Unreconciled Bank Account

by Corey

(Canada)

What to do if bank doesn't reconcile

I took over the job from another bookkeeper who retired. What do you normally do if you can't get the bank account to reconcile in QuickBooks because of the previous bookkeeper's work?

The QuickBooks reconcile was used and it shows even more checks and deposits outstanding than what it should be from doing a manual reconciliation by hand.

I took a look at each month and can't find where the problem originated. I've been at it for a month already. Where should I go from here? Should I continue to look at all the months and re-enter everything again? I already know what the correct bank balance should be but don't know what is the correct way to correct it.

Hi Corey,

Geez that is a hard one. I'm terrible at explaining how to do bank reconciliations ... I'll give it a try but I've never tried to actually "watch" how I do a bank reconciliation .. I just do them.

Here are some questions I have:

1. When you say you aren't reconciled, how far back are you unreconciled?

2. You say you've been working on it for a month, what steps have you taken so far?

3. Are you out on the bank side or the general ledger side?

4. Are both sides out (Compare Deposits and Other Credits; Checks and Payments to bank statement subtotals)? If yes, I like to try and get my deposits completely balanced then move on to my payments.

5. Is there one kind of transaction that seems to be the problem?

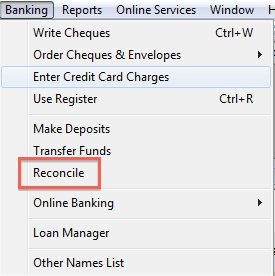

6. Have the bank charges (usually entered in the "begin reconciliation" window accessed through "modify" if you've already begun your reconciliation.) and any preauthorized / recurring entries been entered?

7. Have you recorded all the bank transfers?

8. Have you deposited all payments recorded through "receive payments" which are sitting in the "Undeposited Funds" account? (Look at the "payments to deposit" window under "Make Deposits" to determine if any deposits have not been recorded to the bank account.)

9. Are any of the items outstanding stale dated? If yes, then do a correcting entry.

10. Does your beginning balance match the opening balance on your bank statement?

11. Did you enter the ending balance from the bank statement accurately? (Fix this using the "modify button".)

Here are some general comments:

Double check that the prior bank reconciliation reports actually balanced. (Hopefully a printed copy or eCopy was made of each bank reconciliation. If you are using a Premier Accountant Edition, you can go in and look at the prior reconciliation reports.)

If an "adjustment" was made to "balance" prior bank reconciliations, you should see an account on your income

While doing a bank reconciliation, I like to make sure the box that says "Hide transactions after the statement's end date" is checked. It hides transactions that won't affect the current reconciliation you are working on.

Take a look at each transaction that has not cleared. Try to determine if the transaction was entered twice .... perhaps once manually and once through downloading bank transactions.

Again for uncleared transactions, was a correcting entry made perhaps ... so you'll see amounts on both sides that "clear" each other out?

I've never had to use it before ... as I am usually working with a set of books I've setup ... but you may want to try the "Locate Discrepancies" button. It is my understanding that the discrepancies report will identify any edited or deleted transactions that may affect your bank reconciliation because they were previously reconciled.

If at any point you determine an outstanding entry is wrong, do a journal entry to reverse it in the current period (where current period equals the period that is open and you are reconciling). Please don't just delete or void it! Go in and actually do a reversing entry with a good memo notation as to why you are making the entry. Then "match" the offsetting entry in your bank reconciliation to clear it.

I've been assuming you've checked to make sure there were no transposition errors (divisible by 9) or debit/credit recording errors (you are out double), sliding decimal points, or incorrect account coding errors.

For right now, that's all I can think of without actually working hands on with data. If you want to post back with more details on what you think the problem is, please don't hesitate to do so.

If you'd like to hire me to take a look, contact me.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

QuickBooks® is a registered trademark of Intuit, Inc. ... Member of the QuickBooks ProAdvisor® Program ... Screen shots © Intuit Inc. All rights reserved.

I apologize to my readers ... but while converting this submission to upgraded software, I lost all comments associated with this posting. I'm not sure when this post was originally submitted, probably sometime in 2011. Lake

Comments for Unreconciled Bank Account

|

||

|

||

|

||