- Home

- Canadian Bookkeeping Compliance Resource

- Basic Tax Articles

Canadian Bookkeeping Resources

Basic Tax Articles for Bookkeepers in Canada

Even if you don't do "tax", you need to understand the basics.

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published October 2009 | Revised June 10, 2024

YOU don't have time to spend looking for basic Canadian bookkeeping and tax information that may affect your business so I go hunting to find it for you to ensure you have it at your finger tips ... when you need it.

Learning the various kinds of Canadian taxes small businesses face is very important, I might even be comfortable saying crucial, even if you aren't the one handling tax filings directly.

As a bookkeeper working remotely or a small business owner in Canada, you're likely aware that effective tax planning is not just an annual task—it's an ongoing daily process. Understanding the basics of tax compliance is essential to maintaining a CRA-compliant set of books so you, as a business owner, can think strategically to manage your business's financial affairs throughout the year.

What are some of the kinds of tax that directly impact your business operations making it imperative you have some tax knowledge:

- Sales Tax: Familiarize yourself with the Goods and Services Tax (GST), Harmonized Sales Tax (HST), and Provincial Sales Tax (PST) that apply to the products and services your business offers. Knowing how to accurately calculate, collect, and remit these taxes not only keeps you compliant with CRA but also prevents costly penalties.

More >> How To File A Sales Tax Return - Payroll Tax: If your business has employees, understanding your obligations around payroll taxes is a must. Employment taxes include deductions for the Canada Pension Plan (CPP), Employment Insurance (EI), and income tax from employees' paycheques. Timely and accurate filing of the PD7A Statement of Account for Current Source Deductions are essential to avoid fines and ensure that employee contributions are correctly handled.

More >> PD7A Payroll Tax Filing Deadlines - Income Tax Basics for Sole Proprietors: As a sole proprietor, your business income is taxed at your personal income rate. Keeping diligent records and understanding which expenses can be deducted can significantly reduce your taxable income. Regularly keeping up with changes in tax laws that affect you and your business can help in maximizing these benefits. This website can help you with that.

More >> Learn About Self-Employed Tax Deductions You Are Entitled To - Excise Taxes and Duties: For goods imported into Canada, being aware of the Canada Border Services Agency (CBSA) duties and other applicable excise taxes is important. Proper documentation and compliance with these regulations ensure smooth operations and avoid disruptions due to seized shipments or audits.

More >> How To Record CBSA Duties and CBSA GST - Quarterly Tax Installments: There are two types of tax installments that need to be on your radar so you can determine if they apply to you and your business.

Income Tax Instalments

Sole proprietors, freelancers, and self-employed individuals need to pay their income tax by instalments if their net income tax owing is more than $3,000 in the current year and either of the two previous years. CRA usually sends you a notice letting you know when this requirement kicks in. Don't ignore it. If applicable, the quarterly instalment payments are due on the 15th of March, June, September, and December.

It's important to note that in Quebec, the threshold is $1,800 instead of $3,000.

More >> Learn about all your tax filing obligations

Annual GST Filers

If you are an annual sales tax filer and your net sales tax (the amount of GST/HST you collected minus the amount you're eligible to claim as input tax credits) is more than $3,000, you will need to make quarterly instalment payments. These payments are also due on the same dates as the income tax instalments which is the 15th of March, June, September, and December.

Each instalment payment is supposed to cover a quarter of the total tax owed from the previous year, which helps spread out the tax burden over the year, making it easier to manage financially.

More >> Improve Your Cash Flow By Switching Your GST HST Reporting Period

By making a conscious decision to spend some time learning these basic tax rules, you will be giving yourself the gift that enables you to perform the necessary business paperwork tasks needed to legally minimize your net taxable income and keep your business financially healthy.

Remember, being proactive about tax planning and your compliance obligations aren't just about following laws—they are also the strategic elements of managing your business that can give you a competitive edge which helps you keep the doors open.

Advertisement

Help getting all your ducks in a row

An index or table of contents ... for each series of basic Canadian bookkeeping articles focus on different aspects of tax compliance are outlined.

Clicking on any image below takes you to the Executive Summaries for each series.

Charge the right sales tax rate!

Charge the right sales tax rate!Let's make this clear for all my visitors before I get started ... I am not a tax expert like a tax accountant or lawyer but I do have some formal tax education classes under my belt.

While doing bookkeeping, I learned a bit about small business taxes along the way. I did prepare tax returns for sole proprietors in Canada before I retired.

Welcome to Bookkeeping Essentials - The Tax Articles Index!

Remember to sip on water throughout the day to keep your brain sharp.

Remember to sip on water throughout the day to keep your brain sharp.This article is going to an executive summary index on all the Canadian related articles on tax compliance ... so fill up your water jug and let's get begin.

For your convenience and to help you deepen your tax knowledge, this section is all about basic Canadian bookkeeping and tax information relevant to doing your books.

That means you won’t find a lot about personal taxes here unless it relates to your business somehow.

More >> American small business tax information for my U.S. visitors

I do try to provide references to U.S. tax pages near the top of many pages.

Good to Know

Tax Filing Due Dates

- Quarterly PD7A - 15th following end of calendar quarter

- T4 slips - Last day of February

- Annual Returns - June 15

- Quarterly Returns - end of month following end of fiscal quarter

- T1 Sole Proprietor - June 15 to file; balance due April 30

- Installments - quarterly on 15th

- T2 active - 6 months after yearend; balance due 3 months after yearend

- T2 passive or PSB - 6 months after yearend; balance due 2 months after yearend

- T4A - Last day of February

- T5018 - Six Months After The End Of The Reporting Period You Have Chosen

More >> Looking for tax rates?

Executive Summaries For Each Series ...

Basic Tax Knowledge For Small Business Recordkeeping

Tax filing deadlines and due dates ... to Canadian sales taxes guide ... as well as tax planning opportunities you work at 365 days a year.

Series 1 - Six Basic Canadian Bookkeeping Articles on ...

Tax Primer for Sole Proprietors

Home Business Taxes

| |

Home Business Taxes

| |

Home Business Taxes

| |

Home Business Taxes

| |

Home Business Taxes

| |

Home Business Taxes

|

Series 2 - Three Basic Canadian Bookkeeping Articles on ...

Owner Managed Corporations

Canadian Controlled Private Corporations

| |

Beware of Conferred Shareholder Benefits Beware of Conferred Shareholder BenefitsLoan To Shareholders

| |

Corporate Minute Book

|

Series 3 - Four Basic Canadian Bookkeeping Articles on ...

Tax Compliance Audits

Canadian Bookkeeper's Reference Page

| |

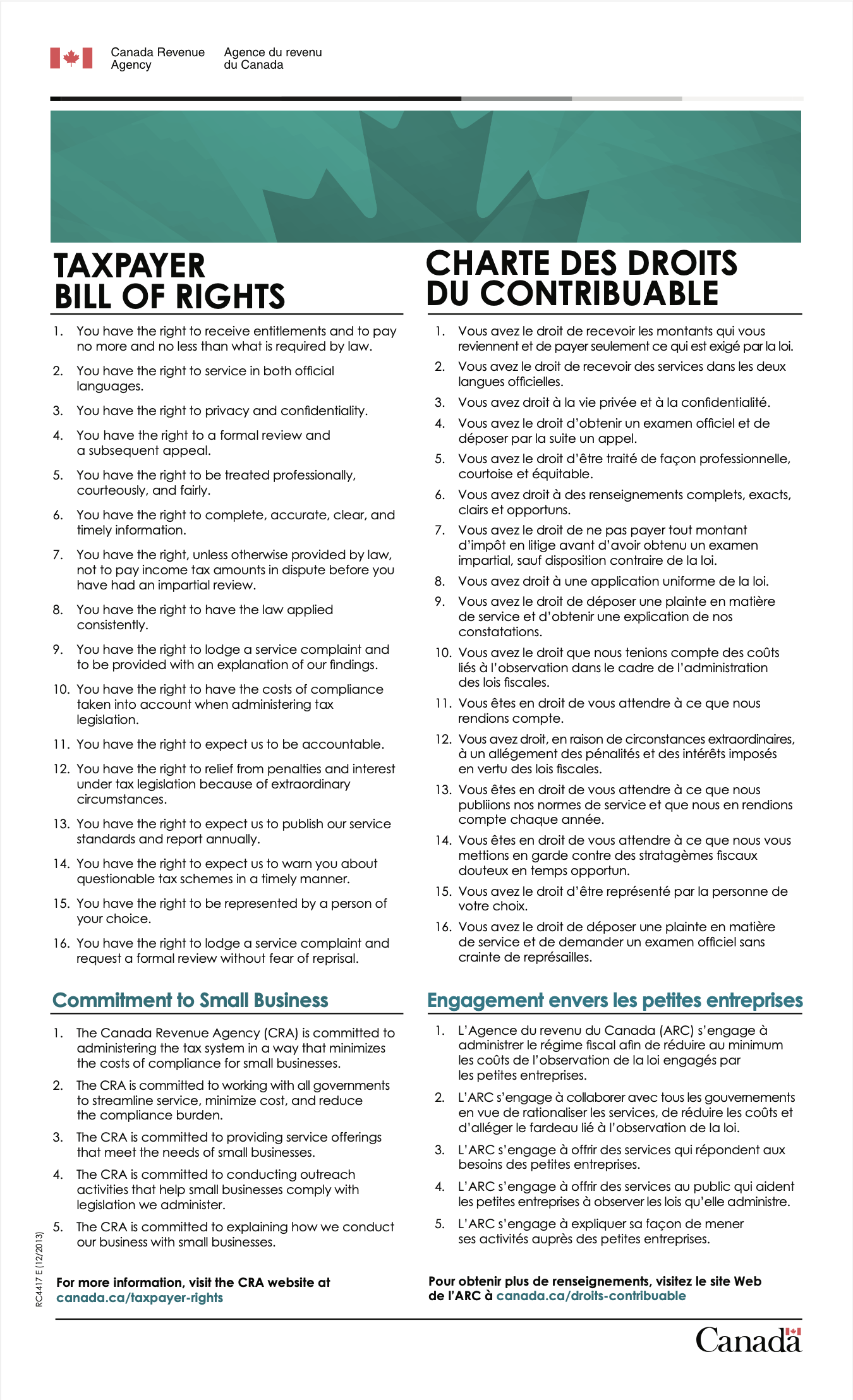

More Tax Audit ArticlesThree additional articles that may be of interest to are: (1) What to do when you receive a notice saying you are going to be audited. (2) Your rights as a taxpayer in Canada. Under taxpayer relief, you will find information on forms:

(3) If you haven't filed past tax returns ... or you filed an inaccurate return, learn about CRA's Voluntary Disclosure Program which grants taxpayer relief to those who satisfy the conditions. There is information for bookkeepers on how to protect themselves against third party civil penalties ... need to know when doing Canadian bookkeeping. |

I thought you might find this information interesting and informative. Check out these links!

- How to run into trouble with Revenue Canada?

- The five types of audit Revenue Canada performs each year.

- Watch out for those lifestyle audits! The cash myth and your lifestyle.

- There are only five ways to pay no tax.

- Get information on the CRA website by typing "what's new" in their search box.