T4 Preparation Rules

by Peggy

(Alberta, Canada)

How to Report Earned But Unpaid Income At Yearend

I'm new at payroll and need major help. I use Simply Accounting (now Sage 50). My client (a corporation) has one employee that started November, 2012. The money that the employee earned in November was paid on December 7th. The employee's earnings for December, 2012 were paid by advance (no deductions) on December 15th. The balance of December, 2012 wages were not paid until January 7, 2013. I'm not sure why the employer pays him late. My client uses CRA's Payroll Deductions Online Calculator (PDOC) to do the payroll. I have just been provided with the backup documentation so I can do the 2012 T4 slip.

I've entered the November paycheque - no problem. I've entered the December 15th advance - no problem. When I enter the January 7th cheque - there is a problem as the year to date calculations in the taxes section have started over. After much searching and reading, I've determined that income is reported in the year it was PAID which means this January 7th cheque is now part of 2013 earnings (even though it relates to December earnings). So only the November income plus the December advance will be on the T4 - is that right? I need to explain all this to my client as well so need to get it straight. When using CRA's PDOC, should the "date the employee is paid" be input as the last day of the month that the income was earned even if not paid on that day?

When I print the PIER report in Sage 50, the errors I get are Note 3. Too much CPP has been deducted. I can make an adjustment for this. The second error is Note 5: Discrepancies may be due to total paycheques not matching pay periods per year. My client chose pay period frequency as Monthly (12 pay periods a year). Since the employee only started November, there will not be 12 pay periods so do I need to be concerned about this note?

For 2013, now that there is already 1 pay period out of the 12 "used up", will I need to ensure that in 2013, only 11 more are used? I know, these all sound like crazy questions, but with no experience at this, I have to ask.

I'd appreciate any input and advice. Thank you in advance.

Peggy,

I am not familiar with Sage 50 so I can't respond to any questions related to the program error messages. I'm fairly certain, but don't have time to play

You are correct about how payroll is reported on T4 slips. I have chatted on this topic. It is a common error small business owners make when preparing T4 slips.

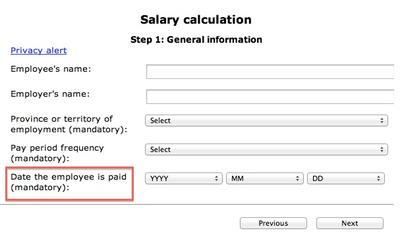

I've taken a snap shot of PDOC which shows there is a place that shows the date to enter is the date of payment, not the pay period the wages are related to.

When doing backwork (bookkeeping work after the fact), I tend to enter transactions by substance instead of form and work with the client to show the correct procedures going forward. However, CCPC withdrawal of funds relating to an owner-manager or related party have very specific rules which are reviewed by CRA.

You will need to get across to your client that tax reporting is different than financial reporting.

For the purpose of tax filing deadlines, income is reported in the year it was paid NOT when the income was earned. This includes your payroll source deduction remittances as well as the preparation of the T4 slips.

For your year-end preparation, you will need to accrue unpaid but earned wage income in the year the wage was earned. The accrual will be reversed in following year when the wages are paid.

If you are using an accounting software program like QuickBooks or Sage 50, it knows the rules and will correctly prepare the T4s provided you have entered your payroll correctly. As mentioned above, check your payroll period is December 2012 to ensure your source deductions are calculated properly.

Payroll advances are a different issue. You may want to read the forum post on my BC research on payroll advances. Once you've read what I found out in BC, you should see if Alberta has similar restrictions. I would appreciate you posting back your findings.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Return to Self-Employed Bookkeepers.