- Canadian Bookkeeping Compliance Resource

- Tax Audits in Canada

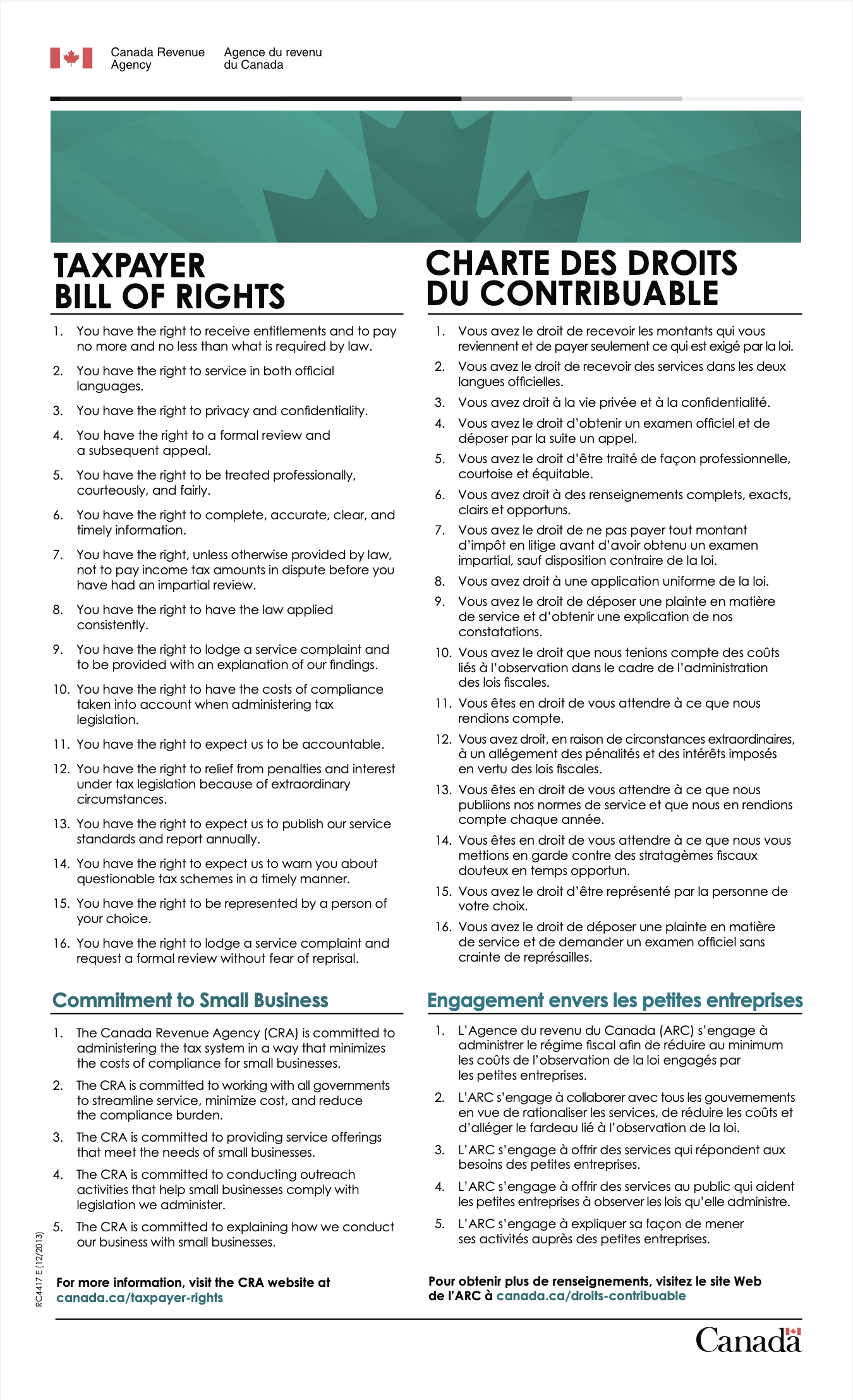

- Taxpayer Bill of Rights

SMALL BUSINESS Insights into the Canadian Taxpayer Bill of Rights

Your rights as a Canadian Taxpayer

By L.Kenway BComm CPB Retired

Revised March 18, 2024 | Edited March 24, 2024 | Originally Published on Bookkeeping-Essentials.com in 2009

Introduction | Inception |Impact on Small Business | 5 Commitments | CRA Assistance | 16 Rights | ITA | Taxpayer Protection | Relief Program | ETA | Ombudsman |Conclusion

Taxpayer disagrees with CRA assessment. What are his rights?

Taxpayer disagrees with CRA assessment. What are his rights?Introduction

The Canadian Taxpayer Bill of Rights is an integral component of small businesses' health and prosperity nationwide. This essential piece of financial legislation embodies fifteen rights and is accompanied by five commitments from the Canada Revenue Agency (CRA) to small businesses.

In 2007, the CRA published the Taxpayer Bill of Rights. This independent document indirectly reflects and upholds many standards and principles in the Income Tax Act and the Excise Tax Act.

The driving force behind the introduction of the Taxpayers' Bill of Rights wasn't a specific event or controversy but rather a general desire to consolidate and affirm the rights of taxpayers in dealings with the CRA. It was seen as a way to support a culture of fairness and service within the CRA by clearly stating the rights taxpayers have. It was also part of a broader trend of governments around the world formalizing commitments to transparency, fairness, and service in tax administration during the late 1990s and early 2000s.

These rights and commitments not only regulate the treatment of taxpayers by the CRA but also empower individuals and small businesses to understand and meet their tax obligations. Understanding these Tax Rights has immense potential to shape the financial lifespan of a small business, making it an advisable topic for exploration.

The Inception of the Canadian Taxpayer Bill of Rights

In May 2007, the Canadian Taxpayer Bill of Rights was officially introduced. The Minister of National Revenue introduced the Bill, which was established to instill a sense of confidence and fairness into Canada's tax system.

The core principles of the Bill of Rights revolve around promoting clarity, transparency, accountability, and responsiveness. The fifteen rights encapsulate fair treatment of all taxpayers; these principles and rights establish a robust foundation for all tax-related interactions.

Impact of the Canadian Taxpayer Bill of Rights on Small Businesses

The Bill of Rights has a substantial impact on small businesses. It levels the playing field, allowing them to understand their obligations and defend their interests more effectively within the Canadian tax environment.

Under this protective umbrella, small businesses can access specified tax rights, like the right to pay no more and no less than what is legally due, the right to service in both English and French, and the right to lodge complaints without fear of reprisal. These rights, considered alongside tax benefits such as the Small Business Deduction (SBD), offer a significant lifeline to small businesses grappling with extensive tax obligations.

The Income Tax Act (ITA) is a framework interpreted and administered by the CRA. However, it's important to note that the CRA does not make the law; Parliament does. Therefore, CRA interpretations of the ITA are not legally binding.

When you or your tax advisor disagree with the CRA's interpretation of the ITA, you can file a Notice of Objection. If you are unsatisfied with the findings, you can proceed to the Tax Court of Canada.

Five Commitments to Small Business

The CRA's overarching mandate is to ensure fair tax administration. The Taxpayer Bill of Rights enhances this mandate by providing 16 individual rights and five commitments to small business that reinforce the CRA's commitment to serving taxpayers with professionalism, fairness, and understanding.

The CRA is committed to:

- minimizing the cost of compliance for small business;

- working with all governments to reduce the compliance burden, minimize cost, and streamline service for small business;

- providing service offerings that meet the needs of small business;

- helping small business comply with the legislation by conducting outreach activities; and

- explaining how they conduct business with small business.

The CRA has made substantial strides to reduce bureaucracy and red tape for small businesses over the years. It has implemented several initiatives to make it easier for businesses to access information and meet their tax obligations, such as My Business Account and harmonizing sales tax with provinces (called participating provinces) that wanted to make it easier for small businesses to file their sales tax returns.

The CRA and provincial/territorial tax administrations have worked together in many areas to reduce duplication of effort and ease the administrative burden on businesses. For instance, most provinces and territories have adopted the Federal Business Number (BN) as a common identifier for businesses, simplifying registration and reducing confusion.

Our small business administrative burdens in Canada are more streamlined than in the U.S. Their tax system is different than Canada's as it is decentralized. Each U.S. state can create its own tax laws and regulations. A business operating in more than one state may have to comply with multiple, varied state tax regimes in addition to federal taxes. Tasks such as sales and use tax can become complex due to different tax rates, exemptions, and filing procedures across states. We are fortunate in Canada that our various levels of government work together to reduce the red tape for small businesses.

The CRA provides several services aimed at assisting small businesses including guidance on managing their books and records effectively.

The CRA provides several services aimed at assisting small businesses including guidance on managing their books and records effectively.How CRA Assists Small Businesses in Canada

In keeping with their stated commitment to small business, the CRA provides several services aimed at assisting small businesses.

As mentioned, Canada has harmonized its Goods and Services Tax (GST) with the provincial sales taxes in some provinces into a single Harmonized Sales Tax (HST) to reduce the administrative burden on businesses further. This results in businesses only needing to file and remit one tax instead of two separately.

We need to remember how far CRA has come, that CRA has been improving digital services for businesses, allowing them to handle many of their tax-related matters online, reducing the need for in-person visits or phone calls. CRA's "one-stop shop" online portal – My Business Account – is a centralized location where business owners can manage all these tasks efficiently. The online portal includes GST/HST, payroll, corporation income tax, excise tax and duties, and other levies. The online services also include making payments, submitting documents, updating business information, and receiving electronic mail. This service is invaluable for business owners who sit down to do their paperwork in the evenings or weekends.

Free Liaison Officer Service

The CRA offers a free Liaison Officer service to small businesses across Canada to provide in-person tax support and education for small businesses. These officers can provide in-depth tax support during in-person visits. They can guide businesses in managing their books and records effectively, as well as educate them about potential tax deductions and how to avoid common tax errors.

Additionally, the CRA has a robust outreach program. It works with industry associations, tax preparer associations, and chambers of commerce to educate and inform their members about tax obligations and changes to tax laws.

These services help small businesses understand and fulfil their tax obligations, avoid missteps, and ensure they utilize all the deductions and credits available. You can request a CRA outreach officer to help your community learn about taxes and benefits by visiting their website, cra-arc.gc.ca. In the search bar, type "How outreach officers can help your community learn about tax and benefits."

A quick online search showed some seminars currently being held through Eventbrite are:

- The Small Business Tax Literacy Seminar (or webinar) allows self-employed participants to interact directly with a CRA employee. I believe this seminar will be held once a month in 2024 in Toronto. You can reserve a ticket through Eventbrite.

- The Guelph-Wellington Business Centre is holding a live online seminar on March 27, 2024, titled Tax Seminar with the CRA: incorporated small business.

The agenda for the seminars seems to be:

- Explain common tax errors, what causes them, and how to avoid them

- Demonstrate how to use financial benchmarks for relevant industries

- Provide information on various tools and services offered by the CRA

- Explain general bookkeeping concepts and best practices

The CRA also offers several webinars and online learning resources for small businesses. Topics covered include an introduction to Canada's tax system, reporting business income and expenses, and Goods and Services Tax/Harmonized Sales Tax (GST/HST) for small businesses.

The 16 Taxpayer Bill of Rights

When Do The Bill Of Rights Not Apply

Criminal matters are subject to the Charter of Rights. Tax audits are a civil matter.

The declaration of taxpayer rights may not apply in certain exceptional circumstances. For instance, taxpayer rights may not provide immunity from federal prosecution in situations of tax fraud, deceptive tax evasion schemes, or criminal activities.

The Bill of Rights is designed to apply within the framework of existing Canadian tax laws, meaning they do not supersede or contradict statutory requirements or restrictions. For instance, if a law mandates obligatory disclosure of specific financial information, the taxpayer's right to privacy may not exempt them from these requirements. However, the precise limitations are subject to interpreting the particular rights and specific tax laws in any given context.

The Taxpayer Bill of Rights is a set of sixteen rights confirmed by the CRA that apply to individuals and corporations interacting with the agency, including income tax matters. It is essentially an administrative document outlining standards and services one can expect when dealing with the CRA. While it is not enshrined in law, it is based on the basic principles of tax administration and customer service.

Here are the first eight of your sixteen basic taxpayer rights as found in RC4417 and RC17 (E). I have presented them out of order from the poster image shown below.

1. Entitlements - to pay no more and no less than what is required by law and to receive all benefits, credits, and refunds you are entitled to.

2. Bilingual service - the right to service in both official languages at designated bilingual offices.

5. Courtesy and consideration - the right to be treated professionally, respectfully, and courteously.

6. Information - the right to complete, accurate, clear, and timely information in plain language that explains policies and laws.

These four rights are out of order; I have classified them as such because they are similar to taxpayer protections covered in the Income Tax Act:

3. Privacy and confidentiality - the right to expect the protection and management of your personal and financial information against unauthorized use or disclosure.

4. Formal review - the right to a formal review and a subsequent appeal to the courts if the disputed taxes cannot be resolved.

7. Disputed amounts - the right to not pay income tax amounts before you have had an impartial review.

8. Consistent treatment - fair and consistent application of the law.

Canadians have recourse options available if they disagree with their CRA assessment. The last eight taxpayer bills of rights include recourse options.

9. Service Complaints - the right to lodge a complaint and receive an explanation of CRA findings.

10. Cost of Compliance - the right to have your time, effort, and costs considered when administering tax legislation with continual improvement and streamlining.

11. Accountability - CRA is accountable for what they do to all Canadians through Parliament. You have the right to have decisions explained, as well as your rights and obligations.

12. Tax Relief - under extraordinary circumstances, you have the right to relief from penalties and interest under tax legislation. Use from RC4288 Request for Taxpayer Relief.

13. Service Standards - you have the right to the published results of CRA service standards once the Annual Report is tabled with Parliament.

14. Tax Schemes - timely warning about questionable tax schemes is a basic taxpayer right. (Subscribing to Tax Alerts is an easy way to do this.)

15. Representation - it is your right to be represented by the person of your choice. AUT-01 Authorize a Representative for Access by Phone and Mail (formerly Form T1013 Authorizing or Cancelling a Representative for individuals or Form RC59 Business Consent Form for businesses) or e-process for online access on file with CRA should be reviewed periodically by signing into My Account or My Business Account. Be selective on who has level 2 access to your account(s). FYI, A representative does not have the ability or access to make changes to your address, marital status, or direct deposit information.

16. Reprisals - the right to lodge a complaint and request a formal review without fear of reprisal.

Correlation between the Canadian Taxpayer Bill of Rights and the Income Tax Act

The Income Tax Act (ITA), first passed in 1917, is the primary piece of legislation governing the federal taxation of income in Canada. This comprehensive and complex Act dictates who is liable to pay taxes, various forms of taxable income, applicable tax exemptions, calculation methods for tax liability, and much more.

I remember reading various sections of the Tax Act when taking my Certified General Accountant (CGA) tax courses in the early nineties. It was not easy, leisurely reading, that's for sure.

While the Taxpayer Bill of Rights is not directly part of the Income Tax Act (ITA), it supports provisions in the Act. It provides taxpayers with a clear explanation of service expectations and a process for filing a service complaint. Rights include being treated fairly, getting complete, accurate, clear, and timely information, paying no more and no less than what is required by law, and having the law applied consistently.

The ITA and the Taxpayer Bill of Rights work jointly within the tax landscape. The ITA generally provides specifics of tax obligations, while the Bill of Rights establishes parameters of fairness and equitable treatment while navigating said obligations.

Canadian Income Act Taxpayer Protection Provisions

The Canadian ITA has various provisions aimed at protecting taxpayers. Here are a few taxpayer's rights covered in the ITA:

1. Section 152 Right to Appeal - A taxpayer can file an appeal if they believe the Canadian Revenue Agency (CRA) has assessed their tax return incorrectly. The CRA has to review the appeal and consider the taxpayer's point of view. If not satisfied, taxpayers have the right to appeal to the Tax Court of Canada.

2. Section 220 Fairness and Leniency - This provision allows the Minister of National Revenue to waive or cancel all or part of any penalty or interest (other than a penalty or interest that is the consequence of a conviction for a tax offense or that arose out of culpable conduct) otherwise payable by the taxpayer under the Act.

3. Section 160.1 Liability—This section protects individuals from being held liable for the tax debt of their spouse or common-law partner in cases of fraudulent conveyance of property.

4. Section 241 Privacy - The Act protects taxpayer's information from public scrutiny. The CRA cannot disclose taxpayer information unless expressly provided in the Act. Additionally, taxpayer information must pass through several levels of approval within the CRA before the information can be disclosed. [A completed AUT-01 Authorize a Representative for Access by Phone and Mail (formerly Form T1013 Authorizing or Cancelling a Representative for individuals or Form RC59 Business Consent Form for businesses) or e-process for online access on file with CRA is required before information can be released to third parties.]

More on Fairness and Leniency Protection

Parts of the ITA in Canada address issues of fairness and leniency, primarily through provisions that allow for relief from penalties and interest.

1. Section 220(3.1): This provision allows the Canada Revenue Agency (CRA) to grant relief from penalty or interest when the following situations prevent a taxpayer from meeting their tax obligations:

- Extraordinary circumstances

- Actions of the CRA

- Inability to pay or financial hardship

2. Voluntary Disclosures Program (VDP): This program, outlined in Information Circular IC00-1R6, is based on the principle of fairness. It gives taxpayers a second chance to correct their tax affairs by avoiding penalties or prosecution as long as they voluntarily disclose instances of non-compliance.

3. Taxpayer Relief Provisions: These provisions also allow the CRA to cancel or waive penalties or interest under certain circumstances, such as undue delays in resolving an objection or appeal or when a taxpayer cannot afford the accumulated interest charges and penalties.

4. The Taxpayer Bill of Rights: As previously stated, this is not directly part of the ITA but enhances the protections provided in the Act. It explicitly enshrines taxpayers' right to be treated impartially, courteously, and professionally.

More on Fair and Consistent Application of the Law

There are parts of the ITA in Canada where fair and consistent application of the law is stated explicitly and implicitly.

1. 'General anti-avoidance rule (GAAR)' under section 245 of the ITA: This rule is a safeguard to ensure that tax planning undertaken by taxpayers does not unfairly exploit or abuse the provisions of the ITA.

2. Section 152(4): This section indicates circumstances under which a reassessment may be made beyond the normal period defined under 152 (3.1), ensuring tax assessments are made fairly and consistently.

3. The Tax Court of Canada, under Section 171, provides an avenue for taxpayers to dispute assessments and reassessments made by the Canada Revenue Agency, ensuring the fair and impartial application of law.

Please note that interpreting tax law can be complex. For a comprehensive understanding and application of all taxpayer protection provisions, it's typically necessary to seek professional advice.

The Taxpayer Relief Program

In Canada, the Income Tax Act has provisions for taxpayers who believe that the application of the tax law is causing them undue hardship. One such relief mechanism is the Taxpayer Relief Program.

The Taxpayer Relief Program, administered by the CRA, allows taxpayers to request cancellation or waiver of interest or penalties (or both) if they can show that they could not meet their tax obligations due to circumstances beyond their control. Some examples of these circumstances include natural disasters, serious illness or death in the immediate family, civil disturbances, errors by the CRA, and more. [Taxpayer Bill of Rights #12; Subsection 220(3.1) of the Income Tax Act]

In addition to the Taxpayer Relief Program, taxpayers have the right to lodge a formal dispute through the objection and appeal process if they disagree with the CRA's assessment or reassessment of their tax returns. If the tax dispute cannot be resolved through these means, the taxpayers can take their case to the Tax Court of Canada. [Taxpayer Bill of Rights #4]

Taxpayers also have the right to make a service complaint through the CRA Service Complaints Program if they are not satisfied with the service they received. [Taxpayer Bill of Rights #16

More On Undue Hardship - Useful for bookkeepers to know

Overpayment (I.E., you get a large refund after filing your tax return) or underpayment of taxes (I.E., you have a large amount of taxes owing after filing your tax return) can be a sign of poor tax planning. In the case of a tax refund, you've loaned your money to the CRA interest-free.

The Knowledge Bureau's July 7, 2009, free newsletter discussed options regarding undue hardship that are useful for bookkeepers. Here are three options to assist individuals with annually reducing underpayment or overpayment of taxes.

- Every year, you can request a reduction in withholding taxes on income by filing Form T1213 Request to Reduce Tax Deductions at Source. Your other option is to update the TD1 form you provided your employer at the beginning of each calendar year. Reasons you might do this include high medical expenses, large charitable donations, regular RRSP contributions, child care expenses, support payments, employment expenses, or you claim the caregiver amount.

- You can also request an increase in withholding taxes. If you had a large tax payment upon filing your tax return, this is one option to consider when receiving OAS or CPP benefits. Use form ISP3520 Request for Income Tax Deductions.

- You can request a refund for overpaid installments if they are causing undue hardship. Decisions are made on a case-by-case basis.

Good Tax Habit

If you receive a large tax refund, it would be prudent to use the funds to reduce your debt or invest them through your RRSP or TFSA. Then, you can actively plan to reduce your refund for next year rather than giving the CRA an interest-free loan.

Relationship between the Canadian Taxpayer Bill of Rights and the Excise Tax Act

The Excise Tax Act (ETA) encompasses Canada's federal value-added tax policy. It most notably houses the crucial Goods and Services Tax (GST) and Harmonized Sales Tax (HST) regulations.

The Bill of Rights augments the application of the Excise Tax Act, providing a protective framework for small businesses. Viewing the ETA strictly through the Bill of Rights prioritizes the business's rights to dispute, appeal, and question and guarantees a system free from intimidation and unnecessary complexity.

Taxpayers' Ombudsman

The CRA has an Ombudsman who operates independently of the CRA. The Ombudsman's role is to uphold the Taxpayer Bill of Rights and investigate complaints from taxpayers who believe the CRA has not respected their rights.

If you feel that the CRA has not satisfactorily resolved your service complaint, you can contact the Taxpayers' Ombudsman at www.taxpayersrights.gc.ca for an independent review of your situation. S/he works to ensure that the taxpayer bill of rights is upheld for all Canadians.

Conclusion

The Canadian Taxpayer Bill of Rights is the cornerstone of Canada's commitment to fair taxation. It ensures transparent and fair treatment and intermingles with the Income Tax Act and the Excise Tax Act to form a robust, comprehensive tax system. For small businesses specifically, understanding and utilizing their rights under this Bill is a vital part of their survival and success.

References

1. Mondaq. (2020). Canada: The Long History Of Taxation.

2. Fraser Institute. (2017) The History and Development of Canada's Personal Income Tax

3. Canada Revenue Agency. (2016). Taxpayer Bill of Rights.

4. Osdoode Digital Commons. (2015). An Introduction to Tax Law Research - Appendix 1 Functional classification of the ITA

5. Criminal Code Help. (2022). Canada's Excise Tax Act: A Tool for Raising Revenue and Supporting Public Policy.

6. Canada Revenue Agency. (2021). Small Business Deduction Rules.

7. LegalLine. (not dated). Overview of the Canadian Tax System.