as well as any related interest or penalty.

- A director can deduct the legal or accounting fees incurred to challenge the assessment.

- A director can avoid liability by demonstrating due care and diligence, which usually requires expensive legal representation.

- A director's liability for unpaid compliance taxes ceases two years AFTER he or she ceases to be a director of the corporation.

AUDIT READY

OPEN A SEPARATE ACCOUNT

The easiest way for small business owners to be tax compliant is to open a separate account to hold all funds held in trust for CRA.

Make it a HABIT of transferring all payroll and GST HST funds collected in trust to the account daily or weekly, whatever works best for you. Don't use the funds to finance your business or your personal lifestyle.

You may want to read about CRA's policy on funds held in trust.

AT RISK OF PERSONAL ASSESSMENT

KRP's March 2021 newsletter states, "If you are at risk of being assessed, resign as soon as possible, and make sure your resignation is legally recorded in the government register of corporations. Once you resign, there is a two-year deadline beyond which the CRA cannot assess you as a director — provided you do not continue as a “de facto” director."

FAQ about tax compliance for small business in Canada

FAQ about tax compliance for small business in CanadaFAQ about

Tax Compliance For Small Business in Canada

What is the difference between calendar year-end and fiscal year-end?

What is the difference between calendar year-end and fiscal year-end?

It is important to understand the distinction between a fiscal and calendar year-end when doing tax compliance.

Calendar year-end refers to the twelve month period January to December. Most sole proprietors in Canada must have a calendar year-end. Generally, CRA requirements do NOT allow sole proprietors to choose their fiscal yearend. However there is one alternate election available for a different year-end than December 31 to qualifying businesses the first time your business files a tax return.

Fiscal year-end refers to any twelve month consecutive period that has been selected (or deemed by CRA) as your "accounting" year. Normally you would choose this to be the least busiest period of activity. Any change to your fiscal yearend, once selected, must be approved by CRA. If you have more than one corporation, you may want each corporation to have different fiscal year-ends to allow for optimal tax planning.

What is considered the "official" receipt date at the CRA?

What is considered the "official" receipt date at the CRA?

Business compliance returns must be physically received by the CRA (not Canada Post) on or before the due date. Canada Post mailing date is not considered to be the receipt date. (The post marked date is only valid as a receipt date for individuals not businesses.) If the due date falls on a weekend or a public holiday, then you have until the next business day.

If you pay electronically, check with your financial institution to see how long from the date of your payment until the funds reach CRA. The funds have to be received by CRA (not your bank) by the due date.

Most financial institutions process overnight. In most cases you have to make your payment online before midnight on the day before the payment is due.

When does interest begin accruing if I haven't paid my income taxes on time?

When does interest begin accruing if I haven't paid my income taxes on time?

Interest begins accruing May 1st if your filing deadline for payment was April 30th. Late filing penalties the day after the filing due date.

For example, a sole proprietor has until June 15th to file their T1 return. If you miss that filing date, late filing penalties begin to accrue on June 16th. Keep in mind that the sole proprietor date for payment of taxes is different. So interest begins to apply on any income taxes owing as of May 1st.

If any due date falls on a weekend or holiday, the due date moves to the first business day following.

What's a quick way for the ordinary small business owner to find out about any new changes being introduced this tax year by CRA?

What's a quick way for the ordinary small business owner to find out about any new changes being introduced this tax year by CRA?

Type "What's New" along with a form name or topic into the CRA website search bar and see what comes up.

Topic suggestions specific to tax credits and benefits for a specific type of Canadian business are:

- Construction

- Daycare

- E-commerce

- Farmers and Fishers

- Film

- Small businesses and self-employed

Topic suggestions for individual taxpayer situations or groups are:

- International and non-residents

- Employees (for the working taxpayer)

- Students

- Seniors

- Persons with disabilities (for the disabled and their caregivers)

- Tradesperson

- Tax professionals

- Parents