- Home

- Accounting Systems

- QBO T4A Reporting Workaround

How to Use QuickBooks Online | Focus on Bookkeeping

QBO T4A Reporting Workaround

by Tiffany J. Stewart, CPA CMA

(Guest Author)

Article reprinted with permission

January 17, 2017

This page is archived. QBO now has a formal T4A Detail report under the "Reports" tab.

As the end of February deadline approaches, we are all scrambling to complete the required T-slips. Quickbooks Online (QBO) has the ability to prepare the T4s but the T4As and T5018s are some of the additional slips that need to be prepared and are not organically available (yet) in QBO.

Chat Continues Below Advertisement

T4A reporting slips...

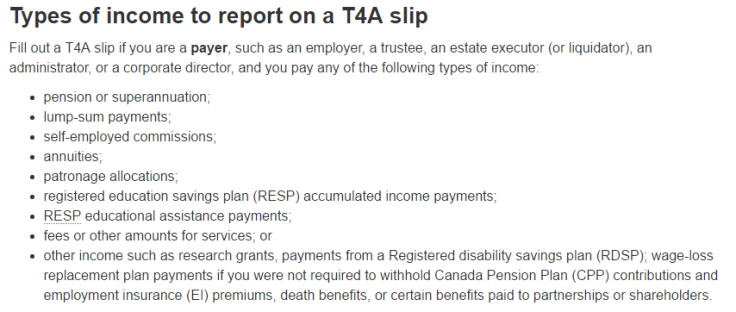

Generally, you need to complete a T4A slip for suppliers if you are a payer of other amounts related to employment.

CRA website explains types of income to report on a T4A reporting slip.

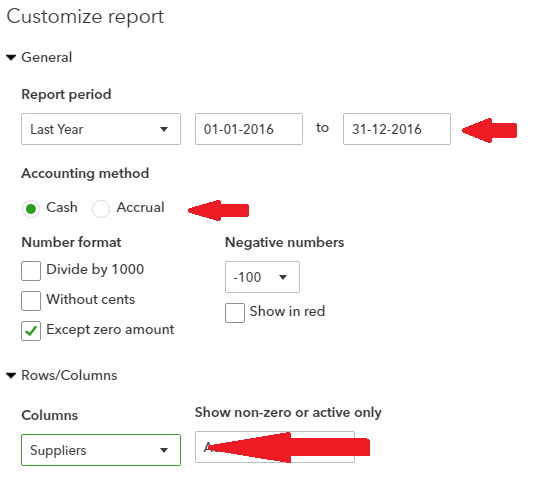

CRA website explains types of income to report on a T4A reporting slip.In this blog, we will be discussing gathering the information for “fees or other amounts for services”. Since you need to report the amount paid to the Supplier for the calendar year net of any taxes, the best report to start with is the Profit and Loss report. Run a Profit and Loss. Click Customize. Change the Report period to Last Calendar Year. Under the Accounting method, click Cash. Click on >Rows/Columns. Click on Columns and pick Supplier.

How to a customize T4A report in QBO.

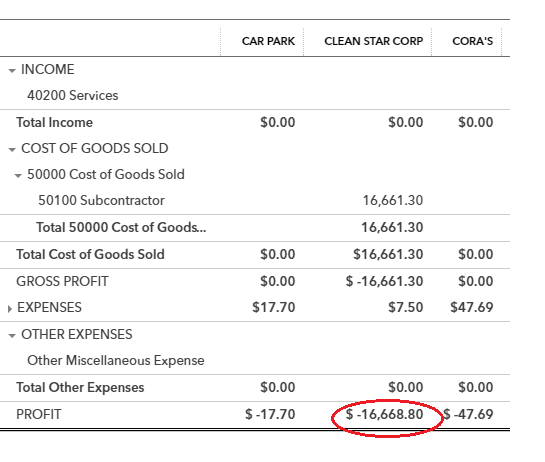

How to a customize T4A report in QBO.This will give you the total amount paid excluding GST/HST for all suppliers. Once you determine which suppliers require the T4A use the PROFIT figure in the appropriate box of the T4A.

QBO T4A reporting total

QBO T4A reporting totalNOTE: This will only work for participating provinces that have Harmonized Sales Tax. Any provinces with separate GST and Provincial Sales tax will need to use an alternate method as the PST will be included in the above figures.

And now those ever popular T5018 slips...

A T5018 slip is the Statement of Contract Payments and is required to be completed for your suppliers when your primary source of business income (50% or more) is derived from construction activities. In many cases there are businesses which have significant amounts of construction done for them or by them, but this activity is not their principal business and they do not have to report under the Contract Payment Reporting System (CPRS). However, the T4A requirements may apply.

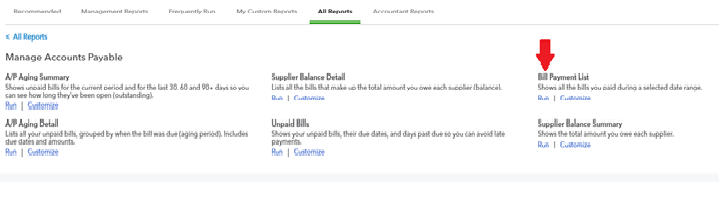

Since you need to report the total payments to subcontractors for construction services, including any GST/HST and provincial/territorial sales tax, the best report to start with is the Bill Payment List which can be found in the Manage Accounts Payable group of reports.

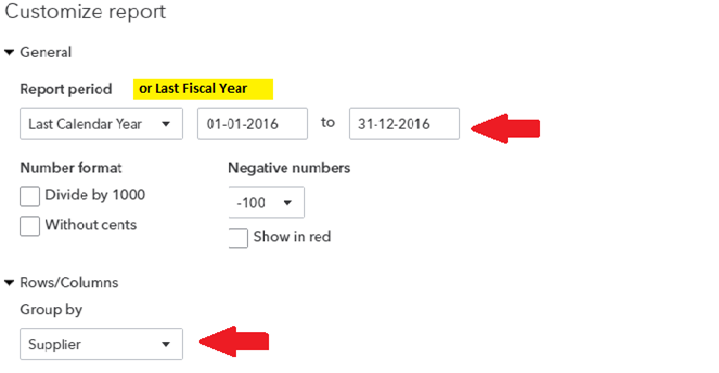

Customize QBO's Bill Payment List Report to collect your T5018 information.

Customize QBO's Bill Payment List Report to collect your T5018 information.You can report payments on a calendar year basis or based on your fiscal year end. Once you choose a reporting period, subsequent returns must be filed for the same reporting year unless otherwise authorized in writing by the CRA. Click on Customize and change the Reporting period to either Last Calendar Year or Last Fiscal Year. Click on Rows/Columns and change Group by to Supplier.

QBO T5018 Customize Report

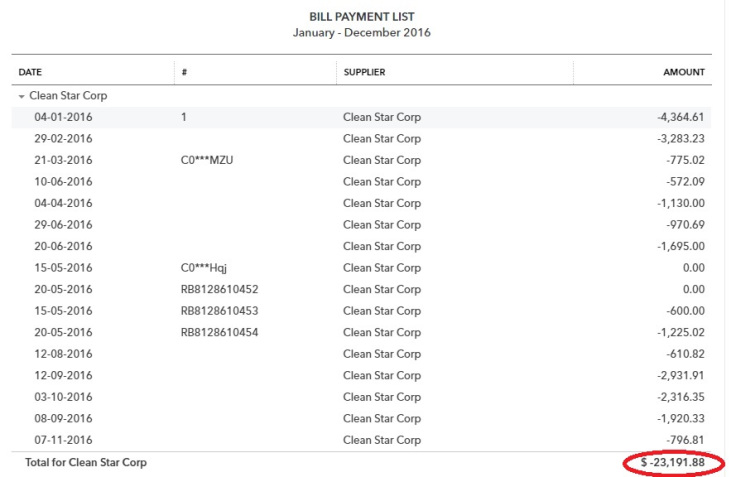

QBO T5018 Customize ReportThis will give you the total amount paid including applicable taxes for all suppliers. Once you determine which suppliers require the T5018 enter the total in box 22.

QBO T5018 detail supplier list

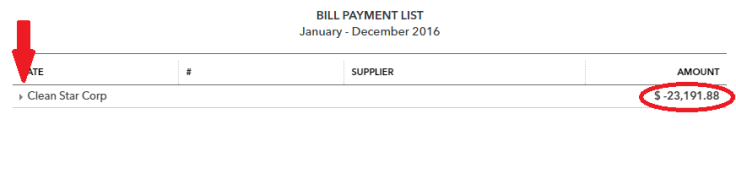

QBO T5018 detail supplier listYou can click on the upside down triangle beside each supplier name to collapse the details and reduce the size of the report.

QBO Supplier Collapsed Report View

QBO Supplier Collapsed Report View Tiffany J Stewart CPA CMA

Tiffany J Stewart CPA CMAAbout the Author:

Tiffany J. Stewart CPA CMA resides in Toronto, Ontario and is self employed. She is an Advanced Certified ProAdvisor for QuickBooks Online and Desktop and can be contacted through Linked-In or Facebook.

12 Part QuickBooks® Primer

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Click here to subscribe to QuickBooks Online Canada. I do not receive any commissions for this referral.