Canadian Sales Tax Guide

GST HST in Canada

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published August 2010 | Revised April 16, 2024 | Edited November 29, 2024

Bookkeeping-Essentials.ca

A Guide to Understanding GST HST in Canada

Links below open to a page on Bookkeeping-Essentials.ca.

Advertisements

GST HST in Canada - Table Of Contents

GST HST Guide

GST HST GuideIntroduction

Introduction

- Overview of GST HST in Canada and its importance for small businesses

I Understanding GST HST

I Understanding GST HST

II GST HST Registration

II GST HST Registration

- When is GST HST registration mandatory? Once $30,000 threshold has been met

- Why you might want to voluntary register for GST HST

- How to register for GST HST

III Bookkeeping for GST HST

III Bookkeeping for GST HST

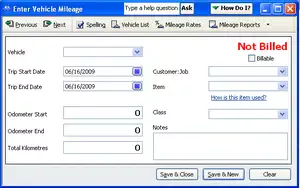

- How bookkeeping software can make it easier to track sales tax

- Importance of knowing the CRA GST HST invoicing rules

- Learning your place of supply rules (What GST HST rate to charge)

- Sales tax rates across Canada

- How bad debts affect your GST HST return

- How meals and entertainment expenses affect your GST HST return

- GST/HST and the sale of business assets

Accounting Systems

- if you are a GST/HST registrant

(GST/HST collected vs GST/HST paid [ITC]) - if you are NOT a GST/HST registrant;

IV Managing GST HST Reporting

IV Managing GST HST Reporting

- How to file your GST/HST report using the Regular reporting method

- Determination of CRA reporting period sets your due date

- Two alternative filing methods for tracking and reporting GST HST - The Quick method and the Simplified method

- How to claim missed input tax credits (ITCs) on previously filed returns

V Navigating Special Cases

V Navigating Special Cases

- GST HST and online internet sales

- GST HST and out of province customers

- GST HST and web hosting / web design

- Taxable benefits and allowances subject to GST and HST

- Input tax credits (ITCs) and business use of your personal vehicle

VI Important Considerations for Small Business Owners

VI Important Considerations for Small Business Owners

- Verification of supplier's registration status to legally collect GST HST

- Special 90% rule about GST/HST rate to customers

- The financial impact of canceling your GST/HST account

VII Dealing with Audits

VII Dealing with Audits

- Your first GST/HST audit - what to expect

MORE >> Audit Process

Ask A Free GST HST Question Here

Share your sales tax knowledge or ask a question about GST HST.

It's been great chatting with you.

Your Tutor

QuickBooks® is a registered trademark of Intuit Inc.