Small Business Accounting Decisions

What About Internal Controls?

This page about internal controls is now only available to my newsletter subscribers. Learn why you want to setup controls early as a preventative measure, how to properly void a cheque (check for my U.S. visitors) and more.

Go to The Bookkeeper's Notes to subscribe. So sorry about that!

Following is an excerpt from the chat ...

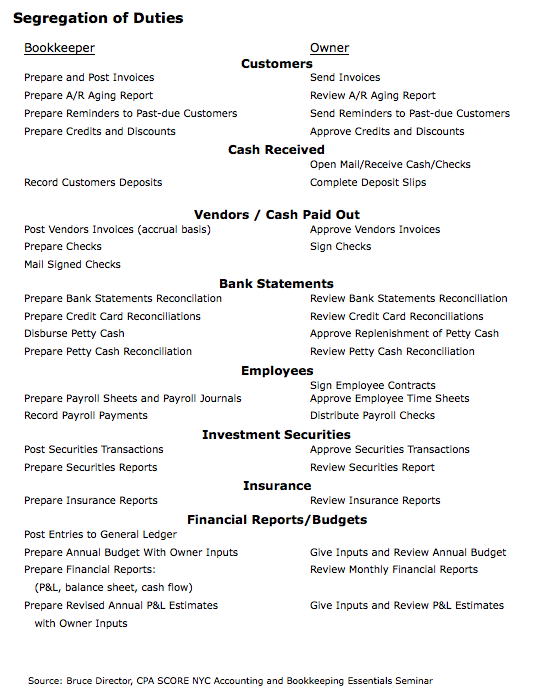

Segregation of Duties

As your business grows and you have more than just a bookkeeper for staff, you may need to restructure your internal controls.

Your most vulnerable areas are those where unauthorized purchases and payments can happen which are:

- cash disbursements;

- cash transactions;

- invoice approvals/accounts payable;

- purchases; and

- month end / year end closing.

I briefly chat about fraud detection for small business accounting in The Monthly Management Review article along with some tips in Creating an Audit Trail and Why Account Reconciliations are Necessary.

To reduce the probability of fraud, a basic internal control technique is to ensure there is a segregation of duties. So if you have a bookkeeper, consider this listing of how to segregate duties. It was suggested by Bruce Director, CPA for SCORE NYC at a seminar at the New York Public Library.