- Home

- How To Use QuickBooks Online

- QBO AI Rollout

New QuickBooks User Interface 2025 Rollout

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published November 10, 2025

WHAT'S IN THIS ARTICLE

What's Changing | Technology Behind the Change | What This Means for You | Making Your Decision

Freelancer studying the new QBO user interface.

Freelancer studying the new QBO user interface.1. What's Changing

WHAT'S COVERED

The New Intuit Platform | What's Actually Happening | Your Data Isn't Changing

New QuickBooks User Interface on Intuit Platform

Starting November 10, 2025, QuickBooks Online is rolling out a new user interface in Canada built on what Intuit calls the 'Intuit Platform'. If you're feeling some resistance to yet another software change, you're not alone. I'm going to walk you through what's changing, what's not, and how to handle it on your terms.

What's Happening: The QuickBooks Online New User Interface Rollout

This is the first time since I began using QuickBooks back in 2000 that I am dragging my feet about embracing this latest update. I attended the Intuit webinar in August introducing the upcoming changes ... and have been thoughtfully considering how this change fits my current needs. As a retired bookkeeper working with a small number of family businesses with low transaction volumes, I find myself evaluating software value differently than I did during my active practice years.

Back in 2013, I was all in on moving from QuickBooks desktop to QBO. That transition made perfect sense for where I was in my career. Now, as Intuit evolves to serve a broader range of business sizes (including medium-sized enterprises) I'm now being more deliberate about which features add value for the smaller operations I support. For example, I would happily use EasyStart (Canadian version of SimpleStart) for most of my files if it included just a few more basic features like accounts payable and recurring entries. The ability to upload bank statements rather than rely solely on bank feeds would be welcome too.

That said, here's my first dive into the new platform.

Today (on November 10, 2025) Intuit will begin rolling out in Canada the new QuickBooks user interface on the Intuit platform. The beta version has been available since August. My goal here is not to review all the updates in detail ... so many other sites are covering this ... but to help you understand what's happening and how to approach the transition thoughtfully.

This update is rolling out to Canadian accounts starting November 10, 2025. US accounts may have already experienced this transition. I'm a bit out of the loop these days.

Your Data and Accounting Tools Aren't Changing

Let's be clear. QuickBooks Online (QBO) itself is not going away. It's just getting a new look.

QuickBooks Online new user interface dashboard with customizable widgets

QuickBooks Online new user interface dashboard with customizable widgetsThe product is still called QuickBooks Online. What's new is the user interface (UI) built on Intuit's platform technology. Intuit has been very clear in stating that your data, workflows, and core accounting functions remain intact on this new platform.

The visual redesign is meant to be the foundation for future AI features. Does this sound familiar? I feel Intuit has promised 'foundations for the future' before. The difference this time is the scale of the AI integration and the eventual removal of the opt-out option ... kind of like when they first introduced QBO.

2. Understanding the Technology Behind the Change

WHAT'S COVERED

The Intuit Platform and AI Agents | Understanding AI Agents | Intuit's Strategic Shift] | QBOA vs. Intuit Accountant Suite

Understanding the Intuit Platform and AI Agents

I attended a QBO webinar back in August 2025 about the new QuickBook user interface (UI) on the Intuit platform. Intuit presenters explained that "small and medium-sized businesses face increasing operational complexity. This complexity, stemming from fragmented tools and a lack of data connectivity, leads to lost time, reduced productivity, and hinders their ability to grow revenue and profitability." Their research showed that "68% of SMBs are seeking a single end-to-end solution across the 7+ tools for SMBs needed to run their business source".

You may remember back in 2013, it was the opposite. Intuit focused on providing the basic core functions and relied on third-parties to provide the extra features. It was a good strategy as they couldn't build a robust platform without setting priorities during the development of the product.

Intuit's response to their research was to introduce "a suite of Apps powered by enhanced shared data and experiences, that helps SMBs run their business in one place. This new UI, makes it easier to do you and your clients’ most critical jobs all in one place. Data flows between tools, enabling one-time data entry and intelligent insights about your clients."

The Intuit platform refers to the underlying technology connecting all Intuit tools, not just QBO. It's an ambitious vision that addresses real pain points many businesses experience.

The new Intuit Platform blends familiar accounting tools in QBO (QuickBooks Online) with new AI (artificial intelligence) Agent capabilities.

QBO has been using AI and machine learning for years. Existing features before this rollout included automated transaction categorization, receipt capture and matching, invoice management, and cash flow forecasting.

The introduction of Intuit Assist and AI Agents is being described as a major transformation in how AI is used. The new agents are designed to perform more complex, end-to-end tasks (such as reconciling books or managing customer leads) with less human intervention. This represents a shift from basic automation to what Intuit calls 'agentic AI' ... software that completes workflows rather than just individual tasks. For the techies, it is a more comprehensive, integrated AI platform built on LLMs (Large Language Models) and the company's proprietary GenOS.

Understanding AI Agents: What's Really Powering Your QuickBooks Tools

As you explore the new QuickBooks interface, you'll encounter "AI agents" and "Intuit Assist". But what exactly are these tools doing? According to Intuit's explanation of agentic AI, there are actually two types of AI working for you:

Agentic AI

Acts like an independent team member. It makes decisions, performs goal-oriented actions, and automates complex processes with minimal human input. Think of it as AI that achieves things for you like automatically managing your books, following up on payments, or flagging potential cash flow issues before they become problems.

Generative AI (GenAI)

Creates content based on your prompts. This is the AI that generates things like drafting invoice reminders, writing email copy, or creating financial summaries. It needs you to tell it what to do, then produces the content.

The Real Power?

When they work together, as Intuit notes, agentic AI handles the behind-the-scenes operational heavy lifting while generative AI creates the customer-facing content. In QuickBooks, this means AI agents can identify that you need to send an invoice reminder (agentic), then draft a personalized, friendly message for you to review (generative).

Why This Matters

You're not just getting a chatbot. You're getting AI that can actually run processes and make decisions on your behalf with your approval.

Intuit's vision is moving from 'here are tools for you to use' to 'let us handle this for you'. Your new workflow will pivot to review and approve. For businesses with high transaction volumes or complex operations, this could be transformative. This technology comes with a cost that may become prohibitive for small businesses with low transaction volumes.

AI Agents are digital assistants working behind the scenes. It's my understanding this rollout has three main agents - Accounting, Finance, and Customer.

Intuit stresses these improvements still leave you in control. You will now review and approve instead of entering data, for example.

This whole environment may be new territory for many self-employed workers and small family businesses. I suggest you take a 'wait and see' approach to determine how much value these AI features add to your specific situation. That's what I'm going to do.

It is my understanding you will be able to turn off the Accounting Agent, but I haven't started playing around with the new platform yet. This also applies to the Payroll Agent but not to other AI Agents at this time. It is not clear to me if this will always be the case once the ability to switch back option is no longer available.

Understanding Intuit's Strategic Shift

If you've been with QuickBooks as long as I have, you may have sensed the ground shifting beneath your feet. The new interface isn't just a visual redesign; it reflects a broader change in Intuit's direction.

QuickBooks began as simple DIY software that empowered small business owners and their bookkeepers to manage their own books. Over the years, Intuit's focus has evolved toward a tightly integrated, AI-assisted platform that increasingly does the work for you. More and more, it does so by connecting multiple Intuit services like payroll, payments, and marketing tools. The vision has shifted from 'here are the tools you need' to 'let us handle more of the workflow for you'.

This is a legitimate business strategy, and for growing businesses with higher transaction volumes, complex operations, and teams to manage, it can represent real value. The AI agents, integrated workflows, and automated processes can save significant time and reduce errors. But it's also a strategy that serves mid-market businesses better than micro-businesses. For very small operations with straightforward needs and low transaction volumes, it can mean paying for capabilities you don't need to access the basics you do.

I'm not saying this shift is wrong ... I'm saying it's real, and it's worth acknowledging as you evaluate whether QuickBooks Online still fits your current business size and needs. Software companies evolve. Your business evolves. The smart move is making sure they're still evolving in the same direction.

QBOA (QuickBooks Online Accountant) vs (IAS) Intuit Accountant Suite

A note for Canadian accountants and bookkeepers.

This November rollout affects QuickBooks Online (QBO), the platform your clients use. The separate rollout of the Intuit Accountant Suite (replacing QBOA) is not part of this rollout. It will be released later.

If you're a bookkeeper or accountant, you'll experience this client-side interface change first, with your own platform updates coming in a future rollout. It's interesting to note that IAS will have a free and paid version. Currently QBOA is entirely free.

3. What This Means for You

WHAT'S COVERED

What You'll Notice When You Log In | Rollout Timeline and Your Options | How I'm Approaching This Change

What You'll Notice When You Log In

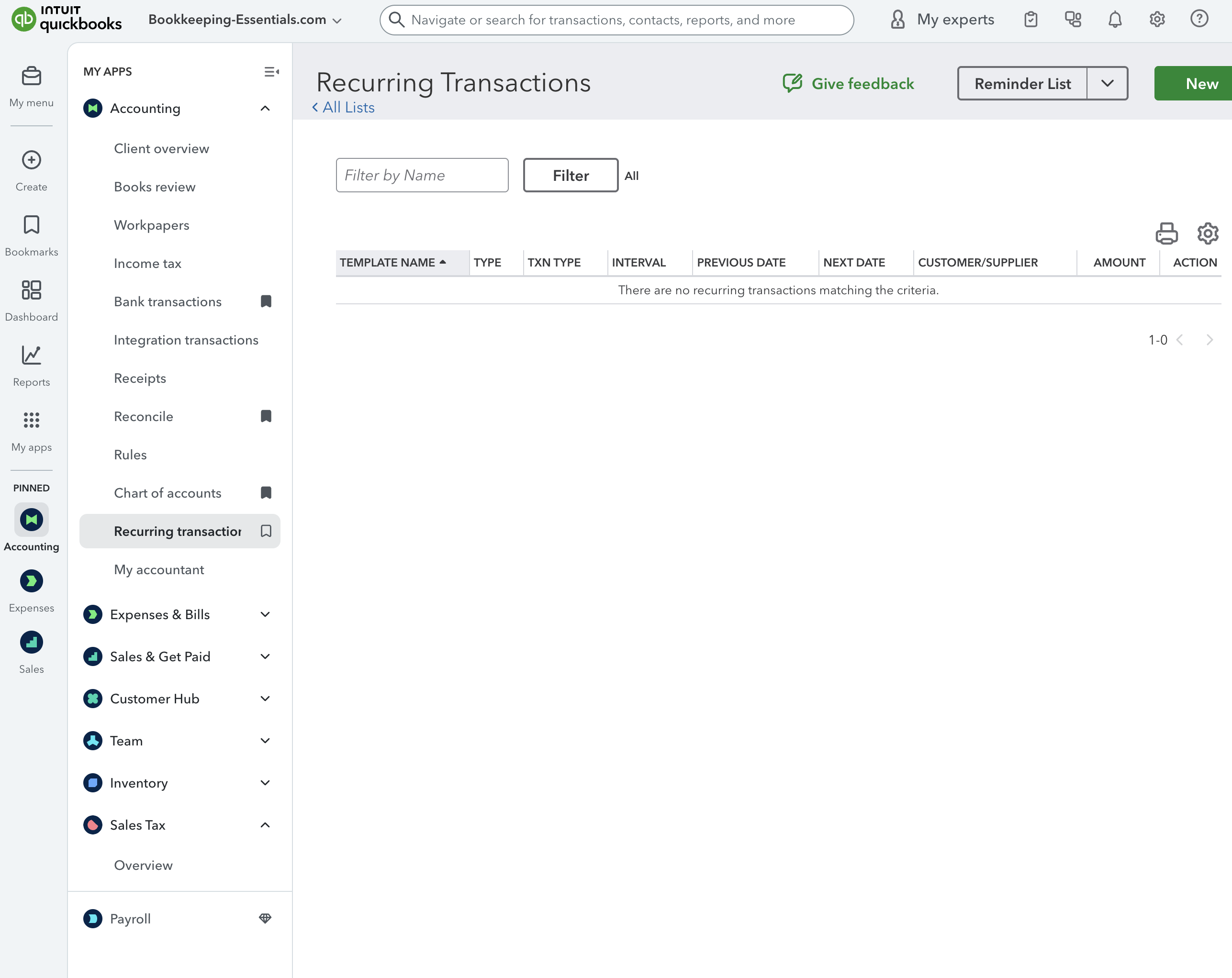

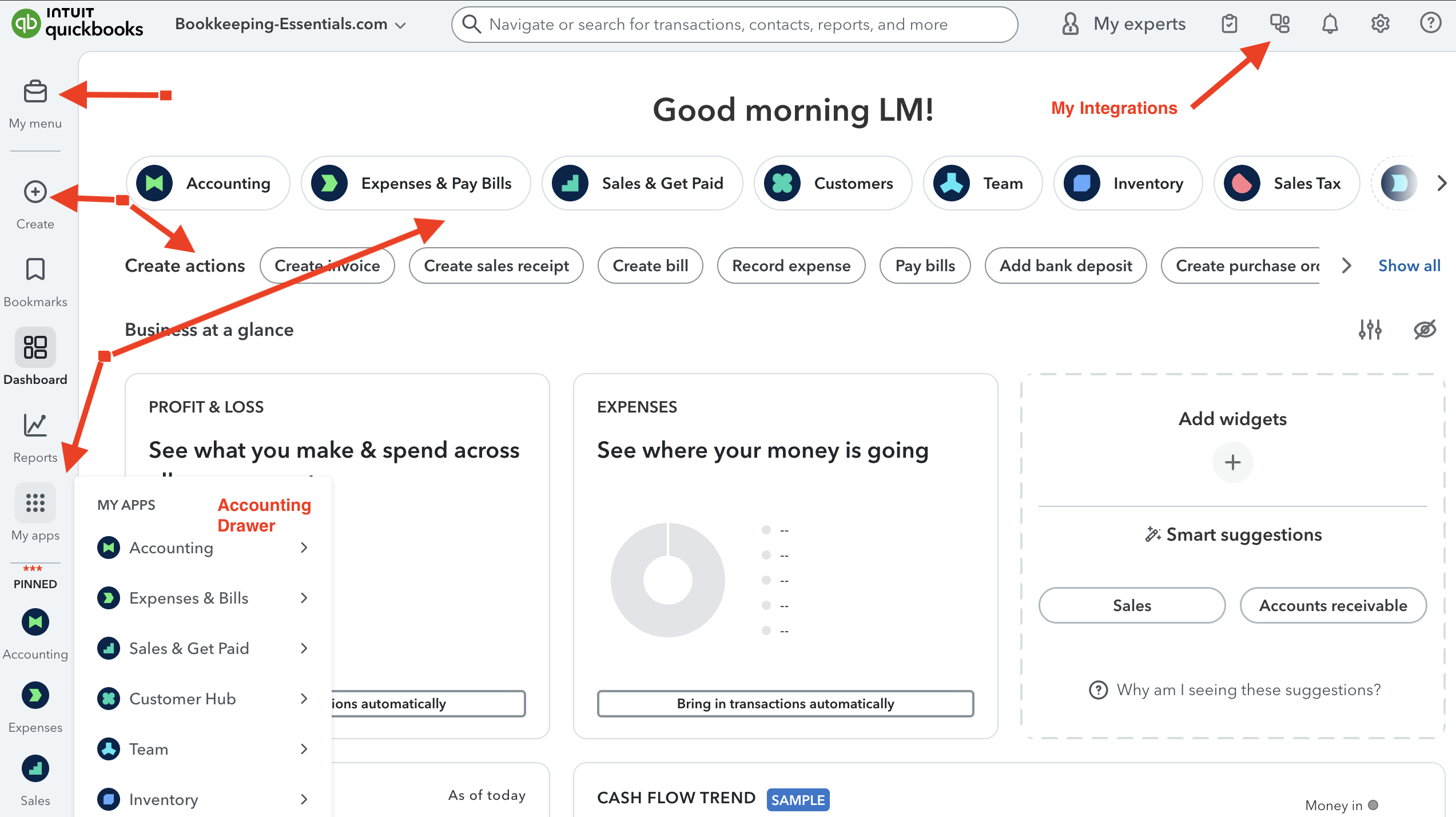

As with all major rollouts in the past, Intuit renames stuff. Here's what I took note of during the August webinar:

- Navigation changes such as Modules become known as Apps. I think the open Apps menu is being referred to as an drawer. This is where you find your old left sided navigation bar. There is also an App Carousel at the top of the screen that gives you access to everything you need so you don't have to open the drawer under the 'My apps' icon. The 'old' apps now becomes 'My integrations'. The icon to access is on the top menu bar.

Think of the 'visual redesign' as rearranging your office rather than moving to a new office

Think of the 'visual redesign' as rearranging your office rather than moving to a new office- Terminology updates such as the 'New' button you click on a lot when doing your books becomes 'Create'. The button lives in the same spot so it won't require a lot of reorientation.

- Customization improvements have been made to bookmarks, pinned items and dashboard widgets For example, the dashboard view is now more personalized. You can add, remove, re-size, and reorder widgets to meet your needs. The 'Business at a glance' button has more funnel widgets that "help you stay on top of core workflows".

As with past rollouts, it's best to think of the 'visual redesign' as rearranging your office rather than moving to a new office.

The Rollout Timeline and Your Options

Here's my understanding of how this rollout will work for QuickBooks Online users in Canada. The automatic opt-in begins the week of November 10th. You can temporarily opt out but only for a limited time. Intuit will provide advance notice before removing this option. What this does is give you breathing room to transition on your terms.

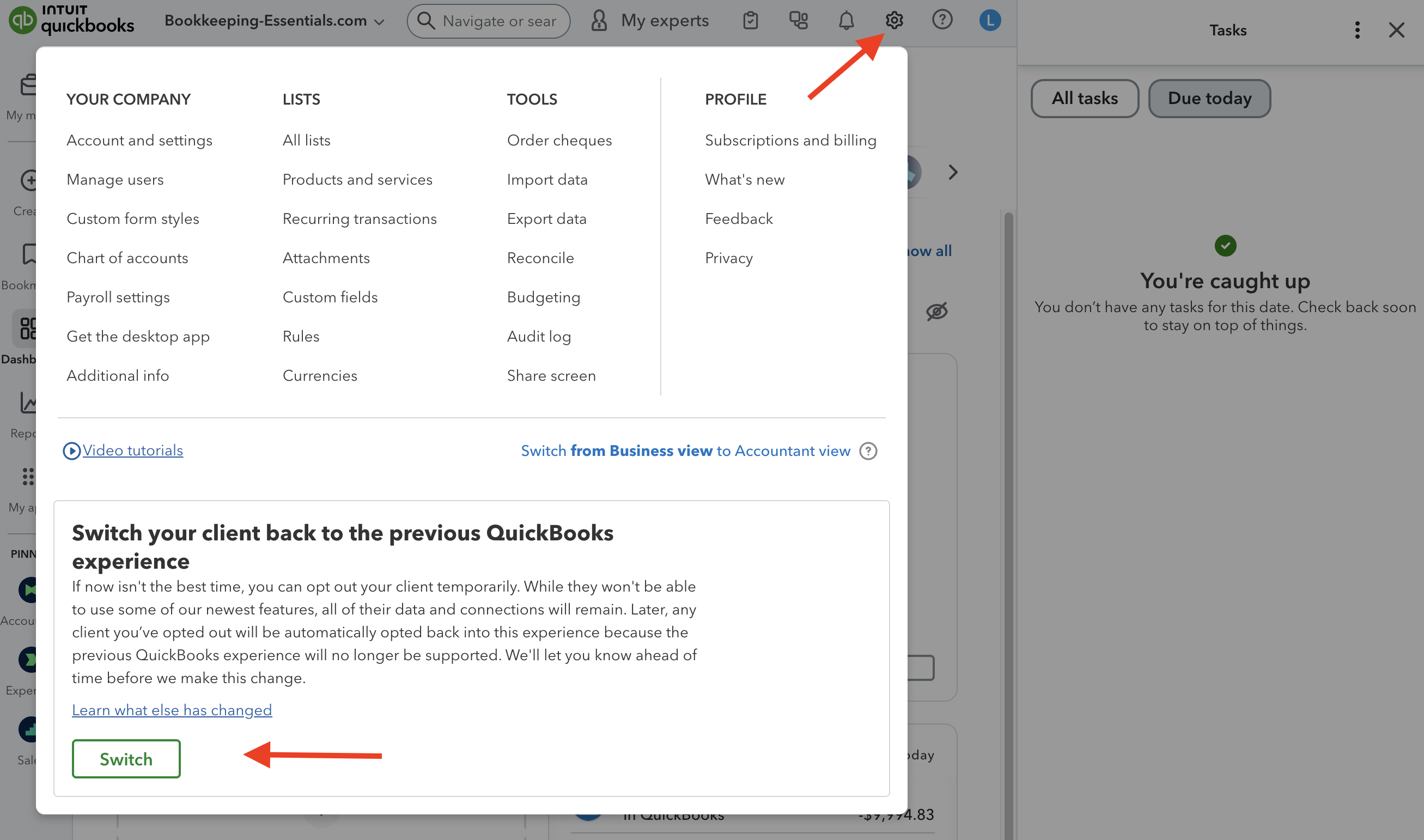

The Switch button in the Settings menu lets you toggle between the new and classic interface.

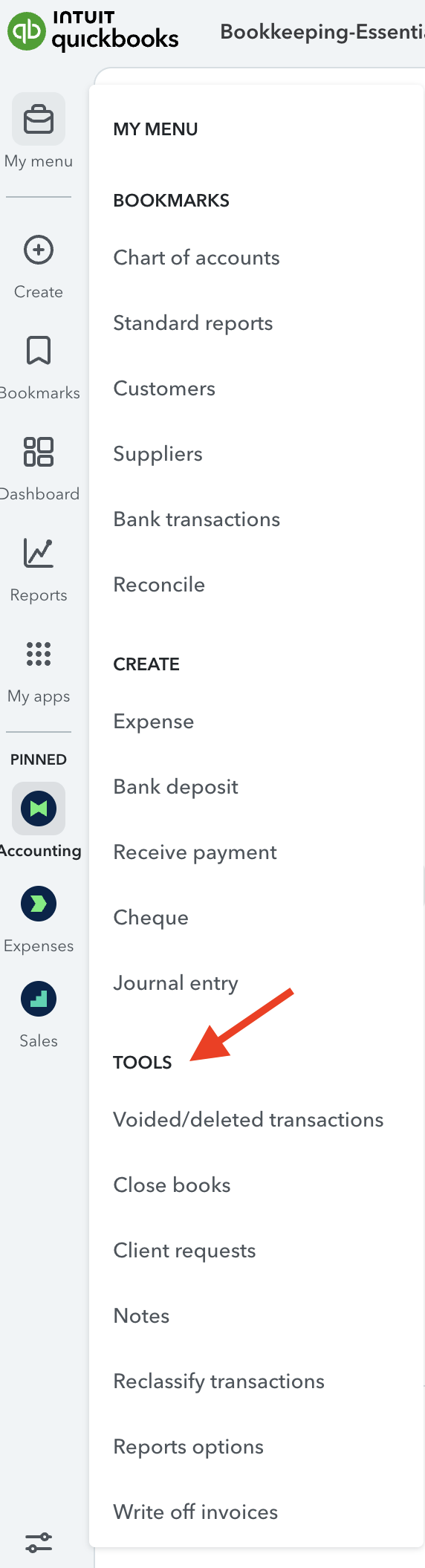

The Switch button in the Settings menu lets you toggle between the new and classic interface. New home for the beloved 'Accountant Tools' in QOBA

New home for the beloved 'Accountant Tools' in QOBAWhat about bookkeepers and accountants using QBOA? This rollout affects the client-side QBO interface. The separate transition from QBOA to Intuit Accountant Suite (IAS) will happen later for Canadian accounts. For now, focus on learning the new client interface so you can support your clients through their transition.

That said, your beloved 'Accountant Tools' is not gone. It's just moved to live under the 'My Menu' side navigation bar and now is called 'Tools'.

How I'm Approaching This Change (And You Can Too)

For DIY (Do-It-Yourself) bookkeepers, take a peek. If you 'get lost', switch back to the previous version, get done what needs to be done ... then try again.

For the owners who are working with a bookkeeper or accountant, coordinate with them on how to approach the transition. Your bookkeeper has likely already mentioned this change. If they haven't, this is a good time to initiate the conversation.

For bookkeepers, Intuit paused their 2025 ProAdvisor recertification due to this rollout. QBOA (QuickBooks Online Accountant) gives you a bulk opt in / opt out tool. This rollout affects your clients' QBO interface, not your QBOA platform yet. Focus on learning the new client-side interface so you can guide your clients. The IAS rollout (replacing QBOA) will come to Canada separately.

I find it's best during these rollouts to remind yourself that learning curves are normal and temporary ... so be kind to yourself. When frustrated, remember to take a few deep breaths (4 counts in, hold 4 counts, exhale to 4 counts, pause for 4 counts ... then repeat two more times) then try again.

Block some time to explore the new user interface

Block some time to explore the new user interfaceCanadian users have had access to the new platform since August. But if you procrastinated like me, here's how I'm going to approach the rollout. You still have time to control the timing, preparation, and customization.

- I'm going to block some time to explore the new user interface and expect for a month or two, it may take me longer to complete my bookkeeping work. Best case scenario is this learning curve will be minimal.

- Watch the free webinar Intuit offers on the changes to orient yourself. I did this back in August.

- I'm going to 'take a peek' by clicking on the gear at the top right hand side of the screen. At the bottom of this screen, you will see a big box on the bottom that asks if you want to switch. All you have to do, is click on the 'Switch' button.

- If I find I am struggling, I am going to switch back to the previous version and take some screen shots. Then I'm going to back in and see if I can find what I'm looking for. I don't expect too many issues as the accounting tools haven't really changed, they have just been rearranged.

- Initially, I'm not going to do too much customizing. I'll use the default setting and customize once I'm more comfortable with the new interface.

- As Intuit continues to increase their subscription pricing annually, I need to (so do you!) evaluate once or twice a year to decide if the additional cost is adding value for your business. Owners who have do not have a large volume of transactions may find it is no longer a value proposition.

- Remember, these 'free' updates that are included in your subscription can be frustrating as they interrupt your workflow. Intuit has been beta testing prior to its preliminary access in August, but as with any major rollout, expect some hiccups in the first few weeks. I hope Intuit has done enough testing that any bugs have been fixed prior to this rollout. By that I mean I hope updates are held to a minimum and bugs are few and far between.

4. Making Your Decision

WHAT'S COVERED

Frequently Asked Questions | Subscription Value and Where I Stand | 5 Key Takeaways

FAQ

Answers to your questions about the new QBO user interface

Answers to your questions about the new QBO user interfaceShould I opt in now or wait?

Should I opt in now or wait?

Starting this week in Canada, Intuit will automatically opt you in. You can use the 'Switch' button to go back to the prior version. I don't recommend that you opt-out now. Instead switch back and forth between the versions if you get lost. Remember the accounting tools haven't changed, just the visual design and the introduction of AI Agents.

What happens if you do nothing?

What happens if you do nothing?

Usually rollouts happen over a few weeks. As this is a new platform, I'm not sure if this will be still be the case. Either way, when the rollout gets to your company file, it is my understanding that it will automatically opt you in.

Is this rollout the same as the Intuit Accountant Suite I've heard about?

Is this rollout the same as the Intuit Accountant Suite I've heard about?

No. This November 10th rollout is the new user interface for QuickBooks Online (QBO), the platform business owners use. The Intuit Accountant Suite (which will replace QBOA for accountants and bookkeepers) is a separate rollout that will come to Canada later. If you're an accountant or bookkeeper, you'll experience this client-side change first, with your own platform updates coming in a future rollout.

Let's Talk About Subscription Value and Where I Am

For the first time since I began using QuickBooks in 2000, I'm going to address something I've been thinking about since retirement ... whether my software subscriptions still match my evolving business needs. These are the 'lessons' I'm going to apply as I become comfortable with the new platform and user interface.

Lesson 1: Understand Who the Software Is Built For

Intuit continues to invest heavily in product development, adding sophisticated features that serve growing businesses. The company is clearly moving toward mid-market clients with complex needs and high transaction volumes. For businesses with those characteristics, the AI agents, integrated apps, and connected workflows could be transformative and represent excellent value.

But here's where I find myself:

Now that I'm retired, I work with only a few small family business entities and self-employed workers with low transaction volumes and straightforward needs. For these operations, the calculation is different.

Back in 2013, I was all in on moving from QuickBooks desktop (QBD) to QBO even though the initial iterations were not as robust as QBD. That transition made perfect sense for where I was in my career. Now, as Intuit evolves to serve a broader range of business sizes (including medium-sized enterprises), I'm being more deliberate about which features add value for the smaller operations I support.

Lesson 2: Recognize the Pricing Pattern

Here's the pattern I'm observing nowadays.

I would happily use EasyStart for most of my clients if it included just a few more basic features like accounts payable and recurring entries. The ability to upload PDF bank statements and have the software read and extract the transactions (converting them into the bank feed format like when you upload a bank transactions file) would also be valuable. This would help clients who can't or don't want to connect their bank accounts directly. Not all banks offer downloadable transaction files anymore, but everyone can easily access their PDF e-statements. That said, LedgerDocs has included in their pricing a PDF bank statement converter to csv format that is easily uploaded to QBO.

And here's something telling. On their Canadian plans & pricing comparison page, Intuit Canada has dropped the QuickBooks Essentials option from the main display. They now only show EasyStart ($28), QuickBooks Plus ($95), and QuickBooks Advanced ($190). If you want pricing for Essentials ($65), you have to make a separate Google inquiry.

The mid-tier subscriptions include those basics but bundle them with AI agents and integrations that simple operations may never use or want ... at a significantly higher cost which pushes you back to EasyStart if you don't want AI Agents.

This isn't criticism; it's acknowledging that Intuit is building for mid-market growth, which serves a different customer profile than the simple bookkeeping operations I support. Different business sizes have different needs, and that's okay.

Lesson 3: Know What You're Watching For

I'm approaching this rollout with an open mind, but I'm also being deliberate about what I'm evaluating:

What I'm watching as I explore this new platform

- Whether the AI features add genuine value for low-volume operations, or solve problems simple businesses don't have.

- Whether the subscription cost continues to make sense for the features actually used.

- Whether Intuit's mid-market focus leaves adequate options for truly small businesses.

- Whether the pricing continues to climb faster than the value delivered to low-volume operations.

What I'm doing

I'll learn the new interface, test the AI features fairly, and evaluate objectively whether the platform still serves me and my clients well. That evaluation might conclude QBO remains the best choice. Or it might lead me to explore alternatives focused on core bookkeeping for small operations. Either way, I'll make an informed decision rather than staying out of habit.

Lesson 4: Do Your Own Unbiased Assessment

I encourage you to do the same evaluation for your situation:

- Which features do you actually use monthly?

- How much time do they save you?

- Does the subscription cost make sense for your transaction volume?

- Are you paying for capabilities bundled with the basics you need?

- Would simpler software serve you better at lower cost?

This is the kind of business evaluation you'd do for any expense. It's healthy business thinking. The fact that I'm doing it myself after 25 years tells you something significant has shifted in how Intuit positions its products.

If you're feeling similar uncertainty, you're not alone. And it's not disloyal to ask these questions. It's responsible business management. Your bookkeeping system should serve your needs, not the other way around.

Lesson 5: Change Is Normal, But So Is Reassessment

Whether this update becomes your favorite or prompts you to evaluate alternatives, remember you've navigated software changes before and you'll navigate this one too. The accounting fundamentals haven't changed, just the visual design and the tools available.

It's human nature to feel resistant to change, especially when you've developed comfortable workflows. I usually look forward to Intuit's updates, but I'm approaching this one more cautiously. Part of that is wanting to ensure the new features align with the simpler needs of the businesses I support. Part of it is objectively evaluating whether the platform's direction still fits.

But I also know that mastering this new UI is a learnable skill, and Intuit has a strong track record of supporting users through transitions. I'm going to try to tune into my 'curiosity' gene rather than my 'dread' gene.

Intuit has been generous in allowing educators and content creators like me to use screenshots and materials for educational purposes. This support helps all of us serve the small business community better, and I appreciate that ongoing access.

Now I'm off to explore the new platform with curiosity, some skepticism, and a commitment to honest evaluation.

5 Takeaways: Lessons Beyond This Rollout

Beyond the technical details of this rollout, here are the lessons I hope you'll carry forward into other areas of your business administration when applicable.

- Your data is safe.

Nothing is being deleted, moved, or lost. QuickBooks Online isn't going away. It's getting a new interface built on new technology. Your transactions, reports, and workflows remain intact. This is rearranging your office, not moving to a new building. - Learning curves are temporary; evaluation is ongoing.

You may (or not) feel disoriented for a few weeks as you learn where things moved. That's normal. But use that disruption as a prompt to ask a bigger question: Does this software still fit my business needs? Evaluate your subscription value at least once a year, not just after rollouts, but as your business evolves and price points change. - Your bookkeeping system should serve you, not the other way around.

You're the business owner. If a platform no longer matches your needs, transaction volume, or budget, it's okay to explore alternatives. Loyalty to a tool is less important than finding the right fit for your operation. Make informed choices, not habitual ones. - Mid-market solutions don't always fit small operations.

As software companies grow and target larger clients, their pricing and features often shift away from simple needs. What worked perfectly five years ago may no longer be the best value proposition. That's not a failure on your part. It's a natural evolution that requires unbiased reassessment. - Change is the new normal in cloud software.

Unlike desktop software that stayed stable for years, cloud platforms update continuously. Some updates improve your workflow; others disrupt it. Build resilience by staying curious rather than resistant, and remember ... you've adapted to changes before, and you'll adapt to this one too ... whether it's on the new platform or an entirely different one.

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Click here to subscribe to QuickBooks Online Canada. I do not receive any commissions for this referral.