2013 Hiring Credit

by Sharon

(Calgary, AB, Canada)

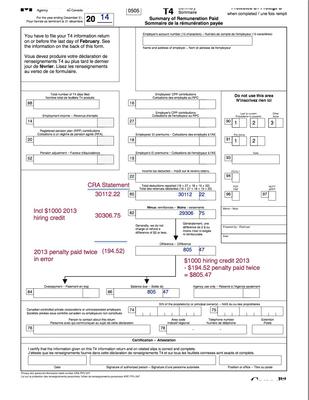

Penalty Payment Paid Twice In Error Causes Confusion

After reading all your posts regarding the hiring credit I am still uncertain how to make my books correct.

I would like to share my specific situation because I am still confused what I need to do to get the books correct.

In Mar 2014 my client paid a penalty of 194.52 twice that was related to 2013. It was transferred to 2014 and was not used as a credit in 2014.

In Nov 2014 CRA applied the hiring credit of 1,000 to my client's Nov 2014 remittance.

In Simply Accounting a general journal entry will not update the remittance amount owing. You have to use the Pay Remittance window which I believe is similar to Quick Books Liability window. There is an adjustment column for EI where you enter the hiring credit as a negative number. Only transactions in this window will update amount owing and allow the system to calculate the balance owing to CRA by the credit amount. The T4 and the T4 Summary are not affected by doing this.

When I ran the T4 Summary:

Box 80 shows Total Deductions of 30,112.22 which I agree with

Box 82 shows Total Remittances of 29,306.75

Difference (805.47) which is the hiring credit (1,000) less the credit still on the books from Mar'14 (194.52)

On the T4 Summary in Simply Accounting there is a box called Other Payments where you can manually add any additional payments. In my case because I know I balance to Box 80 should I enter the 805.47 amount here. Doing this will make me balance to Box 80 so the summary shows 0 for the difference?

The amount CRA shows as a account balance for 2014 is 30,306.75. This amount less the total deductions of 30,112.22 is the penalty payment credit (194.52) still sitting on the books from Mar'14. I know I will get a Pier Report and I will have to explain what this is and once verified I will be allowed to use up the credit in the future.

I am confused if I am missing a step and have to do a JE to get my books balanced and show the 194.52 somehow as a future credit? Do I also need a second JE for the hiring credit?

In

Hi Sharon,

First thing is to take a deep breath, hold it for four counts and exhale slowly. If you have a cup tea or coffee nearby, take a sip. I've been confused many times too and I know it is frustrating. How does something that should be so simple seem to turn into a big headache mainly.

For the benefit of my visual readers, I uploaded a T4Summary with your numbers and explanations because sometimes a picture is worth a thousand words.

I'm not conversant with Simply Accounting (Sage) but it sounds from what you wrote that you modified my QuickBooks "Option One" steps to record your hiring credit which is great.

You don't need to wait for CRA approval (except for the hiring credit) to "use up" or apply your penalty payment credit. You can just short your next payment to CRA ...

OR you can ask the CRA to refund the penalty (194.52) that was paid twice in error ... making your life simpler as you can record the receipt of the cheque when you get it which will "remove" the penalty credit from the payroll taxes payable account.

I want to say there is no need to stress out about receiving a PIER report, especially if you know why the difference has occurred. It is my understanding that CRA WILL KNOW that the outstanding difference is due to the hiring credit. If they don't and you receive a PIER report you can explain it then.

It's unfortunate that with all the online functions that a person can no longer attach a note at the time of the filing to explain the difference.

Simply Accounting (Sage) provided you with the correct T4 Summary amounts based on your data. If the data is correct, I don't think you have any journal entry to make except to post the hiring credit when you "use it" (follow the link above). Your adjustments come when you pay your payroll and short the remittance amount(s) by your account credits which includes the hiring credit.

Return to Ask a Bookkeeping Question.